Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.28% higher at 17,641, signalling that Dalal Street was headed for a positive start on Friday.

Chinese shares were trading lower as technology-related stocks declined. The CSI 300 index was down 0.97% and the Hang Seng index fell 1.52%. Japanese shares were trading higher with the Nikkei 225 index gaining 1.09% and the Topix increasing by 0.57%.

Indian rupee gained 12 paise to 82.73 against the US dollar on Thursday.

Inflation-adjusted gross domestic product in the US, increased at a 2.7% annualized rate during the period, Commerce Department data showed on Thursday. The data and details of the report showed that the economy was losing steam at the end of 2022. Household expenditures increased an annualized 1.4% in the final three months of 2022, driven by a third-straight quarter of decline in spending on durable goods such as motor vehicles. Consumer spending was previously estimated as rising by 2.1%.

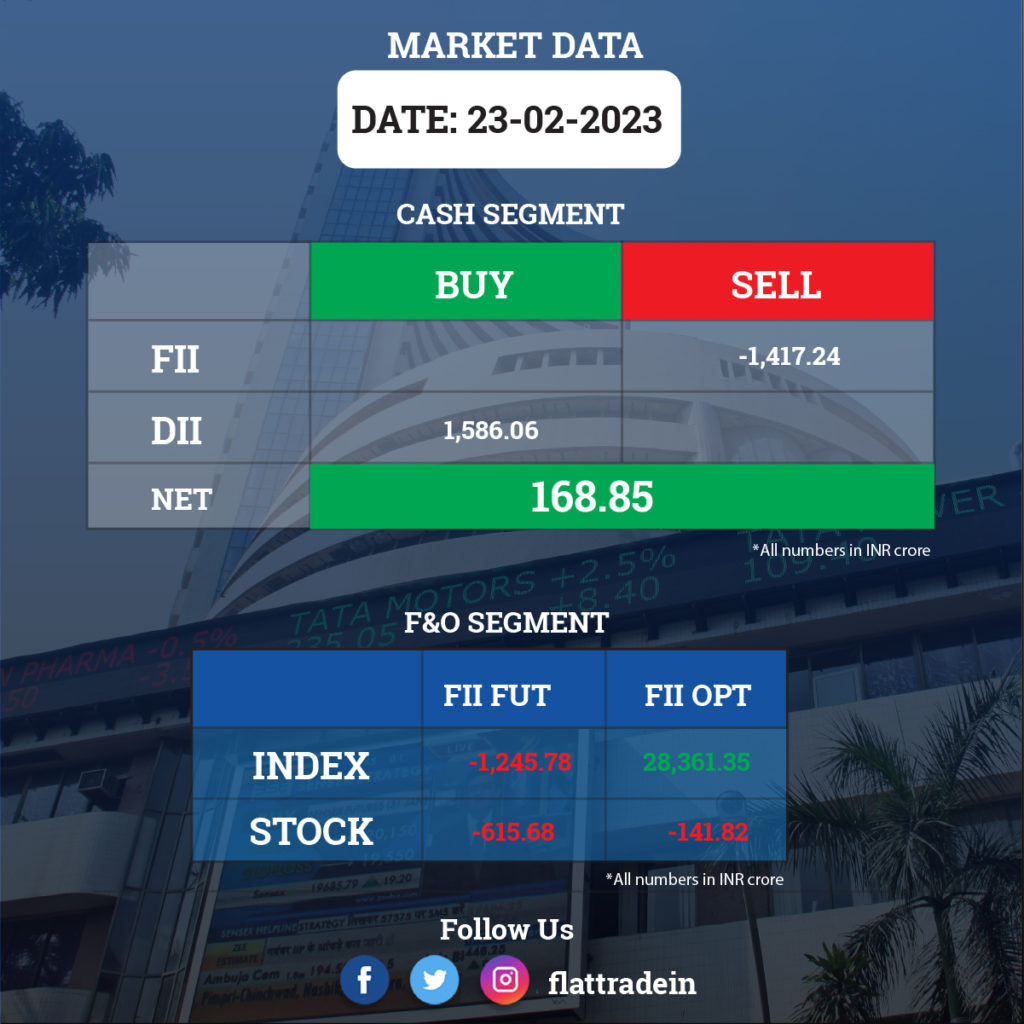

FII/DII Trading Data

Stocks in News Today

Adani Transmission: Rating agency Fitch has affirmed the ‘BBB-’ rating on senior secured notes issued by the restricted group of Adani Transmission and has said its outlook is stable. The credit assessment reflects the project companies’ availability-based revenue under a supportive regulatory framework, with low technical complexity, reflected in high availability levels. It expects operating performance of entities to remain stable.

