Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.36% higher at 17,702, signalling that Dalal Street was headed for a positive start on Friday.

Japanese shares were trading higher with the Nikkei 225 index rising 0.43% and the Topix gaining 0.21%. Meanwhile, Chinese shares were trading lower with the Hang Seng falling 1.78% and the CSI 300 index declining 1.48%.

Indian rupee fell 25 paise to 82.17 against the US dollar on Thursday.

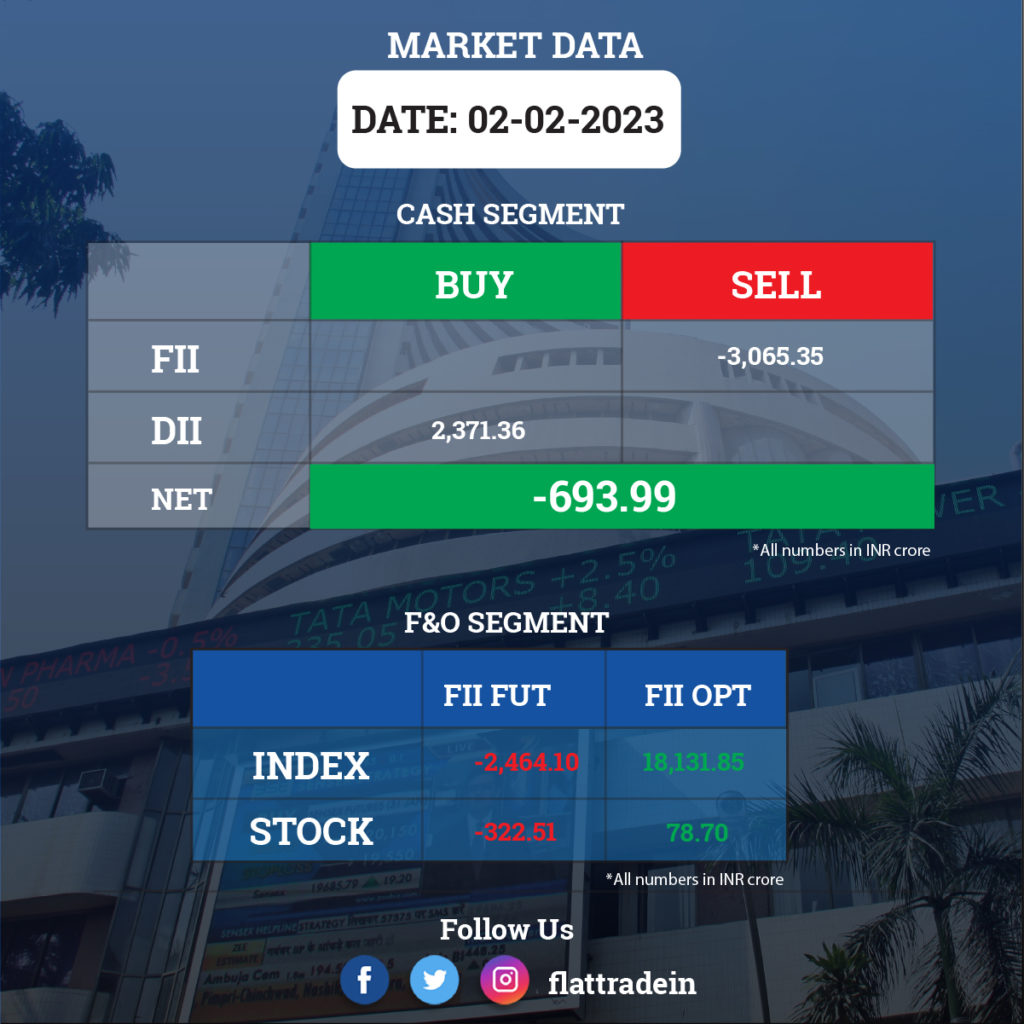

FII/DII Trading Data

Upcoming Results

ITC, State Bank of India, Bank of Baroda, Tata Power, InterGlobe Aviation, One 97 Communications (Paytm), Marico, Mahindra & Mahindra Financial Services, Zydus Lifesciences, Divi’s Labs, Manappuram Finance, Aarti Industries, Borosil, Clariant Chemicals, Elgi Equipments, Emami, Engineers India, India Cements, Intellect Design Arena, JK Tyre & Industries, Jubilant Pharmova, Kansai Nerolac Paints, Nava, Praj Industries, Quess Corp, Shipping Corporation of India, Sun TV Network, and Tube Investments of India will report their quarterly results on February 3.

