Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.05% lower at 18,228, signalling that Dalal Street was headed for a flat-to-negative start on Monday.

Most Asian shares were trading higher. The Nikkei 225 index rose 0.08%, the Topix index was up 0.15%. The Hang Seng jumped 1.47% and the CSI 300 index rose 0.77%.

Indian rupee fell 6 paise to 82.66 against the US dollar on Friday.

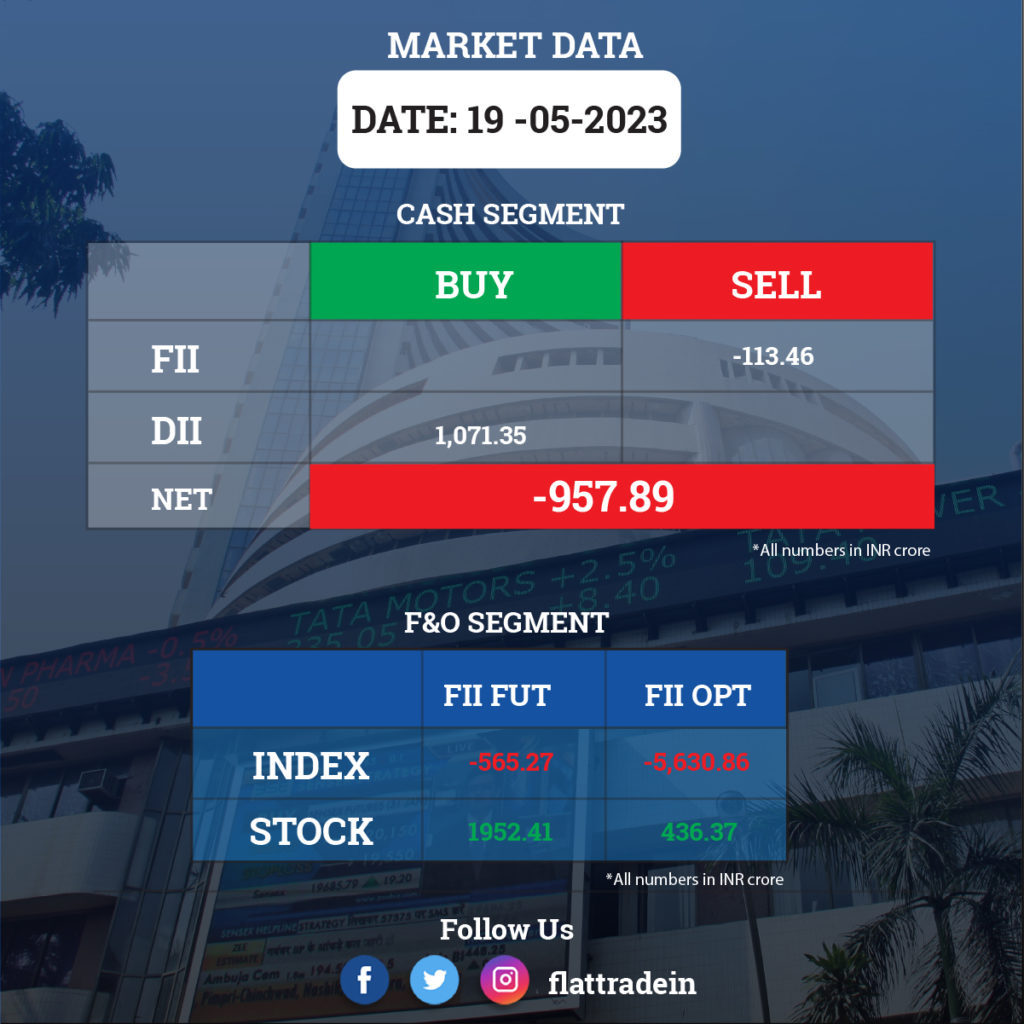

FII/DII Trading Data

Upcoming Results

Bharat Petroleum Corporation, Shree Cement, SJVN, EIH, Sun Pharma Advanced Research Company, PB Fintech, Aditya Birla Fashion and Retail, Borosil, Camlin Fine Sciences, CESC, Capri Global Capital, Finolex Industries, Federal-Mogul Goetze (India), Fusion Micro Finance, Garware Technical Fibres, Gujarat Alkalies & Chemicals, HEG, Indiabulls Housing Finance, Jtekt India, Moschip Technologies, NACL Industries, National Highways Infra Trust, RACL Geartech, Radiant Cash Management Services, Ramco Industries, Keystone Realtors, Sansera Engineering, Spencers Retail, Thangamayil Jewellery.

Stocks in News Today

NTPC: The company reported a consolidated revenue was up 19.33% YoY at Rs 44,252.92 crore in Q4FY23. Ebitda was up 4.52% YoY at Rs 11,942.40 crore in Q4FY23. Consolidated net profit was down 6.31% YoY at Rs 4871.55 crore in Q4FY23. The company will pay final dividend of Rs 3 per share for the fiscal 2022-23.

Meanwhile NTPC Green Energy, the renewable arm of NTPC, signed an MoU with HPCL Mittal Energy under which it will supply 250 MW green energy to the latter, according to a statement by NTPC. Both companies will explore opportunities in production of green hydrogen, green ammonia and green methane.

JSW Steel: The company said its consolidated revenue was flat year-on-year at Rs 46,962 crore in Q4FY23. Ebitda fell 13.5% YoY to Rs 7,939 crore in Q4FY23. Consolidated net profit was up 12% YoY at Rs 3,741 crore in Q4FY23. The board has recommended a final dividend of Rs 3.40 per share for the fiscal 2023. It also approved raising Rs 7,000 crore via non-convertible debentures and additional Rs 7,000 crore through equity shares and/or convertible securities.

