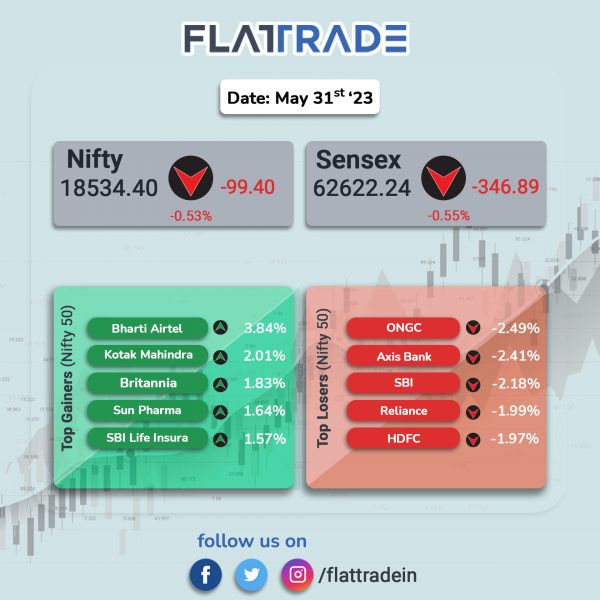

Benchmark equity indices closed lower, weighed down by losses in index heavyweights like RIL, ONCG and financial services stocks. The Sensex fell 0.55% and the Nifty 50 index was down 0.53%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index was up 0.37% and the BSE Smallcap advanced 0.68%.

Top losers among Nifty sectoral indices were Energy [-1.41%], Oil & Gas [-1.26%], Financial Services [-0.82%], Metal [-0.78%], and Bank [-0.69%]. Top gainers were Realty [0.76%], Pharma [0.58%], Media [0.31%], and FMCG [0.23%].

Indian rupee remained little changed at Rs 82.73 against the US dollar on Wednesday.

Stock in News Today

Coal India: The company said that its board has approved a revision of Non-Coking coal prices with effect from 31 May 2023, according to its regulatory filing. The board has approved price rise of 8% over the existing notified prices for high grade coal of grade G2 to G10. This will be applicable to all subsidiaries of Coal India including NEC for regulated and non-regulated sectors. Due to this revision, the company will earn an incremental revenue of about Rs 2703 crore for the balance period of FY24.

Vedanta: Indian Government is reportedly set to decline Foxconn and Vedanta’s joint venture request to receive incentives for manufacturing semiconductor chips in India, Bloomberg reported citing sources. According to the report, authorities are likely to inform the joint venture (JV) that it won’t receive incentives for building 28-nanometre chips. The JV has not been able to meet government requirements to receive the funding as the project is yet to find a technology partner or license manufacturing-grade technology for the 28nm chips it was seeking to build, sources said.

Dixon Technologies (India): The company announced a partnership with Xiaomi India to manufacture and export Xiaomi mobile phones. The two companies would also explore enhancing component ecosystem in India through the wholly owned subsidiaries of Dixon. Dixon Technologies (India) is a diversified electronics manufacturing services (EMS) company with operations across electronic products vertical.

Himadri Speciality Chemical: The company plans to invest AUD 10.32 million or Rs 55.43 crore in Sicona Battery Technologies, which is an Australian startup specializing in silicon anode technology for lithium-ion batteries. Sicona has developed next-generation battery materials technology used in the anodes(negative electrodes) of lithium-ion (“Li-ion”) batteries that enable electric mobility and storage of renewable energy, the press release said. Sicona’s current generation silicon-composite anode technology delivers 50-100% higher capacity than conventional graphite anodes and its anode materials can deliver more than 50% higher cell energy density than current Li-ion batteries, the press release added.

