Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading flat at 16255, signalling that Dalal Street was headed for a flat-to-negative start on Monday.

Asian stocks were mixed as investors’ sentiments were dampened over the bleak outlook of global economic growth, higher inflation and rising interest rates. Japan’s Nikkei 225 rose 0.5%, Topix was up 0.6%. China’s Hang Seng was down 1.41% and CSI 300 fell 1.03%.

The Indian rupee rose 17 paise to 77.54 against the US dollar on Friday.

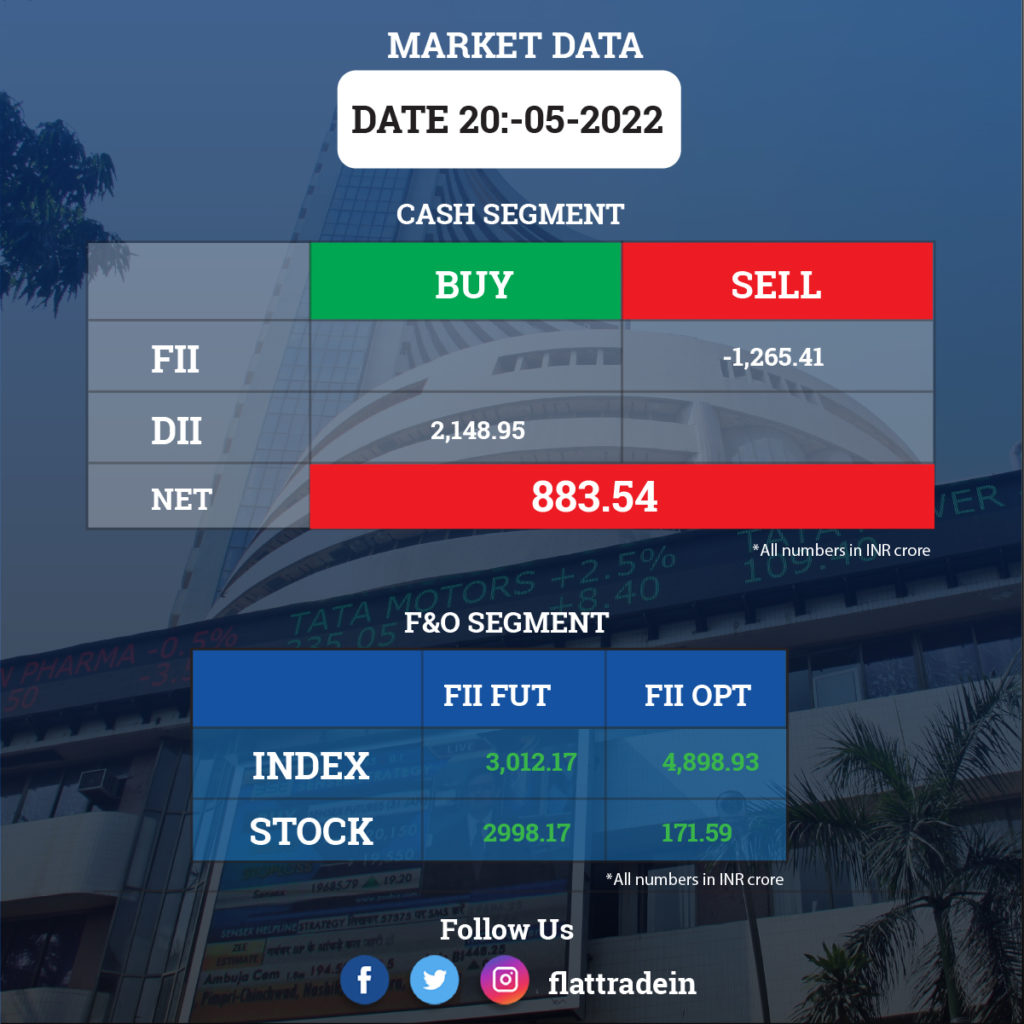

FII/DII Trading Data

Upcoming Results

Zomato, TRF, SAIL, Bharat Electronics, Nelcast, Pricol, The Ramco Cement, TTK Healthcare, Patel Engineering, Igarashi Motors, Graphite India, Divi’s Lab.

Stocks in News Today

Infosys: The IT services major in a regulatory filing announced the reappointment of Salil Parekh as the CEO and MD of the company for the period of five years. Parekh will be the only non-founder CEO to have managed to be at the helm of the company for a second term.

One97 Communications (Paytm): The company reported a loss of Rs 762.5 crore for the quarter ended March 2022 compared with a loss of Rs 444.4 crore in the corresponding quarter of the previous fiscal. The company’s revenues from operations were up by 89% year-on-year to Rs 1,541 crore.

