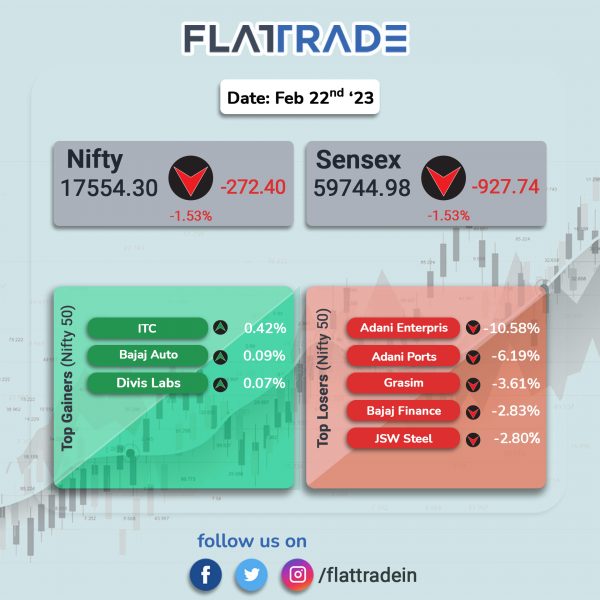

Benchmark equity indices tanked more than 1.5% due to concerns over central bank’s aggressive monetary policy stance, persistent high inflation and rising geopolitical tensions between Russia and the US over Ukraine war. The Sensex and the Nifty slumped 1.53%, each.

In broader markets, Nifty Midcap 100 index fell 1.13% and the BSE Smallcap index dropped 1.09%. Meanwhile, all Adani Group stocks tanked with Adani Enterprises shares tumbling the most by over 10%.

Top losers among Nifty sectoral indices were Metal [-2.64%], Media [-1.93%], PSU Bank [-1.91%], Energy [-1.89%] and Financial Services [-1.76%]. All major indices closed in the red.

Indian rupee weakened by 6 paise to 82.85 against the US dollar on Wednesday.

Stock in News Today

IRB Infrastructure Developers: The company announced that it has emerged as the preferred bidder for a road construction project worth Rs 2,132 crore. The project is under built-operate-transfer mode and it includes upgrading to a “six lane with paved shoulder” of National Highway- 27 from Samakhiyali to Santalpur in Gujarat.

Meanwhile, the stock started trading ex-split, on the record date of the sub-division of company’s equity shares or stock split in the ratio of 1:10.

Biocon: The biopharmaceutical company has announced that the company has issued and allotted non-convertible debentures (NCDs) aggregating to Rs 1,070 crore on private placement basis in three series. These NCDs will have a face value of Rs 1 lakh each and it will be get matured on 21 February 2028.

RailTel Corporation of India: The company said that rating agency, ICRA, has reaffirmed its rating on the debt instruments of the company and has revised the outlook on the same to ‘positive’ from ‘stable’. The rating agency has reaffirmed the company’s long-term rating at “[ICRA] AA- and the short-term rating at “[ICRA] A1+. ICRA expects Railtel Corporation of India will demonstrate healthy revenue growth on the back of a strong order book position, and healthy financial risk profile demonstrated by zero debt and a strong liquidity position.

DB Power (DBPL): The company said that rating agency CRISIL has upgraded the company’s long-term rating from “A+” to “AA-” after Adani Power’s plans to acquire DBPL were called off, Business Standard reported. CRISIL also removed the company from “on watch status” and assigned a “stable” outlook. CRISIL cited improvement in the financial risk profile of DBPL, driven by strong operating performance, prepayment of debt, and enhancement of liquidity.

Allcargo Logistics: The company has entered into a Securities Purchase Agreement (SPA) with BRE Asia Urban Holdings (the Seller) to acquire 5.4 lakh equity shares (representing 90% of the equity share capital), and 1,07,78,147 Class A Optionally Convertible Debentures (Class A OCDs) of Madanahatti Logistics and Industrial Parks (the Target).

Ahluwalia Contracts (India): The infrastructure company said that it has received an order from Puri Construction for civil and structural works of the ‘THE ARAVALLIS’ project based in Gurugram, Haryana. The value of the said contract is Rs 147 crore. With this, the order inflow during the financial year 2022-23 stands at Rs 4,164.63 crore till date, the company said.

Visaka Industries: The company announced that its board has approved 5-for-1 stock split. The company’s board has approved the sub-division of one equity share having a face value of Rs 10 each fully paid up into five equity shares of Rs 2 each fully paid-up, subject to the approval of shareholders of the company. The record date for the sub-division of equity shares will be decided by the board and will be intimated to the exchanges, said the company.

Imagicaaworld Entertainment: The company has entered into a Business Transfer Agreement (BTA) with Rajgreen Amusement Park (RAPPL) to acquire their water park business in Surat, Gujarat on a slump sale basis. The Company shall also execute a sub-lease deed with RAPPL for sub-leasing the underlying water park land in favour of the company, subject to government approvals. In order to manage the business in the interim to the closure of the BTA, the company has also entered into an arrangement for O&M of the said facility.

Religare Finvest: The company reported a net loss Rs 151.65 crore in the quarter ended December 2022 as against a net loss of Rs 255.74 crore during the quarter ended December 2021. Sales declined 10.40% to Rs 34.10 crore in the quarter ended December 2022 as against Rs 38.06 crore in the year-ago period.

Elantas Beck India: The company reported a 46.7% YoY jump in standalone net profit to Rs 24.77 crore and a 13.1% YoY rise in net sales to Rs 164.62 crore in the fourth quarter of 2022. Total expenditure increased by 8.8% YoY to Rs 135.01 crore during the quarter, due to higher raw material costs and higher employee expenses. The company’s board has recommended payment of dividend of Rs 5 per equity share for the year 2022.

West Coast Paper Mills: The company’s shares fell 4.73% in intraday trade on the NSE after the company said that its production at the paper board division in Dandeli has been disrupted due to illegal strike of contract workers. The company said that the strike was called by Joint Negotiation Committee of Trade Unions for unreasonable demands. The company’s management stated that it is expecting to settle the matter amicably.

Servotech Power Systems: The company has inked a pact with Dubai-based Al Ansari Motors to provide electric vehicle (EV) charging solutions to the Middle Eastern and African markets. “The Middle East and Africa present a huge untapped market potential and a sea of potential electric vehicle users. Each charging point installed under the pact will be accessible to all electric four-wheelers,” said Raman Bhatia, Founder and MD of Servotech Power.