Suzlon Energy: The company reported a consolidated net profit of Rs 279.89 crore in Q4FY23 as against a net loss of Rs 204.29 crore posted in Q4FY22. Revenue from operations declined 30.8% YoY to Rs 1,689.91 crore in the quarter under review. EBITDA grew 21.35% YoY to Rs 233 crore in the reported quarter. Net debt reduced to Rs 1,180 crore as on 31 March 2023 from Rs 5,796 as of 31 March 2022. For the full year, the company reported a consolidated net profit of Rs 2,849.01 crore in FY23 as against Rs 199.59 crore in FY22. Revenue from operations fell 8.8% to Rs 5,946.84 crore in FY23 over FY22.

Tega Industries: The company’s net profit jumped 58.04% to Rs 77.25 crore in Q4FY23 from Rs 48.88 crore in Q4FY22. Revenue from operations increased 36.67% YoY to Rs 396.40 in Q4FY23. Operating EBITDA stood at Rs 102.8 crore in Q4 FY23, up 49.21% as compared with Rs 689 crore posted in corresponding quarter last year. For the full year, the company’s net profit jumped 57.44% to Rs 184.03 crore on 27.55% rise in revenue from operations to Rs 1,213.97 crore in FY23 over FY22. The board has recommended a final dividend of Rs 2 per equity share for FY23 and the record date is August 19, 2023.

KRBL: The company’s net profit rose 8.11% to Rs 117.81 crore on 29.61% increase in net sales to Rs 1279.73 crore in Q4FY23 over Q4FY22. EBITDA jumped 10% YoY to Rs 187 crore. EBITDA margin stood at 14.1% in Q4 FY23, lower than 17% in Q4 FY22. For the full year, net profit rose 52.31% to Rs 700.68 crore and net sale rose 27.38% to Rs 5363.23 crore in FY23 over FY22. KRBL is a rice processing and exporting company and also sells India Gate brand of basmati rice.

Oil India: The company said in an exchange filing that a fire broke out at the Numaligarh Refinery’s hydrocracker unit (HCU) in vessel number, vv-04. The vessel was a cold high-pressure separator, said the company. The assessment of damage has not been done yet. There is no personal injury or fatality in the incident. The company added that an external investigation committee is being constituted to investigate the cause of the incident and to ascertain the quantum impact of the incident.

Gujarat Mineral Development Corporation (GMDC): The company’s standalone net profit soared 156.4% to Rs 450.70 crore in Q4FY23 from Rs 175.79 crore posted in Q4FY22. Revenue from operations declined 10% YoY to Rs 951.76 crore in the quarter ended March 2023. EBITDA declined marginally to Rs 456 crore in Q4FY23 from Rs 459 crore posted in the same period last year. For the full year, the company’s net profit soared 199.9% to Rs 1,212.48 crore on 28.2% rise in revenue to Rs 3,501.45 crore in FY23 over FY22. The company’s board has recommended a dividend of Rs 9.10 per equity share for the FY23.

Poonawalla Fincorp: The company has received an approval from the Reserve Bank of India (RBI) to sell its stake in its housing finance subsidiary, Poonawalla Housing Finance, to Perseus SG. In Q3FY23, Poonawalla Fincorp board approved sale of its housing subsidiary, Poonawalla Housing Finance (PHFL), to TPG (Perseus SG, an entity affiliated with TPG Global, LLC) at a valuation of Rs 3,900 crore. Shareholders approval has been received and regulatory approval is under process.

Rhi Magnesita India: The company reported a consolidated net loss of Rs 679.36 crore in Q4FY23 as against a net profit of Rs 99.84 crore in Q4FY22. Revenue from operations surged 47.89% YoY to Rs 874.78 crore in Q4FY23 from Rs 591.51 crore posted in Q4FY22. Meanwhile, the company’s board has recommended a final dividend of Rs 2.50 per equity share for FY23, subject to approval of the shareholders. On full year basis, the company reported a consolidated net loss of Rs 466.11 crore in FY23 as against a net profit of Rs 269 crore recorded in FY22. Revenue from operations jumped 36.36% YoY to Rs 2,726.27 crore in FY23.