Stocks in News Today

Titan Ltd: The company said its profit fell 4% to Rs 951 crore for the three months ended December. It was Rs 987 crore in the corresponding quarter of last year. Sales during the reported quarter rose 11% to Rs 10,444 crore, compared with Rs 9,381 crore in the same quarter last year. In the jewellery business, total income saw 11% growth at Rs 9,518 crore. The India business, meanwhile, rose 9% in the same period, backed by healthy consumer demand during the festive season. EBIT for the segment came in at Rs 1,236 crore, with 13% EBIT margin. A total of 22 stores (excluding Caratlane) were added during the quarter, taking the total jewellery store count to 510 spread across 247 cities.

Tata Consumer Products (TCPL): The FMCG company has recorded a 26% year-on-year growth in consolidated profit at Rs 364.4 crore for quarter ended December FY23 despite weak operating margin, led by tax write-back, exceptional income and higher other income. Revenue for the quarter grew by 8.3% YoY to Rs 3,475 crore. However, EBITDA fell 1.7% to Rs 454 crore and margin declined by 130 bps to 13.1 percent for the quarter. Its Indian market business rose 7.72% to Rs 2,165.34 crore as against Rs 2,010.04 crore in the year-ago period. Its international business contributed a revenue of Rs 929.93 crore, up 3.71% from Rs 896.62 crore earlier.

HDFC Asset Management Company: The Sebi has given an approval and permitted abrdn Investment Management to reduce its shareholding in HDFC AMC to less than 10 percent. In December 2022, HDFC AMC had received letter from abrdn Investment Management, one of the promoters holding 10.21% in the company, intending to sell their entire stake in the company. Abrdn Investment Management is the co-sponsor of HDFC Mutual Fund.

Dabur India: The FMCG company reported a 5.4% YoY decline in its consolidated net profit at Rs 476 crore for the quarter ended December, compared to Rs 503 crore the same period last year. The company’s revenue from operations grew 3.4% to Rs 3,043 crore in the reported quarter. Input cost pressure saw consolidated operating profit decline nearly 3% YoY to Rs 610 crore, and operating margin contracted a sharp 130 basis points to 20%. Dabur’s homecare business registered 18% growth, while its ayurvedic OTC business grew a sharp 17% in Q3, and the digestives category reported 12% growth.

Adani Enterprises: The National Stock Exchange (NSE) has put Adani Enterprises, Adani Port, Ambuja Cement under additional surveillance measure (ASM) framework starting February 3 after a steep decline in most of Adani group stocks. This will mean the intraday trading will also require 100% upfront margin.

IndusInd Bank: The Hinduja Group is looking to increase its stake in IndusInd Bank to 26% from the existing 16.51 percent, reports CNBC-TV18 quoting sources. IndusInd International Holdings, promoter of IndusInd Bank, is preparing the application for the process and will further submit the same to the Reserve Bank of India (RBI), sources said.

Mazagon Dock Shipbuilders: Sanjeev Singhal, with effect from February 1, 2023, has been given additional charge of Chairman & Managing Director of Mazagon Dock Shipbuilders. Singhal joined Mazagon Dock as Director (Finance) on January 8, 2020.

Inox Green Energy Services: The wind power operation and maintenance service provider entered into a definitive investment agreement with I-Fox Windtechnik India, an independent O&M wind service provider, to acquire 51% stake in I-Fox at Rs 35,947.71 per share. I-Fox has a fleet of 230+MW majorly operating in South India. With this acquisition, company entered into multi-brand OEM wind turbine O&M business.

Likhitha Infrastructure: The company has received an order worth Rs 129.63 crore from GAIL (India). The scope of work included pipeline laying and composite works for PART-B (Nagpur Jharsuguda) of MNYJPL project. The contract has to be executed within 14 months from the date of letter of intent.

Berger Paints India: The paint company has recorded a 20.5% year-on-year growth in consolidated profit at Rs 200.94 crore for quarter ended December FY23 impacted by weak operating margin performance. Revenue for the quarter at Rs 2,694 crore grew by 5.6 percent, but EBITDA fell by 11% to Rs 350 crore compared to year-ago period.

Apollo Tyres: The tyre manufacturer has reported a 31% year-on-year growth in consolidated profit at Rs 292.1 crore for December FY23 quarter despite spike in input & finance costs. Revenue for the quarter at Rs 6,423 crore increased by 12.5% and EBITDA jumped 23% to Rs 913.4 crore with margin expansion of 120 bps compared to year-ago period. Jaimini Bhagwati is appointed as Independent Director on the board.

Man Infraconstruction: The company reported a 126.3% jump in consolidated profit at Rs 90.60 crore for the quarter ended December 2022 as against a consolidated profit of Rs 40.02 crore in the year-ago period. Its consolidated revenue from operations in the reported period increased to Rs 456.85 crore from Rs 296.52 crore in the year-ago quarter.

