Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.04% higher at 19,607.50, signalling that Dalal Street was headed for flat start on Tuesday.

Asian markets were trading lower after data showed disappointing services activity in China and investors were worried over China’s economic recovery. The CSI 300 index fell 0.61% and the Hang Seng slumped 1.53%. Japan’s Nikkei 225 index fell 0.21%, the Topix lost 0.36%.

The Indian rupee lost 2 paise to end at 82.74 against the US dollar on Monday.

Vishnu Prakash R Punglia will debut on the stock market today. The final issue price has been fixed at Rs 99 per share.

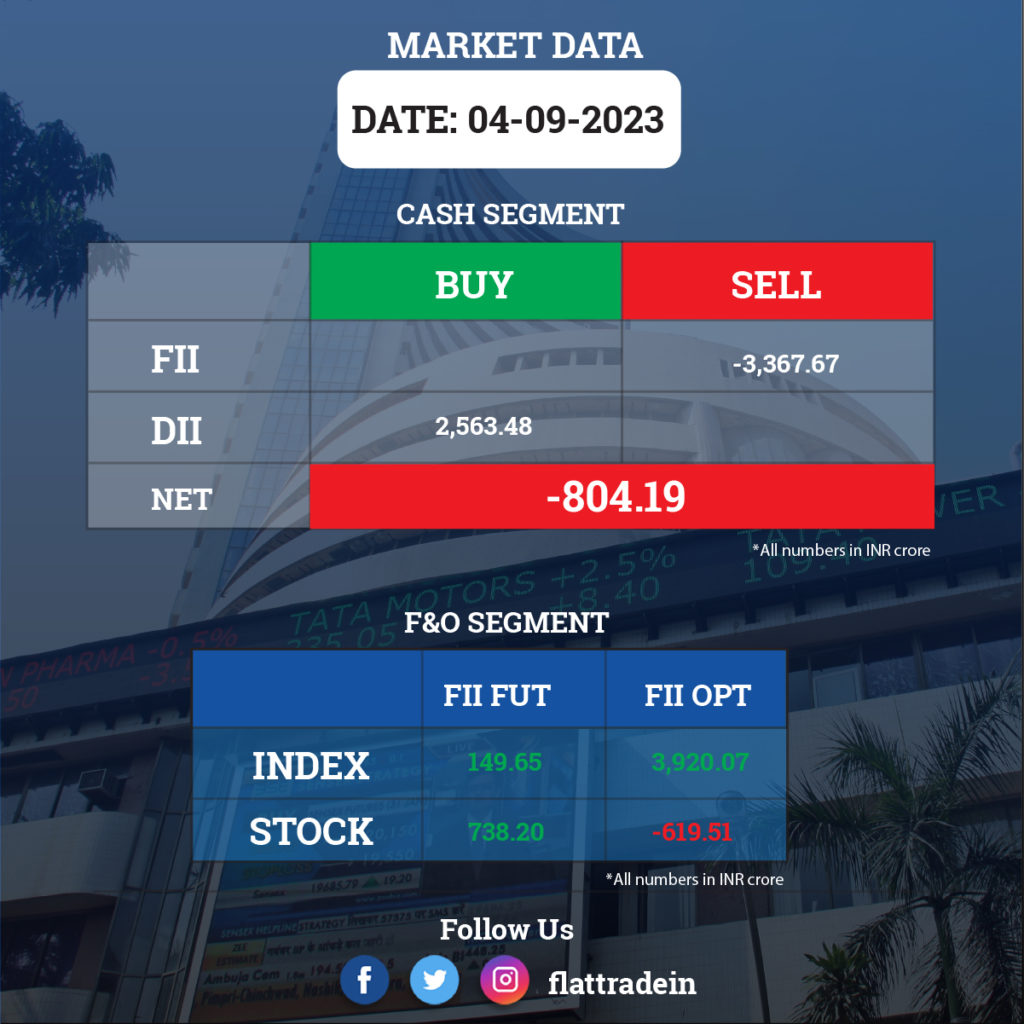

FII/DII Trading Data

Stocks in News Today

Hero MotoCorp: The two-wheeler manufacturer plans to invest Rs 550 crore in Ather Energy Private’s rights issue and the transaction is expected to be completed before the end of September. The company currently holds 33.1% stake in Ather, and with this investment it will see its shareholding rise in Ather.

