Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.60 per cent higher at 17,087, indicating that Dalal Street was headed for a positive start on Wednesday.

Hong Kong shares fell ahead of expected Federal Reserve’s monetary policy decision later in the day. Hang Seng index fell 1% on Wednesday in early trade. Financial markets in mainland China and Japan are shut on account of public holiday.

The Indian rupee ended 9 paise lower at 76.51 against the US dollar on Monday.

India’s biggest IPO, Life Insurance Corporation of India IPO, will open for subscription today. The price band is set at Rs 902-949 apiece.

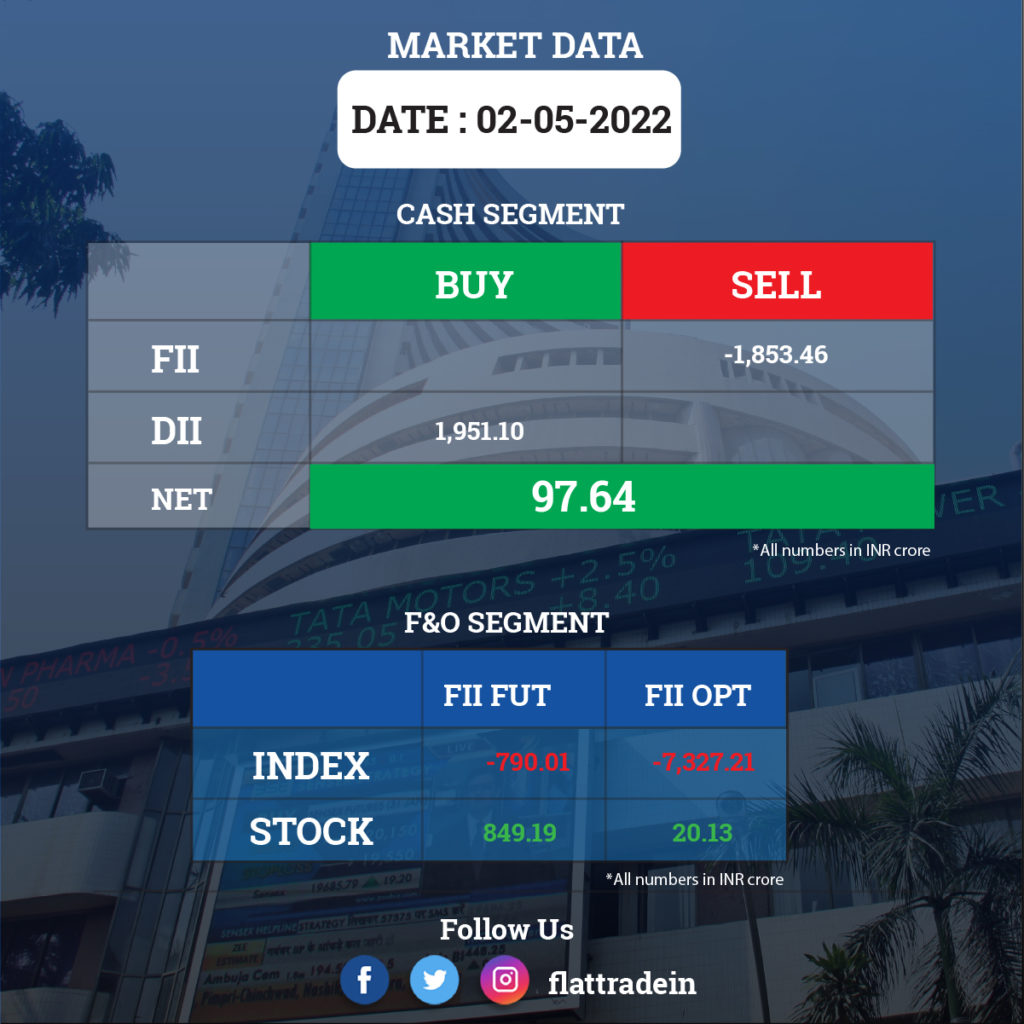

FII/DII Trading Data

Upcoming Results

Kotak Mahindra Bank, Tata Consumer Products, ABB India, Adani Green Energy, CarTrade Tech, Adani Total Gas, Equitas Small Finance Bank, Havells India, Bombay Dyeing & Manufacturing Company, Deepak Nitrite, Laxmi Organic Industries, Mahindra EPC Irrigation, Satin Creditcare Network, SIS, Oracle Financial Services Software, Rain Industries, EIH, IIFL Wealth Management, Aptech, Cigniti Technologies, and MAS Financial Services will announce quarterly results today.

