Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.05% at 15,982.50, signalling that Dalal Street was headed for a positive start on Friday.

Asian shares were trading higher as Powell reaffirmed that the Fed will increase the rate by 50 basis points in the next two meetings amid persistent higher inflation. Japan’s Nikkei 225 jumped 2.61%, Topic rose 1.94%. China’s Hang Seng rose 1.82% and CSI 300 was up 0.11%.

Indian rupee fell 17 paise to 77.41 against the US dollar on Thursday.

India’s retail inflation surged to 7.79% in April on annual basis, driven by rising fuel and food prices, government data showed. In March 2022, the retail inflation was at 6.95%. It was 4.23% in April 2021. The consumer price-based inflation figure remained well above Reserve Bank of India’s (RBI’s) upper tolerance limit for the fourth consecutive month.

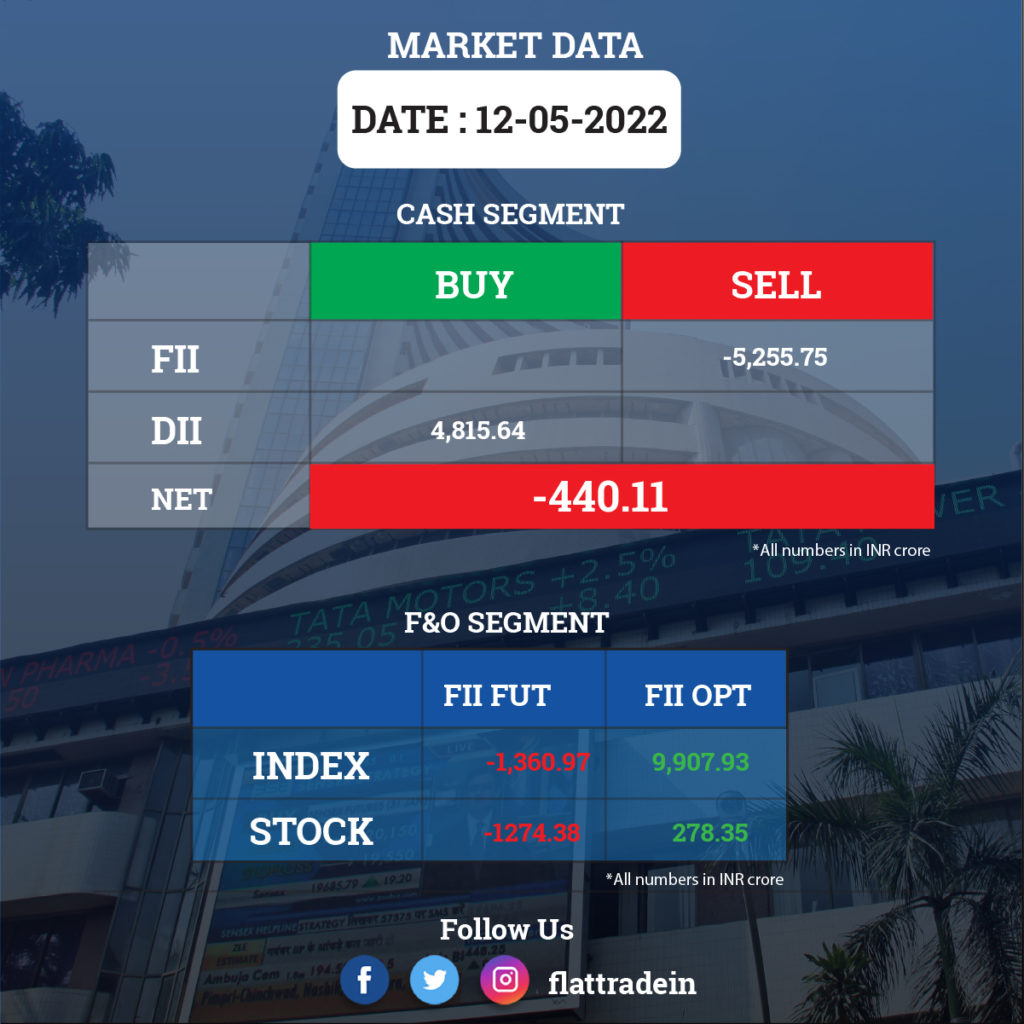

FII/DII Trading Data

Upcoming Results

State Bank of India, Eicher Motors, Tech Mahindra, Bank of Baroda, Bandhan Bank, Union Bank of India, Alkem Laboratories, Emami, Escorts, Hindustan Aeronautics, JK Paper, Linde India, Nazara Technologies, Amber Enterprises India, APL Apollo Tubes, Balkrishna Industries, Carborundum Universal, CESC, Coromandel Engineering Company, DB Corp, Elgi Equipments, Gujarat Fluorochemicals, REC, Reliance Infrastructure, Reliance Power, Sharda Cropchem, Sigachi Industries, Steel Strips Wheels, Triveni Turbine, UCO Bank, and Vakrangee will release quarterly results on May 13.

