Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.08% lower at 19,543, signalling that Dalal Street was headed for muted start on Friday.

Most Asian shares were trading higher, extending Wall Street rallies after easing US inflation improved investor sentiments. The Nikkei 225 index was up 0.23%, while the broader Topix index slipped 0.11%. The Hang Seng index rose 0.48% and the CSI 300 index added 0.11%

Indian rupee appreciated by 18 paise to close at 82.07 against the U.S dollar on Thursday.

Kolkata-based jewellery retailer — Senco Gold — will debut on the stock exchanges on July 14. The issue price has been fixed at Rs 317 per share.

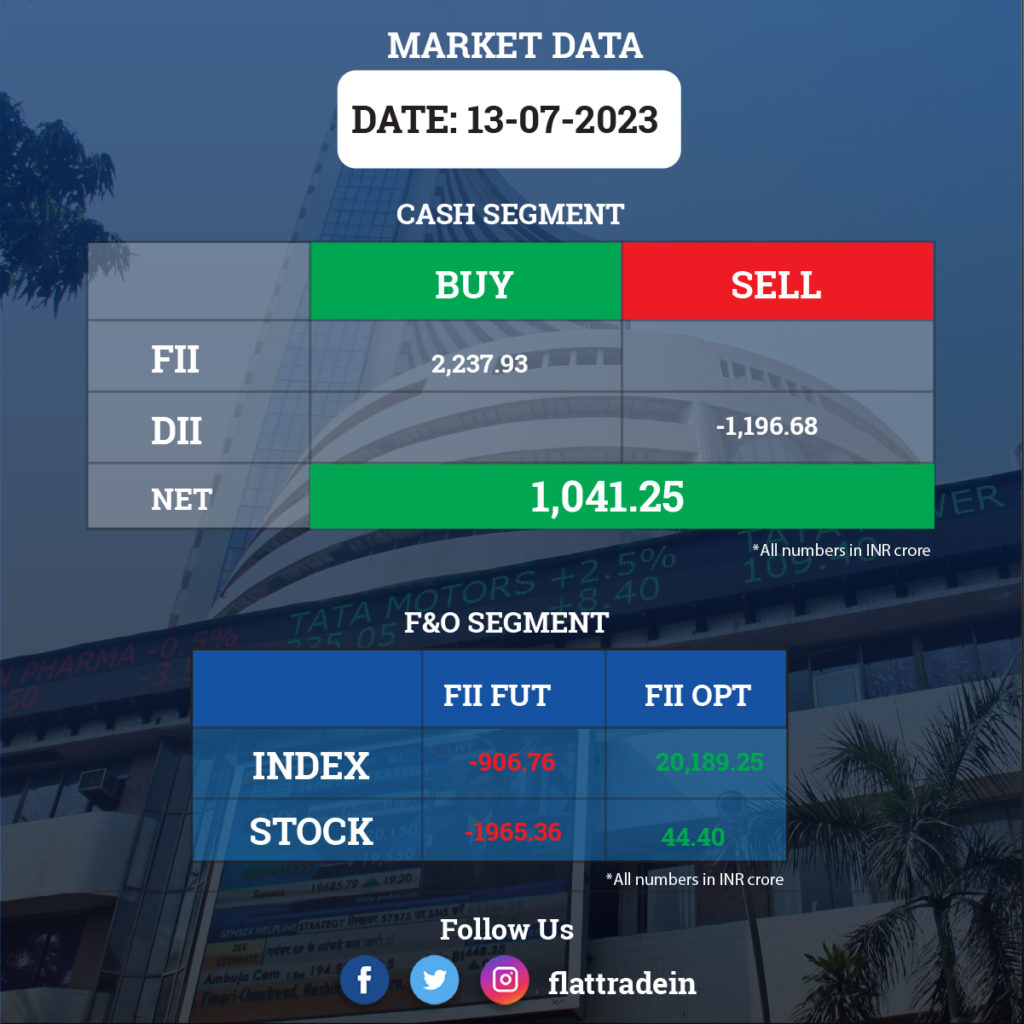

FII/DII Trading Data

Upcoming Results

JSW Energy, Bandhan Bank, CCL Products (India), Just Dial, Tata Steel Long Products, Coromandel Engineering Company, Den Networks, GTPL Hathway, Kesoram Industries, Sastasundar Ventures, Unichem Laboratories, Vandana Knitwear, and VST Industries will announce their quarterly earnings on July 14.

