Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.21% higher at 18,474.50, signalling that Dalal Street was headed for a positive start on Monday.

Japanese markets were trading lower with the Nikkei 225 index down 0.76% and the Topix index falling 0.65%. Chinese stocks gained as Covid-related restrictions eased and on hopes of aid for the country’s property sector. The CSI 300 index was up 0.71% and the HAng Seng index surged 2.27%.

Indian rupee appreciated by Rs 1.01 to 80.79 against the US dollar on Friday.

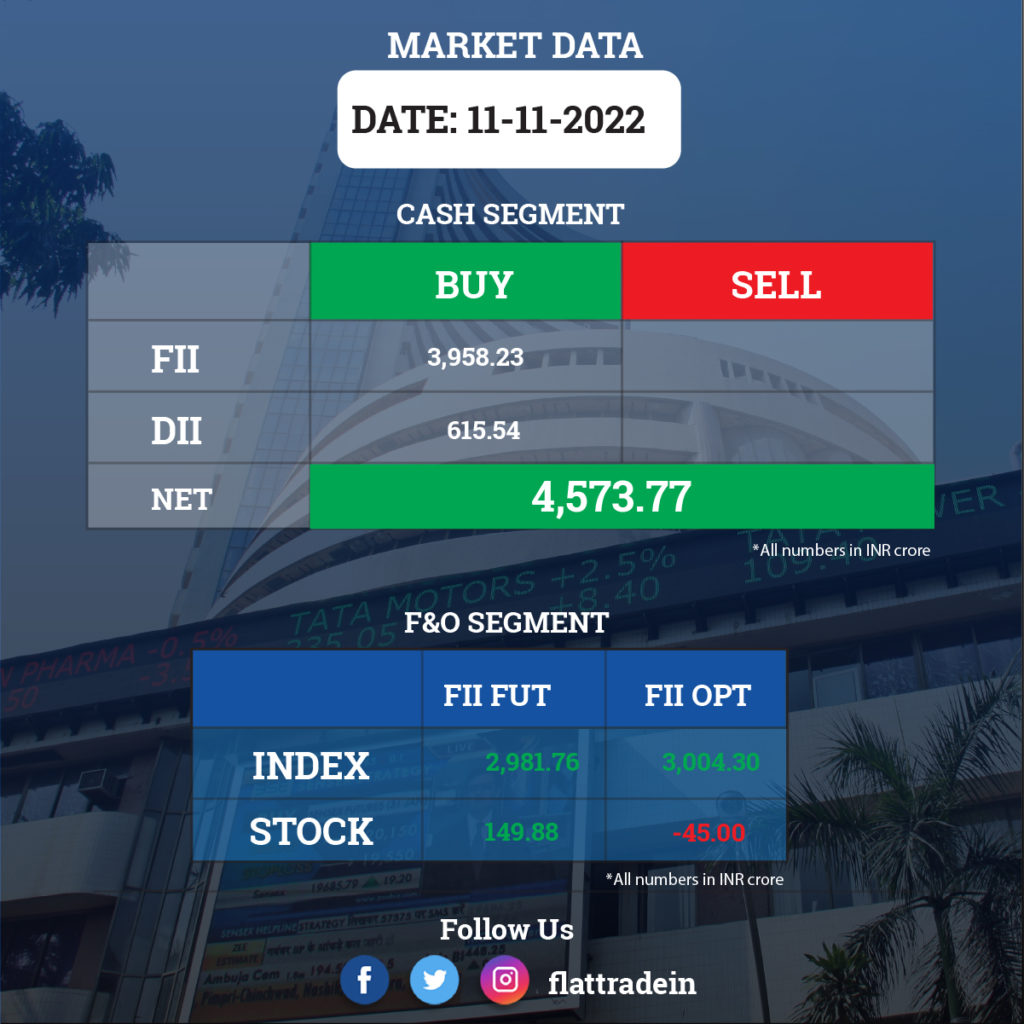

FII/DII Trading Data

Upcoming Results

ONGC, Grasim Industries, Bharat Forge, Godrej Industries, Biocon, Apollo Tyres, IRCTC, Aarti Industries, Abbott India, Ahluwalia Contracts, Aarey Drugs & Pharmaceuticals, Balkrishna Industries, BGR Energy Systems, Birla Tyres, CESC, Dilip Buildcon, Greaves Cotton, HUDCO, Indiabulls Housing Finance, Jyothy Labs, Linde India, Lux Industries, Mindspace Business Parks REIT, NBCC (India), Radico Khaitan, Sobha, and SpiceJet will report their quarterly earnings on November 14.

Stocks in News Today

LIC: The life insurance company registered a 27% year-on-year growth in net premium at Rs 1.32 lakh crore for the quarter ended September FY23. The net profit for the quarter stood at Rs 15,952 crore, a growth of 11 times compared to Rs 1,434 crore recorded in same period last year, partly driven by other income. Other income stood at Rs 6,795 crore as against Rs 46 crore YoY for the quarter including refund of income tax.

Adani Power: The company posted a net profit of Rs 695.53 crore for the quarter ended 30 September on the back of higher one-time income against a net loss of Rs 231 crore in the year-ago period. Consolidated total income for Q2FY23 came in at Rs 8,445.99 crore, 51.5% higher from Rs 5,571.76 crore in Q2FY22. Consolidated EBITDA for Q2FY23 was up 51% to Rs 2,350 crore against Rs 1,551 crore for Q2FY22 on higher one-time revenue. The increase in revenue was due to improved tariffs under long term Power Purchase Agreements (“PPAs”) on account of higher import coal prices, as well as improved short term tariffs due to higher demand, the company said.

