Market Opening - An Overview

Nifty futures on the Singapore Exchange traded 0.06% lower at 18,704, signalling that Dalal Street was headed for muted start on Monday.

Asian markets were mixed. Japan’s Nikkei 225 index rose 0.2% and the Topix gained 0.16%. The Hang Seng fell 0.43% and the CSI 300 index tanked 1.57%.

Indian rupee fell 7 paise to close at 82.03 against the US dollar on Friday.

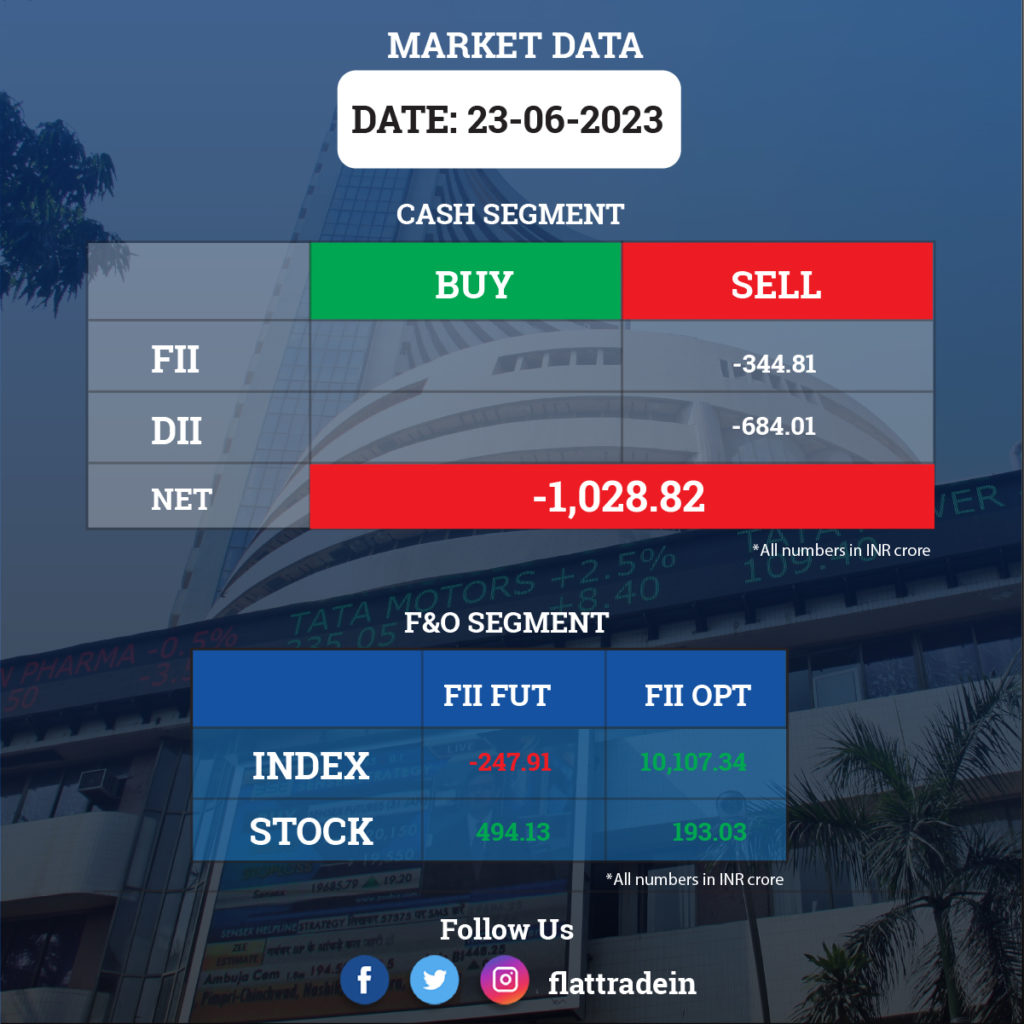

FII/DII Trading Data

Stocks in News Today

Yes Bank: The lender’s board has approved raising Rs 2,500 crore in Indian or foreign currency through the issue of debt securities including but not limited to non-convertible debentures, bonds, Medium Term Note (MTN), etc., subject to approval from shareholders/regulators.

HDFC Life Insurance: The company received a GST demand notice for Rs 942 crore. The demand pertains to the period from July 2017 to FY 2022, and the matter relates to the claiming of an input tax credit against the supply of services that the authority believes are ineligible for such claims. The company has deposited Rs 250 crore under protest.

Separately, The Insurance Regulatory and Development Authority of India (IRDAI) granted its approval for transfer of shares of HDFC Life, from HDFC to HDFC Bank in view of the proposed amalgamation between HDFC and HDFC Bank. IRDAI also granted approval for HDFC to acquire additional shares in HDFC Life, so the holding to be more than 50 percent of its total share capital.

Rail Vikas Nigam (RVNL): The state-owned railway company has emerged as the lowest bidder a project of design and construction of elevated metro viaduct, from Maharashtra Metro Rail Corporation. The cost of project is Rs 394.9 crore and the said project is expected to be executed in 30 months.

Tata Consultancy Services (TCS): The IT firm has suspended four employees for violating its code of conduct, following a whistleblower complaint received earlier this month, according to reports. The company has also clarified that it has probed the allegations made in the complaint and found out that the charges do not “involve any fraud by or against the company and have no financial impact”.

Grasim: The company’s board has approved the issue of non-convertible debentures on private placement basis, aggregating up to Rs 2,000 crore, in one or more tranches.

NHPC: The state-owned company has inked an initial pact with an Odisha state utility to develop 2,000 MW of pumped storage projects and 1,000 MW renewable energy in the state.

RattanIndia Power: The company announced that it has refinanced its senior debt in a Rs 1,114 crore transaction led by Kotak Mahindra Bank.

Zydus Lifesciences: The company’s subsidiary — Zydus Animal Health and Investments — has entered into a share purchase agreement with Rising Sun Holdings and Mylab Discovery Solutions to acquire 6.5 percent stake in Mylab from Rising Sun Holdings, for Rs 106 crore. The proposed investment in Mylab will help Zydus to participate in growing diagnostics space.

Cambridge Technology Enterprises: The IT firm received board approval for acquisition of US-based Appshark Software Inc for Rs 41 crore. Appshark is primarily engaged in salesforce consulting and custom software development. The said acquisition is expected to be completed by March 2026. It also acquired RP Web Apps for Rs 3 crore and the said acquisition is expected to be completed by July 30, 2023.

AU Small Finance Bank: The small finance bank said the board members will meet on June 29 to consider raising of funds by issue of equity shares or debt instruments.

Ipca Laboratories: The US Food and Drug Administration (USFDA) has issued Form 483 with eight observations for company’s Pithampur formulations manufacturing facility in Madhya Pradesh. The USFDA conducted the inspection of said facility during June 15-June 23.

Godrej Properties: The real estate developer has acquired approximately 15 acres of land in Gurugram, Haryan, a through an outright purchase, for the development of premium residential apartments.

Axis Bank: The RBI has imposed a monetary penalty of Rs 30 lakh on the ledner after the bank levied penal charges in certain accounts for late payment of credit card dues, even though the customers had paid the dues by the due date, through third-party platforms.

Jammu & Kashmir Bank: The RBI has imposed a monetary penalty of Rs 2.5 crore for non-compliance with directions issued by RBI on the creation of a Central Repository of Large Common exposures across banks.