Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.04% higher at 17,495.50, signalling that Dalal Street was headed for a flat start on Tuesday.

Asian shares were trading higher, tracking gains on Wall Street, as month-end flows lift sentiments. The Nikkei 225 index was up 0.42%, while the Topix gained 0.26%. The CSI 300 index rose 0.1% and the Hang Seng climbed 0.55%.

Indian rupee fell 8 paise to 82.83 against the US dollar on Monday.

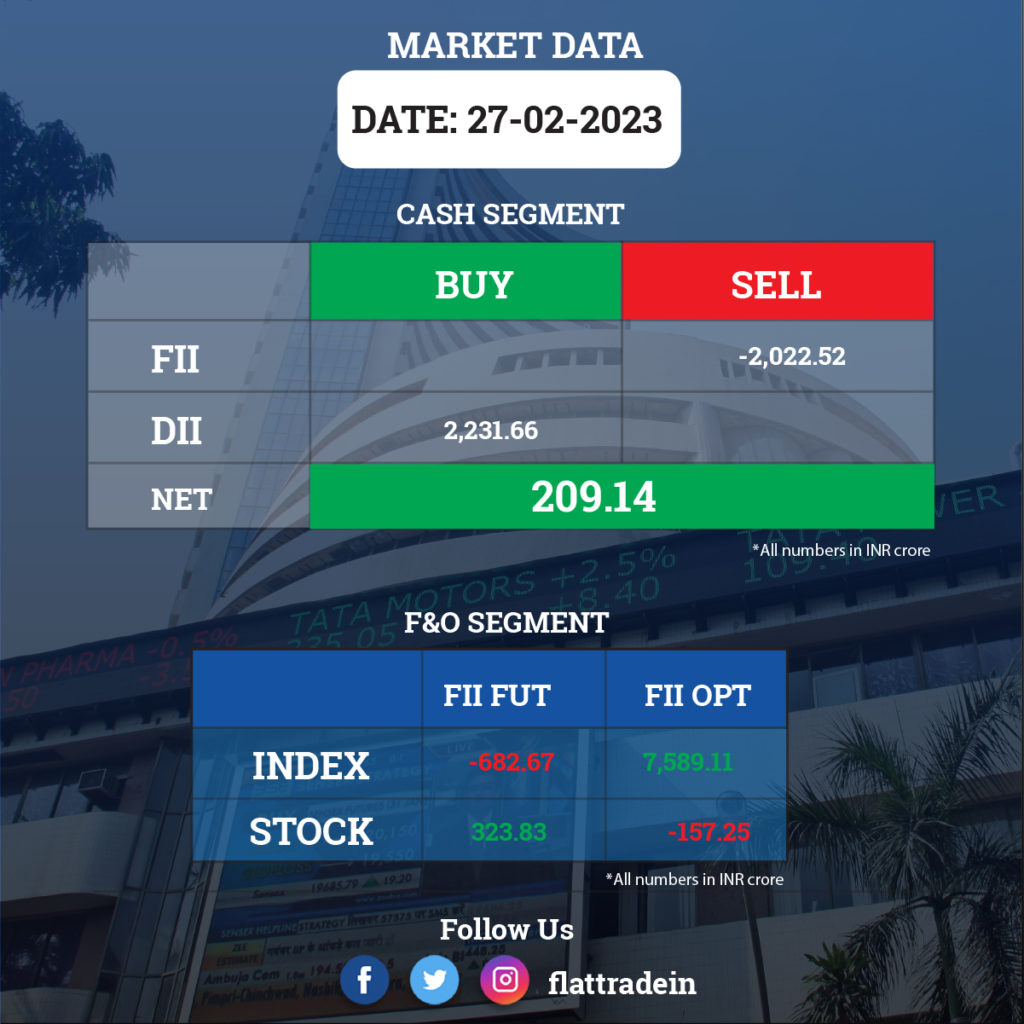

FII/DII Trading Data

Stocks in News Today

Zee Entertainment Enterprises (ZEE): National Company Law Appellate Tribunal (NCLAT) has decided to put a stay on the NCLT order with respect to IBC proceedings initiated against ZEE. Accordingly, ZEE will move out of the IBC framework, and the corresponding surveillance actions on the company will be reverted. Further, National Stock Exchange (NSE) on Monday announced that it would be including ZEE back into the futures and options (F&O) segment and F&O contracts with May 2023 expiry for ZEE will be available for trading with effect from February 28.

