Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.28% higher at 15,816, signalling that Dalal Street was headed for a positive start on Monday.

Most Asian shares pared early gains and were trading lower. Japan’s Nikkei 225 index was up 0.24%, Topix fell 0.14%. China’s Hang Seng lost 0.18% and CSI 300 index dropped 0.66%.

Indian rupee fell 4 paise to 77.45 against the US dollar on Friday.

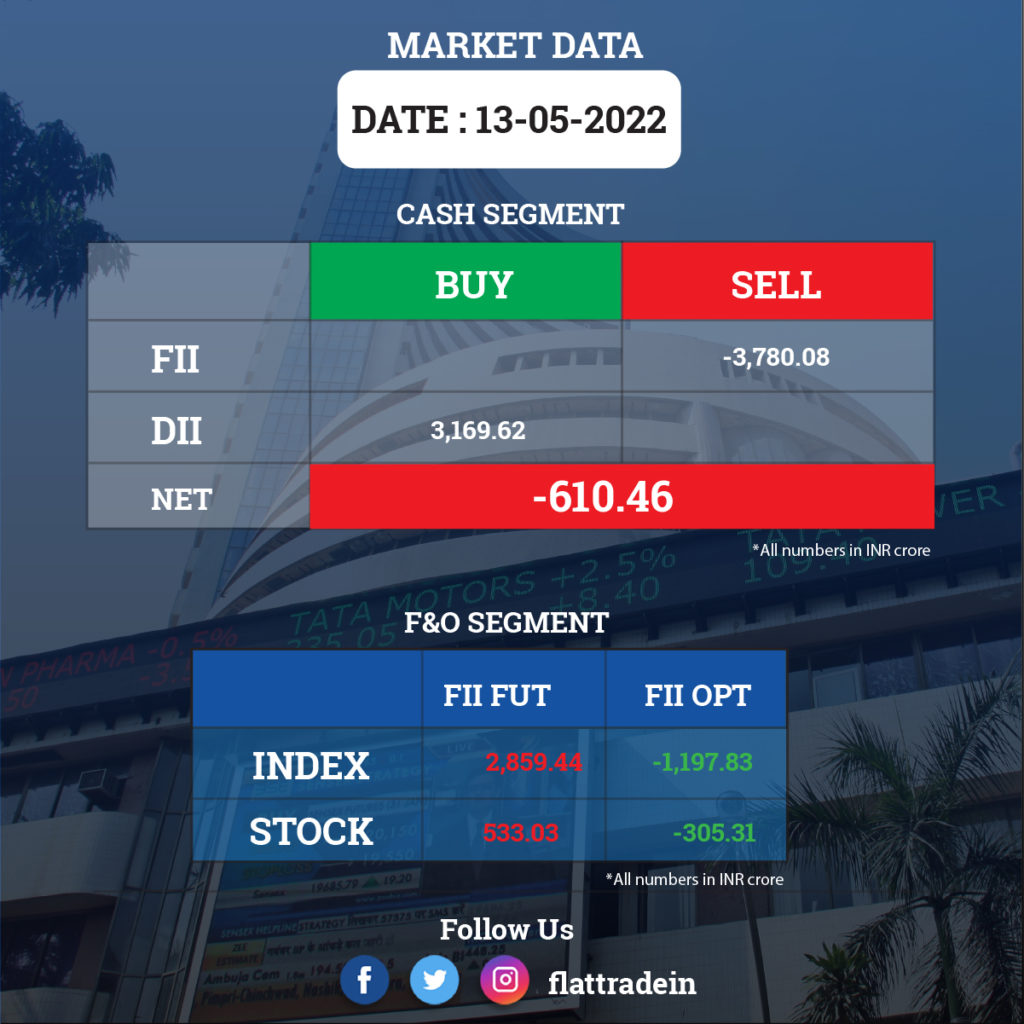

FII/DII Trading Data

Upcoming Results

Bharat Forge, MCX India, Ami Organics, Century Plyboards, Dodla Dairy, Fino Payments Bank, Glaxosmithkline Pharmaceuticals, Greenply Industries, GRM Overseas, Max Ventures and Industries, Nava Bharat Ventures, Omkar Speciality Chemicals, RateGain Travel Technologies, Raymond, Shankara Building Products, Uttam Sugar Mills, and VIP Industries will be in focus ahead of March quarter results on May 16.

