Market Opening - An Overview

GIFT Nifty Futures on the NSE IX traded lower by 0.07% at 19,805, signalling that Dalal Street was headed for flat-to-negative opening on Monday.

Most Asian shares were trading higher as investors were optimistic about the end of rate hike cycle and better-than-expected corporate earnings in Japan. The Nikkei 225 index rose 0.48%, while the Topix fell 0.31%. The Hang Seng index jumped 0.96%, while the CSI 300 index was down 0.2%.

The Indian rupee fell 2 paise to 83.27 against the US dollar on Friday.

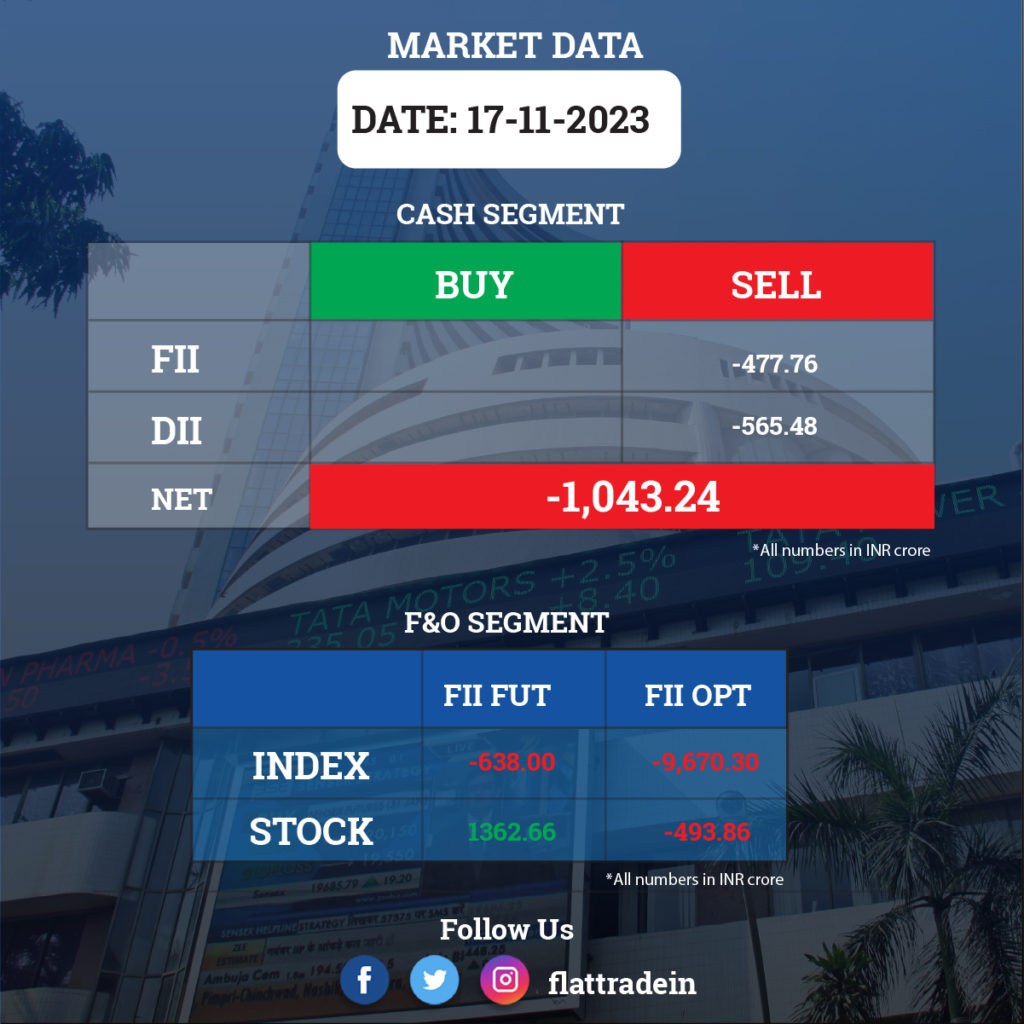

FII/DII Trading Data

Stocks in News Today

Larsen & Toubro (L&T): The company said Qatar’s General Tax Authority has imposed a penalty of Rs 111.31 crore for FY17 and Rs. 127.64 crore for FY18. An appeal has been filed against the levy of this penalty as the company believes it is arbitrary and unjustified.

