Market Opening - An Overview

SGX Nifty futures were trading 1.41% lower at 16,936, signalling Dalal Street was headed for a gap-down opening.

Asian stocks were significantly down as investors were worried over China’s worsening Covid situation and slowdown in demand in the world’s second-largest economy. Japan’s Nikkei 225 was down 1.94%, Topix fell 1.58%. China’s Hang Seng and CSI 300 plunged 2.44% and 1.6%, respectively.

The Indian rupee depreciated by 34 paise to 76.48 against the US dollar on Friday.

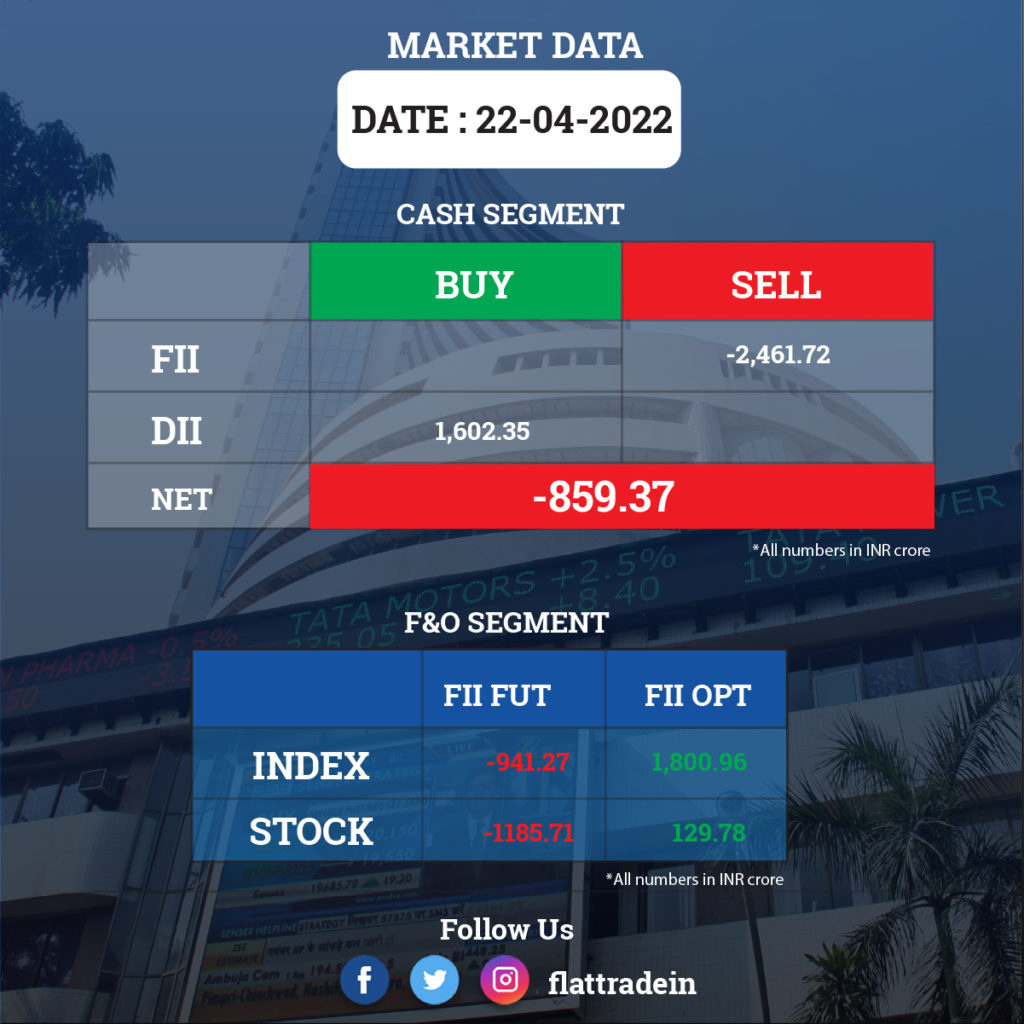

FII/DII Trading Data (22-4-2022)

Upcoming Results

Tatva Chintan Pharma Chem, Tata Investment Corporation, Century Textiles & Industries, Eveready Industries India, Gujarat Mineral Development Corporation, Mahindra CIE Automotive, Meghmani Finechem, Arihant Capital Markets, Artson Engineering, Automotive Stampings & Assemblies, Axita Cotton, Divyashakti, Maharashtra Scooters, Snowman Logistics, Steel Exchange India, Sylph Technologies, Triveni Enterprises and VTM will release quarterly results.

