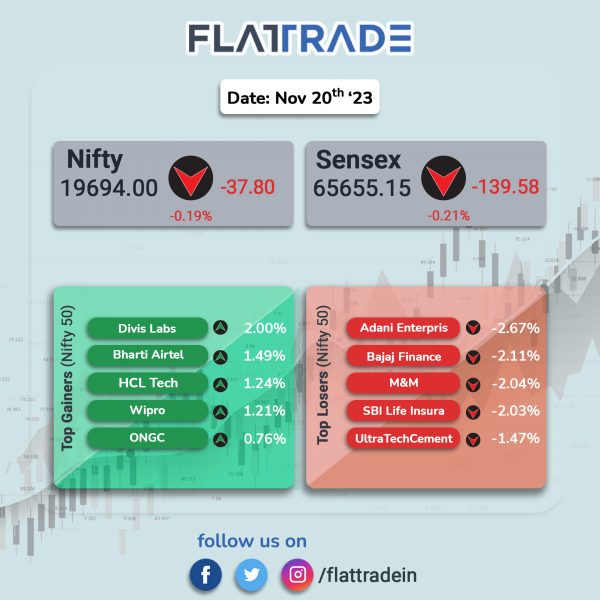

Benchmark equity indices closed lower due to losses in auto, metal and FMCG stocks amid mixed global cues. The Sensex fell 0.21% and the Nifty 50 index lost 0.19%.

In broader markets, the Nifty Midcap 100 rose 0.11% and the BSE Smallcap jumped 0.38%.

Top losers were Auto [-0.76%], Media [-0.6%], Metal [-0.48%], FMCG [-0.39%], and Realty [-0.25%]. Top gainers were IT [0.6%] and PSU Bank [0.1%].

The Indian rupee fell 6 paise to 83.34 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The Hydrocarbon business of the company has received a Letter of Intent for mega offshore order from a prominent client in the Middle East. The scope of work comprises engineering, procurement, construction and installation of a new large offshore platform and brownfield work of integration with existing facilities. According to the company’s classification, the project is worth between Rs 10,000 crore and Rs 15, 000 crore.

Bank of Baroda: The state-owned lender said that its capital raising committee has approved to raise Rs 15,000 crore through infra bonds and Tier II/sub debt bond. The bank will issue Rs 2,000 crore Tier II/sub debt bond with the greenshoe option to raise another Rs 3,000 crore totalling of Rs 5,000 crore (10 years with call option at the end of 5 years). The bank has further decided to issue Infrastructure Bonds amounting to Rs 2,000 crore with a greenshoe option to raise an additional Rs 8000 crore totaling the issue size of Rs 10,000 crore and has a tenure of up to seven seven years.

Yes Bank: The private sector lender said that its board of directors has approved the appointment of Tushar Patankar as chief risk officer (CRO) of the bank for the period of three years, effective from December 1, 2023. Patankar is a qualified Chartered Accountant and comes with close to three decades of diversified experience in risk & front end business expansion.

Mankind Pharma: Shares of the company soared 4.83% after the pharmaceutical stock was added to the FTSE All-World, Large-Cap, Total-Cap, and All-Cap indices.

Omaxe: The company said that it has planning to launch 1200 acres across Tier 2 & Tier 3 cities in Uttar Pradesh, Madhya Pradesh and Punjab across the next four years with an investment of around Rs 4,000 crore.

Blue Dart Express: The company said that it has partnered with India Post for introducing automated digital parcel lockers at selected post offices, offering customers an additional delivery method. This innovation allows consignees to conveniently retrieve their shipments from digital parcel lockers, doing away with the need for personal receipts or signing for a package. Blue Dart has teamed up with Podrones, a last-mile technology and parcel locker company, to power this initiative.

Jubilant FoodWorks: The company announced Ashish Goenka, President & Chief Financial Officer (CFO) and Key Managerial Personnel (KMP) of the company has resigned from the services of the company. His last working day as the CFO and KMP of the company would be December 15, 2023.

Wonderla Holidays: The company’s board appointed Saji K Louiz as the chief financial officer (CFO) and key managerial person (KMP) with effect from November 20. The appointment is based on recommendation of the nomination and remuneration committee of the board. Saji K Louiz, a chartered accountant, is an experienced finance professional having over 15 years of experience with a proven track record in financial strategy, and revenue optimization.

Zen Technologies: The company announced the receipt of an export order valued at approximately Rs 42 crore ($5.12 million). The order, comprising state-of-the-art simulators, is from a friendly nation and stands as a testament to the Indian government’s efforts to boost defense exports, aligning with the national objective of becoming a net defense exporter.

Oberoi Realty: The company has executed an agreement for sale with Ireo Residences Company Private Limited and others for acquiring land admeasuring approximately 14.816 acres at Sector 58, Gurugram, Haryana. The consideration for the transaction is in the form of event/ time linked monetary consideration of up to Rs 597 crore, and up to a certain area in the project for the existing homeowners and others, both subject to the terms and conditions of the agreement. The company’s entitlement from the project at full potential is presently estimated to be about 2.6 million square feet .

Talbros Automotive Components: The company has received new multi-year orders worth Rs 580 crore from both, domestic and overseas customers across its business divisions, product segments and JVs. These orders are to be executed over a period of five years commencing from FY25 onwards covering the company’s product lines – gaskets, heat shields,forgings, chassis and rubber hoses.

Dreamfolks Services: The company announced its entry into Malaysia, marking a significant milestone in its global expansion. The company will provide its cutting-edge technology as a service to partners at three airports: Kuala Lumpur International Airport, Kota Kinabalu International Airport, and Kuching International Airport. Passengers can avail lounge access at these locations by simply tapping or swiping their bank cards on DreamFolks EDC devices placed at these lounges for seamless transactions. Additionally, travelers can skip long queues and gain lounge access through DreamFolks web access portal.

Shreeji Translogistics: The company announced the addition of three locations to its Railway Rake Handling and Transportation service business. The logistics company, has successfully executed Railway Rake Handling & Shifting (H&S) and Transportation services into different locations namely Vishakhapatnam (Andhra Pradesh), Bhilai (Chhattisgarh), Haridwar (Uttarakhand).

Cipla: The drugmaker said that it has received a ‘warning letter’ from the United States Food and Drug Administration (USFDA) for the routine current good manufacturing practices (cGMP) inspection conducted at its Pithampur manufacturing facility between February 6 and February 17. The warning letter summarizes contraventions regarding methods or controls followed at the facility which does not conform to the prescribed cGMP regulations and contains directional guidance for necessary corrections.

Persistent Systems: The company launched a unique open-source maintenance service to facilitate keeping an organization’s open-source software up to date with all patches, bug fixes, and incorporating the latest software releases. The service is comprised of a dedicated team of experts and specialists dealing with a wide range of complex software, equipped with the latest technologies, and backed by a knowledge base to help clients maintain their open-source software with all releases for the continuity of business operations.