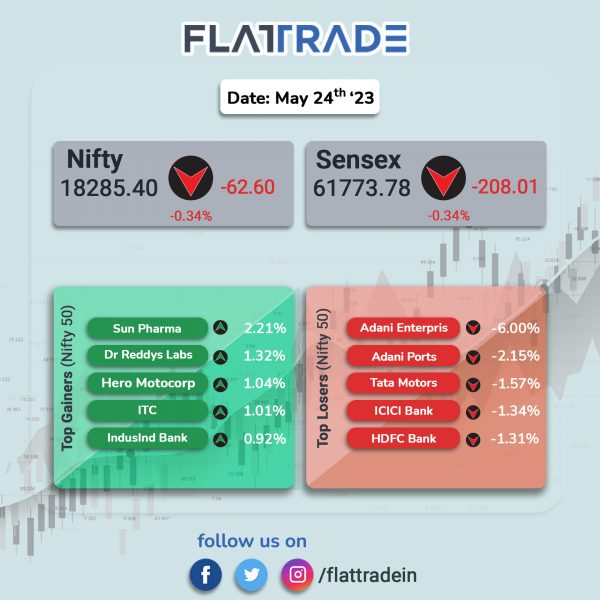

Sensex, Nifty ended lower as losses in metal, banking and Adani Group stocks dragged the markets down. The Sensex and the Nifty 50 indices ended 0.34% lower, each.

In broader markets, the Nifty Midcap 100 index rose 0.21% and the BSE Smallcap index gained 0.10%.

Top losers were Metal [-1.56%], Financial Services [-0.8%], Bank [-0.63%], Private Bank [-0.61%] and PSU Bank [-0.51%]. Top gainers were Pharma [1.03%], Media [0.55%], FMCG [0.48%], and Energy [0.24%].

Indian rupee appreciated by 14 paise to close at 82.67 against the US dollar on Wednesday.

Stock in News Today

Hindalco Industries: The aluminium major’s net profit declined 37.4% to Rs 2,411 crore in Q4FY23 as against Rs 3,851 crore in Q4FY22. Revenue from operations stood at Rs 55,857 crore in the quarter ended March 2023 as compared with Rs 55,764 crore posted in the corresponding quarter previous year. EBITDA declined 23% YoY to Rs 5,818 crore in Q4FY23, impacted by higher input costs and unfavourable macroeconomics. Meanwhile, the board recommended a dividend of Rs 3 per equity share for the year ended March 2023, subject to the approval of shareholders.

On full year basis, the mining company reported 26% fall in net profit to Rs 10,097 crore despite of 14% rise in revenue from operations to Rs 2,23,202 crore in FY23 over FY22.

Deepak Nitrite: Shares of the company surged 9.5% after the company said its subsidiary signed a pact with Gujarat Government to invest Rs 5,000 crore over four years. Deepak Nitrite’s wholly owned subsidiary, Deepak Chem Tech, has signed a memorandum of understanding with the Gujarat government to invest Rs 5,000 crore in the next four years to set up projects to manufacture speciality chemicals, phenol/acetone and bisphenol at Dahej/Nandesari in Gujarat.

Fortis Healthcare: The company’s consolidated net profit surged 95% YoY to Rs 132.55 crore on 19.2% YoY rise in revenue from operations to Rs 1,642.70 crore in Q4FY23. Revenue from the Hospitals business grew by 29.7% YoY to Rs 1,350 crore while net Diagnostics revenue declined by 13.3% YoY to Rs 292 crore during the period under review. EBITDA jumped 25.3% year on year to Rs 285 crore in the quarter ended 31 March 2023.

Wonderla Holidays: The company reported a net profit of Rs 35.1 crore in Q4FY23 as against Rs 9 crore in Q4FY22. Revenue was up 69.7% YoY at Rs 98.6 crore in Q4FY23 as against Rs 58.1 crore in Q4FY22. EBITDA rose to Rs 42.3 crore in Q4FY23 from Rs 20 crore in Q4FY22.

Galaxy Surfactants: The company’s consolidated net profit fell 8% to Rs 90.53 crore on 7.5% decline in revenue from operations to Rs 974.47 crore in Q4FY23 over Q4FY22. EBITDA fell 3.2% to Rs 141.5 crore in Q4FY23 from Rs 146.2 crore in Q4FY22. Total volumes stood at 57,866 million tons (MT) in Q4FY23 as against 57,511 MT in Q4FY22, up by 0.6% YoY. Meanwhile, the board has recommended a final dividend of Rs 4 per equity share for FY23. On full year basis, the company’s consolidated net profit jumped 45% to Rs 380.98 crore on 20.6% increase in revenue from operations to Rs 4,445.24 crore in FY23 over FY22. Shares slumped 2.78% today.

H.G. Infra Engineering: The company bagged a construction project worth Rs 42.5 crore from NTPC, a public sector enterprise. The project is based on a service contract for road construction sites in Andhra Pradesh, scheduled for completion within one year.

SMS Pharma: The company said its net profit was up 51% QoQ at Rs 8 crore in Q4FY23. Revenue inched up 0.4% QoQ to Rs 149.4 crore in Q4FY23. EBITDA was up 24.5% at Rs 23.4 crore in Q4FY23 over Q4FY22.

