Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.66% higher at 17,870, signalling that Dalal Street was headed for a positive start on Wednesday.

Asian shares were mixed as slowdown in US wages raised hopes of a slower interest rate hike. The Nikkei 225 index rose 0.18% and the Topix was up 0.17%. The Hang Seng was down 0.56% and the CSI 300 index fell 0.43%.

Indian rupee fell 42 paise to 81.92 against the US dollar on Tuesday.

India collected Rs 1.56 lakh crore as Goods and Services Tax (GST) in January, the finance ministry said on January 31. At Rs 1.56 lakh crore, the GST collections for January are second only to the record Rs 1.68 lakh crore collected in April 2022. It is up 10.6 percent from the first month of 2022 and 4.3 percent higher from December 2022.

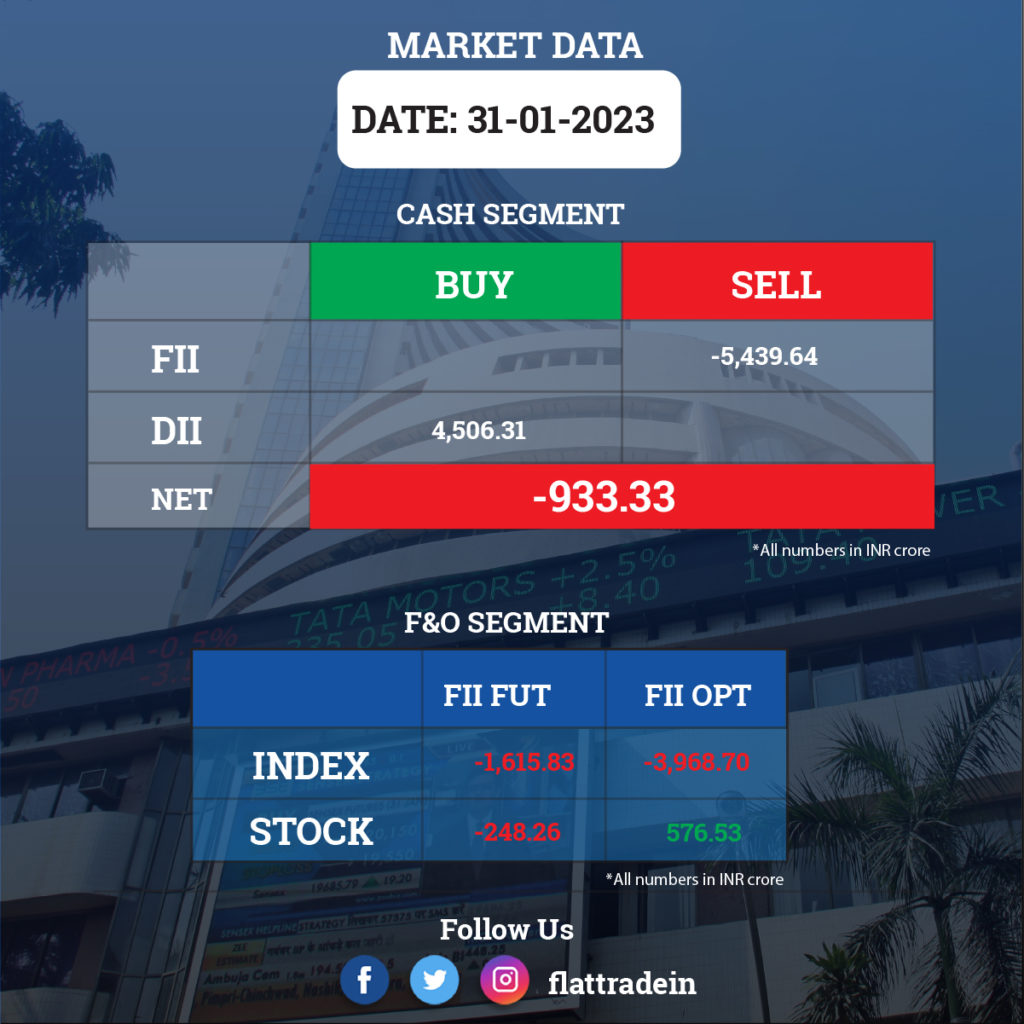

FII/DII Trading Data

Upcoming Results

Britannia Industries, Ashok Leyland, Tata Chemicals, UTI Asset Management Company, Ajanta Pharma, Alembic Pharmaceuticals, Gillette India, IDFC, Jubilant FoodWorks, Kaya, Mahindra Logistics, Ramco Systems, Raymond, Redington, RPG Life Sciences, Sundram Fasteners, Timken India, Whirlpool of India, and Zuari Agro Chemicals will report their quarterly earnings today.

