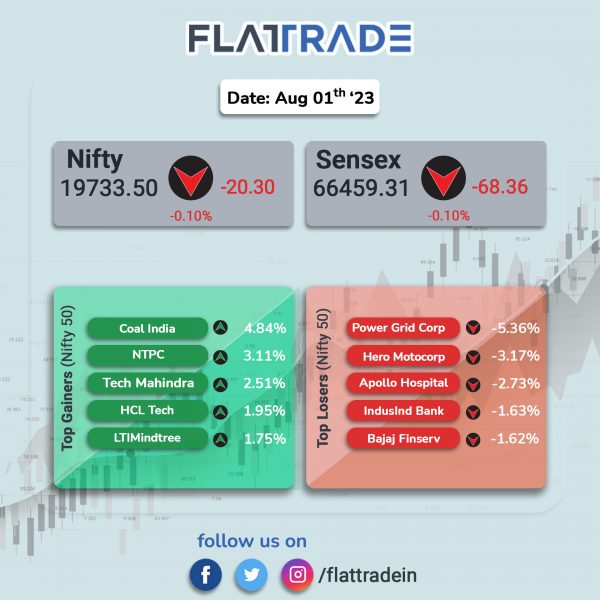

Sensex and Nifty closed marginally lower in a volatile session as investors booked profits amid elevated valuations. The Sensex and the Nifty 50 indices fell 0.10%.

In broader markets, the Nifty Midcap 100 index inched up 0.03% and the BSE Smallcap was up 0.5%.

Top losers were Realty [-1.77%], PSU Bank [-0.52%], Healthcare [-0.42%], Oil & Gas [-0.38%], and FMCG [-0.26%]. Nifty sectoral indices that ended in the green were IT [1.2%], Metal [0.18%], Pharma [0.06%] and Private Bank [0.02%].

The Indian rupee ended flat at 82.26 against the US dollar on Tuesday.

The S&P Global India Manufacturing Purchasing Managers’ Index (PMI) eased slightly to 57.7 in July from 57.8 in June, with output levels continuing to expand but at a slower pace in three months. A reading of over 50 on the index reflects growth in activity levels. India’s core sector growth accelerated to 8.2% in June, driven by higher capital expenditure by the central and state governments. Cement and steel sectors witnessed strong expansion.

The India Government collected Rs 1,65,105 crore Goods and Services Tax (GST) for the month of July, registering a growth of 11% from a year earlier. The GST collections breached the Rs. 1.6 lakh crore mark for the fifth time.

Stock in News Today

Reliance Industries Ltd (RIL): The conglomerate has signed a Memorandum of Understanding (MoU) with Brookfield Asset Management for manufacturing renewable energy and decarbonization equipment in Australia. Under the terms of the MoU, Brookfield will work with Reliance to explore avenues of direct capital investment and development of skills, knowledge and expertise in the renewable energy sector of Australia to facilitate the nation’s transition to a net zero future. Reliance and Brookfield will also evaluate the establishment of advanced operations in Australia to make/or assemble equipment used in the construction of renewable energy projects supplying equipment to all players in the market including Origin Energy Markets.

Hero MotoCorp: Shares of the company tanked over 5% after media reports said that the Enforcement Directorate has raided the residence of Hero MotoCorp chairman Pawan Munjal in a case of alleged money laundering. The Enforcement Directorate conducted searches at his premises located in Delhi and neighbouring Gurugram, and registered a case against him under the Prevention of Money Laundering Act (PMLA). The ED took action after receiving inputs from the Department of Revenue Intelligence case. The DRI had also caught a close aide of Pawan Munjal with a large amount of undeclared foreign currency at the airport.

Tata Motors: The company reported a total sales of 80,633 vehicles in domestic and international markets in July 2023, down by 1.4% from 81,790 units sold during July 2022. The auto major’s total domestic wholesales last month declined marginally to 78,844 units from 78,978 units, YoY. Total Commercial Vehicle (CV) sales in July fell 4% to 32,944 units from 34,154 units in the same month last year. The company’s total passenger vehicle sales, including EVs, rose marginally to 47,689 units from 47,636 units.

Larsen & Toubro (L&T): The EPC major announced that its construction arm has secured ‘large’ multiple orders for its Heavy Civil Infrastructure business. As per L&T’s classification, the value of the ‘Large’ project is worth between Rs 2,500 crore and Rs 5,000 crore. An order has been received from Rail Vikas Nigam (RVNL), for the design and construction of an underground metro project in connection with Joka – Esplanade Metro Corridor in the city of Kolkata. Another order has been bagged from a client in the Middle East for a mandate to rehabilitate structures for strategic purposes.

Adani Total Gas: The company posted a net profit of Rs 150.2 crore in Q1FY24 as against Rs 138.4 crore profit in the year-ago period. Revenue climbed 1.3% to Rs 1056.1 crore in Q1FY24 from Rs 1042 crore during the quarter ended June 2022. EBIDTA during the quarter under review rose 13.3% to Rs 247.8 crore from Rs 218.6 crore in the same quarter in the previous fiscal.

Oil marketing companies: The state-owned corporations have reduced the prices of commercial LPG gas cylinders. The rate of 19 kg commercial LPG gas cylinders has been slashed by Rs 99.75 with effect from today. With this revision, the retail sales price of a 19 kg commercial LPG cylinder in Delhi will be Rs 1,680 starting from today. There is no change in the prices for domestic LPG gas cylinders. According to the website of Indian Oil, the commercial LPG cylinder will now be sold in Kolkata at Rs 1,802, in Mumbai at Rs 1,640 and at Rs 1,852 in Chennai.

