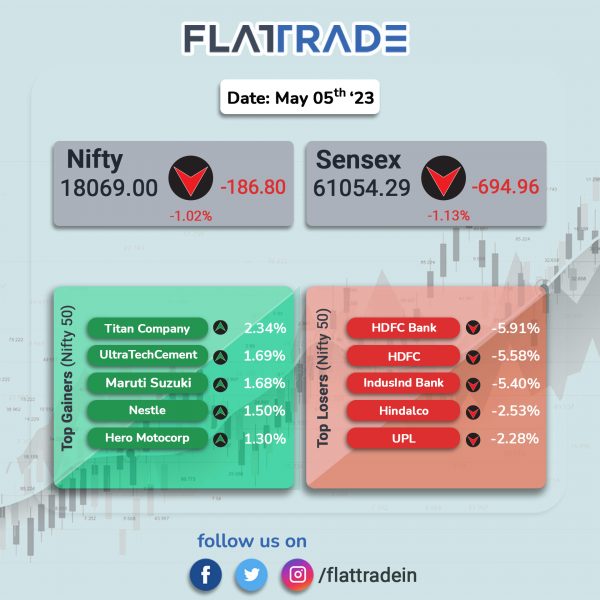

Benchmark equity indices tumbled over 1% as losses in private banking and financial services stocks led by HDFC Bank weighed on the markets. The Sensex tanked 1.13% and the Nifty 50 index plunged 1.02%.

In broader markets, the Nifty Midcap 100 index fell 0.7% and the BSE Smallcap index dropped 0.39%.

Top losers were Private Bank [-2.82%], Bank [-2.34%], Financial Services [-2.34%], Media [-1.74%], and Metal [-1.49%]. Top gainers were Auto [0.4%] and FMCG [0.27%].

Indian rupee closed at 81.80 against the US dollar on Friday.

Stock in News Today

HDFC Bank and Housing Development Finance Corporation (HDFC): Shares of HDFC twins tumbled by over 5% amid news reports that the merged HDFC entity could see $150-200 million in outflows. Various reports said that MSCI plans to include HDFC Bank in the large-cap segment of MSCI Global Standard Indexes with an adjustment factor of 0.5, causing concerns of potential outflows of $150-200 million instead of expected inflows.

Bharat Forge: The company’s standalone net profit declined 6.66% YoY to Rs 244.52 crore in Q4FY23 as against Rs 261.96 crore reported in Q4FY22. Its revenue from operations jumped 19.31% YoY to Rs 1,997.28 crore during the reported quarter. Profit before exceptional items and tax rose marginally to Rs 356.19 crore in the fourth quarter of FY23 from Rs 352.38 crore posted in Q4 FY22. Exceptional loss stood at Rs 40.84 crore in Q4FY23. Exceptional items were allocated to expenses related to the Voluntary Retirement Scheme (VRS) and employee separation costs for certain overseas subsidiaries. EBITDA in Q4 FY23 stood at Rs 487.9 crore, registering a growth of 13% YoY.

Federal Bank: The private bank’s standalone net profit surged 67% YoY to Rs 902.61 crore in Q4FY23 and total income rose 38.2% YoY to Rs 4,120.03 in Q4FY23. Net interest income stood at Rs 1,909 crore in Q4FY23, up 25.2% over Rs 1,525 crore in the same quarter last year. Net interest margin improved to 3.31% in Q4 FY23 from 3.16% in Q4FY22. Provisions and contingencies jumped 55.05% to Rs 116.66 crore in Q4 FY23 from Rs 75.24 crore in Q4 FY22. Gross NPA ratio stood at 2.36% and net NPA ratio was at 0.69%.

KFin Technologies: The company said its consolidated net profit was up 12.2% YoY at Rs 57 crore as against Rs 51 crore in Q4FY23. Consolidated revenue from operations was up 1.3% YoY at Rs 183.1 crore in Q4FY23 as against Rs 180.8 crore in the year-ago period. Ebitda at Rs 83.7 crore in Q4FY23 as against Rs 83.7 crore in the year-ago period.

Rane Madras: The auto ancillary company said its consolidated net profit at Rs 9.5 crore in Q4FY23 as against loss Rs 2.5 crore in the year-ago period. Consolidated revenue was up 23% YoY to Rs 621.6 crore in Q4FY23 as against Rs 505.4 crore in the year-ago period. Ebitda stood at Rs 55.6 crore in Q4FY23 as against Rs 26.8 crore in the same quarter last fiscal.

Gujarat Fluorochemicals: The company’s consolidated net profit was up 51.9% YoY at Rs 331.89 crore in Q4FY23 as against Rs 219.49 crore in the year-ago period. Consolidated revenue rose 37% YoY to Rs 1,471.4 crore in Q4FY23 as against Rs 1,073.8 crore in the year-ago period. Ebitda rose 59.7% to Rs 529.3 crore in Q4FY23 as against Rs 331.5 crore in the year-ago period.

Fertilizers & Chemicals Travancore (FACT): Shared of the company tumbled 11% in intraday trade after the company’s consolidated net profit declined 26.9% YoY to Rs 165.6 crore in Q4FY23 as against Rs 226.54 crore in Q4FY22. Revenue from operations dropped 26.22% YoY to Rs 1,248.84 crore during the quarter ended March 2023 from Rs 1,692.55 crore in corresponding quarter last fiscal. For the full year, the company’s consolidated net profit jumped 76.97% to Rs 612.99 crore in FY23 as against Rs 346.38 crore in FY22. Net sales rose 40.08% YoY to Rs 6,198.15 crore in FY23. The board recommended final dividend at Rs 1 per equity share for FY23.

Symphony: The company’s net profit fell 75% YoY to Rs 16 crore in Q4FY23 as against Rs 64 crore in the year-ago period. Consolidated revenue was down 19.8% YoY at Rs 308 crore in the reported quarter as against Rs 384 crore in the year-ago period. Ebitda declined 68% YoY at Rs 27 crore in the quarter under review as against Rs 86 crore in the year-ago period.

Stylam Industries: The company’s net profit was up 61.4% YoY to Rs 26.8 crore in Q4FY23 as against Rs 17 crore in the year-ago period. Revenue was up 27.2% YoY to Rs 237.5 crore in the reported quarter as against Rs 186.7 crore in the year-ago period. Ebitda jumped 53.7% to Rs 41.2 crore in the quarter under review as against Rs 26.8 crore in the year-ago period.

Jammu and Kashmir Bank: The private lender reported a standalone net profit of Rs 476.33 crore in Q4FY23, higher than Rs 112.20 crore recorded in Q4FY22. Total income jumped 21.2% YoY to Rs 2,678.40 crore in the quarter ended March 2023. During financial year ended March 2023, the bank’s net profit zoomed 138.7% to Rs 1,197.38 crore on 15.5% increase in total income to Rs 10,111.92 crore. Net interest income grew by 21% YoY to Rs 4,745 crore in Fy23. Net interest margin (NIM) improved to 3.89% in FY23 from 3.50% recorded in the same period a year ago. The net NPA ratio stood at 1.62% as on 31 March 2023 as compared to 2.49% as on 31 March 2022.

Greenply Industries: The company shares surged 9.47% in intraday trade after the company said its subsidiary has started commercial production of medium-density fibreboard (MDF) at its unit situated at Vadodara in Gujarat. Earlier on 17 March 2023, the company informed that its wholly owned subsidiary, Greenply Speciality Panels, started trial production of MDF at its unit situated at Vadodara in Gujarat. Greenply manufactures plywood in India for furniture & other applications along with blockboards, doors, decorative veneers and PVC.