Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.05% higher at 17,899, signalling that Dalal Street was headed for a flat start on Thursday.

Japanese shares were trading lower as hawkish comments from the Federal Reserve officials weighed on investors’ sentiments. The Nikkei 225 index was down 0.44% and the Topix fell 0.19%. Meanwhile, Chinese markets were trading higher with the CSI 300 index rising 0.94%, the Shanghai Composite gaining 0.75% and the Hang Seng advancing 0.52%.

Indian rupee ended at 82.49 against the US dollar on Wednesday compared to Tuesday’s close of 82.70/$.

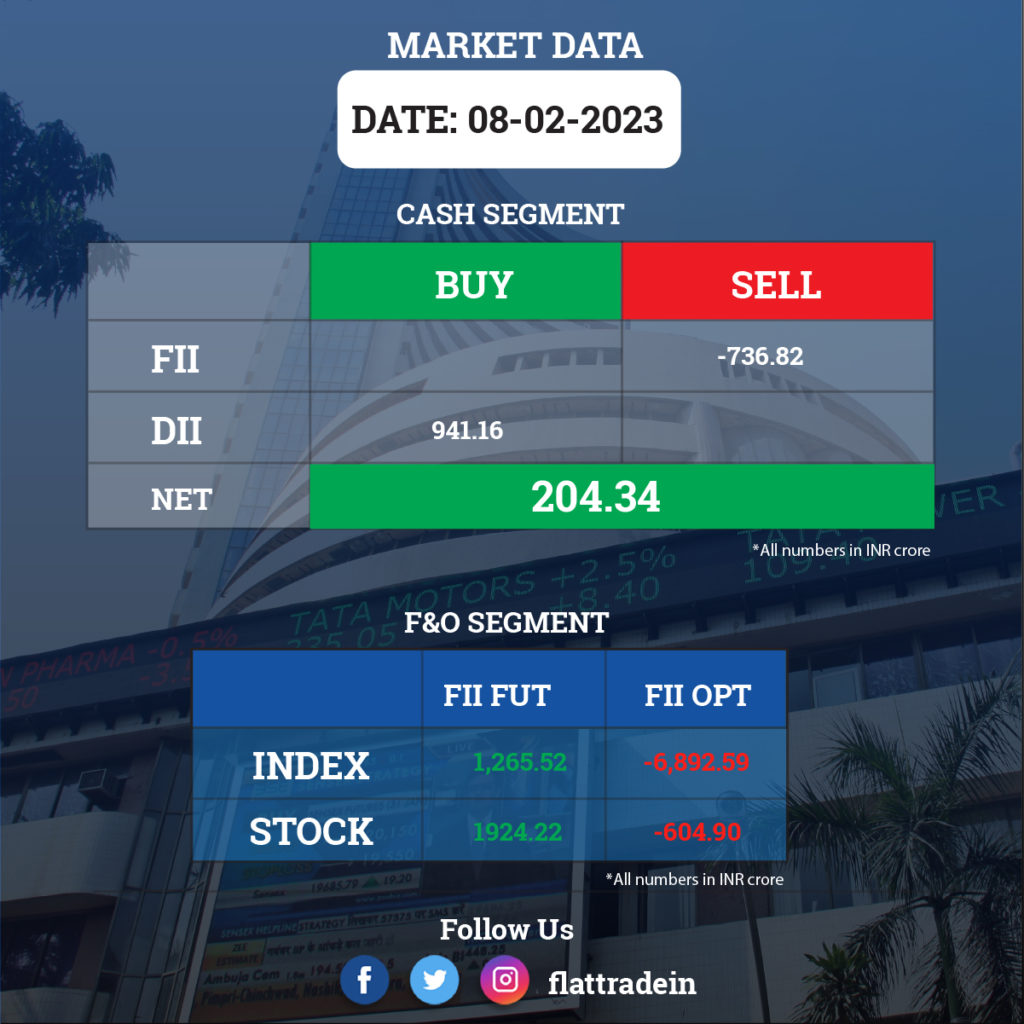

FII/DII Trading Data

Upcoming Results

Hindalco Industries, Hindustan Petroleum Corporation, Life Insurance Corporation of India, Adani Total Gas, Aurobindo Pharma, Lupin, Zomato, Bajaj Consumer Care, Bombay Dyeing & Manufacturing Company, Devyani International, Force Motors, General Insurance Corporation of India, Greaves Cotton, Hindustan Aeronautics, Indian Railway Catering and Tourism Corporation, Jet Airways, Kalpataru Power Transmission, MRF, Natco Pharma, Page Industries, Pfizer, Sapphire Foods India, Suzlon Energy, United Breweries, Ujjivan Financial Services, and Voltas will post their quarterly earnings on February 9.

Stocks in News Today

Reliance Industries Ltd (RIL): The company and and UK supermajor BP are nearing start of production from their giant MJ deep-water project in the KG-D6 block, which will significantly boost gas output from the prized east coast asset. The MJ field will come on stream this quarter, said Sashi Mukundan, Regional President and Head of Country, India, BP Group, at India Energy Week here. Reliance and BP are spending about $5 billion on further developing KG-D6 through three different projects, aimed at rejuvenating gas production from the offshore asset.

