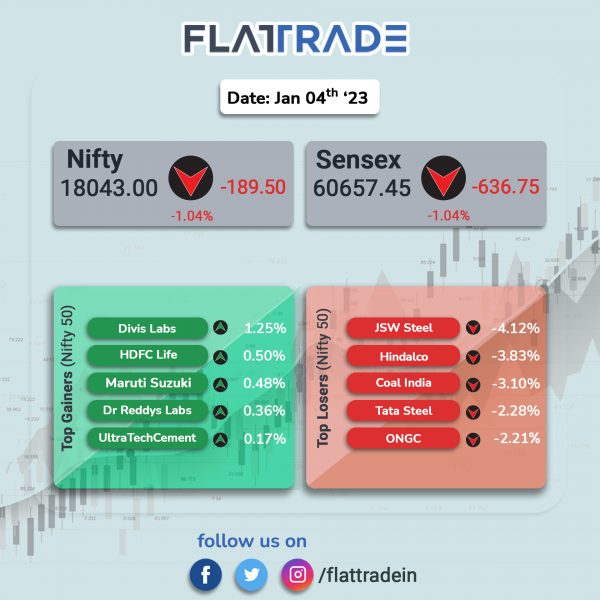

Indian benchmark indices snapped their two-day gains and declined over 1% on Wednesday due to negative global cues. The Sensex closed 1.04% lower and the Nifty index fell 1.04%.

In broader markets, the Nifty Midcap 100 slumped 1.12% and the BSE Small cap index dropped 0.79%.

Top losers were Nifty Metal [-2.11%], Realty [-2.05%], PSU Bank [-1.83%], Oil & Gas [-1.56%] and Energy [-1.54%].

Indian rupee fell 8 paise to 82.80 against the US dollar on Wednesday.

Stock in News Today

HDFC Bank: The private lender’s advances aggregated to approximately Rs 15,07,000 crore in Q3FY23 recording a growth of around 19.5% YoY as against Rs 12,60,900 crore in the year-ago period. The bank’s deposits aggregated to approximately Rs 17,33,500 crore in Q3FY23, registering a growth of around 19.9% YoY. The bank’s CASA ratio stood at around 44% in Q3FY23 compared to 47.1% in the year-ago period.

Tata Consultancy Services (TCS): The IT services company announced that Taiwan’s CTBC Bank has selected TCS BaNCS for Banking and Wealth Management to digitally transform its business and drive its future growth. TCS BaNCS’ next-generation digital core will enable the bank to provide specialized financial services across retail, wealth and corporate banking, including money trusts, as well as trade finance and international remittance.

IndusInd Bank: The private lender’s net advances improved to Rs 2,71,966 crore in Q3FY23, registering a growth of 19% YoY. The bank’s deposits jumped 14% YoY to Rs 3,25,491 crore in Q3FY23. CASA ratio stood at 42% in Q3FY23 compared with 42.2% in the year-ago period.

Infosys: A joint venture between Infosys and Temasek — Infosys Compaz — has announced a collaboration with Singapore-based StarHub, communications, entertainment and digital services provider, to enable their IT transformation, while strengthening their technology operations, service management and cybersecurity.

Equitas Small Finance Bank: In an exchange filing, the bank said that it has received an intimation from RBI giving approval to SBI Funds Management (SBI FML) to acquire up to 9.99% of the paid-up equity capital of the bank through the schemes of SBI Mutual Fund (SBI MF). The banking regulator’s approval is subject to compliance with the relevant regulations issued by RBI and SEBI and the approval is valid for one year till January 2, 2024.

Aurobindo Pharma: The drug maker said that its wholly-owned subsidiary Eugia Pharma Specialities has received the USFDA approval to manufacture and market Azacitidine for injection. Azacitidine for injection would be the bioequivalent and therapeutically equivalent to the Reference Listed Drug (RLD), Vidaza for injection of Bristol-Myers Squibb Company. The approved product has an estimated market size of around $46 million for the twelve months ending November 2022, according to IQVIA.