Stocks in News Today

ICICI Bank: The private sector lender reported a 59.4 per cent year-on-year jump in net profit to Rs 7,018.7 crore for the quarter ended March, compared with a standalone net profit of Rs 4,403 crore in the year-ago period. The net interest income rose 21% year-on-year to Rs 12,605 crore from Rs 10,431 in the same quarter a year ago. Other income, too, rose 15% from a year ago to Rs 4,737 crore. The bank’s board has also approved a dividend of Rs 5 per share for the shareholders.

Future Retail Ltd (FRL) and Reliance Industries Ltd (RIL): A majority of 69.3% of secured creditors of have rejected the Rs 24,713-crore deal between the retail major and Reliance Retail, according to a regulatory filing. Though, more than 75 per cent of shareholders and unsecured creditors supported the deal, FRL did not get the requisite 75 per cent favourable voting from secured creditors. Reliance Retail said on Saturday that it will not proceed with its plan to buy Future Group’s businesses.

Future Lifestyle Fashions Ltd (FRFL): The chairperson and independent director of the company, Shailesh Haribhakti, has resigned observing that “volatile, complex and unpredictable legal and financial circumstances have taken unexpected turns, and the board’s recommendation to find solutions have not been met with implementation impetus, according to a regulatory filing by the company.

Future Enterprise Ltd (FEL): The company has defaulted on repayment of Rs 2,911.51 crore of loans to its lenders, missing 30 days of review period. The company was required to pay an aggregate amount of Rs 2,911.51 crore between March 23 and March 31, 2022, to various consortium banks and lenders, a regulatory filing said.

HDFC Bank: The lender declared Rs 15.50 per share dividend to its shareholders for the financial year 2021-22. The record date for determining the eligibility of shareholders entitled to receive dividend on equity shares is May 13, 2022, it said.

Tejas Networks: The company posted a consolidated loss of Rs 49.62 crore in the fourth quarter ended on March 31, 2022, as the shortage of electronic chips hit its telecom gear production. The company had posted a profit of Rs 33.55 crore in the period a year ago. The consolidated revenue from operations fell 37.23 per cent to Rs 126.5 crore during the reported quarter from Rs 201.55 crore in the March 2021 quarter.

Tata Metaliks: The company registered a 30 per cent fall in its net profit to Rs 52.46 crore for the quarter ended March owing to increased expenses. The company had clocked a Rs 74.99 crore net profit in the year-ago period. Its total income during the said quarter rose 22.75% to Rs 814.65 crore compared to Rs 663.64 crore in the year-ago period. The total expenses were higher at Rs 772.29 crore as against Rs 539.71 crore a year ago.

Tata Motors: The automaker said it has hiked the prices of its passenger vehicles by an average 1.1 per cent with immediate effect. The new prices on various models and variants were effective from April 23.

Sundram Fasteners: The auto ancillary company reported a 24 per cent decline in consolidated net profit at Rs 107.43 crore for the fourth quarter ended March 2022, from a consolidated net profit of Rs 140.80 crore in the same period year ago. Revenue from operations rose to Rs 1,339.84 crore in the reported quarter, as against Rs 1,273.10 crore in the year-ago period.

Aditya Birla Capital Ltd (ABCL): Vishakha Mulye will be the new chief executive officer (CEO) of ABCL. Mulye, executive director of ICICI Bank, will succeed Ajay Srivinasan, present MD & CEO of ABCL. She will join ABCL on June 01, 2022. Srivinasan plans to move out of the current role and he shall be taking up another role within the Aditya Birla Group.

National Aluminium Co Ltd (NALCO): The state-owned company is facing a coal supply shortfall, due to supplies being diverted to priority electricity generation and a shortage of trains to deliver fuel to NALCO’s power plants, Reuters reported citing sources. Daily supplies to NALCO were falling short of requirement by at least 5,000 tonnes due to the train shortage, a senior company official told Reuters.

Torrent Power: The company will acquire 100 per cent equity in a 50 MW solar plant of SkyPower Group at an enterprise value of Rs 417 crore. The acquisition is further subject to customary conditions for transaction closure.

Aditya Birla Money: The company’s net profit more than doubled to Rs 7.62 crore in the March quarter, up from Rs 3.68 crore in the same period of the previous year. Revenue from operations rose 23.2 percent to Rs 60.4 crore year-on-year, driven by broking business that contributed 87 percent to the kitty.

RailTel Corporation of India: The state-owned telecom infrastructure provider received a work order from the Odisha government’s electronics & information technology department. The company will do provisioning of secondary bandwidth and replacement of equipment along with the implementation of SDWAN for OSWAN project for five years at a cost of Rs 122.08 crore.

IRB Infrastructure Developers: IRB Infrastructure Trust, the private InvIT sponsored by the company and Singapore-based sovereign fund GIC Affiliates, has completed total fundraising of Rs 243 crore. IRB Infrastructure Developers in a statement said that post fundraise, IRB and GIC affiliates will continue to hold 51 per cent and 49 per cent, respectively, in the InvIT.