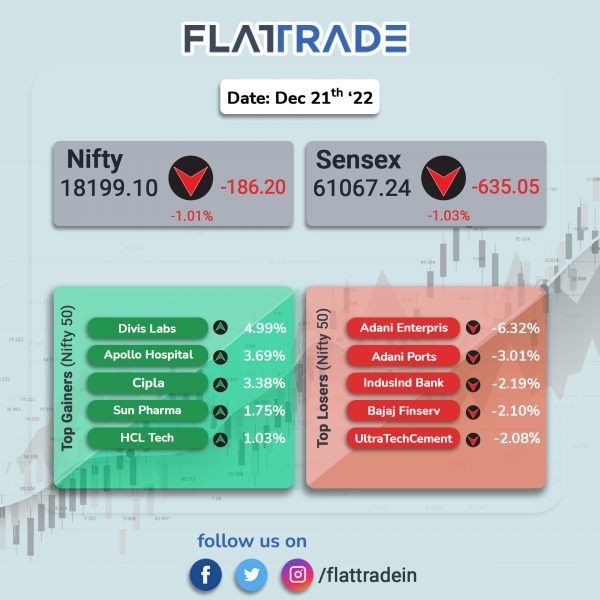

Domestic equities indices fell due to negative market sentiments amid renewed fears over rising Covid-19 cases. The Sensex dropped 1.03% and the Nifty 50 index was down 1.01%.

In broader markets, Nifty Midcap 100 index tanked 1.58% and the BSE Smallcap index plunged 2.18%.

Top losers among Nifty sectoral indices were Media [-3.03%], PSU Bank [-2.85%], Metal [-2.32%], Private Bank [-1.88%] and Energy [-1.86%]. Top gainers Pharma [2.39%] and IT [0.53%].

Indian rupee fell 6 paise to 82.81 against the US dollar on Wednesday.

India VIX, a gauge for measuring the market volatility, jumped 12.92% on Wednesday.

Capital markets regulator SEBI has extended the suspension of futures and options trading in seven agricultural commodities for one more year till December 2023 in a bid to control prices. The agricultural commodities suspended by Sebi are wheat, moong, paddy (non-basmati), chana, crude palm oil, mustard seeds and their derivatives, and soya bean and its derivatives. The suspension permits squaring up of existing positions in these commodities, but no fresh futures trading is permitted in them for a year.

Stock in News Today

Bharat Petroleum Corporation (BPCL): The company said that its board of directors had approved the financial plan and capital expenditure for laying the piped gas network, and building and operating of eight city gas distribution (CGD) projects for an estimated investment of Rs 35,355 crore. According to its regulatory filing, BPCL is authorised to undertake the projects “under PNGRB (Petroleum and Natural Gas Regulatory Board) CGD Bid Round 11 and 11A with an estimated investment of Rs 35,355 crore in a phased manner.

GAIL India: The PSU and Japanese transport company, Mitsui O.S.K. Lines, have signed a pact for a newbuilding LNG carrier and the joint ownership of the existing LNG carrier. Mitsui O.S.K. Lines and GAIL have reached an agreement to share the vessel by transferring a portion of company’s wholly-owned subsidiary’s shares to GAIL.

Lupin: The drug maker said that it has received an approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Brivaracetam tablets. The approved tablets are a generic equivalent of Briviact tablets of UCB Inc. Brivaracetam is used alone and in combination with other medications to control partial onset seizures in adults, children, and infants 1 month of age and older. The company said that the tablets will be manufactured at its facility in Nagpur, India.

In other news, Lupin announced the launch of its Regional Reference Laboratory in Indore, Madhya Pradesh, as part of its expansion in Central India. Lupin Diagnostics currently operates 325+ LupiMitra (Lupin’s franchise collection centers) and 23 laboratories in India.

Hospital and Healthcare Stocks: Shares of hospitals, diagnostic companies and drugmaker rose after the Covid-19 cases have jumped in China. Apollo Hospitals Enterprise, Fortis Healthcare, Dr Lal PathLab, Metropolis Healthcare and Thyrocare were some of the few stocks that gained in trade. Except Gland Pharma, all other stocks in the Nifty Pharma index ended in the green. Top gainers were Glenmark Pharma [7.61%], Divis Labs [5%], Granules Inida [4%], Lupin [3.5%] and Biocon [3.5%].

Bharti Airtel: The telco announced the launch of its cutting edge 5G services in Ahmedabad and Gandhinagar. The 5G Plus services will be available to customers in a phased manner as Airtel is building its 5G network.

Spandana Sphoorty Financial: The company’s board has approved issue of non-convertible debentures having face value of Rs 10 lakh each aggregating up to Rs 300 crore in three rounds. In each round, the company will issue 1,000 senior, secured, rated, listed, redeemable, non-convertible debentures having face value of Rs 10 lakh each aggregating up to Rs 100 crore. The interest rate is fixed at 11.35% per annum. The tenure of the first tranche will be 14 months, tenure of the second tranche will be 28 months and next round of NCDs will have a tenure of 36 months from the allotment date.

Glenmark Pharma: The company has launched a drug For Type-2 diabetes and high insulin resistance. It has become the first company to launch a triple FDC of Teneligliptin + Pioglitazone + Metformin, for adults with type-2 diabetes & high insulin resistance. As per its exchange filing, the drug will be priced at Rs 14.90 per day, claiming that it will reduce the daily cost of therapy by 40%.

Lemon Tree Hotels: The company has announced the opening of its eighth property in Uttarakhand with Lemon Tree Hotel, Mukteshwar. The hotel features 41 well-appointed rooms and suites, complemented by a multi- cuisine restaurant and a bar. It also has a conference room, a swimming pool, a spa and a fitness centre for recreation.

Rajnish Wellness: The wellness and pharmaceutical company has received an in-principle approval from Eastern Railway for setting up of business centres at 500 plus stations across Tier I, II and III cities. Rajnish has already submitted detailed project report (DPR), containing the Earning Plan which includes technical and financial details. With the implementation of this project, the company’s revenues and profitability will increase multi-fold.