Avanti Feeds: The company’s net profit was up 10.7% YoY at Rs 93.3 crore in Q4FY23 as against Rs 84.3 crore in Q4FY22. Revenue fell 17.9% YoY at Rs 1,093 crore in Q4FY23 as against Rs 1,332 crore in Q4FY22. EBITDA was up 14.5% YoY at Rs 133.5 crore in Q4FY23 as against Rs 116.6 crore in Q4FY22.

India Cements: The company reported a net loss of Rs 217.8 crore in Q4FY23 as against a net loss of Rs 23.7 crore in Q4FY22. Revenue was up 4.9% YoY at Rs 1,460.5 crore in Q4FY23 as against Rs 1,392 crore in Q4FY22. EBITDA loss stood at Rs 44.5 crore in Q4FY23 as against EBITDA of Rs 61.4 crore in Q4FY22. It reported an one-time loss of Rs 114 crore in the quarter under review.

Antony Waste: The company’s net profit was down 55% YoY at Rs 9 crore in Q4FY23 as against Rs 20 crore in Q4FY22. Revenue was up 7.9% YoY at Rs 203.1 crore in Q4FY23 as against Rs 188.2 crore in Q4FY22. EBITDA fell 21.7% YoY at Rs 32.5 crore in Q4FY23 as against Rs 41.5 crore in Q4FY22.

Varun Beverages (VB): The bottling company has incorporated a wholly-owned subsidiary in South Africa. The subsidiary, Varun Beverages South Africa, will be based in Johannesburg. The new subsidiary will help Varun Beverages to further expand its reach in Africa and to better serve its customers in the region.

Schneider Electric Infrastructure: The company reported a net profit of Rs 44.84 crore in Q4FY23, higher than Rs 0.07 crore in Q4FY22. The company’s net sales rose 20.73% to Rs 410.51 crore in Q4FY23 over Q4 March 2022. For the full year, the company’s net profit surged 347.57% to Rs 123.62 crore on 16.13% increase in net sales to Rs 1777.19 crore in FY23 over FY22.

CMS Info Systems: The company’s net profit jumped 24.9% to Rs 79.93 crore on 12.9% rise in revenue from operations to Rs 501.44 crore in Q4FY23 over Q4FY22. EBITDA rose 25% to Rs 149 crore in Q4FY23 as compared with Rs 140 crore posted in Q4FY22. ATMs under managed services stood at 17,500 in March 2023, recording 50% YoY growth. Meanwhile, the board has recommended a dividend of Rs 4.75 per equity share for FY23. On full year basis, the company’s net profit jumped 32.7% to Rs 297.24 crore on 20.4% rise in revenue from operations to Rs 1,914.73 crore in FY23 over FY22.

Mishtann Foods: The company announced its plans to introduce new products for domestic markets and also informed about its entry into new markets like North Eastern India. The company expects its top line to rise with these positive actions. Earlier, the company had announced that it had incorporated a wholly owned subsidiary company named “Grow and Grub Nutrients FZ – LLC” in United Arab Emirates to focus on international trade. The company’s primary focus is on various types of Basmati rice and also has a sizeable presence in wheat and pulses segment.

Sudarshan Chemical Industries: The company’s net profit declined 27.1% to Rs 32.57 crore despite 10.1% jump in revenue from operations to Rs 685.17 crore in Q4FY23 over Q4FY22. EBITDA fell 1.16% to Rs 85 crore in Q4FY23 compared with Rs 86 crore in Q4FY22. Meanwhile, the board has recommended a final dividend of Rs 1.50 per equity share for FY23. Further, the company’s board has approved the reappointment of Rajesh B. Rathi as a managing director of the company for a further term of 5 years effective from 1 June 2023. On full year basis, the company’s consolidated net profit tumbled 65.6% to Rs 44.77 crore in FY23 as compared with Rs 129.97 crore in FY22. Revenue from operations increased 4.3% year on year to Rs 2,276.79 crore in FY23.

Cummins India: The company reported 68.38% surge in standalone net profit to Rs 318.50 crore in Q4FY23 as against Rs 189.15 crore posted in Q4FY22. Total sales jumped 28.64% year on year to Rs 1,889.13 crore in the quarter ended 31 March 2023. Domestic sales stood at Rs 1,396 crore (up 33% YoY and down 13% QoQ) while exports sales were at Rs 493 crore (up 17% YoY and down 9% QoQ) during the period under review. Meanwhile, the company’s board has recommended a final dividend of Rs 13 per equity share for FY23. The record date for the same is fixed on 26 July 2023. The said dividend, if approved by the members at the Annual General Meeting, will be paid on 31 August 2023.

SKM Egg Products Export (India): Shares of the company hit an upper limit of 5% on Wednesday after the company’s net profit soared to Rs 29.73 crore in Q4FY23 as against Rs 0.68 crore in Q4FY22. Net sales surged 143.55% year-on-year to Rs 185.56 crore in Q4FY23. The company’s board recommended an interim dividend of Rs 2 per share for FY23.

Suzlon: The company has bagged a significantly large order for its new 3 MW series of wind turbines to develop a 300 MW wind power project for Torrent Power. Suzlon will install 100 wind turbine generators with a rated capacity of 3 MW each. The project will be completed in phases by 2025 in Karnataka.