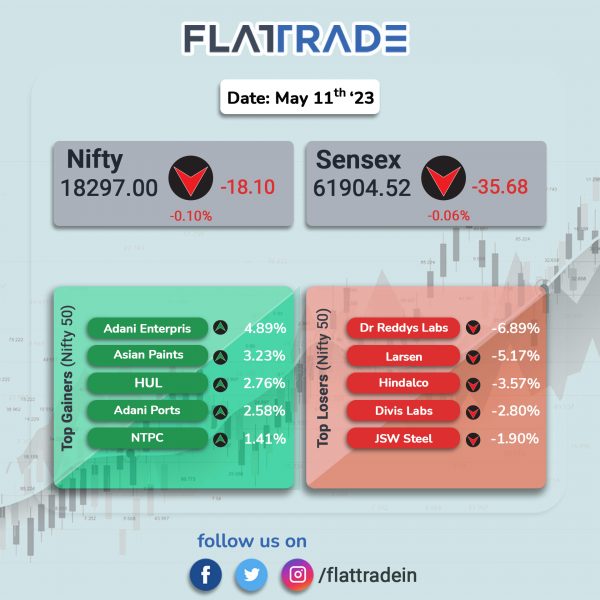

Benchmark equity indices slipped, weighed by losses in pharma and metal stocks. The Sensex edged down 0.06% and the Nifty dropped 0.1%.

In broader markets, the Nifty Midcap 100 index rose 0.3% and the BSE Smallcap index jumped 0.68%.

Top losers among Nifty sectoral indices were Pharma [-1.26%] and Metal [-0.53%]. Top gainers were Realty [0.48%], FMCG [0.46%], Auto [0.38%], Private Bank [0.36%], and Bank [0.33%].

Indian rupee weakened by 11 paise to 82.09 against the US dollar on Thursday.

Stock in News Today

Asian Paints: The paint major’s net profit grew 44% YoY to Rs 1,258.4 crore as compared to Rs 874 crore registered in the same quarter a year ago, according to the regulatory filing. The company’s revenue from operations jumped more than 11% to Rs 8,787.3 crore against Rs 7,892.7 crore logged in the year-ago quarter. Ebitda surged by 29.2% to Rs 1,865 crore during the March quarter against Rs 1,443.3 crore in the corresponding quarter of the past fiscal year. The company’s board has recommended payment of a final dividend of Rs 21.25 for the financial year ended March 2023.

Adani Ports and Special Economic Zone (APSEZ): The company said in an exchange filing that it has completed early settlement of notes tendered pursuant to tender offer for its 3.375% senior notes due 2024. It paid a total of $127.39 million including payment of $970 per $1,000 principal amount, accrued interest of $9.9375 per $1,000 of the notes tendered. It arranged for the tendered notes to be cancelled on May 10, 2023. The outstanding principal amount of notes following cancellation is $520 million.

ABB India: The company introduced a new line for variable speed drive modules at the Peenya factory in Bengaluru. The new modules will produce drives ranging from 75 kW to up to 250 kW and will cater to all major industrial segments. The expansion will strengthen the local supplier eco-system for ABB low voltage AC drives portfolio. Further, the company said it aims to double production capacity by 2025 and also offer customers faster access to products, customization, and quick serviceability.

Dr Lal PathLabs: The company reported a net profit of Rs 56.7 crore in the quarter ended March 2023, registering a fall of 7.5% from Rs 61.3 crore in the corresponding quarter of last year. Its revenue from operations increased marginally by 1.1% YoY to Rs 491 crore in Q4FY23. Ebitda decreased 4.5% YoY to Rs 115.6 crore in the quarter under review from Rs 121.1 crore in the year-ago period. The board of directors of the company also recommended a final dividend of Rs 6 per equity share for the year ended March 2023, subject to shareholders’ approval.

SpiceJet: The carrier has initiated the process of reviving its grounded fleet with $50 million fund, which has been received by the airline from the government’s Emergency Credit Line Guarantee Scheme and internal cash accruals, according to its exchange filing. The airline has also stated that it has no plans to file for insolvency.

Balrampur Chini Mills: The company’s standalone net profit fell 13.2% to Rs 250.8 crore in Q4FY23 as against Rs 288.9 crore in Q4FY22. Consolidated revenue was up 16.6% at Rs 1,491.5 crore in Q4FY23 as against Rs 1,279.6 crore in Q4FY22. Ebitda was up 22% at Rs 404.3 crore in the quarter under review as against Rs 331 crore in the year-ago period.

Aditya Birla Capital: The company consolidated net profit rose 35.1% to Rs 608.6 crore in Q4FY23 as against Rs 450.3 crore in Q4FY22. Consolidate revenue increased 21.3% to Rs 8,025 crore in Q4FY23 from Rs 6,617 crore in Q4FY22.