Bajaj Auto: The two-wheeler maker said that its total sales declined 10% to 3,19,747 units in June 2023 as compared with 3,54,670 units sold in June 2022. Total domestic sales fell 2% to 1,79,263 units in June 2023, from 1,82,956 units sold in the same period last year. Exports in June 2023 aggregated to 1,40,484 units, down 18% YoY.

Glenmark Pharma: The company has received final approval by the United States Food & Drug Administration (US FDA) for Saxagliptin Tablets, the generic version of Onglyza Tablets of AstraZeneca AB. The tablets are for for controlling diabetes and for monitoring blood sugar levels. According to IQVIA sales data for the 12‐month period ending June 2023, the Onglyza Tablets achieved an annual sales of approximately $100.7 million.

IRB Infrastructure Developers: The company’s consolidated net profit tumbled 63.2% to Rs 133.77 crore on 15.1% decline in revenue from operations to Rs 1,634.22 crore in Q1FY24 over Q1FY23. Total income declined 12.5% YoY to Rs 1,745.47 crore in the quarter ended 30 June 2023. EBITDA in Q1FY24 was at Rs 889 crore, down 21.4% from 1,131 crore reported in Q1FY23. During the quarter, the company witnessed a growth of 18% year on year in the toll collection.

Atul Auto: The three wheeler manufacturer company said that its total sales rose by 11.05% in July 2023 to 2,110 units from 1,900 units sold in the same period last year. For the April to July 2023 period, the company’s total sales aggregated to 5,193 units (down 26.91% YoY).

Berger Paints: The company said that its board will consider a proposal for issue of bonus shares by capitalisation of reserves on August 9, 2023. The proposal is subject to approval of the shareholders of the paint manufacturer. The board of directors will also consider approval of the unaudited financial results (standalone and consolidated) of the company for the quarter ended 30 June 2023 on the above said date.

KPR Mill: The company’s consolidated revenue was up 1.63% YoY at Rs 1610.73 crore in Q1FY24 as against Rs 1584.82 crore in Q1FY23. Consolidated net profit was down 10.52% YoY at Rs 202.84 crore in Q1FY24 as against Rs 226.69 crore in Q1FY23. Ebitda fell 9.78% YoY at Rs 332.07 crore in Q1FY24 as against Rs 368.07 crore in Q1FY23.

NCC: The company has received new orders worth Rs 1919 crore in July 2023 from State and Central government agencies. Out of these orders, Rs 1635 crore is related to Water Division, and Rs 284 crore is related to Building Division.

Anupam Rasayan India: The company reported a 24% increase in profit at Rs 52.25 crore for the quarter ended June 30, 2023, compared to Rs 41.96 crore in the corresponding quarter last year. The company’s revenues were up 12.43% at Rs 386.39 crore, compared to Rs 343.64 crore last year. The company’s board has approved the purchase of 10,000 (ten thousand) equity shares of face value of Rs. 10 each, of a company named ARIL Fluorospeciality (AFPL), on book value of Rs. 1,00,000 aggregating to 100% shareholding of AFPL. With this acquisition, AFPL will become a wholly owned subsidiary of Anupam Rasayan. During the quarter, the Company also signed Letters of Intent (LOIs) worth Rs 40,660 million with Japanese and American MNCs for niche life sciences and specialty chemical molecules.

Engineers India: The company has secured a contract worth Rs 837.34 crore from ONGC for renovation of their Hazira Plant. The project is expected to be completed within 45 months.

PVR Inox: The theatre operator said its consolidated revenue was up 14% QoQ at Rs 1,304.9 crore in Q1FY24 as against Rs 1,143.2 crore in the preceding quarter. The company’s net loss stood at Rs 81.6 crore in Q1FY24 as against a net loss of Rs 333.4 crore in the preceding quarter. Ebitda was up 34% QoQ at Rs 352.5 crore in Q1FY24 as against Rs 263.9 crore in Q4FY23.

Escorts Kubota: The company’s standalone net profit rose 91.7% to Rs 282.8 crore from Rs 147.5 crore for the corresponding quarter of the previous year. The consolidated revenue from operations for Q1FY24 came in at Rs 2,327.7 crore, compared to Rs 2,014.9 crore in the year-ago period. EBITDA surged 61.8% YoY to Rs 327 crore in the quarter under review as against Rs 202 crore in the year-ago period. The company said its domestic tractor market share was up by 41 bps at 9.7% on a yearly basis.

Triveni Turbine: The company has reported a total income of Rs 389.77 crore during the period ended June 30, 2023 as compared to Rs.266.49 crore during the period ended June 30, 2022. The company has posted a net profit of Rs 60.75 crore for the period ended June 30, 2023 as against a net profit of Rs 38.25 crore for the period ended June 30, 2022. The company has reported EPS of Rs 1.91 for the period ended June 30, 2023 as compared to Rs 1.18 for the period ended June 30, 2022. EBITDA climbed 45.9% to Rs 70.9 crore in Q1FY24 from Rs 48.6 crore in Q1FY23.

Maharashtra Seamless: The company’s net profit was up 46.9% at Rs 206.6 crore in Q1FY24 from Rs 140.6 crore in Q1FY23. Revenue was down 8.4% at Rs 1,222.9 crore in Q1FY24 as against Rs 1,334.4 crore in Q1FY23. EBITDA was up 7.7% at Rs 243.9 crore in Q1FY24 as against Rs 226.4 crore in Q1FY23.

Telecom firms: According to the latest data released by TRAI, Reliance Jio added 30.4 lakh new users in May, while Airtel added 13.3 lakh users in the same period. Vodafone Idea lost 28 lakh users in May 2023. Jio’s net subscribers in May stood at 43.6 crore, Airtel’s net subscribers were at 37.2 crore, and Vodafone Idea’s customer base decreased to 23 crore.