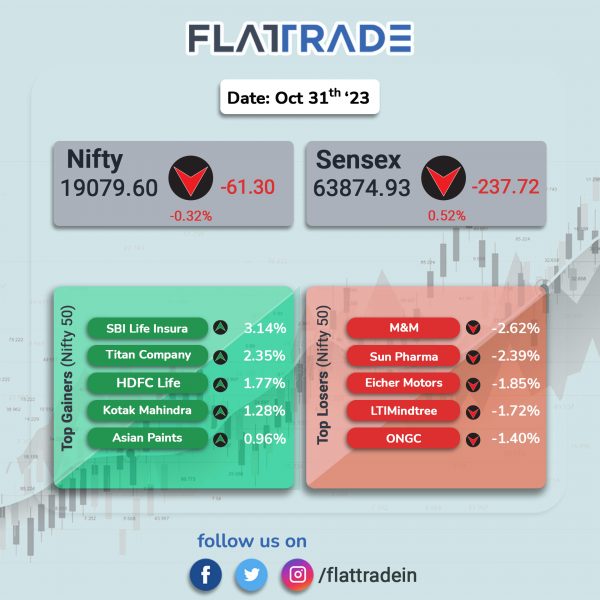

Benchmark indices closed lower as investors’ sentiments were dented due to negative global sentiments after data showed China’s manufacturing activity contracted in October and ongoing Israel-Hamas conflict. The Sensex fell 0.37% and the Nifty index dropped 0.32%.

In broader markets, the Nifty Midcap 100 advanced 0.37% and the BSE Smallcap marginally rose by 0.02%.

Top losers among Nifty sectoral indices were Auto [-0.67%], Pharma [-0.62%], Oil & Gas [-0.53%], Private Bank [-0.47%], and Bank [-0.45%]. Top gainers were Realty [1.27%], Media [0.91%], FMCG [0.16%], and PSU Bank [0.14%].

The Indian rupee weakened by 1 paise to 83.25 against the US dollar on Tuesday.

Stock in News Today

Indian Oil Corporation (IOCL): The state-owned oil refiner reported a net profit of Rs 12967 crore in Q2FY24 as against a net loss of Rs 272 crore in the year-ago period. Its revenue from operations during the quarter declined to Rs 2.2 lakh crore compared to Rs 2.28 lakh crore reported in the same period last fiscal. The company said revenue from the petroleum products segment declined 12.27% YoY to Rs 1.90 lakh crore in Q2FY24. The company’s gross refining margin stood at $13.12 per barrel in Q2FY24 compared to $25.49 per barrel in the same period last fiscal. The company’s board has approved an interim dividend of Rs 5 per share for FY24 and the record date is set as November 10. The interim dividend would be paid to eligible shareholders on or before November 30.

Larsen & Toubro (L&T): The company said L&T Energy Hydrocarbon LTEH, an arm of the company, has secured a Letter of Intent for yet another Ultra-Mega Onshore project from a prestigious client in the Middle East further to the recent Ultra-Mega project award for a Gas Compression plant. According to the company, projects worth over Rs 15,000 crore have been classified under the ‘ultra-mega’ category. The scope of work includes procurement and construction for a gas processing plant, consisting of inlet separation facilities and booster compression system, among others, in new onshore facilities and its integration with existing gas processing plants.

GAIL (India): The state-run natural gas company reported a 70.3% rise in standalone net profit at Rs 2,404.89 crore in Q2FY24 from Rs 1,412 crore in Q1FY24. The company’s standalone revenue from operations declined 1.25% to Rs 31,822.62 crore in Q2FY24 from Rs 32,227.47 crore in Q1FY24. Its Ebitda increased 43.5% to Rs 3,492 crore in Q2FY24 from Rs 2,433 crore in the preceding quarter of FY24.

Zydus Lifesciences: The company announced the acquisition of the UK headquartered LiqMeds Group of companies which has capabilities and specialisation in development, manufacturing and supply of oral liquid products for global markets. Zydus will pay an upfront consideration of GBP 68 million and yearly earn-outs until 2026 depending on achievement of certain agreed milestones towards acquisition of the LiqMeds Group of companies.

Arvind: The company posted a net profit of Rs 80.01 crore in Q2FY24, down 36% from Rs 125.02 crore in the year-ago period. It posted revenue from operations at Rs 1,921.73 crore, down 11.4% as against Rs 2,169.81 crore in Q2FY23. Its Ebitda stood at Rs 206 crore, up 2% YoY. Arvind’s Textiles business posted revenue of 1,455.32 crore in Q2FY24 and the Advanced Materials business delivered a revenue of Rs 354.49 crore in the reported quarter.

Ajanta Pharma: The company reported a 24.71% rise in consolidated net profit at Rs 195.3 crore in Q2FY24 as against a consolidated net profit of Rs 156.6 crore in the same quarter last fiscal. Consolidated revenue from operations was at Rs 1,028.44 crore in Q2FY24 as against Rs 938.10 crore in the year-ago period. The total branded generic business sales across geographies stood at Rs 743 crore in Q2Fy24 compared to Rs 711 crore in the year-ago period. In India the sales was at Rs 355 crore in Q2FY24 as against Rs 314 crore in the same quarter last fiscal.

