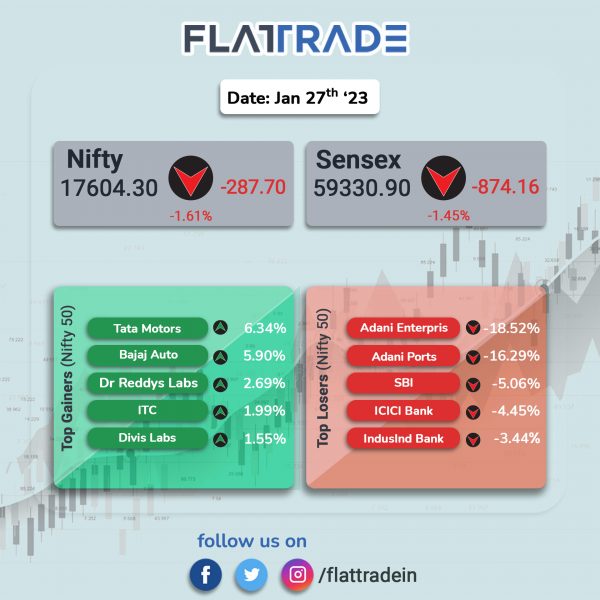

Indian indices tanked on severe selling pressure as Adani Group stocks plunged after a report by Hindenburg Research accused the group of improper use of offshore tax havens and raised concerns over the group’s high debt. In addition, heavy losses in banking, energy and metal stocks weighed on the overall market. The Sensex closed 1.45% lower and the Nifty tumbled 1.61%.

In broader markets, the Nifty Midcap 100 fell 1.47% and the BSE Smallcap plunged 1.89%.

Top losers among Nifty sectoral indices were Oil & Gas [-5.6%], PSU Bank [-5.43%], Energy [-5.03%], Metal [-4.69%] and Bank [-3.13%]. Top gainers were Auto [1.02%], Pharma [0.55%] and FMCG [0.46%].

Indian rupee rose 7 paise to 81.52 against the US dollar on Friday.

Stock in News Today

Bajaj Auto: The two-wheeler manufacturer’s consolidated net profit rose 3.01% YoY to Rs 1,472.70 crore on 3.29% YoY increase in total revenue from operations to Rs 9,318.54 crore in Q3FY23. The rise was attributed to robust double-digit sales growth in the domestic business offsetting the drop in exports arising from the challenging market context. EBITDA grew 29% year on year to Rs 1,777 crore in Q3FY23.

Adani Group: Shares of nine companies of Adani Group continued to witness sharp selling pressure for second trading session after US-based Hindenburg Research LLC said it shorted Adani Group companies due to “brazen” market manipulation and accounting fraud. Shares fell between 5% to 20% in the nine companies on Friday.

In an exchange filing made, Jatin Jalundhwala, Group Head – Legal, Adani, said that the maliciously mischievous, unresearched report published by Hindenburg Research on 24 Jan 2023 has adversely affected the Adani Group, our shareholders and investors. The volatility in Indian stock markets created by the report is of great concern.

Dixon Technologies: The Electronics manufacturing company’s shares tanked 19.09% after the company cut its FY23 revenue guidance to Rs 12,200 crore ‐Rs 12,700 crore from Rs 15,000 crore following a weak October-December quarter. The company’s revenue from operations fell 22 percent year-on-year to Rs 2,405 crore while its net profit grew 13 percent to Rs 52 crore. Operating margins improved from 3.4 percent to 4.7 percent. On the segmental front, Consumer Electronics revenue declined by 39% YoY, Lighting Products revenue plunged by 39% YoY and Mobile & EMS Division revenue contracted by 3% YoY.

Chennai Petroleum Corp: The company’s standalone net profit declined 37.5% to Rs 142.95 crore in Q3FY23 as against Rs 228.83 crore in Q3FY22. Revenue from operations surged to Rs 19214.18 crore in the quarter ended December 2022 from Rs 13,591.7 crore posted in the corresponding quarter previous year. The company’s total expenses spiked 43.2% year on year to Rs 19,032.11 crore in Q3 FY23. Cost of raw materials consumed soared 53.43% YoY to Rs 14,850.18 crore in Q3FY23.

Bikaji Foods International: The company’s consolidated net profit surged 196.2% YoY to Rs 33.06 crore and net sales rose 15.7% YoY to Rs 507.23 crore in Q3FY23. Meanwhile, the company’s board approved an additional investment in Hanuman Agrofood (HAPL) by way of acquisition of 10,000 equity shares of HAPL from its existing shareholders. With this acquisition, HAPL becomes a wholly-owned subsidiary of the company.

