Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.2% lower at 16,219 indicating that Dalal Street was headed for a negative opening on Monday.

Asian shares were trading lower as tightening lockdown in Shanghai spurred worries over global economic growth and possible recession. Japan’s Nikkei 225 plunged 2.2%, Topix was down 1.7%, Hang Seng tanked 3.8% and CSI 300 fell 0.48%.

Indian Rupee nosedived 66 paise to 76.91 against the US Dollar on Friday.

Campus Activewear will make it stock market debut today. The issue price was Rs 292 per equity share. Meanwhile, subscription for LIC IPO ends today.

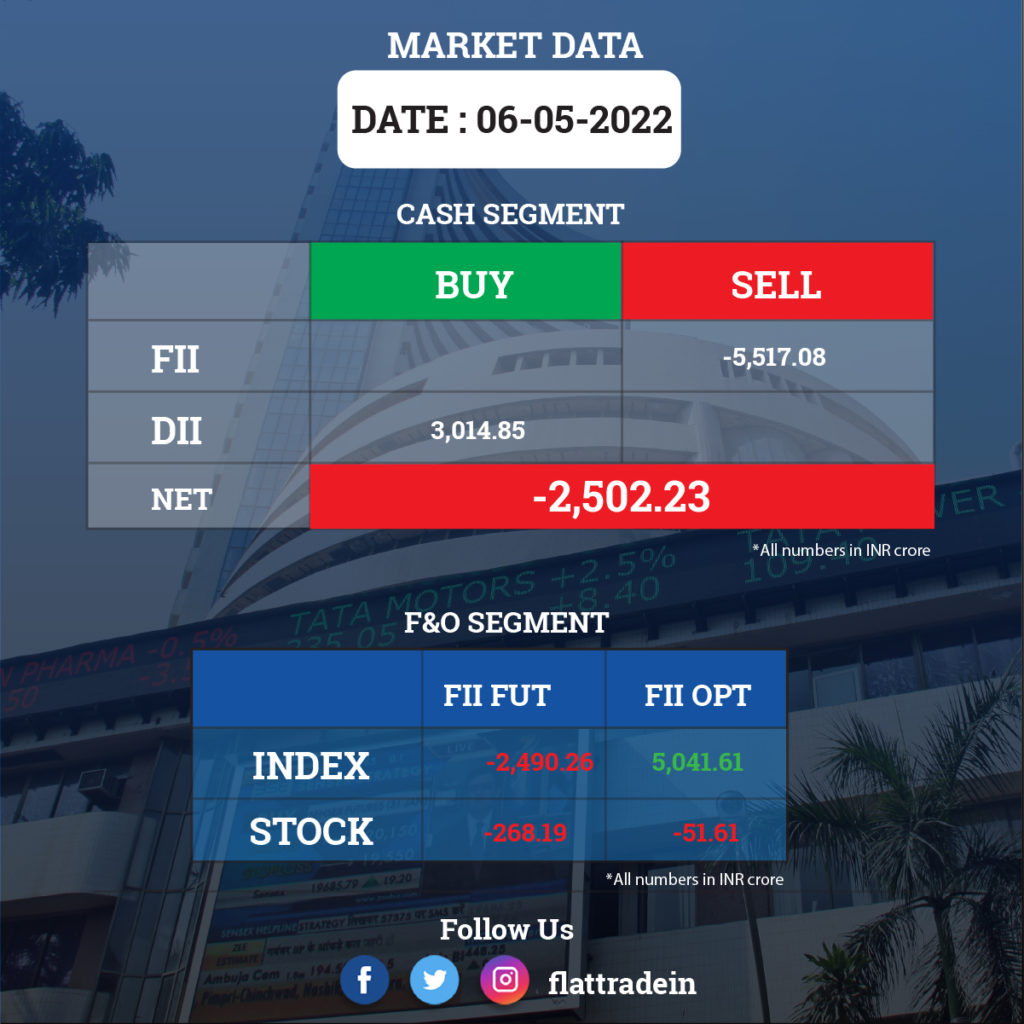

FII/DII Trading Data

Upcoming Results

UPL, PVR, Godrej Agrovet, Infibeam Avenues, Dalmia Bharat, Gujarat Narmada Valley Fertilizers & Chemicals, 3i Infotech, Aarti Drugs, BASF India, Borosil, Central Bank of India, CMS Info Systems, Craftsman Automation, Vedant Fashions, Suven Pharmaceuticals, VST Tillers Tractors, ISMT, Mold-Tek Packaging, Visaka Industries, and Vishwaraj Sugar Industries will release quarterly results today.

