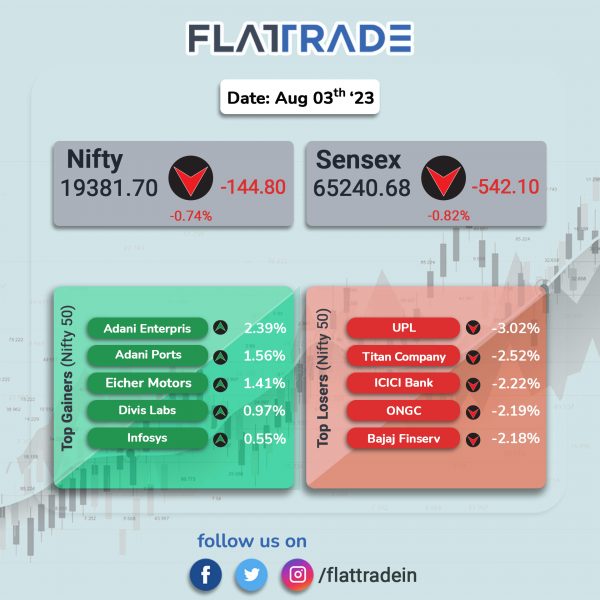

Benchmark equity indices closed lower as investors’ sentiments were dampened amid rising US bond yield and concerns over Fed’s hawkish monetary policy. The Sensex tanked 0.82% and the Nifty fell 0.74%.

Broader markets outperformed benchmark indices. The Nifty Midcap 10 index rose 0.25% and the BSE Smallcap advanced 0.23%.

Top losers were Realty [-1.78%], Financial Services [-1.17%], Bank [-1.07%], Private Bank [-1%], Oil & Gas [-0.8%]. Top gainers were Pharma [1.04%] and Media [0.91%].

The Indian rupee fell 14 paise to 82.73 against the US dollar on Thursday.

The seasonally adjusted S&P Global India Services PMI Business Activity Index stood at 62.3 compared with 58.5 in June, according to S&P Global. The composite PMI rose from 59.4 in June to 61.9 in July. The expansion in the service activity was largely attributed to demand strength and new business gains, the release stated.

Stock in News Today

Adani Enterprises: The company reported a consolidated net profit of Rs 674 crore for the quarter ended June 2023, a rise of 44% over Rs 469 crore reported during the same period of last fiscal. Its revenue from operations stood at Rs 25,438 crore, down 38% from Rs 40,844 crore reported during the previous corresponding quarter, due to correction in coal prices. The company said its EBITDA increased by 47% YoY to Rs 2,896 crore on account of strong operational efficiency.

Sun Pharmaceuticals: The drug maker reported a net profit of Rs 2,022.54 crore in Q1FY24, a decline of 1.86% from Rs 2,060.88 crore in Q1FY23. Net sales rose 10.96% YoY to Rs 11,940.84 crore in the quarter ended June 2023. Sales of formulations in India for Q1FY24 were at Rs 3,560.4 crore, up 5.1% over Q1FY23. US formulation sales were $471 million for Q1FY24, up 12% YoY, and accounted for about 33% of total consolidated sales for the quarter. India formulation sales accounted for about 30% of total consolidated sales. During the reported quarter, EBITDA grew 15.5% YoY to Rs 3,331.8 crore and EBITDA margin improved to 27.9% as against 26.8% for Q1 of last fiscal.

Ambuja Cements: The company has bought a 56.74% stake in smaller rival Sanghi Industries at an enterprise value of Rs 5000 crore ($604.4 million), according to its exchange filing. Ambuja will acquire a 56.74% stake in Sanghi for Rs 1674 crore rupees ($202.4 million), and launch an open offer for a further 26% stake at Rs 114.22 per share, a 13.8% premium to Sanghi Industries stock closing price on August 2. The acquisition will be fully funded through internal accruals.

Mahindra & Mahindra (M&M): The company announced that global investment firm Temasek will invest Rs 1,200 crore in its electric vehicle subsidiary Mahindra Electric Automobile Ltd (MAEL). With this stake buyout, Temasek will own 1.49% to 2.97% stake in Mahindra Electric Automobile Ltd, M&M said in a release. Temasek will invest the amount in the form of Compulsorily Convertible Preference Shares (CCPS) at a valuation of up to ₹80,580 crore.

Vedanta: Shares of the company tanked 9% in Thursday’s intraday trade amid reports that Twin Star Holdings, one of the promoters of the metal and mining firm, sold a 4.3% stake in the company through block deals, The Economic Times reported. The floor price for the transaction was likely set at Rs 258.5 per share aggregating to $501 million or Rs 4,130 crore. The floor price was 5% lower to to Wednesday’s closing price of Rs 272.8 on NSE.

MRF: The tyre maker reported a consolidated net profit of Rs 588.75 crore in Q1FY24, higher than Rs 123.60 crore in Q1FY23. Revenue from operations grew by 13.07% YoY to Rs 6,440.29 crore during the quarter. On the margins front, the company’s operating margin improved to 12.37% in Q1 FY24 as compared to 3.43% posted in Q1 FY23. Net profit margin increased to 9.04% in Q1 FY24 as against 2.16% recorded in the same period last year. Meanwhile, the firm’s board has approved the re-appointment of K M Mammen as managing director of the company for a period of 5 years with effect from 8 February 2024.

