Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.88% lower at 15930.5, signalling that Dalal Street was headed for a gap-down start on Thursday.

Asian equities were trading lower, tracking Wall Street overnight, as investors fled risky equity markets and sought safe havens due to worries over an economic downturn. Japan’s Nikkei 225 and Topix tanked 2.5% and 2.03%, respectively. China’s Hang Seng slumped 3.01% and CSI 300 dropped 0.88%.

Indian rupee was nearly flat at 77.58 against the US dollar on Wednesday.

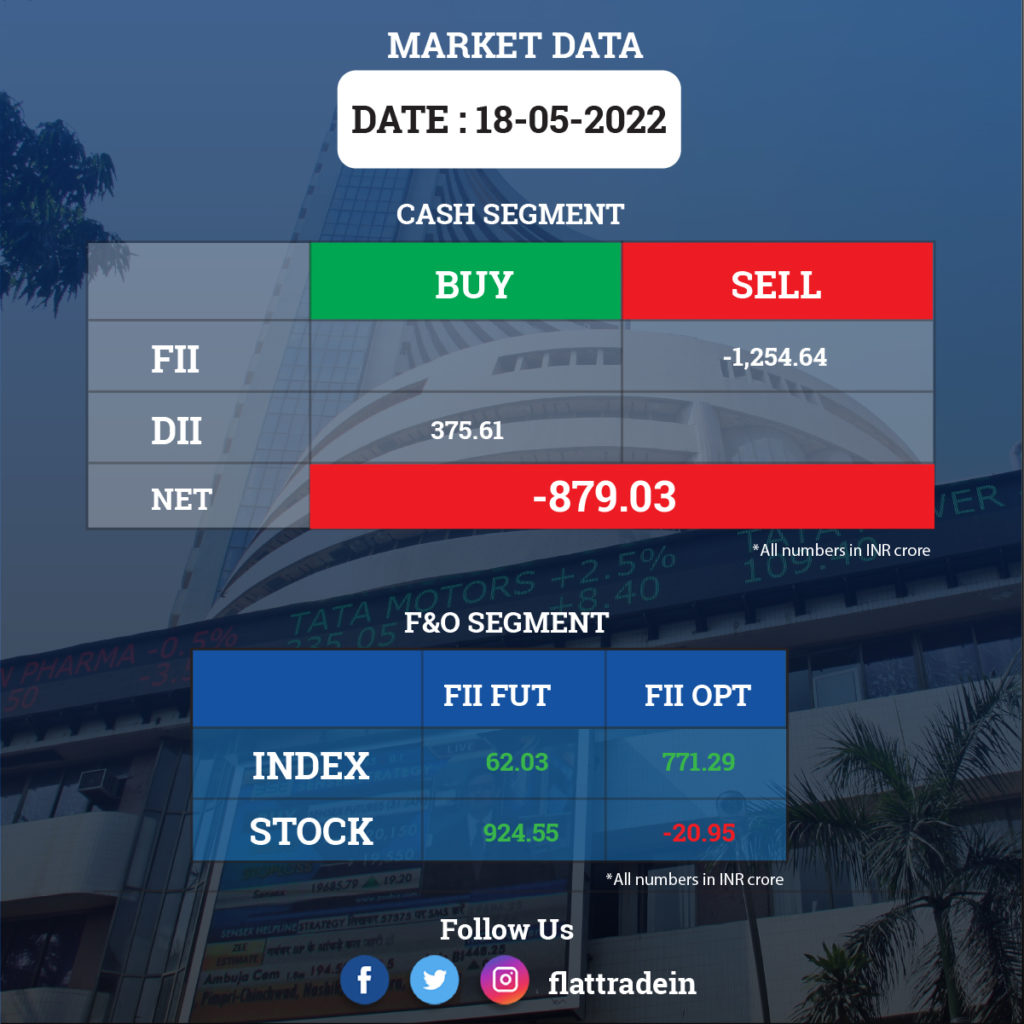

FII/DII Trading Data (20-4-2022)

Upcoming Results

HPCL, Ashok Leyland, Bosch, Chambal Fertilisers & Chemicals, Container Corporation of India, Endurance Technologies, Gland Pharma, Dr Reddy’s Laboratories, Godrej Consumer Products, Novartis India, Ramco Systems, Punjab & Sind Bank, Rossari Biotech, Ujjivan Financial Services, and Suryoday Small Finance Bank will declare quarterly results on May 19.

Stocks in News Today

InterGlobe Aviation (IndiGo): Ronojoy Dutta, the chief executive officer of IndiGo, said he will retire on September 30. The firm also said it has appointed Pieter Elbers as the next chief executive officer. The company has postponed its March quarter earnings announcement and now it will be on May 25.