Stocks in News Today

Reliance Industries Limited (RIL): The oil-to-telecom conglomerate posted a 22.5% YoY growth in its consolidated net profit to Rs 16,203 crore for the quarter ended March 2022. It had posted a net profit of Rs 13,227 crore in the corresponding quarter. The consolidated revenue from operations surged 36.8% YoY to Rs 211,887 crore for the reported quarter.

Mindtree and L&T Infotech: L&T Group announced the merger of Mindtree and L&T Infotech to create India’s next large-scale IT services player. All shareholders of Mindtree will receive 73 shares of L&T Infotech for every 100 shares held. Larsen & Toubro will hold 68.73 percent of L&T Infotech after the merger.

Tata Power Company: The company reported a 31.4 percent year-on-year growth in profit at Rs 632.4 crore for the fourth quarter of FY22. Revenue from operations increased by 15.4 percent to Rs 11,960 crore during the reported period.

Future Enterprises Ltd: The company plans to raise around Rs 3,000 crore by selling its stake in the insurance business to pare debt, which may save the company from facing the rigour of the insolvency process, according to industry sources.

HCL Technologies: The IT services company’s subsidiary has acquired Switzerland-based digital banking and wealth management specialist Confinale AG, for 53 million CHF (Swiss Francs). This buyout transaction is expected to be completed by July 1, 2022.

Macrotech Developers: The realty firm will invest Rs 3,800 crore this fiscal year on construction of its various ongoing and new projects as it has set a target to deliver 10,000 homes by next March, said its MD and CEO Abhishek Lodha in an interview to PTI news agency.

Shipping Corporation of India: The company recorded a massive 77.4 percent year-on-year growth in consolidated profit at Rs 152 crore in the quarter ended March 2022 on strong topline and operating income. Revenue from operations grew by 50 percent to Rs 1,314.5 crore during the same period.

Go Fashion India: The women’s bottom-wear brand reported a 73 percent year-on-year growth in profit at Rs 12 crore in Q4FY22 driven by healthy operating income and revenue. Revenue from operations grew by 29 percent to Rs 116 crore and EBITDA increased 53 percent to Rs 38 crore compared to the year-ago period, with volume growth of 11 percent YoY.

Hariom Pipe Industries: The company recorded a 44.5 percent year-on-year growth in profit at Rs 9.77 crore in quarter ended March 2022 despite higher input cost and power & fuel expenses, led by a strong topline. Revenue grew by 33 percent YoY to Rs 124.2 crore in the same quarter.

Equitas Holdings: The Reserve Bank of India has approved the amalgamation between Equitas Holdings and Equitas Small Finance Bank.

Shriram City Union Finance: The NBFC will focus on personal, gold and small business loans to achieve its 18 per cent growth in AUM in the current fiscal year amid a slowdown in demand for two-wheelers due to shortage of components and other factors, a top company executive said.

CSB Bank: The lender reported an over three-fold jump in its net profit for the fiscal fourth quarter at Rs 130.67 crore, compared with Rs 43 crore in the year-ago period. Total income during the quarter under review rose marginally to Rs 583.17 crore from Rs 560.87 crore int he . Net NPAs declined to 0.68% from 1.17%.

DCB Bank: The private sector lender posted a 44.87% rise in its net profit at Rs 113 crore for the quarter ended March 2022. The bank had registered a net profit of Rs 78 crore in the same quarter a year ago. Total income in the reported quarter increased to Rs 1,035 crore, as against Rs 967 crore in the same quarter of last fiscal. Net interest income during the quarter rose to Rs 380 crore in Q4FY22, from Rs 311 crore in Q4FY21. Its net NPAs fell to 1.97% in the quarter under review as against 2.31% in the year-ago period.

Shanthi Gears Ltd: The company reported a 29.72 per cent rise in profit at Rs 12.22 crore in Q4FY22, as against a net profits of Rs 9.42 crore during corresponding period last year.