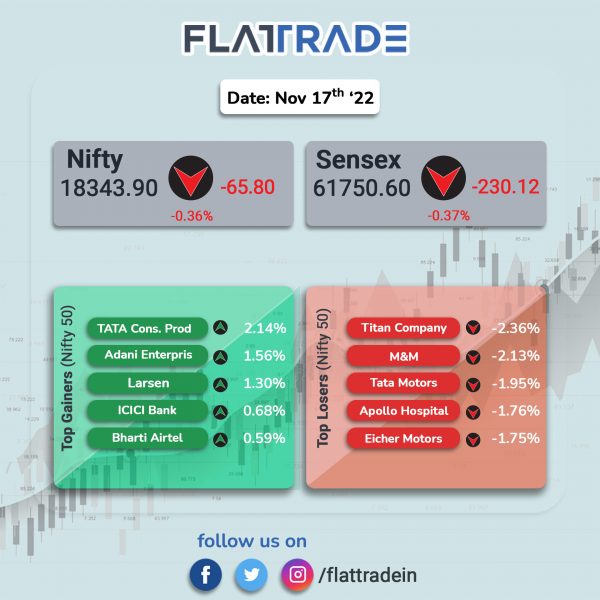

Benchmark stock indices fell on Thursday, dragged by losses in auto, IT and energy stocks. The Sensex fell 0.37% and the Nifty was down 0.36%.

Broader markets also fell, tracking headline indices. The Nifty Midcap 100 index was down 0.40% and the BSE Smallcap index shed 0.27%.

Top losers among Nifty sectoral indices were Auto [-1.36%], Media [-1%], IT [-0.9%], Energy [-0.66%] and Pharma [-0.39%]. Top gainer was PSU Bank which rose 0.79%.

Indina rupee fell 35 paise to 81.65 against the US dollar on Thursday.

Oil prices fell on Thursday due to concerns over geopolitical tensions and rising numbers of COVID-19 cases in China. WTI Crude fell 0.64% and the Brent Crude was down 0.42%.

Stock in News Today

Tata Motors: Shares of the company fell 2.77% in intraday trade on the NSE after the company announced that JLR chief Thierry Bolloré will resign with effect from December 31, 2022, due to personal reasons. Adrian Mardell, who is currently a member of the company’s executive board, will take over as CEO on an interim basis.

In other news, the commercial vehicle manufacturer has secured orders for supplying 1000 buses to Haryana Roadways. Tata Motors will supply the 52-seater fully built BS6 diesel buses in a phased manner, according to the contract.

State Bank of India (SBI): The country’s largest bank has signed a 150 million euro (Rs 1,240 crore) agreement with German development bank KfW to finance various solar power projects in India. The long-term loan under the Indo-German solar partnership will facilitate new and upcoming capacities in the solar sector and further contribute to the country’s goals announced during the COP26, the bank said in a statement.

R Systems International: Shares of the company jumped over 16% in intraday trade after the US-based investment fund Blackstone will buy a majority stake of 52% in the company for Rs 2,904 crore. Blackstone has a signed definitive agreements with Satinder Singh Rekhi and other current promoters to purchase a majority stake in R Systems , the companies said in a statement. Blackstone will acquire the company shares for Rs 245 per share and Blackstone will also launch a conditional delisting offer, at a price of Rs 246 per share.

Aditya Birla Fashion & Retail (ABFRL): The apparel retailer has entered into a strategic partnership with Galeries Lafayette, renowned globally for its flagship location at Boulevard Haussmann in Paris, to open luxury department stores and a dedicated e-commerce platform in India. The flagship stores in Mumbai and Delhi will bring more than 200 luxury and designer brands under one roof. The 90,000 square feet flagship store in Mumbai is expected to be operational by 2024.

Asian Paints: The company has entered into technology and other allied agreements with USA-based Kellogg Brown & Root LLC for manufacturing of Vinyl Acetate Monomer in India. The company would be setting up a manufacturing facility for Vinyl Acetate Ethylene Emulsion (VAE) and Vinyl Acetate Monomer (VAM) in India.

Tata Consultancy Services (TCS): The IT major has expanded its strategic partnership with Randstad. The IT company will modernize the latter’s application estate on the cloud, strengthen the security posture and accelerate its growth and transformation journey. Randstad had selected TCS as the strategic transformation partner in 2016 to implement its strategy of using digital technologies with a human approach, to source the right talent for the right roles.

Tata Power: Tata Power Solar Systems , a wholly-owned subsidiary of Tata Power Renewable Energy, has tied up with state-owned Union Bank of India to help Micro, Small and Medium Enterprises (MSME) sector switch to solar solutions. The objective of this partnership is to improve access to green energy and save on the cost of electricity consumed by MSMEs in India.

Ashok Leyland: The bus and truck maker has delivered 150 trucks and buses to the Tanzania Police Force. The supplies are a part of contract signed between Ashok Leyland and the Ministry of Home Affairs, Tanzania, and financed through a long term soft loan extended by Export Import Bank of India. The vehicles delivered included Police Staff Buses, 4X4 Police Troop Carriers, Ambulances, Recovery trucks and other logistic vehicles for Police support services.

RateGain Travel Technologies: The SaaS solutions provider for travel and hospitality industry has partnered with Booking.com to offer AI-powered solutions. The integration will enable Booking.com supply partners to update content via RateGain’s Content AI platform. It will also help Booking.com to reduce the load on its extranet of multiple and concurrent logins.

Global Health: Shares of the company rose over 9% in intraday trade after news reports said that Nomura India Investment Fund purchased 15 lakh shares in the hospitals chain operator. The transaction took place at an average price of Rs 414.57 per share. Separately, Motilal Oswal Mutual Fund acquired 36.3 lakh shares in the company at an average price of Rs 401 apiece.

Equitas Small Finance Bank: The lender has received the approval from India’s central bank for acquisition of 9.99% stake in the company by DSP investment managers

UPL: The chemicals company signed an agreement to acquire a 20% stake in Brazilian soy genetics company Seedcorp Ho for $42.33 million (Rs 344.79 crore). UPL said the acquisition will help them to offer a complete package of solutions to farmers. The transaction is likely get completed by January.

Mold-Tek Packaging: The company received an order from Grasim Industries- Birla Paints Division to supply packing materials and set up a facility. The company will invest Rs 30 crore to set up the new co-located facility which is expected to be operational by end of calendar year 2025. The company also proposed to set up a food and FMCG container manufacturing facilities in Cheyyar in Tamil Nadu.

Clean Science & Technology: The company announced that a plant has been commercialized at Unit III, Kurkumbh MIDC, Maharashtra, that will manufacture and supply Hindered Amine Light Stabilizers (HALS) Series 701 and 770 with a capacity of 2,000 MTPA. HALS belongs to the performance chemical segment and will cater to the domestic and international market.