Godrej Properties: The real estate developer announced the enhancement in CP (Commercial Paper) limits to Rs 1750 crore from Rs 1500 crore by ICRA and CRISIL. Ratings for CP have been reaffirmed/assigned at [ICRA] A1+ and CRISIL A1+, respectively.

Angel One: The company said that it has increased its client base to 12.51 million in the month of December 2022, a 2.6% MoM growth and 60.7% YoY growth. The number of of orders stood at 86.23 million, up 21.8% MoM and up 33.5% YoY. The overall average daily turnover was Rs 16,399 billion, a rise of 26.4% MoM and 133.3% YoY growth.

Punjab & Sind Bank: The bank’s gross advances rose by 17% to Rs 78,049 crore during the quarter ended December 2022 as compared with Rs 66,710 crore disbursed in the same period last year. Total deposits rose 9.11% YoY to Rs 1,09,497 crore in Q3FY23. CASA ratio was at 33.30% in Q3FY23 as against 32.63% in the same period last year. Credit-deposit (CD) ratio stood at 71.28% in Q3FY23 as against 66.48% in Q3FY22.

Tata Motors and Tata Elxsi: The companies said that they have crossed a significant milestone of onboarding 5 lakh vehicles onto the Connected Vehicle Platform (CVP) of Tata Motors that caters to its entire range of Commercial, Passenger and Electric Vehicles. In early 2019, Tata Motors collaborated with Tata Elxsi to adopt and adapt the TETHER Connected Vehicle Platform (CVP) towards a common standard technology stack to deliver scalability, differentiated features, high performance and expandable to Industry 4.0 to transform their internal operations.

Gland Pharma: The US drug regulator conducted its pre-market inspection covering quality system/current good manufacturing practice (cGMP) regulations for medical devices at Gland Pharma’s Dundigal facility in Hyderabad. The pharma company said that it has now received Establishment Inspection Report (EIR) from the Office of Product Evaluation and Quality Center for Devices and Radiological Health, USFDA, indicating closure of the inspection.

Ramco Systems: The company announced that it will provide its next-gen Enterprise Resource Planning (ERP) software to Addison & Co., strengthening its 25-year association with India’s leading manufacturer and exporter of metal cutting tools. The software will provide Addison with real-time information availability across the business and reporting capabilities to support their decision making.

Allcargo Logistics: The company said that its wholly owned step-down subsidiary AGL N.V. has entered into an agreement to acquire Hong Kong-based Asiapac Equity Investment for $4.99 million. Asiapac Equity Investment is engaged in the business of Investment and related activities through its subsidiaries.

Orient Cement: The company said in an exchange filing that it is not privy to any discussion as reported in the media that the Adani Group is in deal talks with the promoter of Orient Cement to acquire a stake in the cement maker.

Anupam Rasayan India: The company made an announcement with reference to the fire accident at its unit in Sachin GIDC. The company said that it has restarted the operations in one of the the two plants after receiving the closure revocation order and approval to restart the plant from the GPCB and other regulatory authorities after following all the regulatory and safety compliances. As with regards to the other plant, company is in process of completing the required formalities and shall be able to restart the plant at the earliest, subject to regulatory approvals.

Ambuja Cements: Adani Group-owned company has incorporated a new unit named Ambuja Shipping Services. The wholly-owned has an authorized and paid share capital of Rs 1 crore and the company will be in the business of operating ships.

Yes Bank: The lender’s advances grew 11.7% YoY and 2.4% QoQ to Rs 1.96 lakh crore in the quarter ended December 2022. Deposits grew 16% YoY and 6.8% QoQ to Rs 2.13 lakh crore in the same period. The bank’s credit to deposit ratio stood at 89.7% in Q3FY23 compared with 95.6% in the year-ago period.

Radiant Cash Management: The company made a decent debut on the NSE as the stock got listed at Rs 103 per share as against an issue price of Rs 99. The shares hit a high of Rs 116.8 and a low of Rs 98.10. Shares clsoed at Rs 104.90.