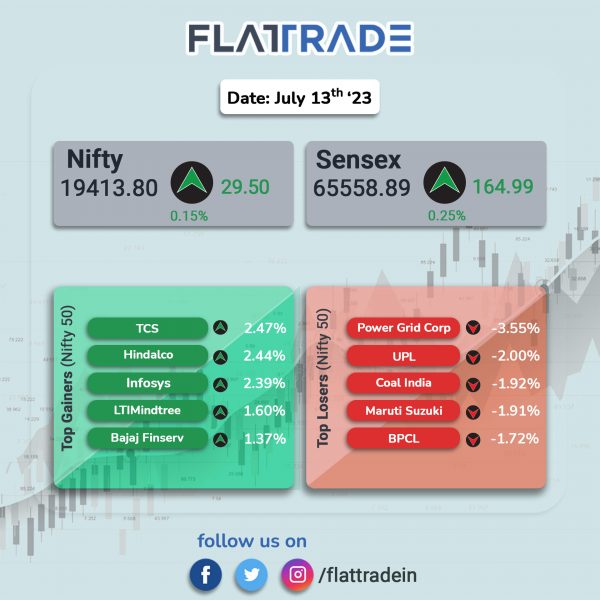

Benchmark equity indices rallied to new highs, led by strong gains in IT shares, but pared gains in the second half of the session and closed with modest gains. The Sensex closed 0.25% and the Nifty 50 index gained 0.15%.

In broader markets, the Nifty Midcap 100 index fell 0.81% and the BSE Smallcap was down 0.54%.

Top gainers among Nifty sectoral indices were IT [1.75%], Realty [1.02%], Financial Services [0.63%], and Metal [0.26%]. Top losers were PSU Bank [-2.38%], Media [-1.88%], Energy [-1.43%], Oil & Gas [-1.17%], and Auto [-0.61%].

Indian rupee appreciated by 18 paise to close at 82.07 against the U.S dollar on Thursday.

Stock in News Today

Federal Bank: The private lender posted a standalone net profit of Rs 854 crore for the quarter ended June 2023, rising 42% compared to Rs 601 crorein Q1FY23. The net interest income (NII) for the first quarter rose nearly 20% to Rs 1,919 crore. It was Rs 1,605 crore in the same period last year. The total income for the first quarter came in at Rs 5,756 crore, up 41%, compared with Rs 4,081 crore in the corresponding quarter of last year. Operating profit for the quarter under review stood at Rs 1,302 crore, up 34% from a year ago. The lender’s provisions fell 7% to Rs 155 crore during the June quarter, compared with Rs 167 crore in the year-ago period and its net NPAs improved to 0.69% from 0.94% a year ago.

Adani Green Energy: The company reported a 70% YoY jump in energy sales at 6,023 million units in Q1FY24, as against the sale of 3,550 million units in Q1FY23. The operational capacity increased by 43% YoY to 8,316 MW in the reported quarter with the addition of 1,750 MW solar–wind hybrid, 212 MW solar and 554 MW wind power plants, the company said. The solar portfolio CUF (Capacity Utilisation Factor) stood at 26.9% with 40 bps improvement on a YoY basis, backed by 99.7% plant availability. Its wind portfolio CUF stood at 38.7% with 830 bps reduction on a yearly basis. The reduction is primarily due to relatively lower wind speed, which was higher last year.

Ultratech Cement: The company announced the commissioning of 1.3 million tonnes per annum (mtpa) brownfield cement capacity at Sonar Bangla in West Bengal, taking the Unit’s capacity to 3.3 mtpa. With this, the cement maker said that it has completed the first phase of expansion in the Eastern region. The company has commissioned cement capacity of 10.3 mtpa in the region over the last two years, catering to the rapidly growing cement demand in the region.

