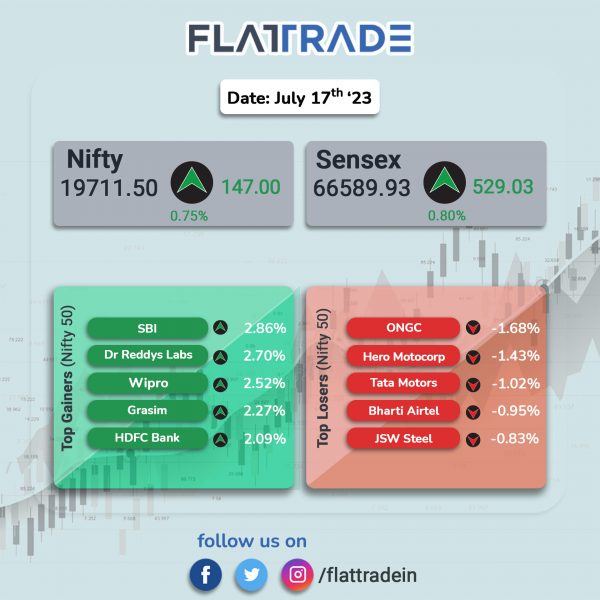

Benchmark equity indices closed at fresh record highs, led by gains in most sectors except the auto sector. Banking stocks led the gains to push benchmark indices to new peaks. The Sensex jumped 0.8% and the Nifty rose 0.75%.

In broader markets, the Nifty Midcap 100 index rose 0.31% and the BSE Smallcap advanced 0.85%.

Top gainers were Media [3.15%], PSU Bank [2.25%], Bank [1.41%], Private bank [1.33%], Financial Services [1.25%]. Top loser was Auto [-0.32%].

Indian rupee appreciated by 12 paise to close at 82.05 against the US dollar on Monday.

Stock in News Today

HDFC Bank: The private lender’s net profit rose 29.97% to Rs 11,951.77 crore on 39.12% jump in total income to Rs 57,816.67 crore in Q1FY24 over Q1FY23. The ratio of net NPAs to net advances stood at 0.30% as on 30 June 2023 as against 0.35% as on 30 June 2022. Net interest income for the quarter ended June 2023 grew by 21.1% to 23,599 crore from 19,481 crore for the quarter ended June 2022. Total advances as of 30 June 2023 were 16,15,672 crore, an increase of 15.8% over 30 June 2022. Total deposits showed a healthy growth and were at 19,13,096 crore as of 30 June 2023, an increase of 19.2% over 30 June 2022. The bank’s total capital adequacy ratio (CAR) as per Basel III guidelines was at 18.9% as on 30 June 2023 as against 18.1% as on 30 June 2022.

Route Mobile: The company announced that its promoters entered into a share purchase agreement with Proximus Opal S.A. / N.V. and Proximus S.A. to sell their entire 57.56% shareholding (3.64 crore shares) at Rs 1,626.4 per share aggregating to Rs 5,922.4 crore. Post this transaction, Proximus Opal will make an open offer to acquire another 1.64 crore shares or 26% of the expanded voting share capital from the public shareholders of Route Mobile. The price of the Open Offer is also Rs 1,626.4 per share, which amounts to a total consideration of Rs 2,675 crore, subject to statutory approvals.

Ashok Leyland: The company received significant orders worth Rs 800 crore in the defense sector that include the procurement of the Field Artillery Tractor (FAT 4×4) and the Gun Towing Vehicle (GTV 6×6). The FAT 4×4 and GTV 6×6 are specialized vehicles employed by the Artillery for towing light and medium guns, respectively.

Larsen & Toubro (L&T): The company said that its Water & Effluent Treatment Business of L&T Construction has secured orders from State Water & Sanitation Mission, Uttar Pradesh, to construct water supply schemes in Ballia and Firozabad. As per the classification the value of the order lies between Rs 2,500 crore to Rs 5,000 crore. The project involves automation including measurement of input & output water quantity and quality through suitable SCADA & other instrumentation works. The project is designed to provide safe & potable drinking water to 50.85 lakh people.

Tata Consultancy Services (TCS): The company announced that its customer, Banque Saudi Fransi (BSF), has successfully transformed its domestic and international real-time payments processing using TCS BaNCS for payments, according to its exchange filing.

Central Bank of India (CBI): The state-owned bank’s standalone net profit jumped 78.22% to Rs 418.43 crore on 28.73% increase in total income to Rs 8,183.92 crore in Q1FY24 over Q1FY23. Net interest income (NII) grew by 48.27% YoY to Rs 3,176 crore in Q1FY24 and net interest margin (NIM) improved by 74 bps to 3.62% YoY in Q1FY24. Total deposits rose 6.05% YoY to Rs 3,63,398 crore in Q1FY24 and gross advances increased by 12.95% YoY to Rs 2,19,863 crore in Q1FY24. Net NPA rose by 218 bps to 1.75% YoY in Q1FY24.