Kirloskar Brothers: Shares of the company hit an upper circuit of 20% after the company’s consolidated net profit surged 83.85% to Rs 100.2 crore in Q4FY23 as against Rs 54.5 crore recorded in Q4FY22. Revenue from operations jumped 17.83% YoY to Rs 1,124.6 in the quarter ended March 2023. On a full year basis, the company’s consolidated net profit zoomed 149.2% to Rs 235 crore on 22% increase in revenue to Rs 3730.2 crore in FY23 over FY22. Meanwhile, the firm’s board has recommended a dividend of Rs 4.50 per equity share for the financial year 2023.

Alkyl Amines Chemicals: The company said its net profit rose 5% YoY to Rs 48.64 crore in Q4FY23 despite a 3% YoY fall in revenue from operations to Rs 411.67 crore in Q4FY23 over Q4 FY22. Alkyl Amines’ net profit increased by 2% to Rs 228.66 crore on a 9% rise in revenue from operations to Rs 1,682.33 crore in FY23 as compared with FY22. The company’s board has recommended a final dividend of Rs 10 per equity share for the financial year 2022-23.

Hindustan Copper: The mining company’s board will consider fundraising by issue of 9,69,76,680 equity shares through qualified institutional placement (QIP) in one or more tranches on Friday. The board of directors will also consider issuance and allotment of secured or unsecured non-convertible debentures or bonds on private placement basis up to Rs 500 crore.

Ajmera Realty & Infra India (ARIIL): The company reported a 7.85% jump in consolidated net profit of Rs 15.11 crore in Q4FY23 as compared with Rs 14.01 crore in Q4FY22. Total revenue declined 36.71% to Rs 114.25 crore in Q4FY23 from Rs 180.51 crore posted in corresponding quarter last year. Ebitda stood at Rs 35 crore in Q4FY23, down 19% from Rs 43 crore recorded in same quarter last year. On a full year basis, the company’s consolidated net profit jumped 54.49% to Rs 71.59 crore in FY23 from Rs 15.62 crore FY22. Net sales declined 10.69% YoY to Rs 431.10 crore in FY23. The board has recommended final dividend of Rs 3 per equity share for FY23, subject to approval of shareholders.

Chemplast Sanmar: The company’s Custom Manufactured Chemicals division has signed a letter of intent (LOI) with a global agrochemical innovator to manufacture an advanced intermediate. The LOI covers a period of 5 years and commercial supplies is likely to start from Q4FY24, the company said. The new product will be manufactured in its new multi-purpose production block which is on track for commissioning in Q2FY24.

Bosch: The technology supplier reported 13.81% rise in consolidated net profit to Rs 398.9 crore and its revenue from operations jumped 22.72% to Rs 4063.4 crore in Q4FY23 over Q4FY22. On a full year basis, the firm’s consolidated net profit rose 17.01% to Rs 1,425.5 crore on 26.72% rise in revenue to Rs 14,929.3 crore in FY23 over FY22. Shares rose 1.64% in intraday trade on Thursday.

Relaxo Footwears: The company’s net profit marginally rose to Rs 63.30 crore in Q4FY23 from Rs 62.93 crore in Q4FY22. Net sales increased 9.56% to Rs 764.94 crore in Q4FY23 as against Rs 698.19 crore in Q4FY22, mainly due to volume growth across all categories. Ebitda rose 6% to Rs 118 crore in Q4FY23 from Rs 111 crore in corresponding quarter last year. On full year basis, the company’s net profit declined 33.61% to Rs 154.47 crore despite of 4.88% jump in net sales to Rs 2,782.77 crore in FY23 over FY22. The board has recommended a final dividend of Rs 2.50 per equity share for FY23. Share jumped 4.3% in intraday trade on Thursday.

Ujjivan Small Finance Bank: The lender posted a net profit at Rs 309.5 crore in Q4FY23 as against Rs 126.5 crore in Q4FY22. Net Interest Income was up 35.7% at Rs 738 crore in Q4FY23 as against Rs 544 crore in Q4FY22. Net NPA stood at 0.04% in the quarter under review as against 0.05% in the preceding quarter. The board recommended a final dividend of 5% i.e. Rs.0.5 per share for the year ended March 2023, subject to the approval of the shareholders

Neuland Laboratories: The company said its consolidated net profit jumped nearly 4x times to Rs 84.5 crore in Q4FY23 as against Rs 21.8 crore in Q4FY22. Consolidated revenue was up 59.1% YoY at Rs 407.07 crore in the quarter under review as against Rs 255.87 crore in Q4FY22. Ebitda stood at Rs 119.9 crore in Q4FY23 as against Rs 39 crore in Q4FY22.