Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.34% higher at 18,437, signalling that benchmark indices were headed for a positive start on Friday.

Asian markets rose on Friday, as technology stocks gained amid Federal Reserve officials hinting at more interest rate hikes to tame inflation. The Nikkei 225 index rose 0.19% and Topix gained 0.31%. The Hang Seng index jumped 1.69% and the CSI 300 index advanced 0.21%.

Indina rupee fell 35 paise to 81.65 against the US dollar on Thursday.

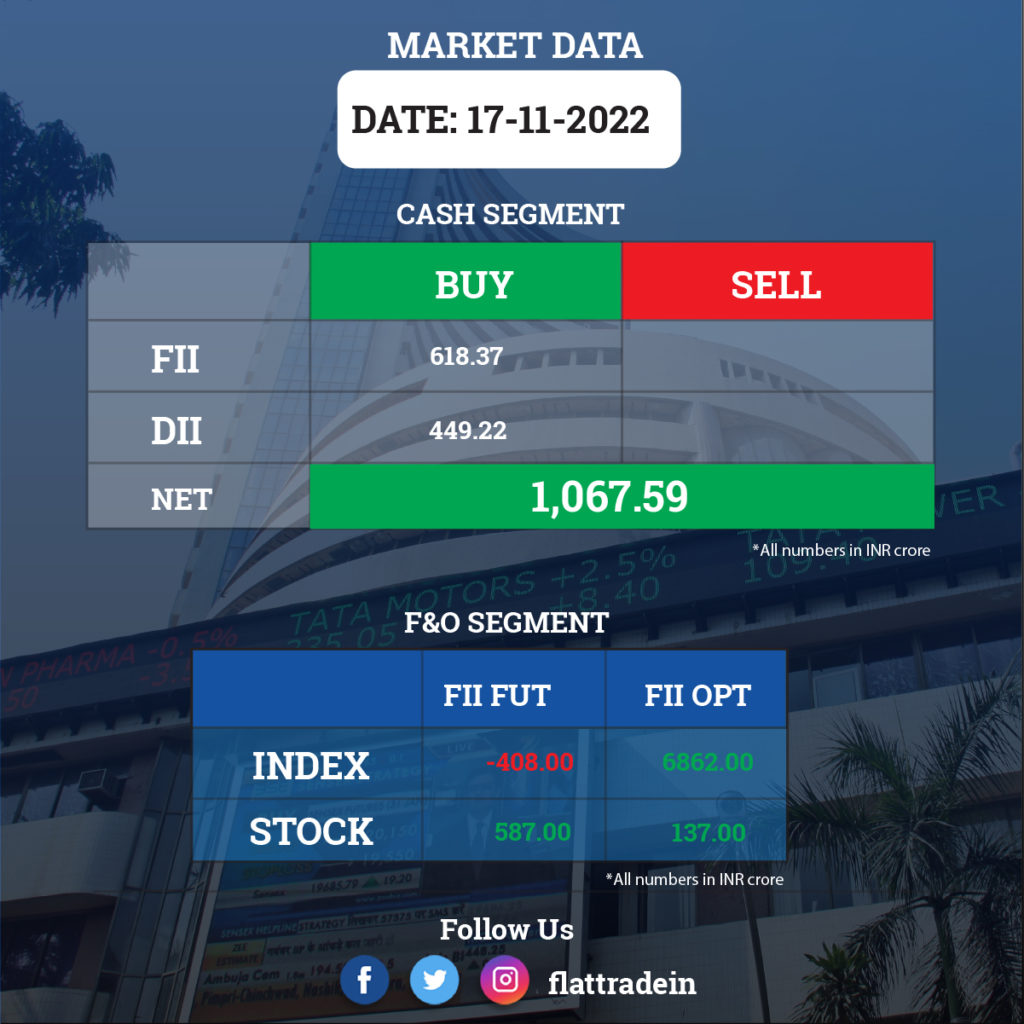

FII/DII Trading Data

Stocks in News Today

Reliance Industries Ltd: Telecom major Jio topped the 4G network speed chart in terms of both average download and upload, according to data published by sector regulator Trai. It was followed by Airtel, which recorded a download speed of 15 mbps and Vodafone Idea (Vi) with 14.5 mbps speed. Meanwhile, Vi recorded an average upload speed of 4.5 mbps in October and Airtel had an average upload speed of 2.7 mbps

One 97 Communications: A host of investment funds including BOFA Securities Europe SA, Morgan Stanley Asia Singapore PTE and Societe Generale – ODI bought Paytm shares worth Rs 1,005 crore through open market transactions at an average price of Rs 555 apiece. Meanwhile, SVF India Holdings (Cayman) offloaded 2.93 crore shares in Paytm at an average price of Rs 555.67 per share, which are worth Rs 1,630.89 crore. SVF as of September 2022 held 11.32 crore shares or 17.45% stake in Paytm.

UltraTech Cement: The company has commenced operation at its third Birla White Wall Care Putty plant in Rajasthan with a capacity of 4 LMT per annum, at a total cost of Rs 187 crore. Now it has a Wall Care Putty capacity of 13 LMT per annum.

FSN E-Commerce Ventures (Nykaa): Citigroup has launched a block deal to sell shares in cosmetics-to-fashion retailer Nykaa, worth $125 million or Rs 1,000 crore, CNBC Awaaz reported. US-based private equity firm, TPG Capital, is the seller in the block deal, which would provide 0.5% discount from the ongoing rate. This comes a few days after the lock-in period for pre-IPO investors ended.

Bajaj Auto: Life Insurance Corporation of India sold 2% stake or 56.68 lakh shares in Bajaj Auto via open market transactions. With this, LIC’s shareholding in the company stands reduced to 5.2 percent, from 7.2 percent earlier.

Blue Dart: The logistics company has opened over 19 retail outlets in Tier I and II towns as part of its expansion plans. These stores are located across 14 states including Uttarakhand, Haryana, Uttar Pradesh, Rajasthan, Punjab, Telangana, Andhra Pradesh, Maharashtra and Karnataka.

Bharat Electronics: The defence PSU has signed a MoU with Armoured Vehicles Nigam Limited (AVNL). The MoU aims at leveraging the complementary strengths and capabilities of BEL and AVNL (AVANI) to address domestic and export opportunities in the areas of Combat Vehicles, Main Battle Tanks (MBTs), Infantry Fighting Vehicles (IFVs), Armored Fighting Vehicles (AFVs) and related systems. It has also signed a MoU with Advanced Weapons and Equipment India (AWEIL), a defence PSU.

Alstone Textiles (India): The company has fixed December 14 as a record date for sub-division of equity shares. The company said each share will stand sub-divided into 10 shares of nominal value of Re 1 each fully paid-up and will ascertain the eligibility of shareholders entitled for issuance of bonus equity shares in the proportion of 9 shares of Re 1 each for every 1 existing share of Re 1 each.

Mahindra Lifespace Developers: The company has launched its residential project – Mahindra Citadel Phase 1, at Pimpri Chinchwad, Pune.

CSB Bank: The bank has received approval from the Reserve Bank of India for appointment of Ms. Bhama Krishnamurthy as Part-time Chairperson of the bank with effect from November 17. She will be the part-time chairperson of the bank during November 17, 2022 and September 28, 2024.

Future Enterprises: The debt-ridden company defaulted on payment of interest on non-convertible debentures of Rs 1.07 crore. The debentures have a coupon rate of 9.28% and Future Enterprises has defaulted on interest payments for the period from May 17, 2022, to November 15, 2022.