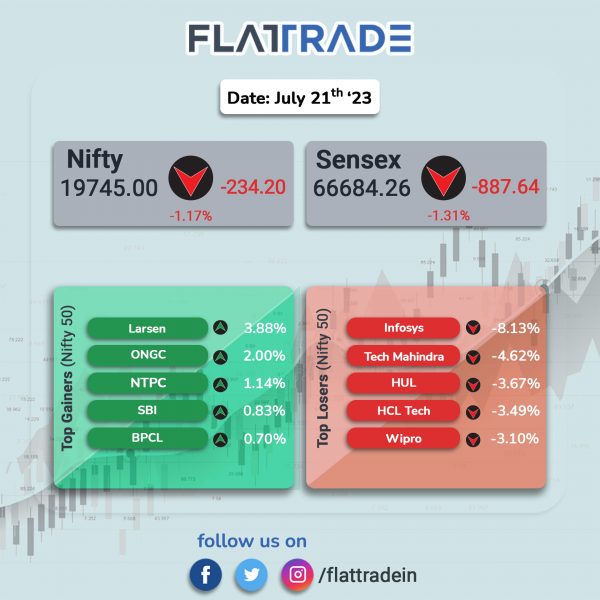

Benchmark equity indices closed lower as IT stocks plunged along with other heavyweights such as HUL, Reliance Industries, TCS, etc. The Sensex tumbled 1.31% and the Nifty tanked 1.17%.

In broader markets, the Nifty Midcap 100 index dropped 0.36% and the BSE Smallcap index rose 0.13%.

Top losers among Nifty sectoral indices were IT [-4.09%], FMCG [-1%], Metal [-0.66%], Energy [-0.61%], Oil & Gas [-0.5%]. Top gainers were Media [0.47%] and PSU Bank [0.25%].

Indian rupee gained 4 paise to 81.95 against the US dollar on Friday.

Stock in News Today

UltraTech Cement: The cement major’s consolidated net profit increased 6.59% to Rs 1,688.45 crore on 16.97% jump in revenue from operations to Rs 17,737.10 crore in Q1 FY24 over Q1 FY23. Profit before interest, depreciation and tax (PBIDT) rose marginally to Rs 3,223 crore in Q1 FY24 as against Rs 3,204 crore in Q1 FY23. The company achieved capacity utilisation of 89% in the reported quarter as against 83% during Q1 FY23. The total consolidated sales volume for Q1 FY23 stood at 29.96 million tons, recording a growth of 20% YoY. The company has commissioned cement capacity of 4.3 MTPA in Q1 FY24, taking total grey cement capacity of the firm to 131.25 MTPA in India.

Larsen & Toubro (L&T): The company announced that L&T Construction has secured a ‘mega’ order for its Heavy Civil Infrastructure Business. The conglomerate said that the National High-Speed Rail Corporation (NHSRCL) has formally awarded the mandate to construct the 135.45 km stretch MAHSR – C3 package which is part of the prestigious Mumbai Ahmedabad High-Speed Rail Project to L&T’s Heavy Civil Infrastructure business. Upon completion, the high-speed rail will operate at a speed of 320 Kmph, covering the entire distance in approximately 2 hours with limited stops and in 3 hours with all stops.

HDFC Life Insurance Co.: The company reported a 15.4% year-on-year (YoY) rise in net profit for the quarter ended June at Rs 415 crore. Revenue up 250% at Rs 23,243 crore in Q1FY24 from Rs 6,637 crore in the year-ago period. Net premium income for the quarter increased 16.6% YoY to Rs 11479 crore. The value of new business (VNB) was up 18% YoY at Rs 610 crore in the reported quarter as against Rs 518 crore in the year-ago period. The market share of the life insurer was 16.4%, compared to 15.8% last year. The assets under management (AUM) crossed the Rs 2.5 lakh crore mark as of June 30.

JSW Steel: The company reported a 179% year-on-year (YoY) rise in consolidated net profit at Rs 2,338 crore in Q1 FY24 on the back of higher sales and lower raw material cost. Net profit was Rs 838 crore in the year-ago period. Consolidated revenue from operations was at Rs 42,213 crore, higher by 10.83% as sales increased. Steel sales in Q1 FY24 stood at 5.71 million tonnes (mt), higher by 27 per cent YoY. JSW Steel’s capacity utilisation at Indian operations was at 92 per cent compared to 96 per cent in Q4 FY23 due to maintenance shutdowns.