Hindustan Copper: The company’s consolidated revenue was up 2.62% YoY at Rs 559.76 crore in Q4FY23. Ebitda was up 22.08% YoY at Rs 186.02 crore in Q4FY23. Consolidated net profit was up 48.42% YoY at Rs 132.21 crore in Q4FY23.

Glenmark Pharmaceuticals: The company’s consolidated revenue was up 12% YoY at Rs 3,374 crore in Q4FY23. EBITDA was up 31% YoY at Rs 605 crore in Q4FY23. Condsolidated net loss stood at Rs 428 crore in Q4FY23 as against a net profit of Rs 156 crore in the year-ago period. The company reported an exceptional loss of Rs 799.73 crore during the quarter under review. The board recommended a dividend of Rs 2.50 per share for the fiscal 2023.

Narayana Hrudalaya: The company’s consolidated revenue was up 30% YoY at Rs 1,222 crore in Q4FY23. Ebitda rose 58% YoY to Rs 276 crore in Q4FY23. Consolidated net profit was up 1.5 times to Rs 173 crore in Q4FY23. The company will pay final dividend of Rs 2.50 per share for the fiscal 2023, with record date fixed as July 7. The board approved raising Rs 300 crore via non-convertible debentures.

Power Grid Corporation of India: The state-owned power transmission utility recorded a 4% YoY increase in consolidated profit at Rs 4,320.43 crore in the March 2023 quarter, driven by healthy sales. Revenue from operations at Rs 12,264 crore grew by 14.7% over a year-ago period. The company announced a final dividend of Rs 4.75 per share for the fiscal 2023.

Muthoot Finance: The NBFC said its consolidated interest income was up 7.45% YoY at Rs 3,134.11 crore in Q4FY23. Consolidated net profit was up 0.3% YoY at Rs 1,009.26 crore in Q4FY23.

IRB Infrastructure Developers: The company’s revenue was up 13% YoY at Rs 1,619.98 crore in Q4FY23. Ebitda was up 18.26% YoY at Rs 758.74 crore in Q4FY23. Consolidated net profit was down 25.42% YoY at Rs 130.15 crore in Q4FY23. The company will pay a second interim dividend of Rs 0.075 per share, with the record date fixed as May 29.