IndiaMART InterMESH: The company said that its board will meet on July 20 to consider the proposal for buyback of fully paid up equity shares of the company. The board will also consider financial results for the quarter ended 30 June 2023.

Angel One: Shares of the company tanked over 6% after the exchange passed an order against stockbroker with respect to an alleged failure to monitor the operations of its Authorised Persons (APs), which resulted in alleged violation of capital market regulations and Futures and Options (F&O) Segment Regulations of the Exchange. The exchange slapped a monetary penalty of Rs 1.67 crore and prohibited the brokerage from onboarding new APs for a period of six months. NSE has directed Angel One to conduct inspection of all its APs and submit a report within six months. Meanwhile, Angel One said that NSE’s order does not affect the existing business or activities of the APs affiliated with the company. Further, the brokerage has said it is evaluating various options available including filing an appeal against the order.

Inox Wind: The company announced that TUV SUD, a leading global certification body based in Germany, has granted a Type Certificate to Inox Wind for their new generation 3 MW wind turbine with a booster capacity of up to 3.3 MW. This certification signifies that the prototype turbine has successfully met the necessary requirements for serial production and commissioning. This wind turbine offers one of the lowest costs of energy on a per unit basis given its compact design, resulting in lower costs of production, transport & logistics, and installation. .

Sterling and Wilson Renewable Energy: The company expects to be profitable in the ongoing financial year based on a healthy order book and an estimated $1-billion worth of projects. It expects to bag a substantial portion of Reliance Industries’ roll-out of 100 GW of solar projects by 2030, the management told analysts in a conference call. The company was equipped to handle the large amount of work expected from the RIL group, they said.

Power Grid: The power transmission company announced that its board of directors has accorded approvals on investment proposals for projects aggregating to Rs 4,781.1 crore. The first project includes an investment proposal for implementation of advanced metering infrastructure projects at an estimated cost of Rs 4067.27 crore. Subsequently, the company received an approval of a revised investment proposal for establishment of a pilot data center at Power Grid Manesar Substation at an estimated cost of Rs 713.83 crore through its wholly owned subsidiary named ‘Power Grid Teleservices’.

Aurobindo Pharma: The company said that it has received the establishment inspection report (EIR) report from the USFDA, classifying the company’s Andhra Pradesh (AP)-based facility as voluntary action indicated (VAI). The USFDA had conducted an inspection at Aurobindo Pharma’s unit, which is located in Anakapalli district, Andhra Pradesh, from 15th May to 19th May 2023.

Alphageo India: Shares of the company rose 6.18% in intraday trading after the company announced winning a contract worth Rs 39.33 crore from ONGC, Dehradun, to acquire 3D seismic data for 303 square kilometers of Ganga Basin in Uttar Pradesh and Bihar. The contract is set to be executed by March, 2024, the company said in an exchange filing.

Metropolis Healthcare: The company said that its core business revenue grew about 12% YoY in the first quarter of FY24 and total revenue from operations stood marginally negative compared to Q1FY23 due to Covid-19 and business to government contracts. Core business volume growth for Q1FY24 stood at 13% YoY.

Tata Steel Long Products: The company’s consolidated revenue from operations rose 21.6% QoQ to Rs 3,668.24 crore in Q1FY24. Its net loss narrowed to Rs 254.18 crore in Q1FY24 as against Rs 523.88 crore in the year-ago period.

Rallis India: The company said its revenue from operations fell 9% YoY to Rs 782 crore in Q1FY24. EBITDA slipped 3% YoY to Rs 110 crore in the reported quarter. Net profit fell 6% to Rs 63 crore.

GTPL Hathway: The company reported a 16.97% fall in consolidated net profit to Rs 35.91 crore in Q1FY24 from Rs 43.25 crore posted in the corresponding quarter last year. Revenue from operations jumped 22.75% to Rs 774.44 crore in Q1 FY24 as compared with Rs 630.89 crore in Q1 FY23. EBITDA declined by 7.09% at Rs 125.8 crore in Q1FY24 as compared with Rs 135.4 crore in Q1FY23. The broadband average revenue per user (ARPU) stood at Rs 460 per month per subscriber.

Ircon International: Shares of the company rose over 4% after it bagged an order worth Rs 144 crore from Railways for Jiribam-Imphal new Railway Line Project. The company received a letter of award from N F Railway Construction and the orders are expected to be executed in 365 days from the date of issuance, according to their exchange filing.

Timken India: The company said in an exchange filing that TS and Roller lines at Jamshedpur plant of the company shall remain closed for scheduled maintenance activities from July 24-29, 2023. Other lines at Jamshedpur Plant would continue to operate as usual during the aforesaid period, the company said in an exchange filing.