Avenue Supermarts (D-Mart), Star Housing Finance, Rallis India, Vakrangee, Ksolves India, Menon Bearings, and Trident Lifeline will report their results on July 15.

Stocks in News Today

Wipro: The software services provider recorded a 6.6% sequential decline in consolidated profit at Rs 2,870 crore for quarter ended June 2023. Its revenue fell by 1.8% QoQ to Rs 22,755 crore, while revenue in dollar terms at $2,778.5 million. The order book stood at $1.2 billion during the quarter against $1.1 billion in previous quarter.

Rail Vikas Nigam (RVNL): The state-owned railway company has received Letter of Award from National Highways Authority of India for rehabilitation and upgradation from 4 to 8 laning of Chandikhole- Paradip section of NH-53 in Odisha on HAM mode. The project cost is Rs 808.48 crore and is to be executed within 24 months.

JBM Auto: The company said it has won orders for supplying about 5000 electric buses to various STUs in the states of Gujarat, Haryana, Delhi, Telangana, Orissa among others, multiple Fortune 500 companies and leading corporates of the country. Different applications such as city bus, staff bus, tarmac coach, etc. in both, 9 meters and 12 meters categories will be delivered for these orders, the company said in an exchange filing.

Samvardhana Motherson International: The auto ancillary company has completed acquisition of 51% equity stake in Saddles International Automotive and Aviation Interiors Private Limited. Saddles International is engaged in manufacturing of premium upholstery for passenger vehicles.

Angel One: The company said its consolidated revenue from operations rose 18% to Rs 807.5 crore in Q1FY24 as against Rs 682 crore in Q1FY23. The company’s net profit rose 22% to Rs 220.8 crore in Q1FY24 as against Rs 181.5 crore in the year-ago period. Ebitda jumped to Rs 320.3 crore in the reported quarter as against Rs 266.4 crore in the year-ago period. Meanwhile, the board declared an interim dividend for FY24 at the rate of Rs 9.25/- per share on equity and the record date for determining eligible shareholder is July 21.

Ahluwalia Contracts: The construction company has received a project worth Rs 199.58 crore for civil structural, facade and related external development works for enterprise computing and cybersecurity training institute at Bhubaneshwar. The project is expected to be executed within 20 months.

Adani Enterprises: The company has fully repaid commercial paper worth Rs 30 crore on the date of maturity, i.e., July 13, 2023.

Tata Communications: The company will consider a proposal to issue unsecured, redeemable, and non-convertible debentures on a private placement basis on July 19.

Aster DM Healthcare: The company’s unit, Aster DM Healthcare FZC, has acquired the remaining 20% stake in Premium Healthcare for Rs 5.18 crore.

Lloyds Metals and Energy: The company has received listing and trading approval from the NSE for the listing of its 50.48 crore equity shares as of July 17.

Stove Kraft: Balaji AS has been relieved from the position of Chief Financial Officer with effect from the close of business hours on July 13, 2023.

GMR Power and Urban Infra: GMR Smart Electricity Distribution received an order from Purvanchal Vidyut Vitran Nigam Ltd. and Dakshinanchal Vidyut Vitran Nigam Ltd. to install and maintain 75.69 lakh smart metres in the Purvanchal and Dakshinanchal areas of Uttar Pradesh.

Polo Queen Industrial and Fintech: The company has approved fundraising of up to Rs 2,500 crore for its proposed Agro Processing Project and Data Centre Project at MIDC. It will raise the funds by issuing equity shares or other instruments through one or more preferential issues on a private placement basis, rights issues, QIPs, or a mix of any.

Deep Industries: The oil & gas field equipment provider has entered into joint venture arrangement with Euro Gas Systems S R L (EGS), for supplying oil filed equipment to the oil & gas industry. EGS has acquired 26% equity stake in joint venture company Deep Onshore Drilling Services and the balance 74% stake is held by Deep Industries. Deep Onshore Drilling Services is also a subsidiary of Deep Industries.