Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.33% higher at 15,986.5, indicating that Dalal Street was headed for a positive start on Friday.

Asian stocks were mixed as investors were concerned over rate hikes that would weigh on global economic growth. Japan’s Nikkei 225 index rose 0.58% and Topix slipped 0.02%. China’s Hang Seng fell 0.65%, while CSI 300 index rose 0.36%.

Indian rupee plunged 25 paise to 79.88 against the US dollar on Thursday.

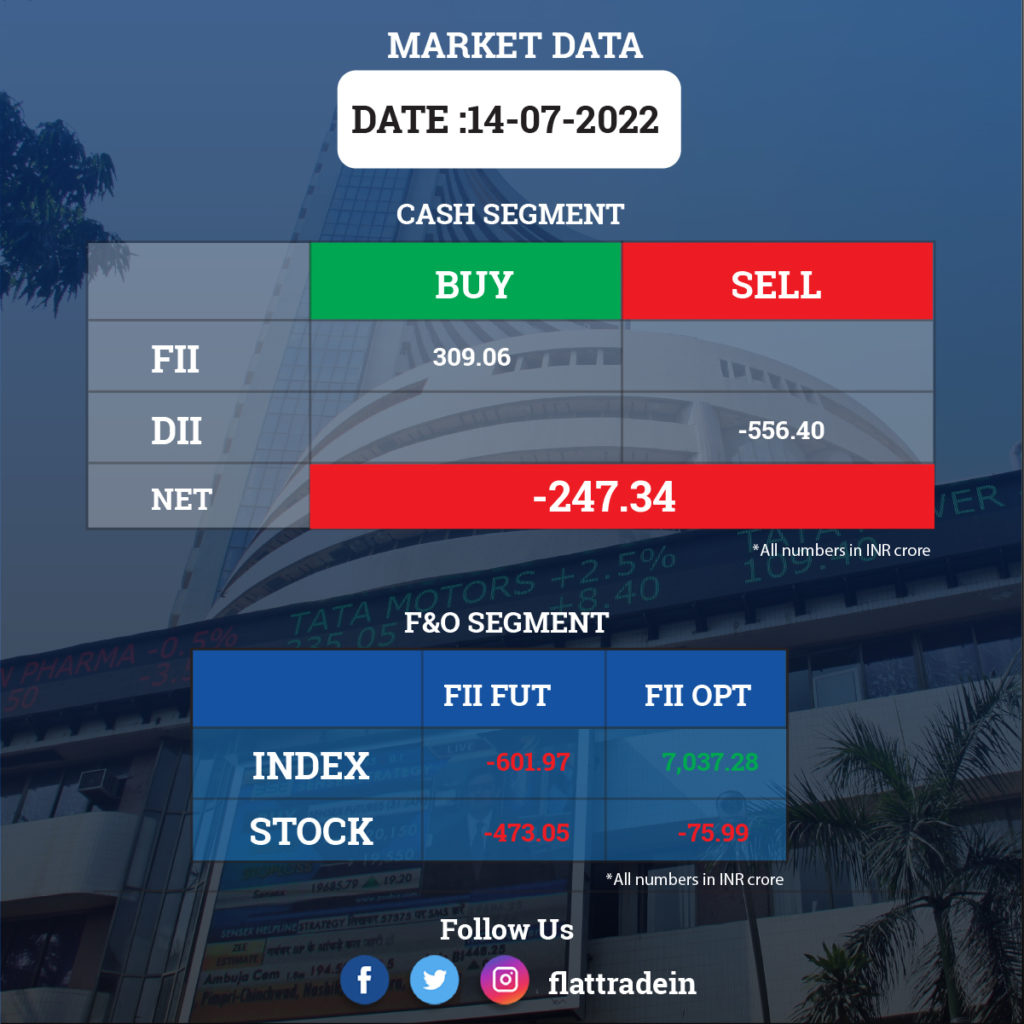

FII/DII Trading Data

Upcoming Earnings

L&T Technology Services, Jindal Steel and Power, Federal Bank, Aditya Birla Money, Deep Diamond India, Den Networks, Integrated Capital Services, Just Dial, Kesoram Industries, Lloyds Metals and Energy, Oberoi Realty, and Opto Circuits (India) will report quarterly earning today.

