Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% lower at 18,813, signalling that Dalal Street was headed for flat-to-negative start on Thursday.

Asian stocks rose on Thursday after the Federal Reserve paused monetary tightening, while China’s central bank lowered its key medium-term lending rates to boost the country’s economy. The Nikkei 225 index rose 0.34% and the Topix gained 0.45%. The Hang Seng jumped 0.68% and the CSI 300 index advanced 0.64%.

Indian rupee appreciated significantly by 29 paise to close at 82.10 against the US dollar on Wednesday.

The US Federal Reserve kept key interest rates unchanged at 5-5.25%, but indicated that there will be two small interest rate hikes by end of 2023.

Meanwhile, the China’s central bank lowered the rate on 237 billion Chinese yuan ($33 billion) of one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points i.e. from 2.75% to 2.65%.

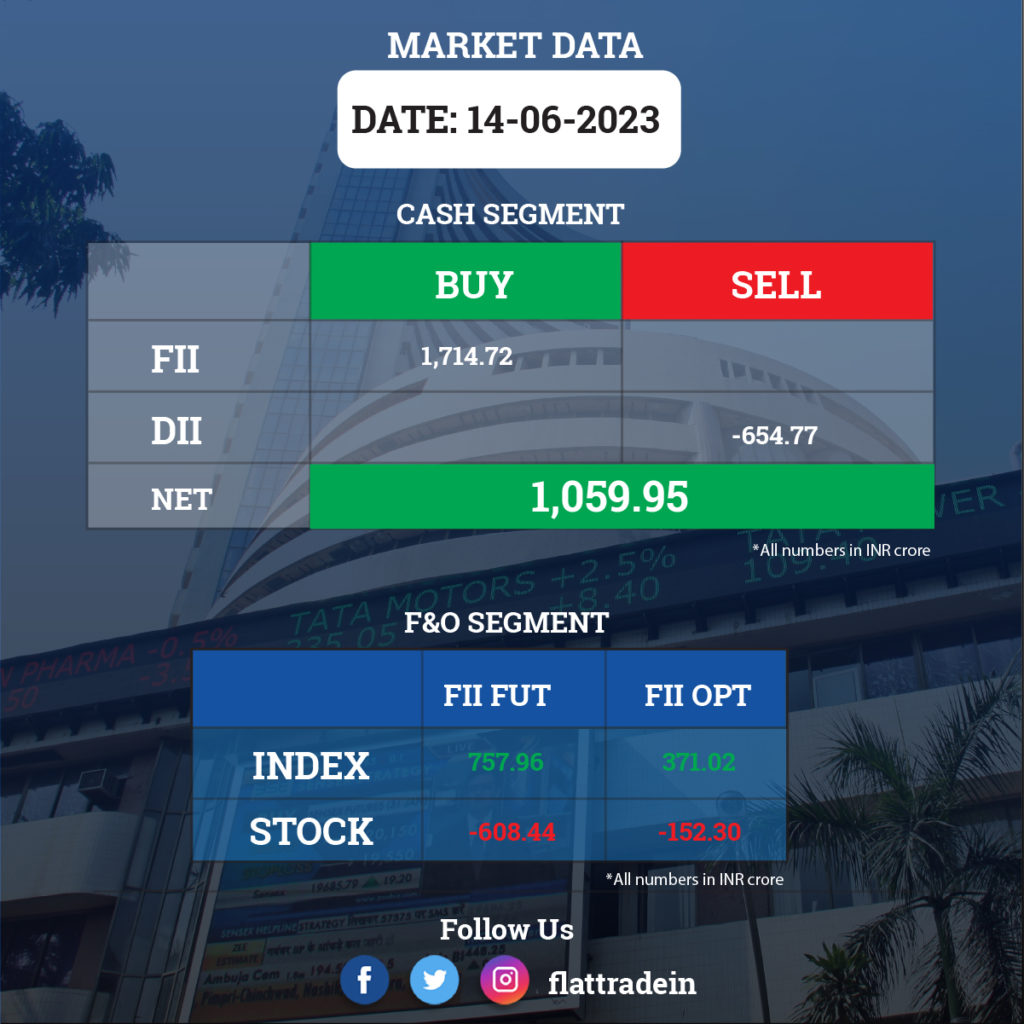

FII/DII Trading Data

Stocks in News Today

Axis Bank: Global private investment firm Bain Capital is likely to sell stake up to $267 million in the private sector lender, CNBC-TV18 reported citing sources. The offer price is likely to be in the range of Rs 964-977.70 per share.

