Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.17% higher at 18,342, signalling that Dalal Street was headed for positive start on Wednesday.

Asian stocks fell on Wednesday as investors awaited the critical US inflation report and the deadlock over raising US debt ceiling dampened sentiments. The Nikkei 225 index fell 0.44%, the Topix dropped 0.51%. The Hang Seng declined 0.6% and the CSI 300 index was down 0.83%.

Indian rupee fell 24 paise to 82.04 against the US dollar on Tuesday.

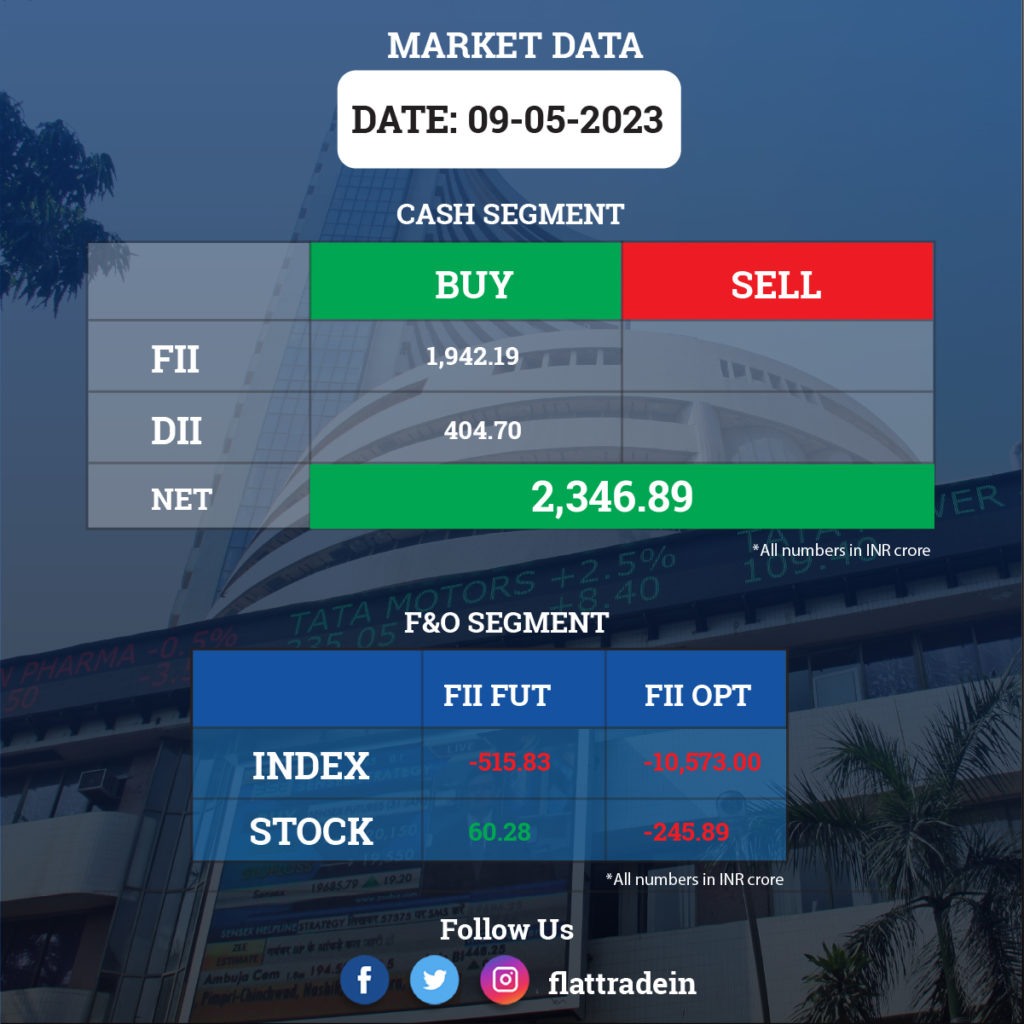

FII/DII Trading Data

Upcoming Results

Larsen & Toubro, Dr Reddy’s Laboratories, Bosch, Escorts Kubota, Godrej Consumer Products, BASF India, Cera Sanitaryware, Chambal Breweries & Distilleries, Gujarat Gas, HG Infra Engineering, JBM Auto, Novartis India, Orchid Pharma, Procter & Gamble Hygiene & Health Care, Pricol, Relaxo Footwears, Sanofi India, and Venky’s India will report quarterly earnings on May 10.

