Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.16% lower at 16,185.5, signalling that Dalal Street was headed for a muted start on Wednesday.

Most Asian stocks rose amid declining Covid cases in China that boosted investors’ optimism. Japan’s Nikkei rose 0.32%, wile Topix fell 0.27%. China’s Hang Seng advanced 0.9% and CSI 300 index jumped 1.57%.

Indian rupee rose 13 paise against the US dollar to 77.33 on Tuesday.

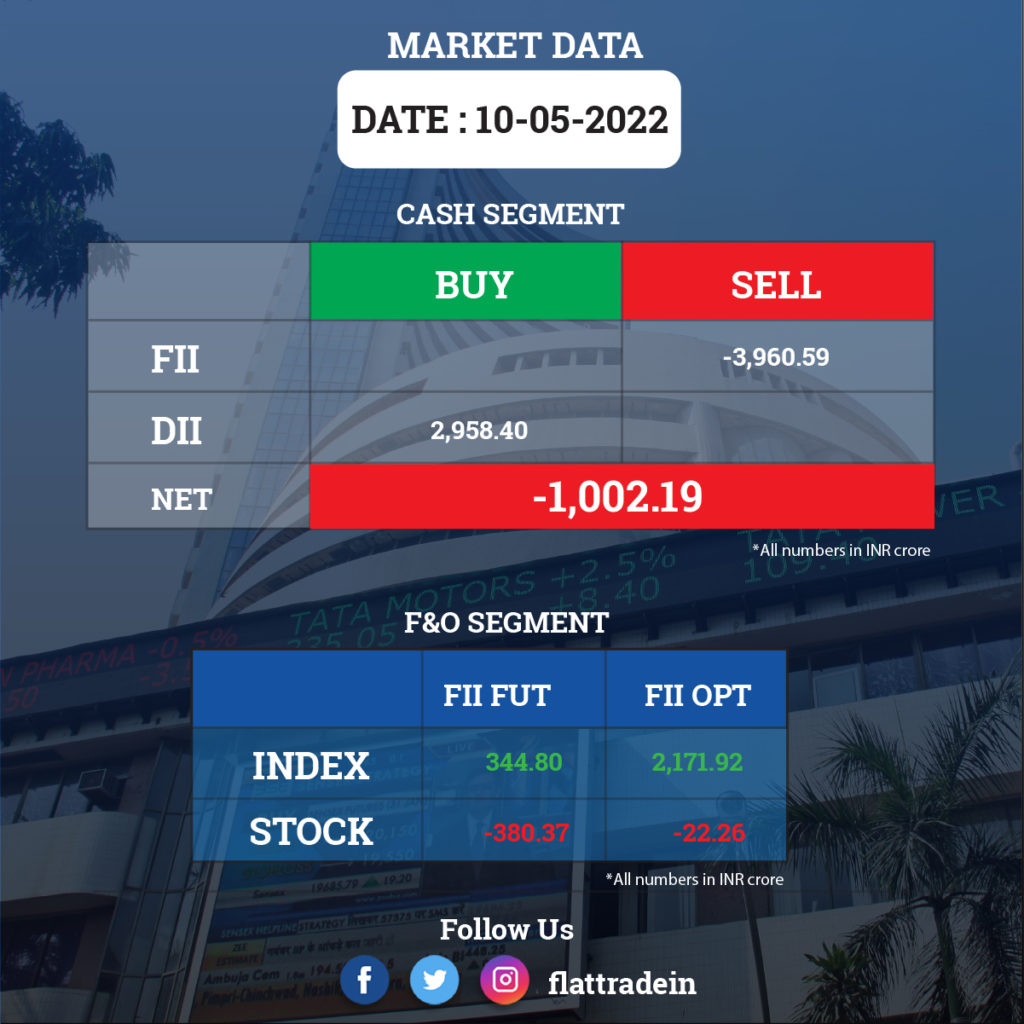

FII/DII Trading Data

Upcoming Results

Adani Ports, Punjab National Bank, Indian Bank, Petronet LNG, Balaji Amines, Birla Corporation, HSIL, JSW Ispat Special Products, Kalyan Jewellers India, Kennametal India, KSB, Lakshmi Machine Works, Lloyds Steels Industries, NCC, Skipper, Prism Johnson, Relaxo Footwears, Sagar Cements, SKF India, Butterfly Gandhimathi Appliances, Century Enka, Cholamandalam Financial Holdings, and DIC India will release quarterly earnings today.

Stocks in News Today

Stata Bank of India (SBI): The country’s largest lender said its board has approved raising up to $2 billion from the overseas market during the current fiscal to fund foreign business growth. The central board has approved raising of funds through single or multiple tranches, SBI said in a regulatory filing.