Stocks in News Today

Adani Group: The group led by billionaire Gautam Adani won the race to acquire Swiss cement major Holcim’s stake in Ambuja Cements and its subsidiary ACC for $10.5 bn (around Rs 81,361 crore), including the open offers. Holcim owns 63.19% in Ambuja Cement and 4.48% in ACC. Ambuja Cement, in turn, owns 50.05% in ACC.

AMG Media Networks, a unit of billionaire Gautam Adani’s conglomerate Adani Enterprises, will buy 49% stake in Raghav Bahl-curated digital business news platform Quintillion Business Media Pvt Ltd for an undisclosed sum, according to a regulatory filing.

Reliance Industries Ltd (RIL): The company’s retail arm will acquire dozens of small grocery and non-food brands as it targets building its own $6.5 billion consumer goods business to challenge foreign giants like Unilever, Reuters reported citing two sources familiar with the plan. Reliance is in final stages of negotiations with around 30 popular niche local consumer brands to fully acquire them or form joint venture partnerships for sales, said the first source familiar with its business planning.

Maruti Suzuki India Ltd (MSIL): The automaker completed the process of allotment of an 800 acre site in Haryana state for its proposed plant, according to a regulatory filing. It plans an investment of more than Rs 11,000 crore in the first phase. The first plant with a manufacturing capacity of 2.5 lakh vehicles a year is expected to be commissioned by 2025. The site will have space for capacity expansion to include more manufacturing plants.

State Bank of India (SBI): The lender has hiked its marginal cost of funds based lending rate (MCLR) by 10 basis points (bps) across tenures, with effect from May 15. With the latest 10 bps increase, SBI’s overnight, one-month, three-month MCLR is now at 6.85 per cent as against 6.75 per cent earlier.

Tech Mahindra: The IT company reported a 10% sequential rise in its consolidated net profit to Rs 1,506 crore for the quarter ended March 2022, which was above analysts’ expectations of Rs 1,411 crore. The IT services major reported a 5.8% quarter-on-quarter rise in consolidated revenue from operations to Rs 12,116 crore for the reported quarter. The firm won deals worth over $1 billion in the January-March period.

Bank of Baroda: The public-sector lender posted a standalone net profit of Rs 1,778.77 crore for the fourth quarter of FY22 as against a net loss of Rs 1,046.5 crore in the year-ago period. On a sequential basis, the lender’s net profit fell 19% from Rs 2,197.03 crore in the third quarter of last fiscal. Net interest income grew 21.2% to Rs 8,612 crore in the quarter under review from Rs 7,107 crore in the same last fiscal.

Amber Enterprises: The company posted a net profit of Rs 57.22 crore in the Jan-Mar 2022 quarter, down 24% year-on-year. Revenue rose 21% from a year ago to Rs 1,940 crore. The firm also approved raising Rs 500 crore via securities.

Eicher Motors: The company said its net profit for the Jan-Mar 2022 quarter rose 16% year-on-year to Rs 610 crore. Revenue grew 9% from a year ago to Rs 3,190 crore. The growth was led by YoY increase in average selling prices (ASPs) on the back of richer model mix and price hikes taken over the past few quarters.

Nazara Technologies: The gaming software company’s net profit for the March 2022 quarter fell 71% quarter-on-quarter to Rs 4.90 crore as against Rs 17.10 crore. Revenue for the quarter fell 6% sequentially to Rs 175.10 crore against Rs 185.80 crore. The firm also announced that it will give 1:1 bonus share to its shareholders.

Avenue Supermarts (D-Mart): The compnay reported a 22% decline in its sequentially consolidated net profit to Rs 427 crore for the fourth quarter ended March 2022. It reported a 3% year-on-year rise in its net profit. Revenue fell 5% quarter-on-quarter to Rs 8,787 crore from Rs 9,218 crore. Revenue rose 19% YoY.