Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.32% higher at 18,759, signalling that Dalal Street was headed for positive start on Tuesday.

Most Asian shares were trading higher after People’s Bank of China cut a short-term policy interest rate to help support the country’s economy. The Nikkei 225 index surged 1.58% and the Topix rose 1.11%. The Hang Seng slipped 0.3% and the CSI 300 index edged up 0.03%.

Indian rupee strengthened by 4 paise to 82.43 against the US dollar on Monday.

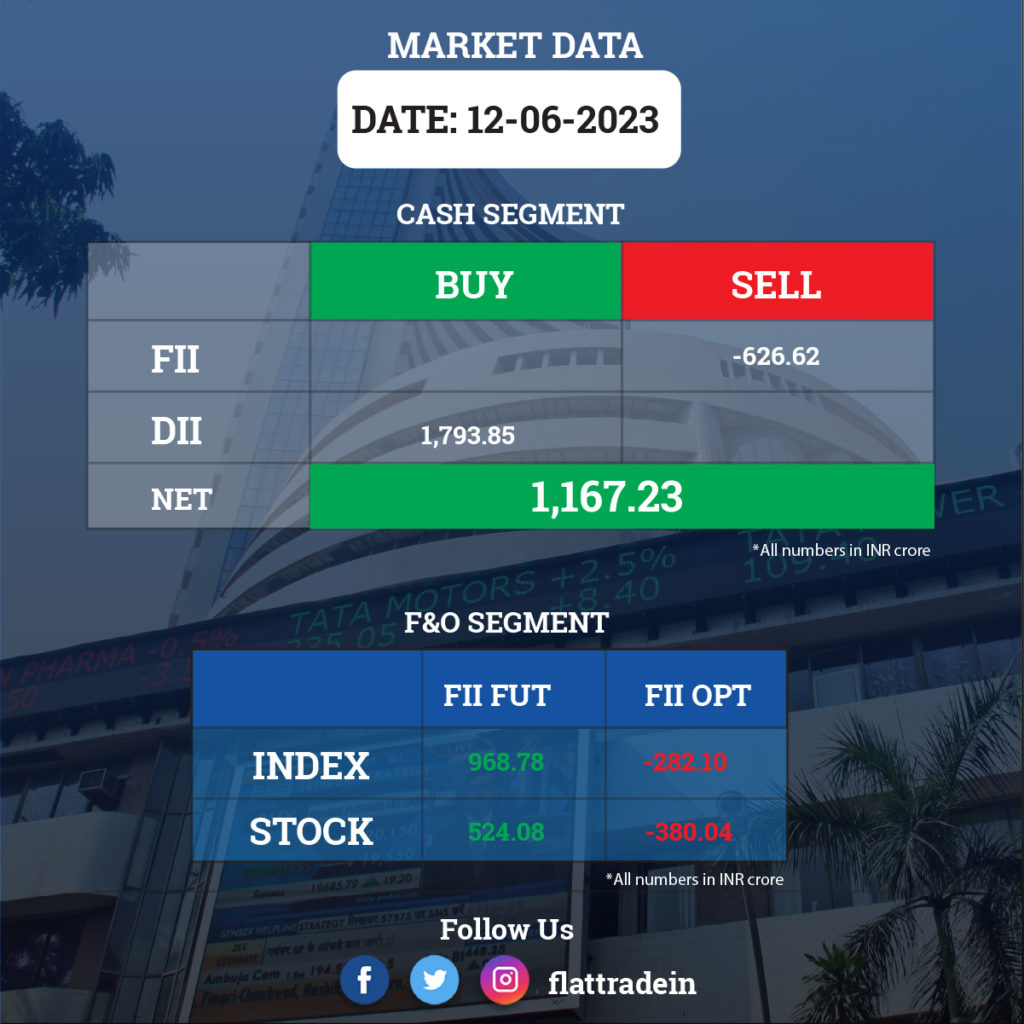

FII/DII Trading Data

Stocks in News Today

Tejas Networks: The wireline and wireless networking products maker has deployed its TJ1400 family of carrier-class Fiber-to-the-x (FTTx) and packet switching network (PTN) solutions to deliver high-speed fibre connectivity services to businesses across the country for Tata Tele Business Services (TTBS).

Greaves Cotton: Greaves Electric Mobility, the electric vehicle business arm of Greaves Cotton, has entered into an agreement with Bike Bazaar Finance. Under the agreement, Bike Bazaar Finance will finance Greaves Electric Mobility’s ELE-branded L3 electric vehicles. This partnership will initially take effect in UP and Bihar, with plans to expand nationwide in the near future.