Fortis Healthcare: The company’s net profit rose 67% year-on-year (YoY) to Rs 218 crore in Q2FY23 as against a net profit of Rs 131 crore in the corresponding quarter of the previous year. The revenues rose 10% YoY to Rs 1607 crore in Q2FY23 compared to 1463 crore in Q2FY22. EBITDA stood at Rs 316 crore in Q2FY23, up by 9% YoY. The hospital business revenues grew 18% YoY to Rs 1,297 crores in Q2FY23 versus Rs 1099 crores in Q2FY22. The company said the growth in hospital business was led by higher occupancy, a better product mix and a 164% increase in international patient revenues.

Zee Entertainment Enterprises: The media and entertainment company reported a 58% year-on-year decline in profit at Rs 112.8 crore for the September FY23 quarter, due to weak operating performance and muted top line growth. Revenue for the quarter was at Rs 2,028.4 crore, a growth of 2.5 percent as domestic advertising revenues were lower by 7.7% due to FTA withdrawal (Zee Anmol) and challenging macroeconomic environment. EBITDA fell 26.3% YoY to Rs 297.3 crore for the quarter.

Glenmark Pharmaceuticals: The pharma company reported a 1.1 percent year-on-year growth in profit at Rs 260.4 crore for the quarter ended September FY23, with revenue rising 7.2 percent YoY to Rs 3,375.2 crore for the quarter impacted by North America business that fell 0.1 percent YoY but India business grew by 12.7 percent and Europe 11.9 percent YoY. EBITDA increased by 5.3 percent to Rs 621.6 crore in Q2FY23 and margin declined by 40 bps to 18.4 percent compared to year-ago period. Numbers were ahead of analysts’ estimates.

ABB India: The company posted 68.6% YoY growth in profit at Rs 202.5 crore for the quarter ended September FY23 with revenue rising 19.2% YoY to Rs 2,119.7 crore. The strong performance for the quarter was on the back of its expanding customer base and industry-leading product portfolio. On the operating front, EBITDA increased by 16.4% YoY to Rs 211 crore and margin expanded by 50 bps YoY to 10% for the quarter.

Thermax: The energy and environment solutions company recorded a 24.1 percent year-on-year growth in profit at Rs 109.2 crore for the quarter ended September FY23 on strong top line and operating performance. Revenue grew by 41.3 percent to Rs 2,075.3 crore and EBITDA surged 28.4 percent to Rs 140.8 crore for the quarter compared to same period last year. As on September 2022, Thermax Group had an order balance of Rs 9,485 crore, up 46 percent YoY.

Bharat Dynamics: The state-owned company reported a massive 75.3 percent year-on-year growth in profit at Rs 75.8 crore for the quarter ended September FY23, supported by healthy operating performance and higher other income. Revenue grew by 6.1 percent to Rs 534.8 crore compared to year-ago period. EBITDA increased by 41.9 percent YoY to Rs 93.8 crore and margin expanded by 450 bps YoY to 17.6 percent for the quarter.

Indiabulls Real Estate: The real estate firm reported a 10-fold year-on-year increase in profit at Rs 56.5 crore for quarter ended September FY23 largely driven by operating performance, but revenue from operations fell 44.4 percent YoY to Rs 194 crore for the quarter. EBITDA at Rs 91 crore for the quarter increased by 306 percent YoY, and margin jumped 40 percentage points as cost of land, plots, constructed properties and others dropped significantly.

EID Parry India: The sugar company clocked a 20 percent year-on-year growth in consolidated profit at Rs 565 crore for quarter ended September FY23 on healthy top line. Consolidated revenue from operations grew by 62 percent to Rs 11,327.6 crore compared to year-ago period, and EBITDA increased by 27.3 percent to Rs 950 crore but margin fell by 230 bps YoY due to higher input cost.

Manappuram Finance: The company reported a 10.7% rise in consolidated net profit at Rs 409.48 crore for the quarter ended September 30, 2022. The NBFC had posted a net profit of Rs 369.88 crore in the year-ago quarter. Sequentially, profit grew by 45% from the June 2022 quarter. The company’s consolidated assets under management (AUM) grew by 7.89% to Rs 30,664.96 crore from Rs 28,421.63 crore a year ago. Its board of directors has approved an interim dividend of Rs 0.75 per share with face value of Rs 2 each, it added.

Prestige Estates: The real estate firm has reported a 55. 2% increase in quarterly net profit as prompt completion and delivery of projects helped revenues. Net profit for the September quarter increased to Rs 149 crore despite the recent inflationary escalations and interest rate hikes, the company said. During the quarter, the company’s net revenue increased 9. 63% from a year ago to Rs 1,474 crore. For the second quarter, the company registered property sales of Rs 3,511 crore, up by 66% YoY, and collections of Rs 2,602. 9 crore up by 68% YoY. Sales during this period is attributed to 4. 55 million sq ft volume with an average realisation of ?7,711 per sq ft. The company sold 3,210 units in the quarter.

Aurobindo Pharma: The company reported a 41% decline in its consolidated net profit at Rs 409 crore for the second quarter ended September 30, 2022. The Hyderabad-based drug firm had posted a net profit of Rs 697 crore in the July-September period of last fiscal. Revenue from operations also declined to Rs 5,739 crore in the September quarter as against Rs 5,942 crore in the year-ago period. Vice-Chairman and Managing Director K Nithyananda Reddy said the company’s second quarter performance was subdued, mainly due to macro-environment factors and higher competitive intensity for some products in the US.

RITES: The public sector transport consultancy and engineering firm, has reported 19.6 per cent decline in consolidated profit after tax (PAT) at Rs 140.20 crore for September quarter 2022-23. The company had logged a PAT of Rs 174.49 crore in the year-ago period, RITES said in a BSE filing on Friday.

Income dropped to Rs 684.30 crore from Rs 788.85 crore in the year-ago period.