Stocks in News Today

Adani Ports and SEZ: Israel said that it will sell Haifa Port, a major trade hub on its Mediterranean coast, to winning bidders Adani Ports and local chemicals and logistics group Gadot for $1.18 billion, Reuters reported. Adani will have a majority 70% stake and Gadot will hold the remaining 30%, according to an industry official.

ACC: The cement maker reported a 60 per cent year-on-year decline in consolidated profit after tax (PAT) to Rs 227 crore for the quarter ended June 30, 2022. In the corresponding period last year, consolidated PAT stood at Rs 569 crore. Consolidated revenue for the quarter grew 15% year-on-year to Rs 4,468 crore, up from Rs 3,885 crore in the year-ago period. The decline was attributed to higher prices of power and pet coke as well as moderation in demand.

Larsen and Toubro Infotech (LTI): The IT company on Thursday posted a 28% increase in consolidated net profit at Rs 633.5 crore in the first quarter ended June 30, 2022. It had registered a profit of Rs 496.3 crore in the same period a year ago, the company said in a regulatory filing. The consolidated income from operations increased by 30.62% to Rs 4,522.8 crore during the reported quarter from Rs 3,462.5 crore in the June quarter last year.

State Bank of India(SBI): The lender has hiked its marginal cost of funds-based lending rate (MCLR) by 10 basis points (bps), effective July 15. The overnight, one-month, and three-month MCLR now stand at 7.15%. The six-month MCLR is at 7.45%, one-year MCLR is at 7.5%, two-year MCLR is at 7.7%, and three-year MCLR is at 7.8%.

Tata Elxsi: The company clocked 63% YoY growth in profit to Rs 184.7 crore Q1FY23 due to strong operating profit and topline growth. Revenues from operations grew 30% YoY to Rs 725.9 crore and EBITDA was up 58.8% YoY to 238.2 crore in Q1FY23.

Life Insurance Corporation of India (LIC): The company reported the Indian Embedded Value (IEV) at Rs 5.41 trillion as of March 31, 2022, as compared to Rs 95,605 crore as of March 31, 2021. The Embedded Value (EV) is a measure of the consolidated value of shareholders’ interest in the life insurance business.

Glenmark Pharmaceuticals: The company’s nitric oxide nasal spray (reduces the viral load of Sars-CoV-2 in high-risk adult Covid-19 patients by 94 per cent within 24 hours and 99 per cent in 48 hours, according to the results of phase 3 trial of the drug published in The Lancet Regional Health Southeast Asia journal.

Eureka Forbes: Construction major Shapoorji Pallonji and Company has exited from Eureka Forbes after selling its remaining 8.7% stake to the new owner Lunolux, a firm backed by private equity firm Advent International. Lunolux acquired 1.68 crore equity shares of Eureka Forbes constituting 8.7% of the equity share capital of Eureka Forbes from Shapoorji Pallonji and Company on July 12, 2022.

Dabur India: The FMCG major owned four brands which had a turnover of Rs 1,000 crore and above, according to the company’s annual report. Its two brands — Dabur Honey and Dabur Chyawanprash – have over Rs 500 crore in sales. The company said it had 12 brands above Rs 100 crore in size, two brands over Rs 500 crore in size and another four brands that have a turnover above Rs 1,000 crore.

Syngene International: The company signed a 10- year agreement with leading animal health company, Zoetis, to manufacture the drug substance for Librela (bedinvetmab), a monoclonal antibody used for treating osteoarthritis in dogs.

Torrent Power: The company has bagged a 300 MW wind energy project worth Rs 2,600 crore in Karnataka from Solar Energy Corporation of India (SECI), according to a regulatory filing. The estimated date of commissioning the project is 24 months from the date of execution of the PPA and the term of the PPA is 25 years from the scheduled commercial operation date at a tariff of 2.94 per kWh.

Marico: The FMCG firm expects demand and margin trends to improve towards second half of FY23 on likely easing of crude and edible oil prices in next few months, according to its latest annual report.

Cipla: The company’s subsidiary Cipla Health has inked pacts for acquisition of Endura Mass – a nutritional supplement brand in the weight gain category of Medinnbelle Herbalcare. Endura and all other associated trademarks would be a part of the acquisition.

Angel One: The brokerage firm reported 46.5% YoY growth in consolidated profit to Rs 181.50 crore Q1FY23. Meanwhile, revenue grew 45% YoY to Rs 669.8 crore in Q1FY23 on the back of healthy growth in fees and commission income as well as interest income.