Sai Silks (Kalamandir) Limited plans to raise up to Rs 1,201 crore through an initial public offering. The subscription for the IPO will be open from September 20 to September 22, 2023. The price band is fixed at Rs 210 – Rs 222 per share.

The IPO consists of fresh issue of shares worth Rs 600 crore and offer for sale of shares worth Rs 601 crore. The face value is Rs 2 per share and the lot size is 67 shares.

Company Summary

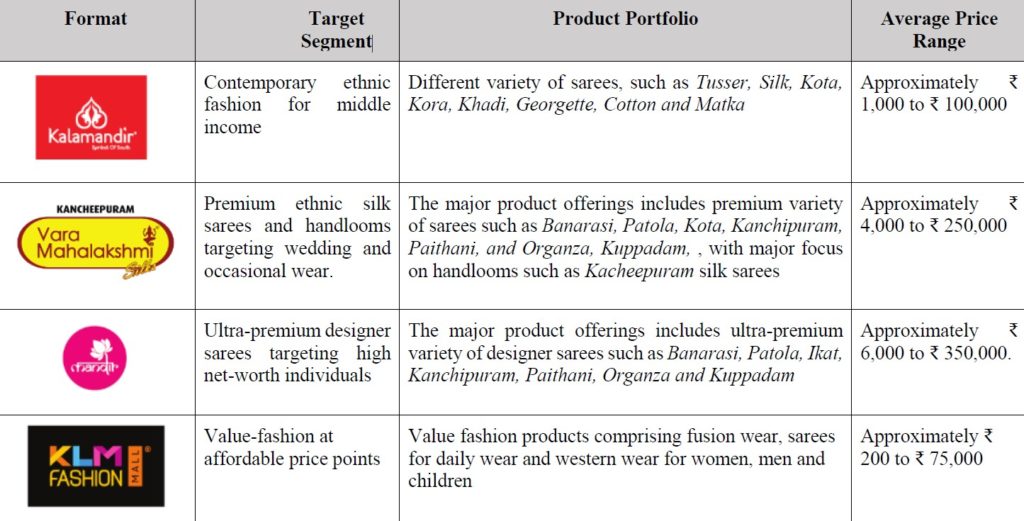

Sai Silks (Kalamandir) in one of the top 10 retailers of ethnic apparel, particularly sarees, in South India in terms of revenues and profit after tax in fiscal 2020, 2021 and 2022. The company through its four store formats, i.e., Kalamandir, VaraMahalakshmi Silks, Mandir, and KLM Fashion Mall, it offers their products to various segments of the market including premium ethnic fashion, ethnic fashion for middle income and value-fashion. As of July 31, 2023, the company operated 54 stores in four major South Indian states, i.e., Andhra Pradesh, Telangana, Karnataka and Tamil Nadu.

As of July 31, 2023, the average store size calculated on the basis of its operating stores, is 10,390 square feet for Kalamandir stores, 3,310 square feet for our Mandir stores, 6,099 square feet for VaraMahalakshmi stores, and 18,400 square feet for our KLM Fashion Mall stores.

Based on the specific markets, the company also opts for a combination of formats to optimize the space that is available in addition to market feedback. In December 2022, the company launched “Valli Silks” which is a combination of our KLM Fashion Mall and VaraMahalakshmi Silks store formats. Further, to cater to niche segments available in certain geographies that they operate, the copany launched “Kalamandir Royale”, an extension of its Kalamandir format, in September 2022, to offer products with higher price points and more exclusive collections.

The company stated that Telangana contributes the maximum to its total revenue from operations. In fiscal 2023 Telangana contributed 44.87% of the the total revenue from operations, Andhra Pradesh contributed 32.77%, followed by Karnataka (13.34%) and Tamil Nadu (9.02%).

The company plans to open approximately 30 additional stores and these are planned over the course of the next two fiscals with more focus on expanding their VaraMahalakshmi Silks store formats. The company also intends to focus on expanding of the KLM Fashion Mall in order to tap the growing potential of value fashion brand and proposes to open five additional stores through a franchisee model.