HFCL: The digital network solutions provider has bagged an order worth Rs 80.92 crore from Delhi Metro Rail Corporation (DMRC). The company will set up a fibre optics transmission system (FOTS) for three priority corridors of Phase IV of Delhi Metro Rail Project. The order is expected to be executed within 156 weeks from the date of notice to proceed and thereafter, the company has to provide warranty support for 104 weeks.

HDFC Bank: The lender said that 99.7% of votes received were in favour of naming Kaizad Bharucha as a deputy managing director of the bank for a period of three years starting April 19, 2023. As many as 99.8% of votes were received in favour of appointing Bhavesh Zaveri as an executive director of the bank for a period of three years starting April 19, 2023.

Housing Development Finance Corporation: The company inked a share purchase agreement to sell the entire stake held in HDFC Ventures Trustee Company for an aggregate consideration of Rs 7.60 lakh.

Tata Motors: The company said $111.94 million in aggregate principle amount of external commercial borrowing bonds of $250 million with 5.75% senior notes for 2024 were validly tendered as of June 9.

Adani Ports and SEZ: The company has suspended vessel operations in Mundra and Tuna Port in light of an advisory issued by the Indian Metrological Department on the expected cyclone storm ‘Biparjoy’.

Star Health and Allied Insurance Company: The insurance company said 96.21% of member voted in favour of the appointment of Managing Director Shankar Roy Anand as managing director and chief executive officer of the company. While 99.33% of votes were received in favour of changing the designation of Venkatasamy Jagannathan from chief executive officer and chairman to non-executive director and chairman of the board,

Inox Wind: The wind energy solutions provider said its board members have approved the merger of Inox Wind Energy into the company. The merger is subject to various regulatory approvals and compliances. The appointed date for the amalgamation is set as July 1, 2023. As per the proposed amalgamation, Inox Wind will issue 158 equity shares for every 10 equity shares to shareholders of Inox Wind Energy, and also issue 158 share warrants with an issue price of Rs 54 each, to shareholders of Inox Wind Energy, for every 10 share warrants with an issue price of Rs 847 each held by them.

JSW Steel: The company is declared as a preferred bidder, by the Directorate of Mines and Geology, Goa, for the grant of a mining lease for iron ore minerals in two blocks in Goa. Two blocks are VI- Cudnem-Cormolem Mineral Block, and IX-Surla-Sonshi Mineral Block in North Goa, with projected iron ore resources of 9.77 MMT and 65.73 MMT respectively.

Engineers India: Oil and Natural Gas Corporation (ONGC) has awarded the project for the replacement of CSU off-gas compressors and regeneration gas compressors, installation of CBD vessel at Uran Plant under EPC reimbursable basis to Engineers India. The total estimated order value is about Rs 472 crore with a project completion schedule of about 40 months.

Punjab & Sind Bank: The bank has received board approval for raising capital up to Rs 750 crore through the issuance of Basel-III compliant additional Tier-1 bonds or Tier-II Bonds in one or more tranches within a period of 12 months.

Zee Entertainment Enterprises (ZEE): SEBI has barred the company’s Chief Executive Officer Punit Goenka and Essel Group Chairman Subhash Chandra from holding the position of a director or a key managerial position in a company’s board.

PC Jeweller, State Bank of India: PC Jeweller has filed a suit against State Bank of India in district court in New Delhi for declaration and injunction and has requested to declare the action of the lender in classifying the loan account of the company as non-performing assets with effect from June 29, 2021, and April 24, 2019, as illegal, null, void, arbitrary, discriminatory, and against the RBI circulars and guidelines issued in this regard. The District Court has ruled that until any further orders, SBI must maintain the status quo regarding any further action to be taken against the company as a consequence of the NPA decision.

Ramkrishna Forgings: The company incorporated Ramkrishna Titagarh Rail Wheels Ltd. along with Titagarh Rail Systems Ltd. Ramkrishna Titagarh Rail has been incorporated to manufacture and supply forged wheels. Both companies will hold 50% stakes in Ramkrishna Titagarh Rail.

Hero MotoCorp: The motorcycle manufacturer launched a new model, Passion+, under its brand Passion. It is available at the company’s dealerships across the country at an ex-showroom price of Rs 76,301.

SJVN: SJVN Green Energy bagged a 200 MW wind power project on a build, own, and operate basis from Solar Energy Corporation of India. The project shall be developed by the company anywhere in India through an EPC contract. The tentative cost of the project is Rs 1,400 crore. After commissioning, the project is expected to reduce 7.08 lakh metric tonnes of carbon emissions.