Hindalco Industries: The company said that its board has approved a proposal to sell land at Kalwa, Maharashtra, for Rs 595 crore. The land will be sold to Birla Estates, a subsidiary of Century Textiles and Industries for a total sum of Rs 595 crore, which is to be received in multiple tranches over a period of time. The expected date of completion of the sale/disposal is about 15 months, it added.

G R Infraprojects: The company received a letter of award (LoA) from the Ministry of Road Transport and Highways (MRTH) to construct a highway in Uttar Pradesh. The project includes construction of a four lane highway from Baranpu Kadipur Ichauli to Rampuriya Awwal in Uttar Pradesh on hybrid annuity mode. The bid project cost is Rs 737.17 crore. The project will be completed within 730 days from the appointed date. The operation period is for 15 years from the commercial operation date.

Granules India: The drug maker informed that the US drug regulator issued an establishment inspection report (EIR) for its Gagillapur facility in Hyderabad. The United States Food and Drug Administration (USFDA) inspected the facility as a part of a pre-approval inspection (PAI) in January 2023 which resulted in three observations during the inspection. The company responded to these observations within the stipulated period.

Mangalore Refinery & Petrochemicals (MRPL): The company has appointed Vivek Chandrakant Tongaonkar as chief financial officer (CFO) for a term of five years in place of Yogish Nayak S with effect from May 24, 2023. He is an industry veteran with over 36 years of professional experience in diverse activities across the exploration and production (E&P) value chain. He grew up along the hierarchy and served in different capacities in ONGC.

KIOCL: The company announced that the operations of its pellet plant unit located at Mangalore have been restarted with effect from July 13, 2023. The company had temporarily shut down the operations at the said plant w.e.f. July 2, 2023 to carry out refractory repair work.

Equitas SFB: The small finance bank (SFB) said that CRISIL Ratings has reaffirmed its ‘CRISIL A1+’ rating on the certificate of deposits of the bank. CRISIL said that the rating is driven by the bank’s diversified product portfolio with increasing focus on secured lending, the adequacy of its capital position in relation to the scale, steady growth in its deposit franchise and experienced management team with strong focus on process orientation.

The Ramco Cements: The company’s board has approved the execution of share subscription and purchase agreement to sale its entire shareholding in Lynks Logistics to Bundl Technologies (Swiggy). The company will sell and transfer its entire shareholding of 49,95,16,202 equity shares to Bundl Technologies, and simultaneously will acquire 24,18,915 compulsorily convertible preference shares of Bundl. The said transaction is expected to be completed by August 14, 2023.

5paisa Capital: The company’s consolidated net profit surged 96.8% to Rs 14.54 crore in Q1FY24 from Rs 7.39 crore reported in Q1FY23. Total income rose marginally year-on-year to Rs 84.58 crore in the reported quarter. EBDTA in Q1FY24 grew to Rs 21.8 crore in Q1FY24, from Rs 12.2 crore reported in Q1FY23. EBDTA margin improved to 26% during the quarter as against 14% in the same quarter previous year, according to its exchange filing. The company on-boarded more than 1.08 lakh new clients during the quarter, taking the total number of registered customers to 3.6 million.

Jubilant Foodworks: The quick service restaurant company has opened a fried-chicken outlet ‘Popeyes’ in Hyderabad. With this, Popeyes store count has jumped to 18. The company said it plans to open 32-35 stores in India in the current fiscal.

Vodafone Idea: The telecom company has partnered with Truecaller for integrating Truecaller’s verified business caller ID solution into its operations. The company, in partnership with Truecaller, aims to enhance the safety and reliability of customer interactions by integrating Truecaller’s Verified Business Caller ID solution into its operations.

Ashiana Housing: Shares of the company jumped 15% in intraday trading after its board approved a buyback proposal. The company will buyback about 18,27,242 equity shares with a face value of Rs 2 apiece at a price of Rs 301 per share, according to an exchange filing. The proposed number of shares represents 1.78% of the total number of equity shares in the paid-up share capital of the company. The record date is fixed at July 28, 2023. However, the shares pared some gains and closed 5.17%.