Stocks in News Today

Britannia Industries: The biscuit maker reported an increase of 4.96 per cent in consolidated net profit at Rs 377.95 crore for the fourth quarter of FY22, compared with a net profit of Rs 360.07 crore in the year-ago period. Its total revenue from operations climbed 13.40 per cent to Rs 3,550.45 crore during the quarter under review, as against Rs 3,130.75 crore in the year-ago period.

The company said it has judiciously increased prices in the January-March quarter on account of cost inflation and would further take such calibrated price hikes to retain its profitability.

Adani Wilmar: The edible oil major reported a 26 per cent decline in consolidated net profit at Rs 234.29 crore for the quarter ended March 2022. The company had posted a net profit of Rs 315 crore in the year-ago period. Adani Wilmar reported that its total income increased to Rs 15,022.94 crore during the January-March period of last fiscal from Rs 10,698.51 crore in the corresponding period of FY21.

Tata Steel: The company posted a 37 per cent jump in consolidated net profit at Rs 9,835.12 crore for the quarter ended March 2022, on account of higher income and robust business in Europe. The steel major had reported a net profit of Rs 7,161.91 crore in the year-ago quarter. During January-March 2022, Tata Steel’s total income jumped to Rs 69,615.70 crore from Rs 50,300.55 crore earlier.

Titan Company: The jewellery-to-watch retailer registered a 7.2 percent year-on-year fall in standalone profit at Rs 491 crore in the quarter ended March 2022 with revenue rising 2 per cent to Rs 7,276 crore during the same period on the back of partial lockdowns, volatility in gold prices and uncertainty in a fragile geopolitical situation. Its EBITDA fell 1.6 per cent to Rs 782 crore and margin declined by 40 bps to 10.7 per cent compared to the year-ago period.

Route Mobile: Enterprise communications service provider will acquire artificial intelligence-based blockchain and DLT platform of Teledgers Technology for over Rs 130 crore, according to a regulatory filing. The acquisition would enable Route Ledger to offer DLT (distributed ledger technology) and encrypted messaging solutions to mobile network operators besides its existing firewall analytics and grey route monetisation solutions.

NTPC Ltd: India’s state-run electricity giant plans to expand its coal-fired power fleet with a first new project in six years, a policy shift that reflects alarm over the nation’s worsening power crisis, Bloomberg reported citing sources. In May, NTPC will award a contract to construct a 1,320-megawatt plant in Odisha, according to a company official with knowledge of the plans. The company will also consider awarding contracts for two previously stalled expansion projects at its Lara and Singrauli sites in central India, the official said, requesting anonymity as the plans are still private.

JSW Energy: The power generation company recorded a massive 8 times year-on-year growth in consolidated profit at Rs 864.3 crore in Q4FY22, with EBITDA climbing 79 per cent YoY to Rs 1,131.8 crore led by a one-time reversal of provision due to tariff true-up order of the Karcham Wangtoo plant. Revenue increased 55.5 per cent to Rs 2,440.7 crore in the quarter under review compared to the corresponding period last fiscal.

Jindal Stainless: The company posted a 156 per cent year-on-year growth in Q4FY22 profit at Rs 750 crore with EBITDA rising 55 per cent to Rs 842 crore. Its revenue climbed 68 per cent to Rs 6,564 crore compared to the year-ago period. The domestic business contributed 68 per cent to sales volumes, and exports’ contribution stood at 32 per cent in March 2022 quarter doubling from 16 per cent in the same period last year.

