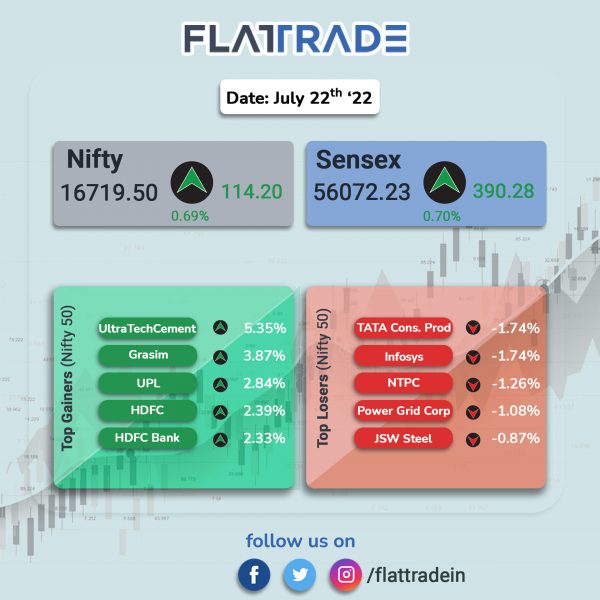

Major equity indices rose as investors gauged the second-quarter earnings to evaluate how companies were weathering inflation. The Sensex rose 0.7% and the broader index Nifty 50 index gained 0.69%. In addition, index heavyweights and HDFC twins rose pushing the indices higher.

Top gainers among Nifty sectoral indices were Financial Services [1.55%], Bank [1.49%], Private bank [1.43%], FMCG [0.52%] and Auto [0.42%]. Top laggards were IT [-0.62%], Energy [-0.38%] and Pharma [-0.27%].

Indian rupee rose 9 paise to 79.86 against the US dollar on Friday.

Meanwhile, Foreign Institutional Investors have bought a net $1 billion of domestic stocks in the first three days of this week, according to market data compiled by Bloomberg.

Stock in News Today

UltraTech Cement: The company posted a consolidated profit of Rs 1,582 crore for the quarter ended June 2022, a decline of 7% YoY, from Rs 1,700 crore in the same quarter last year. The company’s consolidated revenue in Q1FY23 rose 28% to Rs 15,163.98 crore as against ₹11,830 crore reported in Q1FY22. The company said that cement demand was affected by overall inflationary trends and lower labour availability in May 2022.

HDFC Asset Management Company: The company reported a 9% fall in net profit to Rs 314.19 crore in Q1FY23 from 344.59 crore in the year-ago period. It posted a 12.4% decline in total income at Rs 532.90 crore in Q1FY23 from Rs 607.99 crore in Q1FY22. Total expenses during the quarter rose 4.3% YoY to Rs 147.92 crore.

Meanwhile, Prashant Jain has tendered his resignation after staying as CIO with the asset management company for 19 years. The board has approved the appointment of Chirag Setalvad as Head – Equities and Shobhit Mehrotra as Head-Fixed income.

Bharti Airtel: The company’s chairman Sunil Mittal said that the company will be at the forefront of bringing 5G connectivity to India with a powerful network to support the country’s digital-first economy. Mittal aired his views ahead of 5G spectrum auction. A total 72 GHz (gigahertz) of radiowaves worth at least Rs 4.3 lakh crore will be put on the block during the auction, which is scheduled to begin on July 26.

Hindalco Industries: The company and Aequs have entered into a strategic pact for long-term collaboration and joint business development in the commercial aerospace sector. The move is expected to strengthen the commercial aerospace business of Aequs Pvt Ltd.

YES Bank: The lender’s aim to bring investment worth $1 billion from private equity investment companies Carlyle and Advent has gained momentum,according to a report by The Economic Times. Top executives from both the PR firms met with YES Bank, State Bank of India’s (SBI’s) senior management, and Reserve Bank of India officials this week, The Economic Times reported citing sources.

Olectra Greentech: The company climbed over 4% after the Evey Trans Private received LoA from one of the state transport corporations for 300 electric buses under FAME-II scheme. Evey will procure the buses from Olectra Greentech within 20 months. The value of the order for the 300 buses is nearly Rs 500 crore and includes contract period of 12 years after supply.

Crompton Greaves Consumer Electricals: The company’s Standalone net income rose to Rs 127.52 crore in Q1FY23 from Rs 93.12 crore in the same quarter last fiscal. Its revenue increased to Rs 1,608.05 crore in the quarter udner review as against Rs 1,046.15 crore in the year-ago period. The company’s EBITDA was Rs 193.67 crore in the reported quarter from Rs 122.77 crore in the same quarter a year ago.

Atul: The company’s net profit declined 0.86% to Rs 164.52 crore in the quarter ended June 2022 as against Rs 165.94 crore during the quarter ended June 2021. Sales rose 36.72% to Rs 1476.85 crore in the reported quarter of June 2022 as against Rs 1080.20 crore in the year-ago period.

Hathway Cable & Datacom: Shares of the company rose 3% a day after it reported its results. Its net profit declined 57.05% to Rs 20.95 crore in the quarter ended June 2022 as against Rs 48.78 crore during the same quarter last fiscal. Sales rose 1.33% to Rs 447.18 crore in the quarter ended June 2022 as against Rs 441.33 crore during the same quarter last financial year.