Stocks in News Today

Coal India: The coal mining company registered a consolidated net profit of Rs 7,719 crore for the three months ended December 2022. The profit was up 69% compared with Rs 4,556 crore posted in the year-ago period. Its consolidated revenue grew by 24% YoY to Rs 35,169 crore for the quarter under review. The realisation per tonne of coal was Rs 5,046 under the auction segment, in Q3FY23 against Rs 1,947 per tonne for the comparable quarter in FY22. The jump was Rs 3,099 per tonne or 159%.

Indian Hotels Company (IHCL): The company reported a profit of Rs 404 crore for quarter three of this fiscal year, up by 321% YoY. The hospitality chain reported revenue from operations of Rs 1,686 crore, an increase of 52% YoY. The company said EBITDA was up 90% YoY to Rs 655 crore. It had achieved a free cash flow of Rs 766 crore for nine months ended December 31. The company said the demand outlook for the sector in 2023 remains robust on the back of sporting events, global events like the ongoing G20, and recovery of inbound and corporate travel.

Power Grid Corporation of India: The state-owned company reported a 10.5% YoY rise in standalone net profit to Rs 3,701.72 crore. Revenue from operations grew 7.4% on-year to Rs 10,746.40 crore. The board has declared an interim dividend of Rs 5 per share for the current financial year. Earnings before interest, taxes, depreciation and amortization (EBITDA) rose nearly 8% on-year to Rs 9,380 crore, and operating margin improved 40 basis points to 87.28%.

UPL: The company reported 16% year-on-year (YoY) rise in consolidated net profit for the quarter ended December 2022 at Rs 1,087 crore. Revenue from operations increased 21% on-year to Rs 13,679 crore. Growth in revenue continued to be led by marginal increase in volumes, higher realizations, and favourable exchange rate. Realisations increased 13% on-year, while volumes grew a marginal 1%. The company saw continued growth momentum in the crop protection business in the quarter, along with robust growth in Advanta Seeds at 31% YoY. EBITDA rose 14% YoY to Rs 3,035 crore, but operating margin contracted 141 basis points to 22.2%.

Blue Star: The company reported a 22.79% rise in consolidated net profit at Rs 58.41 crore in the third quarter ended December 2022. The company had posted a consolidated net profit of Rs 47.57 crore in the same quarter last fiscal, it said in a regulatory filing. Consolidated revenue from operations during the quarter under review stood at Rs 1,788.2 crore as against Rs 1,506.22 crore in the year-ago period, it added. Total expenses in the reported quarter were higher at Rs 1,712.96 crore as compared to Rs 1,449.64 crore in the corresponding period last fiscal.

Great Eastern Shipping: The company reported a 205% year-on-year growth in consolidated profit at Rs 627.2 crore for the quarter ended December FY23 led by healthy topline and operating performance. Revenue from operations at Rs 1,421 crore increased by 51.4% compared to the year-ago period.

Procter & Gamble Hygiene & Health Care: The FMCG company recorded a 2.2% year-on-year decline in profit at Rs 207.5 crore for the quarter ended December FY23 hit by weak operating margin and muted topline growth. Revenue grew by 4% to Rs 1,137.4 crore compared to the year-ago period. At the operating level, EBITDA declined 2% YoY to Rs 290.5 crore and the margin dropped 158 bps YoY to 25.54% for the quarter. The company declared an interim dividend of Rs 80 per share.

RailTel Corporation of India: The company recorded a 52% year-on-year decline in consolidated profit at Rs 31.95 crore for the quarter ended December FY23 on a high base. The year-ago period included higher other income, which fell from Rs 56.46 crore in Q3FY22 to Rs 7.85 crore in Q3FY23. Revenue from operations grew by 9% YoY to Rs 454.32 crore for the quarter.

Cholamandalam Investment and Finance Company: The NBFC recorded 31% year-on-year growth in profit at Rs 684 crore for December FY23 quarter. Net income jumped 22% YoY to Rs 1,832 crore, with disbursements rising 68% to Rs 17,559 crore for the quarter. Total AUM stood at Rs 1.03 lakh crore, up 31% YoY. Despite high inflation and high interest rates, strong festive season sales and workforce returning to metro cities have helped drive growth.

Sterlite Technologies: The company has signed an agreement to sell its telecom product software business through a slump sale as a going concern to Skyvera through its Indian subsidiary. The company will receive $15 million from the sale of the telecom product software business. Skyvera LLC is an affiliate of TelcoDR, which is a US-headquartered global acquirer of telecommunication software businesses.