Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.19% lower at 19,625, signalling that Dalal Street was headed for negative start on Thursday.

Most Asian shares were trading lower, tracking Wall Street overningt, as investors were worried over rising oil prices and further interest rate hikes. The Nikkei 225 index fell 0.11% and the Topix was marginally higher by 0.06%. The Hang Seng dropped by 0.74% and the CSI 300 index tanked 0.55%.

The Indian rupee depreciated by 9 paise to 83.14 against the US dollar on Wednesday.

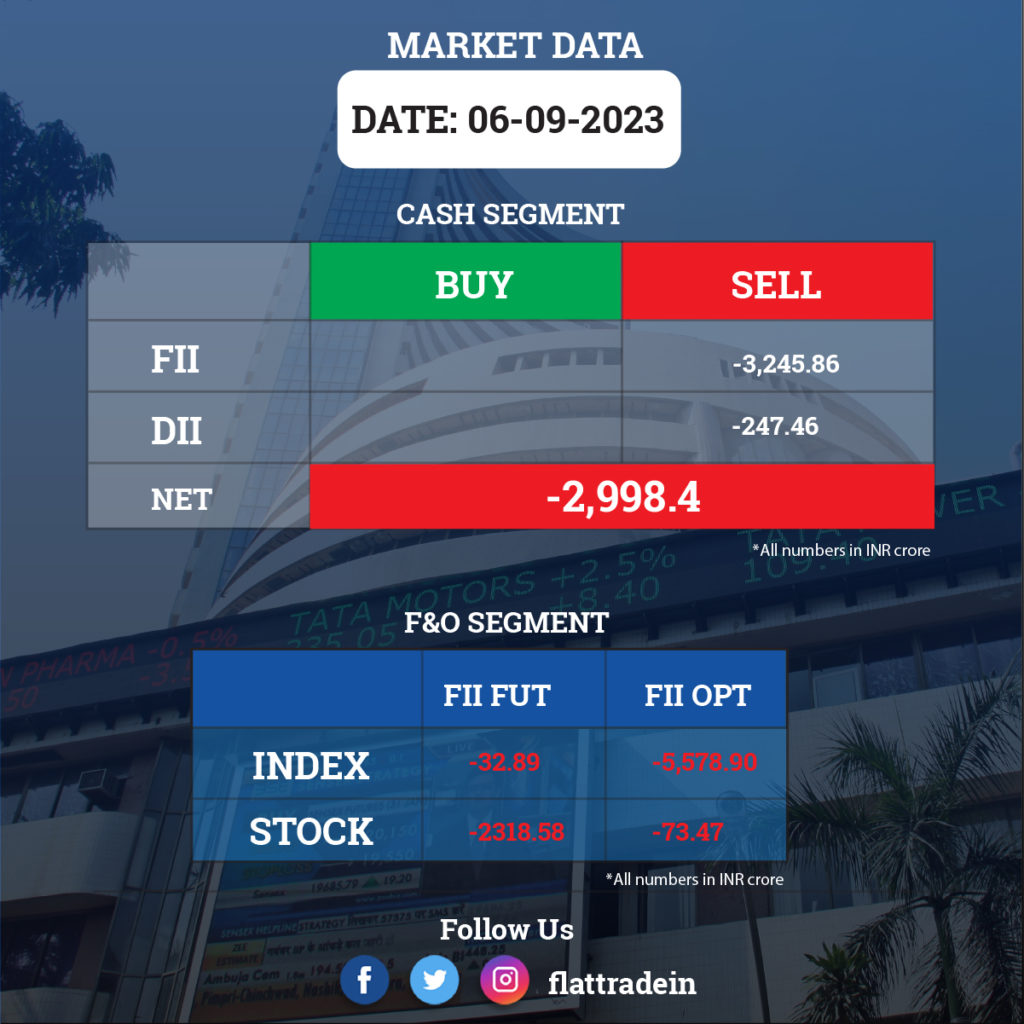

FII/DII Trading Data

Stocks in News Today

Tata Consultancy Services (TCS): The IT major and the digital unit of Jaguar Land Rover Plc have entered into a strategic partnership to support the latter’s “Reimagine” strategy. The new partnership is valued at £800 million over five years. As a part of the new partnership, TCS will deliver a range of services spanning application development & maintenance, enterprise infrastructure management, cloud migration, cybersecurity and data services.

Reliance Industries (RIL): The conglomerate’s retail business — Reliance Retail Ventures — has entered into a joint venture with Alia Bhatt’s kids and maternity-wear brand, Ed-a-Mamma, for a 51% stake. Further, the retail arm received the subscription amount of Rs 8,278 crore from Qatar Holding and allotted 6.86 lakh shares to QIA.