Stocks in News Today

Larsen & Toubro (L&T): The engineering & infrastructure major reported a 10% year-on-year growth in profit at Rs 3,621 crore in the quarter ended March 2022, with revenue rising 10% YoY to Rs 52,851 crore and EBITDA increasing 2.1% YoY to Rs 6,520.5 crore compared to year-ago period. The number of order inflow grew by 46% YoY to Rs 73,941 crore in Q4FY22 in value terms.

Tata Motors: The automaker posted a loss of Rs 1,033 crore in Q4FY22, declining from loss of Rs 7,605 crore in same period last year. Revenue during the quarter declined by 11.5% to Rs 78,439 crore YoY, impacted by subsidiary Jaguar Land Rover, whose revenues in Q4 fell 27.1% YoY to 4.8 billion pound sterling amid semi-conductors shortage, and disruption in the European and China business.

Apollo Tyres: The company’s consolidated net profit declined by 61% to Rs 113 crore for the fourth quarter ended March 2022 due to higher raw material costs. The company had reported a consolidated net profit of Rs 287 crore in the year-ago period. Revenue from operations rose 11% to Rs 5,578 crore, as against Rs 5,026 crore in the fourth quarter of FY21.

Tube Investments of India: The company registered a 57.5% YoY growth in consolidated profit at Rs 225 crore in Q4FY22, driven by higher operating income and topline. Revenue grew 25% YoY to Rs 3,415 crore in the quarter under review compared to year-ago period.

Siemens: The company reported a 2.6% YoY growth in consolidated profit at Rs 340 crore in quarter ended March 2022. Revenue rose 13.5% to Rs 3,954.7 crore compared to year-ago period and EBITDA increased 6.1% to Rs 484.8 crore. Higher input cost, finance cost, and other expenses weighed on profitability.

Ujjivan Small Finance Bank: The bank reported a 7% YoY fall in net profit at Rs 127 crore in Q4FY22 due to higher provisions. Net interest income grew 48% to Rs 544 crore and pre-provision operating profit increased 40% to Rs 217 crore compared to the corresponding period last fiscal.

Matrimony.com: The company in a BSE filing said the board approved to buyback shares worth up to Rs 75 crore of the company, at a price of Rs 1,150 per share.

Windlas Biotech: The company reported a 151% YoY rise in profit at Rs 14.8 crore in Q4FY22, driven by higher sales and operating income. Revenue grew 14.3% YoY to Rs 122.1 crore and EBITDA rose by 28.7% to Rs 14.3 crore compared to year-ago period.

Kalpataru Power Transmission Ltd (KPTL): The company has bagged new orders worth Rs 4,474 crore. KPTL received orders from India and international markets in the power transmission business of Rs 1,957 crore. Its subsidiary JMC bagged water supply projects of Rs 2,193 crore in India.

RBL Bank: The lender’s consolidated net profit after tax more than doubled to Rs 164.77 crore in the March quarter. For the reporting quarter, its core Net Interest Income (NII) grew 25% to Rs 1,131 crore, despite a tepid 2% advances growth while the Net Interest Margin (NIM) widened to 5.04%.

Aditya Birla Capital: The company reported a rise of 20% in its consolidated profit after tax at Rs 450 crore in quarter ended March 2022.The consolidated revenue of the company for Q4 FY22 grew 18% YoY to Rs 6,962 crore.

Hindustan Construction Company (HCC): The company reported an 80.4% decline in consolidated net profit at Rs 30.88 crore in Q4FY22. The company had registered a profit of Rs 157.28 crore in the year-ago period. Total income during the quarter under review stood at Rs 2,946.16 crore, compared to Rs 2,398.38 crore in the year-ago period.

Poonawalla Fincorp Ltd (PFL): The company’s consolidated net profit stood at Rs 119 crore in Q4FY22 helped by improved net interest margin and credit costs. It had made a consolidated loss of Rs 648 crore in Q4FY21. The company’s net interest margins, on consolidated basis, improved to 9.5% in Q4FY22, up 33 basis points from Q4FY21. The company’s board recommended a dividend payment of 20 per cent for Fy22 subject to shareholder’s approval.