Oil India: The state-run company has received the board approval for an investment of Rs 1,738 crore in the joint venture company North East Gas Distribution Company (NEGDCL). In the joint venture, incorporated for executing the city gas distribution (CGD) projects, Oil India will hold 49% shareholding and the remaining 51% stake will be held by Assam Gas Company.

Mahindra & Mahindra Financial Services (MMFS): The NBFC has recorded a 15% year-on-year growth in disbursements at Rs 4,400 crore for August. The year-to-date disbursements till the end of August 2023 stood at Rs 20,950 crore, up 22% over a year-ago period. The collection efficiency in August remained flat at 96% YoY.

Tata Power: The company’s subsidiary Tata Power Renewable Energy has signed a power delivery agreement (PDA) with Neosym Industry for 26MW AC group captive solar plant. Neosym Industry is a gray and SG Iron casting and manufacturing company in India. The project at Ahmednagar in Maharashtra with an anticipated electricity generation capacity of 59 million units annually will start from March 2024.

Cipla: The drugmaker’s subsidiary in South African has entered into an agreement to acquire a 100% stake in Actor Holdings (Pty), a privately owned pharmaceutical company specialising in consumer health and generic medicine. The consideration has been fixed at ZAR 900 million (approx. $48.6 million) in cash for 920 equity shares, representing a 100% equity stake.

Mahindra and Mahindra: The automaker and German-based Volkswagen is in advanced discussions with the automaker on the use of central MEB components such as e-drive and unified cells.

Escorts Kubota: The agri machinery business division of the company plans to increase the prices of its tractors effective September 16. The increase in prices would vary across models or variants and geographies.

Gland Pharma: Ankit Gupta has been appointed as Vice-President (strategy & investments) with effect from September 4. Before joining Gland, Ankit with 15 years of experience in the pharmaceutical and biotechnology industry, worked as the Vice President and Head of Corporate Development and Strategy for Strides Pharma Science.

Mrs Bectors Food Specialities: The bakery products maker has appointed Arnav Jain as Chief Financial Officer. Meanwhile, the company’s 28th Annual General Meeting will be held on September 29.

Yes Bank: The private lender has clarified and denied any role in settlement or negotiation after the sale of the loan portfolio to JC Flowers ARC. The association of the bank with JC Flowers ARC remains limited to the extent of its current shareholding, at 9.9%.

Bombay Dyeing: The company has settled its dispute with Axis Bank and has also executed a Conveyance Deed in favour of Axis Bank for transfer of land measuring 11,541 square meters, which will enable independent and exclusive access to Axis Bank’s headquarters. The value of the transaction is Rs 149 crore.

Rail Vikas Nigam: The RVNL-MPCC JV emerged as the lowest bidder for all civil engineering works in the Varodara Division of Western Railway. The project cost is Rs 174.27 crore, and the contract is to be executed in two years. The company’s share in the JV stands at 74%, while MPCC’s share is 26%.

Dabur: The FMCG major’s unit, Dabur International, has decided to convert its existing branch, Dabur International Dubai, into a wholly owned subsidiary under the name of Dabur International FZE.

LIC Housing Finance: The mortgagae finance company has infused Rs 21.61 crore of incremental capital in LIC Mutual Fund Asset Management Company in a rights issue.

Dhanuka Agritech: The company launched an herbicide for sugarcane crops that has effective control of broad and narrow leaf weeds for the domestic market.

Ramco Cements: The company has commissioned the balance of the 3 MW capacity of the Waste Heat Recovery System out of the 12 MW capacity in its Kolimigundla plant. With this development, the total operating capacity has gone up to 43 MW.