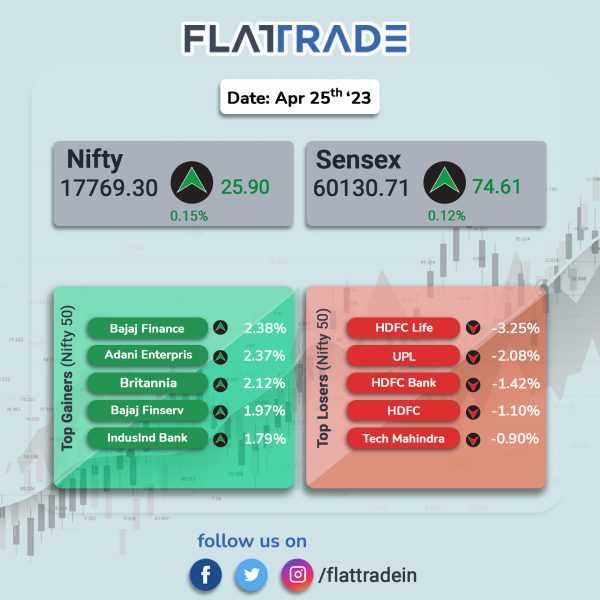

Benchmark equity indices ended positive with minor gains as public sector banking stocks rose. HDFC Group stocks – HDFC Life, HDFC Bank and HDFC – dropped between 1.1% and 3.25%, thereby, weighing on the headline indices. The Sensex rose 0.12% and the Nifty 50 index advanced 0.15%.

In broader markets, the Nifty midcap 100 index slipped 0.09% and the BSE Smallcap gained 0.19%.

Top gainers PSU Bank [1.31%], Energy [0.77%], Oil & Gas [0.71%], Metal [0.61%], and Realty [0.49%]. Top losers are Media [-0.72%], Financial Services [-0.16%], and IT [-0.1%].

Indian rupee closed at 81.91 against the US dollar on Tuesday.

Stock in News Today

Nestle India: The food processing company reported a net profit of Rs 736 crore for the quarter ended March 2023, a rise of 24.7% over the year-ago period. Revenue from operations jumped 21.3% year-on-year to Rs 4,830 crore. EBITDA rose 18% to Rs 1,098 crore in the quarter under review. EBITDA margin stood at 22.7% compared with 23.4% in the year-ago period. The company’s board has declared an interim dividend for 2023 of Rs 27 per equity share amounting to Rs 260 crore. The dividend will be paid starting from 8th May 2023 along with the final dividend for 2022 of Rs 75 per share.

HDFC AMC: The company reported a 9.5% YoY jump in net profit at Rs 376.20 crore in Q4FY23 and a 9.79% YoY increase in total income at Rs 637.81 crore in Q4FY23. Its operating profit for the quarter ended March 2023 was Rs 394.8 crore as compared to Rs 378 crore in the year-ago period. Meanwhile, the board has recommended a dividend of Rs 48 per equity share for FY23, subject to shareholders’ approval.

For the full year, HDFC AMC recorded 2.21% rise in net profit to Rs 1,423.92 crore on a 2.03% rise in revenue from operations to Rs 2,482.57 crore in FY23 over FY22. The operating profit for FY23 was Rs 1,554.8 crore as compared to Rs 1,537.5 crore posted in the last fiscal.

Biocon: The company’s subsidiary, Biocon Biologics Limited (BBL), and Serum Institute of Life Sciences (SILS) have decided to withdraw from the original equity structure contemplated under their Strategic Alliance announced in Sep, 2021. As per the new terms of the strategic alliance, Serum Life Sciences would make an additional equity investment of USD 150 million through the conversion of the USD 150 million loan provided to Biocon Pharma, a wholly owned subsidiary of Biocon , into equity in BBL, according to its regulatory filing. This investment is in addition to the U$ 150 million that SILS had invested in Biocon Biologics in November 2022, resulting in SILS’s aggregate equity investment in BBL amounting to US$300 million, the exchange filing said. As per the new arrangement, BBL will have access to 100 million doses of vaccines annually together with the distribution rights to Serum’s Vaccine portfolio which will add to BBL’s product portfolio for global markets.

Persistent Systems: The company recorded a 5.7% QoQ increase in consolidated net profit to Rs 251.51 crore and a rise of 3.9% QoQ in revenue to Rs 2,254.47 crore in Q4FY23 over Q3 FY23. As compared with Q4FY22, the company’s net profit and revenue are higher by 25.1% and 37.6%, respectively. EBITDA for the fourth quarter was Rs 416.31 crore, up 48.1% YoY. The board of directors of the company has recommended a final dividend of Rs 12 per share and special dividend of Rs 10 per share on achieving $1 billion in annual revenue.

Larsen & Toubro (L&T): The company announced that its Power Transmission & Distribution (PT&D) business has secured ‘significant’ orders in India and overseas. As per L&T classification, the value of the large project is Rs 1,000 crore to Rs 2,500 crore. The business has secured orders to develop distribution infrastructure in two discom circles of western Rajasthan. The business has also bagged a power supply system order for the second phase of Chennai Metro. Further, in the overseas market, the PT&D business has won an order to supply, construct, test, and commission a 132kV substation in the United Arab Emirates.