For the full year FY22, the company posted a loss of Rs 2,396 crore against a loss of Rs 1,701 crore in the previous fiscal. Revenues from operations for FY22 stood at Rs 4,974 crore, up 77% from FY21.

Further, the digital financial services firm said it has formed a joint venture general insurance company in which it has committed to invest Rs 950 crore over a period of 10 years.

Power Grid Corporation of India Ltd: The company posted about 18% rise in its consolidated net profit at Rs 4,156.44 crore for the March 2022 quarter, backed by higher income. The company’s consolidated net profit stood at Rs 3,526.23 crore in the year-ago quarter. Its total income during the reported quarter increased to Rs 11,067.94 crore compared to Rs 10,816.33 crore recorded in the corresponding period of FY21.

BHEL: The government-owned engineering firm posted Rs 912.47 crore consolidated net profit in the March quarter, backed by higher income. In the year-ago quarter, the company had reported a consolidated net loss of Rs 1,036.32 crore. Total income during January-March 2022, rose to Rs 8,181.72 crore, from Rs 7,245.16 crore in the year-ago period.

Shree Cement: The company posted a 16% fall in its standalone fourth quarter net profit, which stood at Rs 645 crore in the March quarter of FY22. The company had recorded a profit of Rs 768 crore during the year-ago period. The decrease in profit was due to an increase in power and fuel costs, along with the high base of last year’s quarter. The company’s standalone revenues during the March quarter rose 3.6% to Rs 4,099 crore as compared to a revenue of Rs 3,958 crore in the year-ago period.

Bandhan Bank: The lender will gradually increase its exposure to secured loans by enhancing advances to the housing and MSME sectors, its Managing Director and CEO Chandra Shekhar Ghosh said. Presently, the bank’s exposure to MFI loans, which are unsecured, is 47%, and the share of its advances to the housing segment is at 24%, retail at 2% and MSME sector at 27%, he added.

Future Retail Ltd (FRL): Amazon has accused independent directors of FRL of facilitating “fraudulent stratagem” of transfer of 835 stores to billionaire Mukesh Ambani’s Reliance group, saying the narrative of that transfer was on account of failure to pay huge outstanding rent was a “sham” as the retailer had a month prior to such move stated that outstanding rent was only Rs 250 crore.

IDBI Bank: The lender has signed a share purchase agreement with Ageas Insurance International as the bank is looking to sell its remaining stake of 25% in private sector life insurer Ageas Federal Life Insurance for Rs 580 crore. Post this stake sale, Ageas will own 74% stake in private sector Ageas Federal Life Insurance.

India Grid: IndiInfrastructure investment trust has posted over 45% rise in its consolidated net profit at Rs 99.80 crore in the March quarter, mainly on the back of higher revenues. The consolidated net profit of India Grid Trust (IndiGrid) was Rs 68.69 crore in the quarter ended March 31, 2021, a regulatory filing showed. Total income in the quarter under review rose to Rs 568.50 crore, from Rs 514.09 crore a year ago.

JK Cement: The company plans to raise up to Rs 500 crore via non-convertible debentures (NCDs) on a private placement basis in one or more tranches. The company’s board has recommended the proposal in this regard for approval of shareholders in the next AGM of the company.

Bank of Maharashtra: The PSB is eyeing a 25-30% growth in its net profit in the current financial year, aided by a healthy growth in net interest income (NII) and fall in provisions for bad assets. In the FY22, the lender reported an over two-fold jump in its profit after tax (PAT) at Rs 1,152 crore, as against Rs 550 crore in FY21. NII grew by 23.42 per cent on a year-on-year basis to Rs 6,044 crore in FY2022, as against Rs 4,897 crore in FY2021.

Karur Vysya Bank: The lender has posted a 105% rise in net profit during the fourth quarter of the financial year, ended in March 2022, to Rs 213 crore as against Rs 104 crore during the January to March quarter of 2020-21. The operating profit for the quarter stood at Rs 441 crore, up by 118% from Rs 202 crore for Q4 of the previous year. Net interest income for the quarter was higher at Rs 710 crore for the March 2022 quarter, compared to Rs 613 crore for Q4FY21.

Indiabulls Housing Finance: The company’s net profit rose by 11.2% to Rs 307 crore for the fourth quarter ended March 2022 from Rs 276 crore in Q4FY21. Total income declined 7.7% YoY to Rs 2,189 crore from Rs 2,372 crore in the year-ago period.

Amara Raja Batteries: The company reported a 47.8% steep fall in consolidated net profit at Rs 98.85 crore in the fourth quarter ended March 2022 when compared with Rs 189.38 crore in the year-ago period. Total income was up 3.7% YoY at Rs 2,180.96 crore.

Jet Airways: The company has received the revalidated air operator certificate from the DGCA, fulfilling all the criteria under the National Company Law Tribunal approved resolution plan. The airline is planning to re-commence commercial operations in July-September quarter.