GE T&D India: The company has secured orders worth approximately Rs 500 crore from Power Grid for supply of 765 kV Power Transformers and Shunt Reactors for Power Grid’s various transmission system projects in India. These projects aim to facilitate the integration of renewable energy into the national electricity grid and enhance electricity transmission within the country.

Gillette India: The company said its net profit rose 6.81% to Rs 92.69 crore in Q2FY24 from Rs 86.78 crore in Q2FY23. Sales rose 7.68% to Rs 667.55 crore in the quarter ended September 2023 as against Rs 619.92 crore during the same quarter last fiscal. During the quarter, the company’s revenue from grooming segment stood at Rs 527.47 crore (up 7.78% YoY) and revenue from Oral Care stood at Rs 140.08 crore (up 7.32% YoY).

Gujarat Industries Power Company: The company announced the signing of power purchase agreement (PPA) with Gujarat Urja Vikas Nigam for procurement of 500MW Power under bilateral mode. The said power will be procured from the Solar PV project that would be set-up in RE Park at Khavda, Bhuj Taluka, Kutch District, Gujarat.

DCX Systems: Shares of the company surged over 14% in intraday trade after the company posted robust results. The company’s consolidated net profit jumped 151.58% YoY to Rs 19.8 crore for the quarter ended September 2023. Its consolidated revenue was up 77.77% to Rs 309.12 crore in Q2FY24 as against Rs 173.89 crore in Q2FY23. Ebitda surged 82.39% to Rs 18.44 crore in Q2FY24 from Rs 10.11 crore in Q2FY23.

Vedant Fashions: The company which operated clothing retail chain Manyavar said its consolidated revenue fell 11.6% to Rs 218 crore in Q2FY24 as against Rs 247 crore in the year-ago period. Its consolidated Ebitda was down 19.6% YoY at Rs 92.8 crore in Q2FY24 as against Rs 115.4 crore in the year-ago period. Consolidated net profit was down 29.4% at Rs 49 crore in Q2FY24 as against Rs 69 crore in Q2FY23.

Triveni Engineering and Industries: The company registered a net profit of Rs 29 crore, down by 98% YoY in Q2FY24 as against a net profit stood of Rs 1,388 crore. The company’s revenue from operations in Q2FY24 came stood at Rs 1,671.4 crore, up 10% higher as compared to Rs 1,471.6 crore reported in the same quarter last fiscal. Its Ebitda rose 38.8% to Rs 63 crore in the September 2023 quarter from Rs 45.4 crore in the year-ago period. The company’s margin widened to 3.9% in Q2FY24 as against 3.1% in Q2FY23.

GMR Airports Infrastructure: The company said its consolidated net loss fell to Rs 190 crore in Q2FY24 from a net loss of Rs 197 crore in the year-ago quarter. The company’s net income during the quarter under review rose 25% to Rs 1,607 crore from a net income of Rs 1,285 crore Q2FY23. The total passenger traffic increased by 25% YoY to 26.5 million in the July-September period, the company said. Its Ebida grew by 34% YoY to Rs 848 crore during the reported quarter. Domestic traffic rose 16% YoY, while international traffic increased by 22% YoY in Q2FY24.

Managlore Chemicals and Fertilisers: The company’s standalone revenue from operations stood at Rs 1,410.41 crore in Q2FY24, up 397.7% from Rs 283.39 crore in Q2FY23. Its standalone net profit stood at Rs. 67.71 crore in Q2FY24, up 310.36% from Rs 32.19 crore in Q2FY23. Its Ebitda was at Rs 151.93 crore in September 2023 as against from Rs 12.52 crore in the year-ago period.

DCM Shriram: The company’s consolidated revenue fell 1.7% to Rs 2,708 crore in Q2FY24 from Rs 2,740 crore in Q2FY23. Consolidated Ebitda fell 57.8% to Rs 114 crore in Q2FY24 from Rs 270 crore in Q2FY23. Consolidated net profit fell 74.8% to Rs 32 crore in Q2FY24 from Rs 128 crore in Q2FY23.

SIS: The company reported a consolidated revenue of Rs 3073.6 crore in Q2FY24, up 11.1% from Rs 2,767.7 crore in Q2FY23. Consolidated Ebitda was up 23% YoY at Rs 145 crore in Q2FY24 as against Rs 110 crore in Q2FY23. Its consolidated net profit was up 9.9% YoY to Rs 75 crore in Q2FY24 from Rs 67 crore in Q2FY23.

TVS Holdings: The company’s revenue rose 16.9% to Rs 10,473 crore in Q2FY24 from Rs 8,963 crore in Q2FY23. Consolidated Ebitda increased 18.1% to Rs 1,360 crore in Q2FY24 from Rs 1,152 crore in the year-ago period. Its consolidated net profit grew 16% to Rs 457 crore int he quarter under review from Rs 394 crore in the year-ago period.