HCLTech: The IT services company and Google Cloud expanded their partnership to help enterprises leverage generative artificial intelligence (AI) and develop joint solutions powered by Google Cloud’s generative AI technologies. HCLTech’s AI platforms and solutions will utilize Google Cloud’s full suite of enterprise generative AI products and services.

Central Depository Services (CDSL): The BSE (Bombay Stock Exchange) has sold 47.44 lakh equity shares or 4.5% stake in the central securities depository via open market transactions at an average price of Rs 985.98 per share, amounting to Rs 467.74 crore. BSE held a 20% stake in CDSL as of March 2023. However, ICICI Prudential Technology Fund was the buyer for some of those shares, acquiring 5.28 lakh shares in CDSL at an average price of Rs 985 per share.

SJVN: The company has signed a memorandum of understanding with Maharashtra State Power Generation Company to develop 5,000 MW renewable energy projects in the state. The partnership will explore the feasibility of establishing various renewable projects including hydro, pumped storage, wind, solar, hybrid and green hydrogen projects.

Dilip Buildcon: The company has received completion certificate for rehabilitation and upgradation work of Chandikhole-Bhadrak section of NH-5 in Odisha on Hybrid Annuity mode. The project cost was Rs 1,522 crore. DBL Chandikhole Bhadrak Highways Ltd. is now a subsidiary of the company.

AAVAS Financiers: Smallcap World Fund Inc has sold 12.84 lakh equity shares or 1.6% stake in the Jaipur-based housing finance company via open market transactions at an average price of Rs 1,349.94 per share, which amounted to Rs 173.43 crore.

Welspun India: France-based Societe Generale has acquired 50 lakh shares or 0.5% stake in the textile business company at an average price of Rs 93.5 per share. However, foreign portfolio investor Infinity Holdings sold 94.88 lakh shares or 0.96% stake in the firm at an average price of Rs 93.61 per share.

Reliance Industries: The company and Panorama Studios have entered into an agreement through its media and entertainment division Jio Studios for producing a movie.

PTC India Financial Services: The company has named Mahendra Lodha as director (finance) and the chief financial officer of the company with effect from June. 14. Lodha will replace current Chief Financial Officer Sanjay Rustagi.

IndiaMART InterMESH: The company has approved the re-appointment of Dhruv Prakash as director liable to retire by rotation.

Reliance Communications: The delegate of the Australian Securities and Investments Commission notified regarding the deregistration of Reliance Communications (Australia) PTY Ltd. with effect from June 4.

DCW: The company will produce lower Soda Ash by an estimate of 6 KMT in first quarter of fiscal 2023-2024 due to unforeseen mechanical breakdown of carbon dioxide gas compressor in its Soda Ash Plant.

Persistent Systems: The company further strengthened its strategic relationship with Zscaler and achieved Zenith partnership tier to assist in strengthening and modernising security.

Tega Industries: The National Company Law Tribunal (NCLT) has given its approval for the Composite Scheme of Arrangement between Nihal Fiscal Services (NFSPL), promoter of Tega Industries, Marudhar Food & Credit (MFCL) and MM Group Holdings, which all are part of the promoter group of the company. With this approval, MFCL will merge into NFSPL, the entire shareholding of MFCL (1.96% equity) in Tega will stand transferred to NFSPL, resulting in NFSPL holding 57.05% stake in Tega.

Indian Overseas Bank: The public sector lender has increased its base rate by 20 bps to 9.10%, from 8.90% earlier. The base rate hike will be effective from June 15.