Adani Power: The company’s net profit jumped 83.3% to Rs 8,759 crore in Q1FY24 as against Rs 4,780 crore in the corresponding period last year. The company said its consolidated total revenue grew by 16.8% to Rs 18,109 crore in Q1FY24 from Rs 15,509 crore in the year-ago period. Consolidated EBITDA for Q1FY24 grew 41.5% to Rs 10,618 crore, from Rs 7,506 crore in Q1FY23.

Dabur: The FMCG major’s consolidated net profit rose 5.35% to Rs 463.88 crore on 10.91% increase in revenue from operations to Rs 3,130.47 crore in Q1FY24 over Q1FY23, driven by strong double-digit growth in both home and personal care as well as health care businesses. The first-quarter revenue growth stood at 13.3% on constant currency. EBITDA stood at Rs 714.5 crore, a rise of 11.2% YoY as compared with Rs 644.2 crore posted in corresponding quarter last year. EBITDA margin was 23.9% during the quarter. Dabur’s International Business reported a 20.6% growth in constant currency terms.

Varun Beverages: The company’s consolidated net profit surged 25.36% to Rs 1,005.42 crore on 13.25% rise in revenue from operations to Rs 5,611.40 crore in Q2CY23 over Q2CY22. During Q2CY23, total sales volumes grew by 4.6% to 314 million cases from 300 million cases in Q2 CY22, led by robust growth in international markets. However, sales volume growth in India got affected due to abnormally high unseasonal rains during the quarter. EBITDA stood at Rs 1,511 crore, a growth of 21% YoY, while EBITDA margins improved by 169 bps to 26.9% in Q2CY23, driven by operational efficiencies.

Campus Activewear: Institutional Investors Societe Generale and ICICI Prudential Life Insurance Company on Wednesday bought shares of athleisure footwear company worth Rs 124 crore through bulk deals. ICICI Prudential Life Insurance Company acquired 25 lakh shares (0.82% equity) of Campus Activewear on the NSE at Rs 295 each. Meanwhile, Societe Generale purchased 17.14 lakh shares (0.56% equity) on the BSE at the same price.

Vaibhav Global: The company’s consolidated net profit jumped 51.3% to Rs 29.68 crore in Q1FY24 as compared with Rs 19.62 crore in Q1FY23. Revenue from operations rose 4.8% YoY to Rs 658.25 crore in Q1FY24. EBITDA jumped 49.1% YoY to Rs 65 crore in Q1FY24. The company has declared the interim dividend of Rs 1.50 per share for financial year 2023-24. The record date for payment of interim dividend will be Thursday, 10 August 2023.

KSB: The company’s consolidated net profit rose 32.49% YoY to Rs 62.80 crore in April-June quarter of FY24 and net sales jumped 31.87% YoY to Rs 591.30 crore in the quarter under review. During the quarter, cost of materials consumed stood at Rs 283.50 crore (up 27% YoY) while employee benefits expense was at Rs 66.80 crore (up 10.2% YoY). Shares of the company soared 19% in intraday trade.

Tube Investments of India: The company reported a 10% rise in consolidated net profit to Rs 214.97crore on a 4% increase in revenue from operations to Rs 3,767.47 crore in Q1FY24 as compared with Q1FY23. Total expenses rose by 3% to Rs 3,550.50 crore in Q1FY24 over Q1FY23, due to higher raw material costs and employee expenses.

FDC: The drug maker announced that its board will meet on 9 August 2023 to consider a proposal to buyback fully paid up equity shares of the company. At the same meeting, the firm’s board will also consider and approve the unaudited standalone & consolidated financial results of the company for the quarter ended 30 June 2023. 434.80 crore in Q4 FY23.

Newgen Software Technologies: The company said that it has secured a purchase order for implementation & management of LLMS and DMS services from a domestic entity. The aggregate value of the purchase order is Rs 11.93 crore and the duration of contract is till December 2024.

STL: The optical and digital solutions provider said it has won a multi-year agreement worth Rs 250 crore with a public sector entity to design, build, commission, and maintain two data centre facilities. The deployments will happen across multiple network sites in India. The company will also be responsible for three years of operations & management to ensure the reliable functioning of the envisaged project.

Akzo Nobel India: Shares of the company rose 4.3% after it posted strong earnings. The company’s net profit jumped 43% at Rs 109.9 crore in Q1FY24 as against Rs 76.9 crore in Q1FY23. The company’s revenue rose 6.6% to Rs 999.2 crore in the reported quarter as against Rs 937.7 crore in the year-ago period. Ebitda rose 33.8% to Rs 162.1 crore in Q4FY24 from Rs 121.1 crore in the year-ago period.

Blue Star: The company’s revenue from operations increased by 12.6% to Rs 2,226.00 crore for the quarter ended June 2023, compared to Rs 1,977.03 crores during the same period in the previous year. Its EBITDA for the quarter was Rs 145 crore compared to Rs 123.31 crore in the year-ago period. Net profit grew to Rs 83.37 crore compared to Rs 74.35 crores in Q1FY23.