Hindustan Zinc: The company’s consolidated net profit tumbled 36.48% to Rs 1,964 crore in Q1 FY24 from Rs 3,092 crore recorded in Q1 FY23. Revenue from operations during the quarter was Rs 7,282 crore, down 22.4% YoY on account of lower zinc & lead LME and lower lead volumes. Ebitda for the quarter was at Rs 3,359 crore, registering a decline of 36.4% YoY. The company’s first quarter mined metal production stood at 257 kt, an increase of 2.1% YoY on account of higher ore production largely at Rampura Agucha & Kayad mines supported by improved mined metal grades and better mill recovery.

ICICI Securities: The stock broking firm’s consolidated net profit declined 1.01% to Rs 270.84 crore in Q1 FY24 as against Rs 273.59 crore in Q1 FY23. Total revenue from operations jumped 17.7% to Rs 934.31 crore in Q1 FY24 from Rs 793.55 crore posted in the same quarter last year. Brokerage income increased from Rs 342.89 crore in Q1 FY24 to Rs 303.38 crore in Q1 FY23, an increase of 13.0%. This was primarily due to increase in retail equity & derivative volumes. Total clients stood at about 84,000 and the brokerage firm added approximately 6,000 clients during the quarter.

Ashok Leyland: The company reported a net profit of Rs 576 crore in Q1 FY24, up by more than eight times as compared with a PAT of Rs 68 crore in the same period last year. Revenue for the quarter stood at Rs 8,189 crore as against Rs 7,223 crore in Q1 FY23, up 13.4% YoY. Ebitda increased by 157% to Rs 821 crore in Q1 FY24 from Rs 320 crore in Q1 FY23. Ashok Leyland said that it continued to witness strong demand for the modular AVTR range of trucks.

NELCO: The company reported a 21.4% jump in consolidated net profit of Rs 5.73 crore in Q1 FY24 as compared with Rs 4.72 crore in Q1 FY23. Revenue from operations declined 3.53% to Rs 78.80 crore in Q1 FY24 as compared with Rs 81.68 crore in corresponding quarter last year. NELCO, which is part of the Tata Group, is a leading satellite communication service provider in India, providing highly reliable data connectivity solutions across the country for the enterprise, aero IFC and maritime sectors.

Ramkrishna Forgings: The auto ancillary company announced that it will acquire 100% equity of Multitech Auto Pvt. Ltd., along with its wholly-owned subsidiary Mal Metalliks Pvt. Ltd. for an overall consideration of Rs 212 crore. With this acquisition, the company plans to expand and grow its business.

Lupin: The drug maker said that its unit has launched a pressurised metered dose inhaler for the treatment of asthma and chronic obstructive pulmonary disease (COPD) in Germany. Hormosan Pharma GmbH, a wholly-owned subsidiary of the company in Germany, has introduced Luforbec in the European nation, Lupin said in a statement.

Federal Bank: The lender has raised 9.59 billion Indian rupees ($116.92 million) via preferential issues of shares to the International Finance Corporation (IFC), a member of the World Bank Group. The shares were issued at a price of 131.91 per share and were approved by the board on Friday, the bank said in a regulatory filing. Post the acquisition, IFC and related entities will hold equity of nearly 8% in the bank. Separately, the bank’s board also approved the raising of 80 billion rupees via the issue of debt instruments, it said.

Atul: The chemicals company posted a net profit of Rs 102.05 crore for the April-June quarter of FY24, a decline of 37.6% from Rs 163.47 crore in the corresponding quarter last fiscal. Revenue also declined 20% YoY to Rs 1,182.02 crore, from Rs 1,476.85 crore in the year-ago period. Weakness in demand across key segments like polymers, aromatics and colours along with double digit price erosion across segments weighed on the company’s topline. Ebitda margin fell sharply to 15.4% in April-June from 18.2% in the same period last fiscal.

Glenmark Lifesciences: The company’s consolidated net profit jumped 24.57% to Rs 135.45 crore in Q1 FY24 as compared with Rs 108.73 crore posted in corresponding quarter last year. Revenue from operations increased 18.08% to Rs 578.45 crore in Q1 FY24 as compared with 489.87 crore in Q1 FY23. Ebitda stood at Rs 195 crore in Q1 FY24, registering a growth of 24.8% as compared with Rs 156.3 crore in Q1 FY23.

Utkarsh Small Finance Bank: The company had a strong stock market debut. The scrip was listed at Rs 40 per share as against its issue price of Rs 25. It touched a high of Rs 48 and closed at the same price.