Cipla: The pharma company reported a 10 percent year-on-year fall in consolidated profit at Rs 370.7 crore in Q4FY22, due to lower operating income and impairment loss with respect to investment in associate company Avenue Therapeutics Inc. Revenue grew by 14.2 percent to Rs 5,260.33 crore in the reported compared to the year-ago period, while EBITDA fell 6 percent to Rs 750 crore in the same period.

Vodafone Idea Ltd (VIL): The telecom operator posted a consolidated loss of Rs 6,563.1 crore in Q4FY22, compared to a loss of Rs 7,230.9 crore in the previous quarter, supported by higher operating income and ARPU. Revenue during the quarter rose 5.4% QoQ to Rs 10,239.50 crore. EBITDA grew by 22 percent QoQ to Rs 4,649 crore in the reported quarter with average revenue per user increasing by Rs 9 sequentially to Rs 124 during the quarter.

Ashok Leyland: The company’s electric vehicle arm, Switch Mobility, will invest about Rs 1,000 crore for setting up a new manufacturing unit in South India. The company is also in talks with financial investors to raise over $200 million for its expansion.

Torrent Power: The company posted a consolidated loss of Rs 487.4 crore in Q4FY22 against a profit of Rs 398 crore in the same period last year hit by an additional impairment charge of Rs 1,300 crore with respect to DGEN Mega Power Project. Revenue from operations grew by 21 percent YoY to Rs 3,743.65 crore in Q4FY22 and EBITDA increased by 15 percent YoY to Rs 1,088 crore during the quarter.

Cera Sanitaryware: The company reported a 15 per cent rise in its consolidated net profit attributable to owners at Rs 52.59 crore for the fourth quarter ended March 2022, as against Rs 45.76 crore for the same period last year. Its total consolidated income fell by seven per cent to Rs 413.75 crore in Q4 FY22 as against Rs 442.72 crore in Q4 FY21. The Board of Directors approved the capex of about Rs 197 crore for the company’s expansion plans including a greenfield sanitaryware plant and a brownfield faucetware unit.

ICICI Bank: The private sector bank announced a tie-up with Santander bank in Britain in a pact aimed at facilitating the banking requirements of corporates operating across both countries.

Wipro: The IT services company has extended its strategic agreement with Crédit Agricole CIB, the corporate and investment bank division of Crédit Agricole Group, to support its IT infrastructure transformation.

Kansai Nerolac Paints: The company posted a decline of 84.49 per cent in its consolidated net profit at Rs 19.17 crore for the fourth quarter of FY22, as against a net profit of Rs 123.62 crore in the January-March quarter a year ago. Its revenue from operations was up 5.27 per cent at Rs 1,536.60 crore during the quarter under review as compared to Rs 1,459.57 crore in the corresponding quarter of the previous year.

Gulshan Polyols: The company has signed and executed a contract with Meghna Pulp & Paper Mills received on May 9. It will supply GCC, GCC coating plant, vibrator separating machine with standard accessories including motor, conveyor, panel etc. and spare parts for GCC and GCC-coated machine to Meghna Pulp.

Gujarat Gas: The company registered a 27.6 percent year-on-year growth in consolidated profit at Rs 444.4 crore in the quarter ended March 2022. Revenue increased 36.5 percent to Rs 4,773.4 crore during the same period.

EPL: The company reported a 14.2 percent year-on-year decline in consolidated profit at Rs 50.1 crore in the quarter ended March 2022 impacted by higher input costs. Revenue grew by 8.6 percent to Rs 880.2 crore during the same period.

Welspun India: The company reported a 62 percent year-on-year fall in consolidated profit at Rs 51.25 crore in the quarter ended March 2022. Revenue grew by 4.3 percent to Rs 2,227 crore and EBITDA increased by 29.3 percent to Rs 226.5 crore during the quarter under review.

Chalet Hotels: The company reported a consolidated net loss at Rs 11.56 crore in Q4FY22, compared with a consolidated net loss of Rs 25.96 crore in the same quarter of the preceding fiscal. Consolidated revenue from operations for FY22 stood at Rs 148.01 crore compared to Rs 94.9 crore in FY21.

Jet Airways: The National Company Law Appellate Tribunal (NCLAT) has directed the airline to vacate its office from the premises of Mack Star Marketing in Mumbai. A three-member bench of the NCLAT also said that no monthly fees shall be payable to Mack Star Marketing for use of the premises during the period when the the airline was undergoing Corporate Insolvency Resolution Process.

Max Financial Services Ltd: The company reported a two-fold jump in consolidated net profit at Rs 144 crore for the last quarter of Fy22, compared with a net profit of Rs 70 crore in the same period a year ago. Its consolidated revenues declined to Rs 8,962 crore in the quarter from Rs 9,760 crore in Q4 of the previous financial year.