ITC: Diversified conglomerate reported an 11.8% year-on-year (YoY) jump in net profit at Rs 4,191 crore in Q4FY22 as against Rs 3,748 crore in the year-ago period. Consolidated revenue from operations rose 15.3% YoY to Rs 17,754 crore from Rs 15,404 crore in the corresponding quarter last fiscal. Revenue from cigarette business grew 9.96% while non-cigarette FMCG revenue was up 12.32% from the corresponding quarter last year.

Adani Enterprise: The company announced its entry into the health care sector. In a regulatory filing, the company said it has incorporated a wholly-owned subsidiary, Adani Health Ventures (AHVL), for this purpose. AHVL will carry out the business of healthcare-related activities like setting up of medical and diagnostic facilities, research centres, it said.

Lupin: The pharma major posted a net loss of Rs 511.9 crore for the fourth quarter of FY22 due to rising costs, price erosion in the US and impairment expense of Rs 126.7 crore for US-based Gavis. Lupin had posted a net profit of Rs 464 crore in the corresponding quarter last fiscal. Its consolidated revenue rose 3% YoY to Rs 3,883 crore in the quarter under review.

Biocon: The Competition Commission of India (CCI) has approved a proposed deal involving Serum Institute Life Sciences, Covidshield Technologies and Biocon’s subsidiary Biocon Biologics. After the completion of the deal, Serum will have about 15% stake in Biocon Biologics.

Pidilite Industries: The company reported a 17.3% decline in its net profit for the March quarter to Rs 254 crore from Rs 308 crore a year ago. Revenue for the quarter rose 12% year-on-year to Rs 2,507 crore versus Rs 2,235 crore last year. Total cost rose 18% year-on-year to Rs 2,178 crore.

Sugar companies: Stocks of sugar manufacturers such as Triveni Engineering, Uttam Sugar Mills, Bajaj Hindusthan, Balrampur Chini will be in focus after the government approved amendments to the National Policy on Biofuels, 2018, to advance the date by which fuel companies have to increase the percentage of ethanol in fuel to 20%, from 2030 to 2025. The policy of introducing 20% ethanol will take effect from April 1, 2023.

Indraprastha Gas: The company reported a rise in net profit of 9.24% to Rs 361.60 crore in the quarter ended March 2022 as against Rs 331 crore during the corresponding quarter ended March 2021. Revenue rose 55.16% to Rs 2,405.92 crore in the quarter under review as against Rs 1,550.63 crore during the year-ago quarter. Total cost surged 72% YoY to Rs 2,230 crore.

Manappuram Finance: The NBFC reported over 44% decline in net profit at Rs 261 crore in the quarter ended March 2022 as against a net profit of Rs 468 crore in the same quarter of the previous year. The company said their PAT (Profit After Tax) was affected temporarily due to shifting of high yield to lower yielding gold loans.

LIC Housing Finance: LIC Housing Finance reported a 174% surge in net profit for the March quarter to Rs 1,114 crore from Rs 406 crore a year ago. Revenue for the quarter rose 6.3% year-on-year to Rs 5,207.53 crore. Provisions for loan losses for the quarter stood at Rs 177 crore.

Ratnamani Metals & Tubes: The board approved the issue of bonus shares in the ratio of 1 for 2 held. The firm also recommended a dividend of Rs 14 a share for the fiscal year 2022. For Bonus shares the record date will be on July 1, 2022.

Indian Overseas Bank (IOB): The state-owned lender has posted a 58% jump during the fourth quarter of the financial year ended in March to Rs 552 crore, as compared to the January-March quarter of FY21, on account of lower provisioning for bad loans. Net NPA during the quarter under review was contained to Rs 3,825 crore with a ratio of 2.65%, as compared to Rs 4,578 crore with a ratio of 3.58%.

IDBI Bank: The lender said it has divested its entire stake of over 19% in ARCIL to Avenue India Resurgence Pte. However, the lender did not disclose the deal value.

Ujjivan Small Finance Bank: The lender plans to increase its secured loan book to 50% of total assets over the next two-three years. As part of its asset diversification strategy, the lender has already resumed auto loans and plans to enter the gold loan space shortly.

Aditya Birla Fashion and Retail : The company reported a consolidated net profit of Rs 31.90 crore for the fourth quarter ended in March 2022, led by a revival in demand across categories. The company had posted a net loss of Rs 195.86 crore during the January-March quarter of the previous fiscal. Its revenue from operations was up 25.32 per cent to Rs 2,282.83 crore during the quarter under review as against Rs 1,821.58 crore in the corresponding period of the previous fiscal.