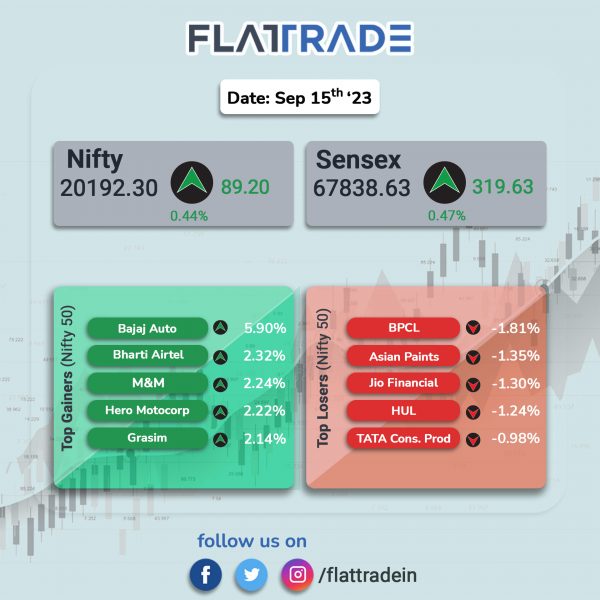

Benchmark equity indices closed at fresh record highs on Friday due to positive global cues after better-than-expected Chinese economic data. The Sensex gained 0.47% and the Nifty jumped 0.44%.

In broader markets, the Nifty Midcap 100 index rose 0.28% and the BSE Smallcap rose 0.27%.

Top gainers were among Nifty sectoral indices were Auto [1.58%], IT [0.94%], Private Bank [0.64%], Pharma [0.61%], and Financial Services [0.6%]. Top losers were Oil & Gas [-0.75%], FMCG [-0.48%], Realty [-0.39%], Metal [-0.16%], and Media [-0.1%].

The Indian rupee weakened by 14 paise to close at Rs 83.18 against the US dollar on Friday.

India’s exports declined by 6.86% to $34.48 billion in August this year as against $37.02 billion in the same month last year, government data showed. Imports too declined by 5.23% to $58.64 billion as against $61.88 billion recorded in August 2022. India’s trade deficit stood at $24.16 billion in August. During April-August this fiscal, exports contracted by 11.9% to $172.95 billion. Imports during the five-month period fell by 12% to $271.83 billion.

Stock in News Today

Adani Green Energy: The company and TotalEnergies SE are in talks, where the latter would invest in renewable energy projects developed by Adani Green Energy, Bloomberg reported citing people familiar with the matter. TotalEnergies is planning to buy stakes in some of Adani Green’s projects to expand its portfolio of clean energy projects, said the sources. TotalEnergies could invest about $700 million in total into the projects, one of the sources said, according to Bloomberg.

Infosys: The IT major has entered into a Memorandum of Understanding with a global company to provide enhanced digital experiences, along with modernization and business operations services, leveraging Infosys platforms & AI solutions, according to its exchange filing. The total client target spend over 15 years is estimated at USD 1.5 billion and this is subject to parties entering into a Master Agreement.

Ashok Leyland: The company said that it has signed a MoU with Uttar Pradesh Government for setting up a new integrated commercial vehicle bus manufacturing facility with an initial investment of Rs 200 crore. The capacity is to be added in 18 months from the date of acquisition of land for setting up the plant and obtaining other statutory approvals. The auto major said that upon commencement of operations, the manufacturing facility will initially have the capacity to produce 2,500 buses per year. The company intends to gradually expand this capacity to accommodate up to 5,000 vehicles per year over the next decade. .

Godrej Properties: The company announced that management committee of the board of directors approved issuance of non-convertible debentures (NCDs) aggregating to Rs 1,500 crore in two series. Under the first series, the company will issue 1,00,000 rated, listed, unsecured, redeemable NCDs having face value of Rs 1 lakh each, aggregating to Rs 1,000 crore. In the second series, 50,000 rated, listed, unsecured, redeemable NCDs will be issued, having face value of Rs 1 lakh each, aggregating to Rs 500 crore.

Zydus Lifesciences: The company said that it has received final approval from the USFDA for Norelgestromin and Ethinyl Estradiol Transdermal System, which contains combination hormone medication and is used to prevent pregnancy. Norelgestromin and Ethinyl Estradiol Transdermal System had annual sales of $330 million in the United States, according to IQVIA MAT July 2023 data.

Alkem Laboratories: The company announced that its board has appointed Dr. Vikas Gupta as the chief executive officer (CEO) of the company with effect from 22 September 2023. The appointment is based on the recommendation of nomination and remuneration committee of the company’s board of directors. Gupta has over two decades of experience in pharmaceutical sector and brings with him deep experience across therapeutic areas including acute, chronic, metabolic and respiratory.

Ami Organics: The company has signed multi-year agreement with Fermion to supply additional advanced pharmaceutical intermediate. Based on the supply projection shared by Fermion, the total minimum contract value is expected to be multi-million Dollar, spread across multi-year horizon. The product is expected to start contributing meaningfully to the revenue from FY25.

Schneider Electric Infrastructure: The company’s board has approved the appointment of Udai Singh as managing director (MD) & chief executive officer (CEO) of the company for three years with effect from 15 September 2023. Singh holds a bachelor’ degree in electrical engineering from IIT Varanasi and has undertaken various leadership programs at Ross Business school & INSEAD. Over the last 30 years, he has held various roles in the areas of sales, marketing, projects & contract management, and manufacturing operations.

Shakti Pumps (India): The company has received letter of award (LoA) under PM- KUSUM III scheme under component-B from Department of Agriculture, Uttar Pradesh, for supply of 10,000 pumps for Rs 293 crore. The order entails supply, installation and commissioning of solar water pumping systems. The contract is to be executed within 90 days from the date of issue of work order.

Siyaram Silk Mills: The company announced that it has increased the buyback price to Rs 720 from Rs 650 per share. The company has also reduced the maximum number of equity shares proposed to be bought back from 16,61,530 shares to 14,99,992 shares, representing 3.20% of the total paid-up equity shares of the company. Siyaram Silk has fixed Monday (18 September 2023) as the record date for its share buyback.