Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.4% higher at 16,005, indicating that Dalal Street was headed for a positive start on Friday.

Asian stocks were trading higher with investors on the hunt for beaten-down stocks. Japan’s Nikkei 225 rose 1.17%, Topix was up 0.72%. China’s Hang seng increased 1.71% and CSI 300 gained 0.93%.

Indian rupee fell 14 paise to 77.72 against the US dollar on Thursday.

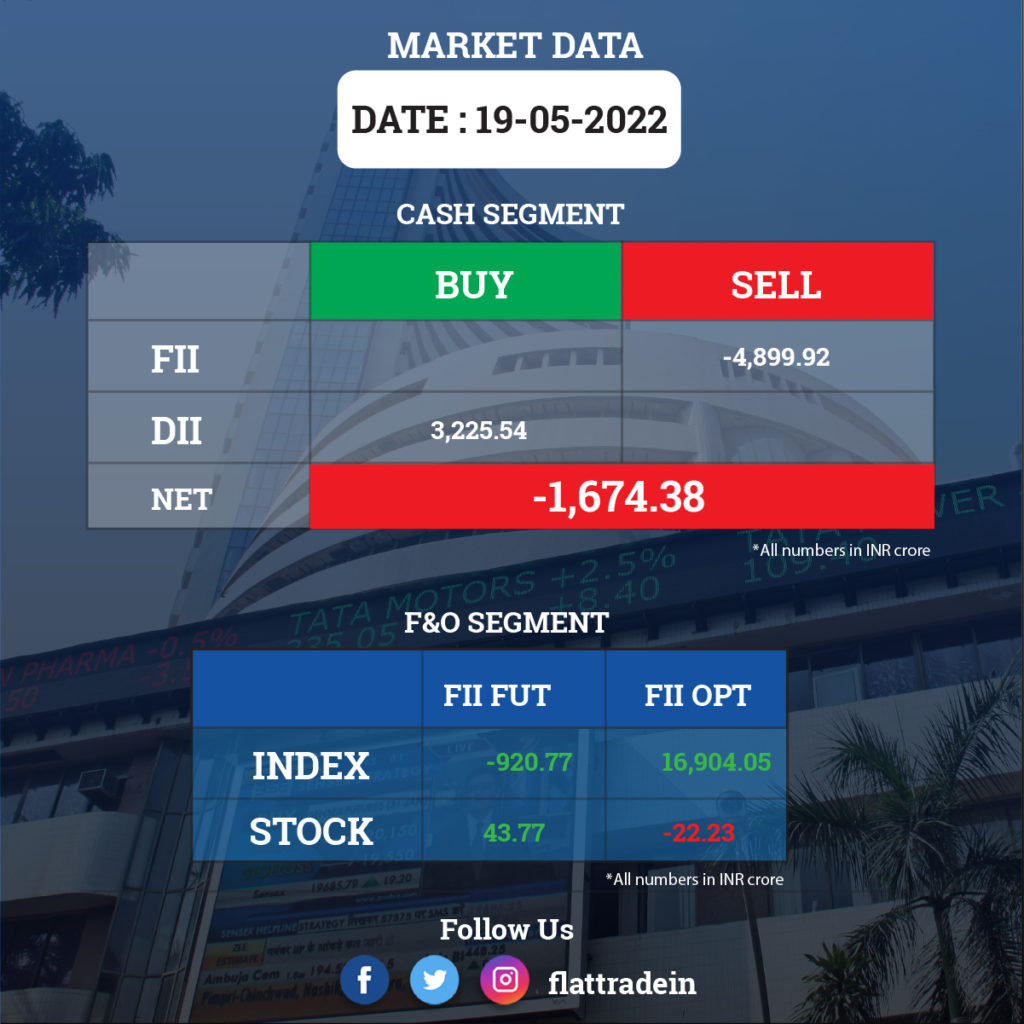

FII/DII Trading Data

Upcoming Results

NTPC, One 97 Communications (PayTM), Amara Raja Batteries, Gati, HeidelbergCement India, Indiabulls Housing Finance, IDFC, Indigo Paints, Indian Railway Finance Corporation, JK Tyre and Industries, CE Info Systems, Metro Brands, Narayana Hrudayalaya, Nuvoco Vistas Corporation, Paras Defence and Space Technologies, Pfizer, SML Isuzu, Sobha, Thermax, and Zydus Lifesciences will report their March quarter earnings on May 20.

Stocks in News Today

Hindustan Petroleum Corp Ltd (HPCL): The state-run oil refiner posted a 34% decline in consolidated net profit to Rs 2,019 crore in the quarter ended March 2022 from Rs 3,061 crore in the year-ago period due to rise in total cost.

Revenue for the quarter stood at Rs 1.07 trillion, up 24.2% from Rs 85,755 crore last year. Average gross refining margin during the year ended March 2022 was $7.19 per barrel as against $3.86 per barrel during the corresponding previous year.

Ashok Leyland: The company reported a 274% YoY jump in net profit at Rs 901.4 crore for the fourth quarter of FY22. Total income stood at Rs 8,744.3 crore during the quarter, up 24.9% against Rs 7,000.5 crore in the corresponding period of the preceding fiscal. Its truck market share for Q4FY22 improved to 30.6% against 28.9% in Q4 FY21.

Maruti Suzuki India (MSI): The carmaker said its new manufacturing facility in Haryana, the company’s third in the state, would reach peak production capacity of 10 lakh units per annum in the next eight years entailing a total investment of Rs 18,000 crore.

The new facility that would come at a 800-acre site at IMT Kharkhoda in Sonipat district, will entail total investment of Rs 11,000 crore in the first phase with a production capacity of 2.5 lakh units per annum. The first set of vehicles are expected to roll out of the facility in 2025.

Equitas Small Finance Bank (Equitas SFB): Veteran banker P N Vasudevan has resigned as the managing director and chief executive officer of Equitas Small Finance Bank, the lender informed the stock exchanges. Vasudevan, in his resignation letter, said he wants to devote his time towards social welfare through his public charitable trust.

Godrej Consumer Products: The company reported a 1% fall in net profit for the March quarter to Rs 363 crore year-on-year as a slowdown in consumption and high commodity inflation weighed. Revenue rose 7% from the year-ago period to Rs 2,920 crore. Total cost rose 12% YoY to Rs 2,540 crore.

Wipro: The IT company has launched its new innovation studio at Austin in Texas, US, the company said on Thursday. Wipro said that the new centre, spread over 40,000 square feet, will create hundreds of jobs locally.

Gland Pharma: The net profit rose 10% to Rs 285.90 crore in the quarter ended March 2022 as against Rs 260.41 crore during the same quarter previous fiscal. Net sales rose 24.25% to Rs 1,103.01 crore as against Rs 887.75 crore in the year-ago quarter. EBITDA margin contracted sharply to 35% from 40% year-on-year.

Biocon: The company’s subsidiary Biocon Biologics, and Viatris Inc. announced that Abevmy (bBevacizumab) is now available in Canada. Abevmy, co-developed by Biocon Biologics and Viatris, is a biosimilar to Roche’s Avastin (Bevacizumab) and has been approved by Health Canada across four oncology indications.

Eros International: The company’s board approved raising Rs 405 crore by issuing 13.50 crore warrants at a price of Rs 30 per equity share.

Go Fashion (India) Ltd: ICICI Venture through its fourth private equity fund — India Advantage Fund S4 I sold 18,11,478 shares of the company at an average price of Rs 1,050 apiece, taking the transaction size to Rs 190.21 crore, according to BSE’s bulk deal data.