Cholamandalam Investment and Finance Company: The NBFC announced its maiden public issue of non‐ convertible debentures (NCDs) for a base Issue size of Rs 500 crore with an option to retain any oversubscription up to Rs 500 crore, aggregating up to Rs 1,000 crore. The company will issue secured, rated, listed redeemable NCDs have face value of Rs 1,000 each aggregating up to Rs 1,000 crore, which is within the shelf limit of Rs 5000 crore. The NCDs shall be listed on BSE and NSE. The tranche I issue, which will be open from April 25 to May 9, offers various series of NCDs for subscription with coupon rates ranging from 8.25% per annum to 8.40% per annum. The minimum application size would be Rs 10,000 (i.e., 10 NCDs) and thereafter in multiples of Rs 1,000 (i.e. 1 NCD) thereof. The NCDs under the tranche I issue are being offered with maturity of 22 months, 37 months and 60 months.

Sun Pharmaceutical Industries: The company said that its wholly owned subsidiary has launched a novel ophthalmology treatment, CEQUA, in India for patients who have dry eye disease (DED). DED occurs when the quantity or quality of tears fails to keep the surface of the eye properly lubricated. CEQUA is the first dry eye treatment available in India that is delivered with nanomicellar (NCELL) technology.

Tata Teleservices (Maharashtra): The company reported a net loss of Rs 277.07 crore in Q4FY23 as against a net loss of Rs 280.62 crore posted in Q4 FY22. Revenue from operations stood at Rs 280.13 crore in Q4FY23, up 2.7% from Rs 272.78 crore in the same period a year ago. On a full year basis, the company reported a net loss of Rs 1,144.72 crore in FY23 as compared to net loss of 1,215 crore in FY22. However, revenue rose 1.1% YoY to Rs 1,106.17 crore in FY23. Meanwhile, the company’s board has approved the appointment of Harjit Singh as the managing director of the company for a period of three years with effect from 24 April 2023, subject to shareholders approval.

Birlasoft: The company announced that its wholly owned subsidiary, Birla Soft Solutions (BSI) has entered into an agreement with its customer, Invacare Corp. As per the agreement, the parties have mutually provided releases and waiver from claims. BSI would receive $2 million for disengagement services ending on 31 May 2023.

YES Bank: The lender plans to acquire a microfinance institution (MFI) in 18 months and open 150 branches in semi-urban and rural areas in FY24. In FY23, the bank had added 83 new branches in FY23, taking the branch count to 1,192, including 450 in semi-urban and rural areas.

Anupam Rasayan India: The company signed a letter of intent (LoI) worth revenue of $46 million (Rs 380 crore) with American multinational company to supply new age specialty chemical advance intermediate for next 5 years. This product will be manufactured in the upcoming multipurpose manufacturing facilities.

Bharat Wire Ropes: The company’s consolidated net profit surged 105.9% to Rs 15.94 crore in Q4FY23, from Rs 7.74 crore in Q4FY22. Net sales jumped 20.7% YoY to Rs 162.33 crore in Q4FY23. On full year basis, the company’s net profit surged to Rs 62.23 crore in FY23, from Rs 13.67 crore in FY22. Net sales jumped 43% YoY to Rs 589.06 crore in FY23.

IndiaMART InterMESH: The company said that its board will meet on Friday [28 April 2023] to consider a proposal for bonus issue. The said proposal is subject to approval of shareholders in the foresaid board meeting.

Meghmani Finechem: The company’s consolidated net profit declined 23% to Rs 76.73 crore in Q4FY23 from Rs 99.18 crore in Q4FY22. Revenue from operations increased by 13% YoY to Rs 562.17 crore in Q4FY23. Total expenses increased by 28% YoY to Rs 456.63 crore during the period under review, due to higher raw material costs (up 53% YoY), higher depreciation and amortisation expense (up 43% YoY) and higher finance costs (up 61% YoY). The company’s consolidated net profit increased by 40% to Rs 353.29 crore on a 41% rise in revenue from operations to Rs 2,188.39 crore in FY23 over FY22.

Venus Remedies: The company’s German subsidiary, Venus Pharma GmbH, has secured marketing authorization from the UK Medicines and Healthcare products Regulatory Agency (MHRA) for Cisplatin. Cisplatin is a chemotherapy drug used as a first-line treatment for advanced ovarian cancer, testicular cancer and bladder carcinoma. The authorisation for Cisplatin will also expedite the process of registering the oncology products of Venus Remedies in many other countries around the world which consider the UK as a reference country for fast-tracking registration and open opportunities for supplying unregistered products to several markets globally.

S Chand and Company: The education and content firm will acquire a stake in test preparation startup ixamBee (AToZLearn Edutech Private Limited). The management said that the synergy with ixamBee will help meet aspiration of future workforce of the country via quality content development, and marketing.