Adani Total Gas: The company received a work order to design, build, finance, and operate a 500 tonne per day bio-CNG plant in Ahmedabad on a public-private partnership model.

Biocon: The company’s subsidiary Biocon Biologics has completed the integration of the acquired biosimilars business from Viatris in North America. With this development, it is expected to grow its employee count to over 150 in North America by the end of the year. The acquisition is expected to further strengthen its leadership in the global biosimilars industry and provide complete end-to-end capabilities to patients and customers.

REC: The state-run company plans to to increase its loan portfolio of green projects by more than 10 times to Rs 3 lakh crore by 2030. Further, it has signed a loan deal worth $100 million with EXIM Bank to refinance its borrowers in power, infrastructure and logistics sectors for importing capital equipment. It has also raised $1.15 billion through Syndicated Term Loans in August 2023 to fund power, infrastructure and logistics sector projects.

Lupin: The pharma company will join hand with Mark Cuban Cost Plus Drug Co and COPD Foundation to expand the availability of Tiotropium Bromide Inhalation Powder, 18 mcg/capsule, to chronic obstructive pulmonary disease patients in the US.

Tata Consumer Products: The company said that it is not in negotiations with Haldiram’s to acquire a 51% stake in the company, as reported by some section of the media.

Varroc Engineering: The company and its units will buy up to 26% stake in AMP Energy SPVs for Rs 13 crore. The SPVs will be used to construct renewable power plants in Maharashtra having combined captive capacity of 33.10 MWp / 22.01 MWac.

360 One Wam: The asset management company has launched its global platform – 360 ONE Global – for offshore wealth and investment advisory. The group has roped in industry veteran Vikram Malhotra as the co-founder and CEO.

AU Small Finance Bank: The lender has entered into bancassurance tie-ups with Star Health and Allied Insurance Co. and Bajaj Allianz Life Insurance Co.

Power Finance Corporation: The company has fixed September 21 (Thursday) as the record date for its bonus issue in the ratio of 1:4, which implies shareholders will recieve one equity share for holding four equity shares as on the record date.

PNC Infratech: The company said its unit PNC Raebareli Highways will settle the NHAI dispute with one time settlement of Rs 107.17 crore. The settlement amount represents 65% of total ‘eligibe disputes’ amount.

Lemon Tree Hotels: The hospitality company announced that a new hotel at Mashobra is expected to be operational by Q1FY26 and shall be managed by Carnation Hotels Private Limited, a wholly-owned subsidiary and the management arm of Lemon Tree Hotels.

Cosmo First: The company has entered into an agreement with O2 Renewable Energy XV and its holding company for acquisition of 26% stake in the SPV for Rs 17.85 crore. The company will source solar power for its plants situated at Aurangabad on a group captive consumer basis.

GVK Power and Infrastructure: The company said its CFO and Whole-time Director Anicattu Issac George has resigned with effect from August 31.

Responsive Industries: The company secured a contract for the Garib Rath initiative from Indian Railways, following the recent Vande Bharat orders.

Som Distilleries and Breweries: The board has proposed to raise Rs 350 crore via Qualified Institutional Placement, subject to approval of members at the ensuing AGM, to be held on September 27.

Force Motors: The company has reported domestic sales of 2,601 units and export of 675 units in August. The total production of vehicles stood at 3,032 units.

RHI Magnesita: The Competition Commission of India (CCI) has cleared Rhone Capital’s proposed acquisition of a 29.9% stake in RHI Magnesita NV.

Danube Industries: The company has fixed September 20 (Wednesday) as the record date to determine names of shareholders, entitled for allotment of bonus equity shares in the ratio of 1:1.

MIC Electronics: The company’s board has approved a proposal to issue securities to raise funds totalling Rs 90 crore through QIP or private offerings or any combination.

Tiger Logistics (India): The company said it has won a government contract from Bharat Earth Movers Limited (BEML) through a bidding process and the project is expected to yield revenue of about Rs 10 crore.

Shri Venkatesh Refineries: The company’s board has approved issuance of bonus shares in the ratio of 1:1. With this decision, shareholders will receive one fully paid up equity shares for every One equity share held as on the record date.

Trident: The company said that an agreement for sale of equity shares of Trident Global Corp Limited (TGCL) has been executed between Trident Limited (“Seller”) and Lotus Hometextiles Limited (“Buyer”) for a consideration of Rs 36.55 crore. Post the transaction, TGCL will cease to be subsidiary of Trident.