RailTel Corporation of India: The state-owned telecom infrastructure provider has received a work order from Madhya Pradesh State Electronics Development Corporation. The company will act as a system integrator for the expansion of SDC and the establishment of a disaster recovery centre. The work order is worth Rs 97.64 crore.

Astec Life Sciences: The agrochemical active manufacturer clocked a massive 80 percent year-on-year growth in profit at Rs 43 crore driven by strong realisations in export markets and healthy volume growth in contract manufacturing. Revenue grew by 58 percent to Rs 272 crore and EBITDA increased by 82 percent to Rs 72 crore with 345 bps improvement in margin compared to the corresponding period last fiscal.

Adani Enterprises Ltd (AEL): The company posted a consolidated net profit attributable to owners at Rs 304.32 crore for the quarter ended March 2022, up 30 per cent on a year-on-year (YoY) from Rs 233.95 crore in the year-ago period. AEL’s consolidated revenue grew by 83.66 per cent in Q4FY22 at Rs 25,141.56 crore, from Rs 13,688.95 crore in Q4FY21.

Adani Transmission: The company said it has received shareholders’ approval for issuance of 1.56 crore shares worth around Rs 3,850 crore on a preferential basis to Green Transmission Investment Holding RSC Ltd.

IDBI Bank: The private sector lender’s net profit rose 35 per cent to Rs 691 crore year-on-year (YoY) in the fourth quarter (Q4) of FY22 on moderation in provisions and contingencies. ts net interest income (NII) was down by 25 per cent at Rs 2,421 crore for Q4FY22 against Rs 3,239 crore in the year-ago period. Net interest margin (NIM) stood at 3.97 per cent for Q4 against 5.14 per cent for Q4FY21.

Voltas Ltd: The air conditioner maker announced that it has entered into a partnership to set up a joint venture with Highly International (Hong Kong) Ltd to manufacture compressors in India. In the JV, Highly International (Hong Kong) will have 60 per cent shareholding while the rest is to be owned by Voltas. The proposed JV will have an equity capital of Rs 250 crore to be contributed in tranches by the partners.

Mahindra & Mahindra Financial Services: The NBFC reported more than two times increase in consolidated net profit at Rs 629 crore for the quarter ended March 2022 as a drop in bad loans helped in credit cost reversal. The company’s net profit stood at Rs 219 crore in the same quarter a year ago. Total income during the quarter of FY22 declined by 5 per cent at Rs 2,897 crore, as against Rs 3,038 crore in the year-ago quarter.

Alembic Pharmaceuticals: The drug firm reported a consolidated profit after tax (PAT) of Rs 35 crore for the fourth quarter ended March 2022. It had reported a PAT of Rs 251 crore in the year-ago period. Revenue from operations rose to Rs 1,416 crore for the fourth quarter of FY22, compared to Rs 1,280 crore in the year-ago period.

Ruchi Soya Industries Limited: Capital markets regulator Sebi has imposed a penalty amounting Rs 25 lakh on nine entities for indulging in fraudulent trade practices in the scrip of Ruchi Soya nearly 10 years ago. The order came after Sebi had conducted an investigation in the trade of securities and futures of Ruchi Soya during the last half hour of trading between 15:00 hours and 15:30 hours on September 27, 2012.

Motilal Oswal Financial Services Ltd: Capital markets regulator Sebi has imposed a penalty of Rs 2.5 million on the company for misutilisation of clients’ funds and incorrect reporting of the margin. In addition, it has been charged for funding clients beyond the stipulated time period, failure to keep appropriate evidences of client order placement and discrepancies in CKYC (Central Know Your Customer) process among others, according to a Sebi order. The period covered in the inspection was from April 2018 to August 2019.

Network18 Media & Investments: The company reported 58.1 per cent year-on-year surge in its consolidated net profit to over Rs 61 crore during Q4FY22. The media company reported a 14.6 per cent year-on-year rise in consolidated revenue from operations to over Rs 1,621 crore.