Coromandel International: The company reported a standalone profit after tax at Rs 539 crore up by 42% during the quarter ending December 2022. It had registered a standalone profit after tax at Rs 379 crore last year. Total income during the quarter under review surged to Rs 8,350 crore as against Rs 5,101 crore registered last year. The revenue from the nutrient and allied business during the quarter under review was at Rs 7,710 crore as against Rs 4,483 crore registered in December 2021. Crop protection business generated revenues of Rs 651 crore as compared to Rs 623 crore registered in same period of last year. The board approved an interim dividend of Rs 6 per share.

Berger Paints India: The company reported a decline of 20.47% in its consolidated net profit at Rs 201.17 crore in the third quarter ended December 2022. The company had posted a net profit of Rs 252.97 crore in the October-December period a year ago. Its revenue from operations was up 5.59% at Rs 2,693.59 crore during the quarter under review as against Rs 2,550.77 crore in the year-ago period. Berger Paints total expenses were at Rs 2,437.84 crore, up 9.39% in Q3FY23, as against Rs 2,228.56 crore a year ago.

Deepak Fertilisers and Petrochemicals Corporation (DFPCL): The company reported a 39.67% growth in consolidated profit after tax at Rs 252.26 crore during the quarter ended December 2022. The company’s PAT (profit after tax) stood at Rs 180.61 crore during the corresponding quarter of the previous financial year, DFCL said in a regulatory filing. Revenue from operations of the company witnessed a growth of 40.85% during the quarter under review at Rs 2,754.76 crore compared to Rs 1,955.70 crore in the same period of 2021-22.

Godrej Properties: The realty firm reported a 51% increase in its consolidated net profit to Rs 58.74 crore for the third quarter ended December 2022. Its net profit stood at Rs 39.02 crore in the year-ago period. The total income declined to Rs 404.58 crore in the third quarter of this fiscal from Rs 466.91 crore in the corresponding period of the previous year, according to a regulatory filing. Godrej Properties has posted a net profit of Rs 159.25 crore during the April-December period of this fiscal from Rs 91.90 crore in the year-ago period. Its total income rose to Rs 1,200.18 crore in the first nine months of this fiscal from Rs 1,063.12 crore a year ago.

Sundram Fasteners: The company reported a 7.3% rise in net profit for the third quarter of the fiscal at Rs 118.07 crore, compared to Rs 110 crore in the same period the previous year. The company’s consolidated revenue from operations for the quarter ended December 31 was at Rs 1,403.03 crore, a 16.2% rise compared to Rs 1,207.53 crore in the same period the previous year. Consolidated earnings per share (EPS) for the quarter amounted to Rs 5.57 as against Rs. 5.15 in the same period last year.

Mahindra Lifespace Developers: The realty firm reported a 33% increase in its consolidated net profit at Rs 33.21 crore for the quarter ended December. Its net profit stood at Rs 25.02 crore in the year-ago period. Total income rose sharply to Rs 198.14 crore in the third quarter of the current financial year from Rs 33.32 crore a year ago, according to a regulatory filing.

Fino Payments Bank: The financial services firm posted a 35.5% jump in its December quarter net profit at Rs 19.1 crore, aided by widening profit margins. The payments bank said its revenues grew 14.2 per cent to Rs 314.1 crore during the reporting quarter. The operating cost grew by just 2.5 per cent to Rs 61.9 crore, resulting in the widening of the operating profit margin to 12.4 per cent as against 9.4 per cent in the year-ago period.

Parag Milk Foods: The dairy firm increased the price of the Gowardhan brand of cow milk by Rs 2 per litre with effect from February 2 due to a rise in the cost of operations and milk production. With the hike in prices, Gowardhan Gold milk will now cost Rs 56, up from Rs 54 per litre, the company said in a statement. During the course of a year, the dairy company increased milk prices by nearly 17 per cent.

Thomas Cook: The company’s consolidated income from operations grew by 105 per cent year-on-year (YoY) in Q3FY23 to Rs 1,536.3 crore, and operational profit before tax was at Rs 58.4 crore as against loss of Rs 28.9 crore, reflecting strong recovery and business momentum across segments. Its net profit came in at Rs 26.54 crore vs loss of Rs 24.59 crore YoY.

Karnataka Bank: The private sector lender on Thursday reported a net profit of Rs 301 crore forQ3FY23, registering a solid growth of 105 per cent. The Gross NPs declined to 3.28 per cent from 3.36 per cent as compared to the sequential previous quarter. The Net NPA, meanwhile, declined to 1.6 per cent from 1.72 per cent QoQ.

Inox Green Energy Services: The company has entered into a definitive investment agreement with I-Fox Windtechnik India Private Limited, an independent O&M Wind Service Provider, to acquire a majority stake. The deal is valued at Rs 3,5947.71 per share.