Abbott India: The company said its revenue was up 7% YoY at Rs 1,343 crore in Q4FY23. Ebitda was down 5% YoY to Rs 280 crore in Q4FY23. Net profit rose 9% to Rs 231 crore. The board has recommended a final dividend of Rs 180 per share along with a special dividend of Rs 145 per share.

NLC India: The consolidated revenue was up 66.37% YoY at Rs 5,134.04 crore in Q4FY23. Ebitda was up 61.22% YoY at Rs 1,722.45 crore in Q4FY23. Consolidated net profit was up 152.62% YoY at Rs 836.59 crore in Q4FY23. The company declared a final dividend of Rs 2 per share for the fiscal 2023.

Crompton Greaves Consumer Electricals: The consolidated revenue was up 15.7% YoY at Rs 1,790.96 crore in Q4FY23. Ebitda was down 7.58% YoY at Rs 211.44 crore in Q4FY23. Consolidated net profit was down 25.49% YoY at Rs 131.55 crore in Q4FY23. The board recommended a final dividend of Rs 3 per share for the fiscal 2023.

Sun TV: The media conglomerate said its consolidated revenue was down 1.92% YoY at Rs 840.36 crore in Q4FY23. Ebitda fell 11.72% YoY at Rs 497.83 crore in Q4FY23. Consolidated net profit was down 7.26% YoY at Rs 380.4 crore in Q4FY23.

Zomato: The food delivery giant’s consolidated loss for the March quarter narrowed to Rs 187.6 crore from a loss of Rs 359.7 crore in the same period last year, as topline increased sharply and operating loss narrowed. Consolidated revenue from operations grew by 70% YoY to Rs 2,056 crore in Q4FY23.

Bandhan Bank: The private sector lender registered a massive 57.5% year-on-year decline in profit at Rs 808 crore in the March quarter of FY23, hit by significantly higher provisions & contingencies. Lower non-interest income, net interest income and pre-provision operating profit also impacted profitability. Net interest income fell 2.7% to Rs 2,472 crore from the year-ago quarter, with a 140 bps decline in net interest margin.

Delhivery: The logistics services provider reported a consolidated loss of Rs 158.6 crore for the March quarter, widening losses from Rs 119.8 crore in same period last year. Lower revenue and tepid operating performance impacted profitability. Consolidated revenue from operations fell 10.2% YoY to Rs 1,860 crore.

JK Lakshmi Cement: The cement company reported a 40.1% year-on-year decline in consolidated profit at Rs 110 crore in the March quarter, impacted by weak operating numbers. Consolidated revenue grew 16.4% year on year to Rs 1,862 crore, with sales volume increasing 3% to 33.88 lakh tonnes. Ebitda was down 28.34% YoY at Rs 232.66 crore in Q4FY23. The company will pay a dividend of Rs 3.75 per share for the fiscal ended 2023. The board approved raising Rs 300 crore via debt.

Zee Entertainment Enterprises, IDBI Bank: The Mumbai bench of the National Company Law Tribunal has dismissed the application by IDBI Bank to initiate insolvency proceedings against Zee Entertainment.

NDTV: The company’s stock has been moved out of long-term additional surveillance measure framework by BSE and National Stock Exchange.

Dilip Buildcon: The company has been selected as the L-1 bidder for construction of Malhargarh pressurized micro lift major irrigation project on turnkey basis by Water Resource Department in the state of Mandsaur, Madhya Pradesh at a cost of Rs 699.03 crore.

Aurobindo Pharma: The U.S. FDA has issued a Form 483 with four observations after inspecting the company’s Unit XIV, an API non antibiotic manufacturing facility situated at Paravada Industrial Area, in Anakapalli, Andhra Pradesh.

Piramal Pharma: The U.S. FDA completed the good manufacturing practices and pre-approval inspection of the company’s Pithampur facility with no Form 483 observations.