Adani Power: The company reported 96% decline in consolidated net profit at Rs 8.77 crore for December quarter 2022-23 due to higher expenses. The profit was Rs 218.49 crore in the year-ago period. Total income rose to Rs 8,290.21 crore from Rs 5,593.58 crore in the same period a year ago. Total expenses jumped to Rs 8,078.31 crore in the quarter from Rs 5,389.24 crore. During the quarter, the company and its subsidiaries achieved an average Plant Load Factor (PLF or capacity utilisation) of 42.1% and power sale volume of 11.8 Billion Units (BU), as compared to PLF of 41% and power sale volume of 10.6 BU in Q3 FY22.

Meanwhile, the Adani Group plans to prepay a $500 million loan due next month to a group of banks as the Indian conglomerate looks to bolster its finances following a short seller attack, Bloomberg reported. Global banks such as Barclays Plc, Standard Chartered Plc and Deutsche Bank AG are among banks that lent Adani $4.5 billion to finance the purchase of Holcim Ltd. cement assets last year and a portion of that loan is due March 9.

Larsen & Toubro (L&T): The infrastructure behemoth said the Ministry of Defence has signed a contract with L&T for the procurement of 41 indigenous modular bridges, worth over Rs 2,585 crore, for the Corps of Engineers of Indian Army. A modular bridge is fabricated in modules that can be installed quickly in the field.

Trent: The company reported a consolidated net profit of Rs 154.81 crore in the third quarter ended on December 2022. The company had posted a net profit of Rs 113.78 crore in the October-December quarter a year ago. Its revenue from operations was at Rs 2,303.38 crore during the quarter under review compared to Rs 1,499.08 crore in the third quarter of FY22. Trent’s Westside registered a growth of 17% in same store sales. Currently, it operates 211 Westside stores, 326 Zudio stores and 21 stores across other lifestyle concepts. The company had entered into a 50:50 joint venture with Mas Group of Sri Lanka for design, development and manufacture of intimate wear, active wear and related apparel products.

Bharti Airtel: The telcom firm and Vultr announced a strategic partnership to offer cloud solutions to enterprises in India. Airtel will offer Vultr’s extensive suite of cloud solutions to its enterprise customers, especially those in the digital space.

Gujarat Pipavav Port: The port services company clocked a 89% year-on-year increase in consolidated profit at Rs 84.4 crore for three-month period ended December FY23, driven by healthy topline as well as operating income. Revenue from operations grew 49% YoY to Rs 250.6 crore, while EBITDA at Rs 142 crore increased by 63.4% , with margin expansion of 512 bps compared to year-ago period.

RBL Bank: The Reserve Bank of India has approved the re-appointment of Rajeev Ahuja as Executive Director for three years effective from February 21 this year. Rajeev Ahuja will be designated as key managerial personnel of the bank.

Oberoi Realty: The Mumbai-based real estate company registered a 50.3% year-on-year growth in consolidated profit at Rs 702.6 crore for quarter ended December FY23 on healthy topline and operating performance. Consolidated revenue surged 96% YoY to Rs 1,630 crore for the quarter. On the operating front, EBITDA jumped 184% YoY to Rs 940.4 crore with margin expansion of 1,786 bps compared to year-ago period.

Cummins India: The diesel and natural gas engines manufacturer has recorded better than expected earnings on all fronts for Q3FY23 as profit grew by 49% YoY to Rs 360.14 crore and revenue increased by 25.7% to Rs 2,181 crore for the quarter. At the operating level, EBITDA jumped 52.4% YoY to Rs 412.2 crore with margin expansion of 331 bps compared to year-ago period. The company announced an interim dividend of Rs 12 per share for FY23.

Piramal Enterprises: The company Wednesday reported a multi-fold jump in net profit at Rs 3,547 crore for the third quarter that ended December 2022. Its revenue from operations rose 41.4% to Rs 3,231.6 crore during the period.

Equitas Small Finance Bank: The lender said it has recorded its highest-ever quarterly disbursement of Rs 4,797 crore, a growth of 68% YoY in Q3FY23. It reported a 57.4% YoY jump in net profit at Rs 170.1 crore for the third quarter of FY23.

Techno Electric & Engineering Company: The company has sold off 37.50 MW of its wind power assets out of the 111.90 MW situated in Tamilnadu at an approximate consideration of Rs 158.93 crore and entered into MOUS for the sale of another 71.40 MW. It had installed 111.90 MW wind power assets in the year 2011.

Honeywell Automation India: The company’s net profit rose 18% YoY to Rs 106 crore for the three months ended December 2022 quarter. Its revenue from operations surged 18% YoY to Rs 1,017 crore.

NCC: the company said its consolidated total income stood at Rs 3903 crore (including other income) for the third quarter as against Rs 3,032 crore in the corresponding quarter of the previous year. The company’s net profit came in at Rs 157.7 crore during the reported quarter compared to Rs 76.42 crore in the year-ago period.

Torrent Power: The company said it has acquired Airpower Windfarms for Rs 21.74 crore. With this acquisition, the company will have the right to appoint Directors on the board of sellers.

Pennar Industries Ltd (PIL): The company said its consolidated profit after tax for the quarter ended December 2022 was up by 97.2% at Rs 21.12 crore compared to Rs 10.71 crore in Q3FY22. The city-based value-added engineering products and solutions company said net revenues during the quarter stood at Rs 692.22 crore up 29.9% compared to Rs 532.97 crore in Q3FY22. For the first nine months period in the current fiscal, the company booked Rs 51.6 crore PAT on Rs 2,226.2 crore net revenue.