ONGC: The oil and gas producer will invest over $2 billion in drilling a record 103 wells on its main gas-bearing asset in the Arabia Sea as it pivots a turnaround plan that will add 100 million tonnes to production. “We have released a record 103 locations for drilling of wells on the Bassein and Satellite (B&S) assets over the next 2-3 years,” ONGC Director (Offshore) Pankaj Kumar said. The wells will tap smaller and hereto untapped reservoirs and help raise output.

Bharat Forge: The investment committee of the company’s defence business has approved the transfer of the company’s stake in Aeron Systems, to wholly-owned subsidiary Kalyani Strategic Systems. The leading forging company has decided to house all its defense-related investments under Kalyani Strategic Systems, for a better strategic alignment.

Zee Entertainment Enterprises Ltd. (ZEEL): The media company filed an appeal in the National Company Law Appellate Tribunal (NCLAT) seeking relief after the Mumbai bench of the National Company Law Tribunal (NCLT) allowed the initiation of insolvency proceedings against the media company. This appeal comes a day after the NCLT ruling. “All necessary steps are being taken as per law to protect the interests of all stake holders of Zee Entertainment and to achieve timely completion of the proposed merger with Culver Max Entertainment Pvt. Ltd (Sony),” according to a statement from the office of Punit Goenka.

Tech Mahindra: The IT company announced that it is expanding its partnership with Vodafone Germany to enhance customer and sales experience. As a part of this multi-year engagement, Comviva, a Tech Mahindra company, will deliver a unified sales solution across mobile, fixed, cable and TV services businesses of Vodafone Germany. The partnership will target transforming non-assisted digital sales channels and elevating the entire integrated buying experience.

Axis Bank: The private sector lender said that the deal to acquire Citibank India’s consumer business and NBFC business of Citicorp is expected to be completed by March 1.

Alkem Laboratories: The company said that the USFDA has concluded its inspection at the company’s Indore facility. The USFDA had issued an Establishment Inspection Report (EIR) for the company’s manufacturing unit, after inspecting the company’s Indore facility in July 2022. After the inspection, Alkem Labs was issued Form 483 containing only one observation.

Isgec Heavy Engineering: The company has received an order from a major steel company in eastern India for the supply of seven waste heat recovery boilers utilising waste gases from DRI sponge iron kiln. These boilers will generate steam at 125 kg/cm2(a) pressure.

KSB: The pumps and valves manufacturer announced payment of a dividend of Rs 15 per share (face value Rs 10 each up) for the financial year ended December 2022. The company recorded a 42% YoY growth in consolidated profit at Rs 56 crore for the quarter ended December 2022. Revenue from operations for the quarter at Rs 524.6 crore increased by 18% YoY during the reported quarter. EBITDA rose by 36.2% YoY to Rs 76.8 crore with a margin expansion of 196 bps for the quarter under review.

Sanofi India: The healthcare company has reported a 45% YoY growth in profit at Rs 130.9 crore for quarter ended December 2022. Revenue for the reported quarter fell by 2.3% YoY to Rs 672 crore. EBITDA jumped 31.2% to Rs 167 crore with a margin expansion of 635 bps compared to the year-ago period. The company announced a final dividend of Rs 194 per share (face value Rs 10 each) and a second special dividend of Rs 183 per share for the financial year ended December 2022.

West Coast Paper Mills: The company said the illegal strike of contract workers was called off and production at the paper and paper board division at Dandeli has begun. There has been marginal production loss due to the disruption of plant operations. However, during that period, the company carried out the needed preventive maintenance work in the plant.

Mahindra Lifespace Developers: Arvind Subramanian has resigned as Managing Director and Chief Executive Officer of the real estate developer with effect from May 22 this year, to pursue his personal interests outside the company. The company has appointed Amit Kumar Sinha as Managing Director and Chief Executive Officer, for a period of five years with effect from May 23 this year.

Nahar Industrial Enterprises: The National Company Law Tribunal’s Chandigarh bench has sanctioned the scheme of arrangement for the amalgamation of Cotton County Retail with Nahar Industrial Enterprises.

Tube Investments: It has acquired a 50% stake in X2Fuels and Energy, which is an early-stage start-up engaged in developing thermochemical technologies for the conversion of any solid feedstock into storage liquid and solid fuels.

Vason Engineers: The company has bagged an order worth Rs 95.92 crore from Pune Metropolitan Region Development Authority for construction of residential quarters.

Rail Vikas Nigam: The company has recieved a letter of award from M. P. Madhya Kshetra Vidyut Vitaran Co. for a project worth Rs 196.77 crore.