Infosys: The IT services major announced the roll-out of private 5G-as-a-Service to drive business value for its enterprise clients globally. Infosys’ wireless 5G expertise and its private network management solution ensure high bandwidth, low latency, and reliable wireless connectivity for enterprises, the company said in a statement. “To reduce the complexity of deployment, Infosys has pre-integrated the 5G stack from multiple product vendors and tested against different use case requirements,” the release said.

Tata Steel: The steel major has received an approval from the Committee of Directors for allotment of 2.15 lakh non-convertible debentures (NCDs), with an 8.03% fixed coupon rate, having a face value of Rs 1 lakh, amounting to Rs 2,150 crore, for a period of five years, to identified investors on private placement basis. The NCDs are proposed to be listed on the Wholesale Debt Market Segment of BSE.

NHPC: The Cabinet Committee on Economic Affairs has given its approval for incurring expenditure on pre-investment activities and various clearances for Dibang multipurpose project (MPP), in Arunachal Pradesh for Rs 1,600 crore. The project is being developed by NHPC and the estimated total cost of the project is Rs 28,080.35 crore including IDC & FC of Rs 3,974.95 crore at June 2018 price level. The estimated completion period for the project will be nine years from receipt of government sanction. This is the largest ever hydroelectric project to be constructed in India.

Vodafone Idea: The company said it has allotted 12,000 optionally convertible debentures to ATC Telecom Infrastructure. The balance 4,000 debentures will be allotted on receipt of application form and subscription money and due intimation of the same shall be filed as necessary, according to a regulatory filing.

Meanwhile, The Department of Telecommunications (DoT) will soon approve the plan proposed by Vodafone Idea (VI) to clear its third quarter dues, including licence fee and spectrum usage charges, according to a report by the Economic Times.

Wipro: The IT major announced four strategic global business lines as it looks to deepen alignment with clients’ evolving business needs and tap emerging opportunities in high-growth segments of the market. The new model sharpens focus on strategic growth areas of cloud, enterprise technology and business transformation, engineering, and consulting, Wipro said. The changes will be effective from April 1, 2023.

SpiceJet: The company announced that Carlyle Aviation Partners will acquire a 7.5% stake in the airline by converting outstanding dues as well as snap up shareholding in the cargo business. The carrier will also tap the Qualified Institutional Buyer (QIB) route to raise up to Rs 2,500 crore. SpiceJet’s board has approved restructuring more than $100 million outstanding dues to aircraft leasing firm Carlyle Aviation Partners into equity shares and Compulsorily Convertible Debentures (CCDs). Carlyle Aviation Partners is the commercial aviation investment and servicing arm of Carlyle’s $143 billion Global Credit platform.

SAIL: The company’s subsidiary, Bhilai Steel Plant, has bagged orders from the UAE to supply large volumes of special quality plates. The plant has received an export order of 10,000 tonnes, with plates complying with European and American specifications.

Mahindra Logistics: Yogesh Patel has resigned as Chief Financial Officer of the company, to pursue his professional interests outside the Mahindra group. Yogesh Patel will be relieved of his duties on March 10 this year.

Laxmi Organic Industries: Satej Nabar has resigned as ED and CEO of the company with effect from April 2 this year. The company has appointed Rajan Venkatesh as MD & CEO with effect from April 3 and Ravi Goenka will step down as MD on the same day.

GIC Housing Finance: The housing finance company has received the company’s board approval for the allotment of 32,500 non-convertible debentures (NCDs) with 8.7% per annum interest, having a face value of Rs 1 lakh each, amounting to Rs 325 crore on Private placement basis. The NCDs are proposed to be listed on BSE.

Tanla Platforms: The company launched has Wisely ATP, an innovative solution for protection against SMS phishing, at Mobile World Congress (MWC) Barcelona 2023. Wisely ATP is a one-stop platform to combat the challenge of SMS phishing comprehensively.

Brigade Enterprises: The realty company announced expansion plans for its managed office brand, BuzzWorks. The management said that BuzzWorks acts as a value-added service for our office occupiers who were looking for flexible office space.

Mastek: The company inked a pact with Netail to usher AI-led digital transformation to the retail, and consumer industry. The management said that the partnership would help e-Commerce and Omni-channel retailers optimise their retail value-chain and thereby attract, convert, and retain digital consumers.

Sterlite Technologies: The company has signed a business transfer agreement to transfer its digital business undertaking to its subsidiary STL Digital, as a going concern on a slump sale basis. The sale transaction cost is Rs 15 crore, subject to working capital adjustments.

Triveni Glass Ltd: The company will invest Rs 1,000 crore to set up a 840 metric tonnes per day capacity solar glass manufacturing plant in Andhra Pradesh. The glassmaker will set up the plant at Pangidi in East Godavari district, which will create 2,000 jobs.