Stocks in News Today

Apollo Tyres: The tyre manufacturer has registered a 277% year-on-year growth in consolidated profit at Rs 427.4 crore for the quarter ended March FY23, supported by strong operating numbers. Revenue from operations at Rs 6,247.33 crore increased by 12% over a corresponding period of the last fiscal. Ebitda rose 59.4% YoY to Rs 998.45 crore in the quarter under review. The board recommended a final dividend of Rs 4 per share and special dividend of Rs 0.50 per share, aggregating to Rs 4.50 per share and a total outgo of Rs 285.80 crore. It also approved fixation of tenure of Onkar Kanwar as chairman for five years, effective from Feb. 1, 2023 to Jan. 31, 2028. It also approved the reappointment of Neeraj Kanwar as managing director and Satish Sharma as whole-time director for five years from April 1, 2024 to March 31, 2029.

Nazara Technologies: The diversified gaming and sports media platform has recorded a massive 92% year-on-year growth in consolidated net profit at Rs 9.4 crore, driven by healthy topline and operating numbers. Revenue for the quarter grew by 65% to Rs 289.3 crore compared to year-ago period. Ebitda increased by 86% YoY to Rs 27.7 crore in the same period. The company will invest Rs 15 crore in subsidiary Next Wave Multimedia by acquiring 19.5% stake from promoters.

Lupin: The drugmaker said its revenue rose 14.09% YoY to Rs 4,430.08 crore in Q4FY323. Consolidated net profit stood at Rs 235.96 crore in Q4FY23 as against a net loss of Rs 517.98 crore in the year-ago period. Ebitda was up 165.38% at Rs 604.05 crore in the reported quarter. The company announced a dividend of Rs 4 per share.

Nuvoco Vistas Corporation: The cement manufacturer said its consolidated revenue fell 0.06% YoY to Rs 2,928.5 crore in Q4FY23. Ebitda fell 11.48% YoY to Rs 380.44 crore in Q4FY23. Consolidated net profit surged multi-fold timed to Rs 201.06 crore in Q4FY23.

Birla Corporation: The company’s revenue rose 8.76% YoY to Rs 2,462.57 crore in Q4FY23. Ebitda fell 0.86% to Rs 274.33 crore in Q4FY23. Consolidated net profit was down 23.52% YoY to Rs 84.95 crore in Q4FY23. The board recommended a dividend of Rs 2.50 per share for the fiscal ended March 2023 and it also approved raising Rs 200 crore via non-convertible debentures on private placement basis.

Raymond: The company has received board approval for the issuance of non-convertible debentures of up to Rs 2,200 crore in two or more tranches on a private placement basis to associate Raymond Consumer Care, for repayment of external debt.

SRF: The chemicals company has increased its capex to set up an aluminium foil manufacturing facility to Rs 530 crore from Rs 425 crore earlier. In March 2023, the company incorporated a wholly-owned subsidiary for setting up the said manufacturing facility. The increase in capex is due to changes being made to the machine configuration to enhance output, product portfolio, and quality along with some increase in civil and preoperative expenses.

Castrol India: The automotive and industrial lubricant manufacturing company has registered an 11.3% year-on-year decline in profit at Rs 202.5 crore for the quarter ended March FY23, dented by disappointing operating numbers. Revenue from operations at Rs 1,293.9 crore increased by 4.7% compared to the corresponding period last fiscal.

Latent View Analytics: The analytics consulting firm has reported a 4% year-on-year decline in profit at Rs 34.2 crore in March FY23 quarter, impacted by disappointing operating numbers. Revenue from operations jumped 20% YoY to Rs 141 crore in Q4FY23.

IRB Infrastructure Developers: The company reported 18.76% year-on-year increase in toll collection during April 2023 at Rs 388.42 crore. Toll collection by wholly owned subsidiaries increased 16.5% year-on-year to Rs 194.52 crore, while its joint ventures entities under IRB Infrastructure Trust grew 4.3% to Rs 193.90 crore.

Life Insurance Corporation of India: The insurance major increased its shareholding in Hindustan Petroleum Corporation to 5.013% from 4.901%.

Greaves Cotton: The engineering company has completed the first stage acquisition of 60% shareholding in Excel Controlinkage.

Godrej Agrovet: The consolidated revenue was up 0.68% YoY at Rs 2,094.99 crore in Q4FY23. Ebitda fell 55.91% YoY to Rs 74.62 crore in Q4FY23. Consolidated net profit was down 74.63% YoY to Rs 31.02 crore in Q4FY23. The company declared a final dividend of Rs 9.50 crore for the fiscal 2023.

Castrol India: The company’s consolidated revenue was up 4.71% YoY at Rs 1,293.89 crore inQ4FY23. Ebitda fell 6.99% YoY to Rs 295.03 crore in Q4FY23. Consolidated net profit declined 11.34% YoY to Rs 202.5 crore in Q4FY23.

Eveready Industries: The company’s consolidated revenue was up 18.63% YoY at Rs 286.17 crore in Q4FY23. Ebitda profit stood at Rs 1.03 crore in the reported quarter as against an Ebitda loss of Rs 35.64 crore in the year-ago period. Its consolidated net loss narrowed 62.53% YoY to Rs 14.39 crore in the quarter under review.