Bajaj Finance: The company said in an exchange filing that it has temporarily suspended issuance of Existing Member Identification cards (‘EMI cards’) to new customers until the deficiencies observed by RBI are rectified to their satisfaction. The Company continues to offer financing to new and existing customers at dealer stores in the normal course of business.

SBI Cards and Payment Services: After India’s central bank tightened norms for consumer credit and bank credit to NBFCs, the company said the latest rules would impact the capital adequacy ratios for banks and NBFCs, and for SBI Card, it would reduce capital adequacy by around 4%. It further said this is a positive move by RBI to ensure prudent growth in unsecured lending. The company further said it is well capitalized and well above the regulatory guideline of 15%.

Adani Power: The company said that Ardour Investment Holding bought 1.93% stake, or 7,42,71,400 Adani Power shares between September 26 and November 16. Meanwhile, Emerging market Investment DMCC bought 50,00,000 Adani Power shares or 0.13% on September 29.

Exide Industries: The Delhi High Court has passed a decree by recording the terms of the Settlement Agreement executed by the parties namely Exide Industries, Vertiv Company Group Limited UK (VCGL), and Vertiv Energy (VEPL), while disposing of the suits pending since 2006. As per the said Settlement Agreement, VCGL & VEPL has agreed and acknowledged that the trademark CHLORIDE and its variants in India are registered in the name EXIDE. It has further been agreed and recorded that VCGL and VEPL shall not use the said CHLORIDE mark in India, either directly or indirectly, and shall withdraw all their claims over this mark in favor of EXIDE.

IndusInd Bank: The private sector lender informed that Reserve Bank of India has conveyed its approval for appointment of Arun Khurana as Whole-time Director (Executive Director) of the Bank for a period of three years with effect from November 16, 2023. Arun Khurana is qualified as a Chartered Accountant and has over 29 years of banking experience.

Aurobindo Pharma: The USFDA has concluded a pre-approval inspection (PAI) of Unit-I & III of formulation manufacturing facility of APL Healthcare, a subsidiary of Aurobindo Pharma, in Telangana with zero observations. The inspection, conducted during the November 13-17 period, was closed with “No Action Indicated (NAI)”.

Kalyan Jewellers: Kalyan Jewellers FZE, a material subsidiary of Kalyan Jewellers India has acquired the remaining 30% stake in Kalyan Jewellers LLC, Oman on November 16, 2023. With the said acquisition, Kalyan Jewellers LLC, Oman, has become a wholly owned subsidiary of Kalyan Jewellers FZE.

RITES: The company has emerged as the lowest bidder in two tenders from CFM Mozambique. Out of the two tenders, one was for supply of 10 diesel electric locomotives with incidental service and the other was for supply of 300 high side wagons, the company said in an exchange fling.

Dalmia Bharat Sugar: The company informed that there is disruption of operations at Kolhapur and Ninaidevi units, in Maharashtra, due to Farmer’s Sangathan Agitation. Consequentially, there could be a material impact. The Company further said it is taking all possible steps to restore normalcy and shall keep you updated about further development in the matter.

Elecon Engineering: Elecon Middle East FZCO, Dubai has incorporated its wholly owned subsidiary namely “Elecon Radicon Africa (Pty) Ltd.” The objective of the new company is for sales & marketing and servicing of Industrial Engineering Products in the African Continent.

Newgen Software: The company’s board will meet on November 27 to consider and recommend a proposal for declaration of bonus shares to the equity shareholders of the company, subject to the approval of shareholders.

NBCC (India): NBCC has signed a memorandum of understanding with the Institute of Chartered Accountants of India (ICAI) where ICAI has agreed to award the planning, designing and execution of its buildings and renovation works at various locations in India. NBCC will and complete the works at a PMC fee of 6.5% (excluding GST) of the actual project cost.

Tamilnad Mercantile Bank: The Enforcement Directorate has ordered for transfer of movable properties of MGM Maran, Former Non-Executive Part Time Chairman of the Bank, including his 52,39,959 equity shares (3.31%) held in our Bank, in favour of the Director of Enforcement. The ED had attached assets worth Rs 205 crore of MGM Maran and his associates under PMLA in 2016.

Remsons Industries: The company has informed the exchanges BSE that the meeting of the board of directors of the company is scheduled on November 22, to consider and approve the proposal for raising of funds by way of issuance of equity shares or any other eligible securities / warrants convertible into equity shares of the company, subject to such regulatory approvals.