Aavas Financiers: The lender has reported net profit of Rs 303.5 crore in Q3FY23, up 26 per cent YoY. The management said Sushil Kumar Agarwal will continue as the managing director (MD), while Sachinder Pal Singh has beeen appointed as the chief executive office (CEO).

Engineers India: EIL has been awarded an assignment from Ministry of Housing and Urban Affairs (MoHUA) for ‘providing Transaction Advisory Services for setting up large scale Bio‐Methanation and Waste to Energy projects in selected million plus cities’.

IndusInd Bank: The Hinduja Group is looking to increase its stake in IndusInd Bank to 26% from the existing 16.51%, reports CNBC-TV18 quoting sources. IndusInd International Holdings, promoter of IndusInd Bank, is preparing the application for the process and will further submit the same to the Reserve Bank of India (RBI), sources said.

Likhitha Infrastructure: The company has received an order worth Rs 129.63 crore from GAIL (India). The scope of work included pipeline laying and composite works for PART-B (Nagpur Jharsuguda) of MNYJPL project. The contract has to be executed within 14 months from the date of letter of intent.

Apollo Tyres: The tyre manufacturer has reported a 31% year-on-year growth in consolidated profit at Rs 292.1 crore for December FY23 quarter despite spike in input & finance costs. Revenue for the quarter at Rs 6,423 crore increased by 12.5% and EBITDA jumped 23% to Rs 913.4 crore with margin expansion of 120 bps compared to year-ago period. Jaimini Bhagwati is appointed as Independent Director on the board.

Eclerx Services: The IT services management company has recorded a 23.2% year-on-year growth in consolidated profit at Rs 131.3 crore for quarter ended December FY23 despite fall in operating profit margin that hit by higher employee expenses, led by other income and topline. Revenue for the quarter grew by 23% YoY to Rs 687 crore compared to year-ago period.

GMM Pfaudler: The technologies, systems and services provider has reported a 41.3% year-on-year decline in profit at Rs 18.67 crore for quarter ended December FY23 hit by negative other income and exceptional loss. Revenue for the quarter at Rs 792.3 crore grew by 23.4% and EBITDA surged 44% to Rs 118.4 crore compared to year-ago period with margin expansion of around 2 percentage points.

Bajaj Electricals: The company reported a near 27% surge in third-quarter profit, helped by higher demand for consumer goods such as room heaters and lighting products that helped cushion a hit from rising expenses. Consolidated net profit rose to Rs 61.12 crore for the three months ended December 2022, compared to Rs 48.21 crore a year earlier. Revenue from its consumer products business, which includes room heaters, air cooler and kitchen appliances and accounts for nearly 70% of total sales, rose about 10% to Rs 1039 crore.

Dr Lal PathLabs: the company said its consolidated profit after tax declined 7% to Rs 54 crore for the December 2022 quarter. The company had reported a net profit of Rs 58 crore in the same quarter of the previous fiscal. Revenue also declined to Rs 489 crore for the period under review as compared with Rs 497 crore in the year-ago period, the company said in a regulatory filing. “We continue to focus on geographical expansion and strengthen our presence in Tier 2, Tier 3 towns. Our focus continues to take a higher market share in West and South markets by leveraging technology and promoting high-end super specialty test portfolios,” Dr Lal PathLabs Managing Director Om Manchanda said.

Kalpataru Power Transmission: The company and its international subsidiaries have bagged new orders worth Rs 2,456 crore. These orders include residential and commercial buildings construction projects in the country worth Rs 1,427 crore and T&D (Transmission and distribution) business orders worth Rs 498 crore in India and overseas markets, a company statement said. In the domestic market, the firm bagged railway projects worth Rs 299 crore and Oil & Gas pipeline projects worth 232 crore.

Max Healthcare Institute: The company reported a 7% increase in its consolidated profit after tax at Rs 269 crore for the December 2022 quarter. The healthcare provider had posted a profit after tax of Rs 252 crore in the corresponding period of last fiscal. Its network gross revenue increased to Rs 1,559 crore, registering a 13% year-on-year growth, Max Healthcare said in a statement.

Aditya Birla Capital (ABCL): The financial services company on Thursday said its consolidated net profit increased 27% year-on-year (YoY) basis to Rs 530 crore for the quarter ended December 2022. The company made a consolidated net profit of Rs 416 crore in the same quarter a year ago (Q3 FY22). Consolidated revenue grew 31% YoY to Rs 7,699 crore. Strong momentum across businesses led to a 40 per cent YoY growth in the overall lending book (non-banking finance company and housing finance company) to Rs 85,869 crore as on December 31,2022.