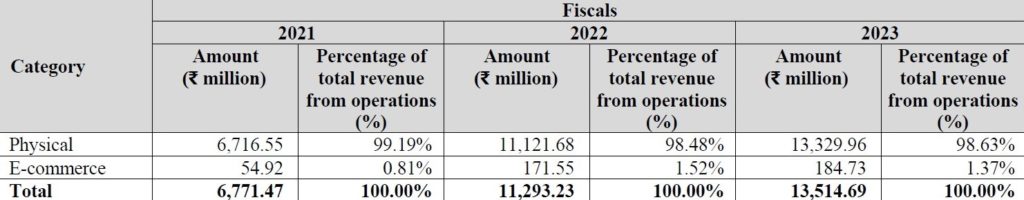

The table below shows the company’s revenue from operation through different sales channels in the last three fiscals:

Company Strengths

- Leading ethnic and value-fashion retail company in South India having a portfolio of established formats.

- Focused sales and marketing strategies that has enabled robust brand recognition and brand recall as well as customer loyalty.

- Scalable business model that is positioned to leverage growth in the ethnic and value-fashion apparel industry in India.

- Strong presence in offline and online marketplace with an omni-channel network.

- Well-established track record of growth, profitability, and unit economics with an efficient operating model.

- Experienced promoter and management along with in-house teams with proven execution capabilities.

Company Financials

Period Ended | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 1,220.45 | 842.49 | 665.42 |

Total Revenue (Rs in crore) | 1,358.92 | 1,133.02 | 679.1 |

Revenue from Operations (Rs in crore) | 1,351.47 | 1,129.32 | 677.25 |

EBITDA (Rs in crore) | 212.53 | 133.05 | 62.36 |

EBITDA Margin | 15.73% | 11.78% | 9.21% |

Profit After Tax (Rs in crore) | 97.59 | 57.69 | 5.13 |

Return on Equity | 27.96% | 21.22% | 2.61% |

Return on Capital Employed | 23.55% | 21.71% | 8.51% |

Debt to Equity Ratio | 0.87 | 0.87 | 0.89 |

Purpose of the IPO

- The net proceeds from fresh issue of shares will be used for funding capital expenditure towards setting-up of 30 new stores aggregating up to Rs 125.08 crore; funding capital expenditure towards setting-up of two warehouses totalling Rs 25.40 crore; funding working capital requirements of the company totalling Rs 280.07 crore; repayment or pre-payment, in full or part, of certain borrowings availed by the company aggregating up to Rs 50 crore; and general corporate purposes.

- The selling shareholders will be entitled to their respective portion of the proceeds from offer for sale after deducting the offer related expenses and relevant taxes. Further, the Company will not receive any proceeds from the offer for sale.

Company Promoters

Nagakanaka Durga Prasad Chalavadi and Jhansi Rani Chalavadi are the promoters of the company.

IPO Details

IPO subscription Date | September 20 to September 22, 2023 |

Face Value | Rs 2 per share |

Price Band | Rs 210 to Rs 222 per share |

Lot Size | 67 shares |

Total Issue Size | 5,40,99,027 shares aggregating up to Rs 1,201 crore |

Fresh Issue | 2,70,27,027 shares aggregating up to Rs 600 crore |

Offer for Sale | 2,70,72,000 shares of Rs 2 aggregating up to Rs 601 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 67 | Rs 14,874 |

Retail (Maximum) | 13 | 871 | Rs 1,93,362 |

Small HNI (Minimum) | 14 | 938 | Rs 2,08,236 |

Small HNI (Maximum) | 67 | 4,489 | Rs 9,96,558 |

Large HNI (Minimum) | 68 | 4,556 | Rs 10,11,432 |

Allotment Details

Event | Date |

Allotment of Shares | September 27, 2023 |

Initiation of Refunds | September 29, 2023 |

Credit of Shares to Demat Account | October 3, 2023 |

Listing Date | October 4, 2023 |

To check allotment, click here