Torrent Pharmaceuticals: The company’s net profit rose 13.7% YoY to Rs 283 crore on 18.17% YoY increase in net revenue from operations to Rs 2,491 crore in Q3FY23 over Q3FY22. Operating EBITDA stood at Rs 724 crore in Q3 FY23, registering a growth of 35% from Rs 538 crore recorded in Q3FY22. Meanwhile, the company’s board has approved an interim dividend of Rs 14 per equity share. The dividend is expected to be paid/ dispatched on or around 14 February 2023.

Oil and Natural Gas Corporation (ONGC): The company anounced that its board has appointed Arun Kumar Singh as chief executive officer (CEO) of the company. He has experience of over 35 years in the oil & gas industry.

Taj GVK: The company posted a net profit of Rs 17.3 crore in Q3FY23, up 39% from Rs 12.5 crore in Q3FY22. Revenue was up 28.5% YoY to Rs 105.4 crore in Q3FY23 from Rs 82 crore in Q3FY22. EBITDA was up 15.2% to Rs 33.1 crore in the quarter under review as against Rs 28.7 crore in the year-ago period. EBITDA margin stood at 31.4% in the reported quarter as against 35% in the year-ago period.

Zydus Life: The company said the US drug regulator issued no observations for its Moraiya manufacturing unit in Ahmedabad. The USFDA conducted pre-approval inspection of Moraiya Unit from January 23-27.

Sterlite Technologies: The company said its net profit rose 15% to Rs 46 crore in Q3FY23 from Rs 40 crore in Q2FY23. Revenue was up 11.8% QoQ to Rs 1,882 crore in Q3FY23 from Rs 1,683 crore in the preceding quarter. EBITDA was 7.7% higher at Rs 252 crore in the reported quarter from Rs 234 crore in Q2FY23.

AIA Engineering: The company reported a net profit of Rs 352.46 crore in Q3FY23 from Rs 138.16 crore Q3FY22. Revenue rose 44.7% to Rs 1,227 crore in Q3FY23 from Rs 848.1 crore in Q3FY22. EBITDA more than doubled to Rs 365.7 crore in the quarter under review from Rs 161.2 crore in the year-ago quarter.

Glenmark Life Sciences : The company posted a marginal increase of 1% in its net profit at Rs 105 crore in Q3FY23 from Rs 103.71 crore Q3FY22. Revenue was up 3.5% to Rs 540.7 crore in the quarter under review from Rs 522.5 crore in the corresponding quarter last fiscal. EBITDA slipped 0.4% to Rs 145.4 crore in Q3FY23 from Rs 146 crore in Q3FY22.

Kalyani Steels: The company said its net profit fell 8.7% to Rs 39 crore in Q3FY23 from Rs 43 crore In Q3FY22. Revenue was up 9.8% to Rs 446.5 crore in Q3FY23 from Rs 406 crore in Q3FY22. EBITDA fell 6.3% to Rs 56.7 crore in Q3FY23 from Rs 60.5 crore in Q3FY22. EBITDA margin was at 12.7% in the reported quarter as against 15% in the corresponding quarter last year.

Dr Reddy’s Labs: The company announced the launch of Difluprednate Ophthalmic Emulsion 0.05% in the US Market that is used to treat eye pain, redness. Difluprednate Ophthalmic Emulsion is equivalent to Durezol brand and the generic had US sales of approximately $40 million MAT for the most recent twelve months ending in November 2022, according to IQVIA data.

Shree Digvijay Cement: The company’s net profit rose 39.7% to Rs 10.2 crore in Q3FY23 from Rs 7.3 crore in the year-ago period. Revenue gained 36.1% YoY to Rs 206.4 crore from Rs 151.6 crore in the same period last fiscal. EBITDA fell 16.2% to Rs 16 crore in Q3FY23 from Rs 19.1 crore in Q3FY22. EBITDA margin stood at 7.8% I the reported quarter as against 12.6% on a yearly basis.

Anupam Rasayan: The company’s net profit rose 13.2% to Rs 43 crore in Q3FY23 from Rs 38 crore Q3FY22. Its revenue was up 44% to Rs 383 crore in Q3FY23 from Rs 266 crore in Q3FY22. EBITDA rose 35.8% YoY to Rs 102 crore in the reported quarter from Rs 75 crore in the year-ago period. EBITDA margin was at 26.6% in the quarter under review as against 28.2% in the same period last quarter.

Ramco Industries: The company said its net profit declined 97.75% to Rs 0.84 crore in the quarter ended December 2022 as against Rs 37.39 crore during the quarter ended December 2021. REvenue declined 9.94% to Rs 303.57 crore in the quarter ended December 2022 as against Rs 337.08 crore during the same quarter last fiscal.

Samvardhana Motherson International: The company’s board has approved the scheme of amalgamation of Motherson Consultancies Service, Motherson Invenzen Xlab, Samvardhana Motherson Polymers, and MS Global India Automotive with the company and their respective shareholders and creditors under applicable provisions of the Companies Act, 2013 (scheme).