Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.48% higher at 18,079, signalling that Dalal Street was headed for positive start on Friday.

Asian stocks rallied on positive investor sentiments after robust technology earnings boosted Wall Street, while awaiting the policy decision from the Bank of Japan. The Nikkei 225 inde rose 0.7%, Topix was up 0.69%, the Hang Seng jumped 0.95% and the CSI 300 index climbed 0.69%.

Indian rupee fell 7 paise to 81.84 against the US dollar on Thursday.

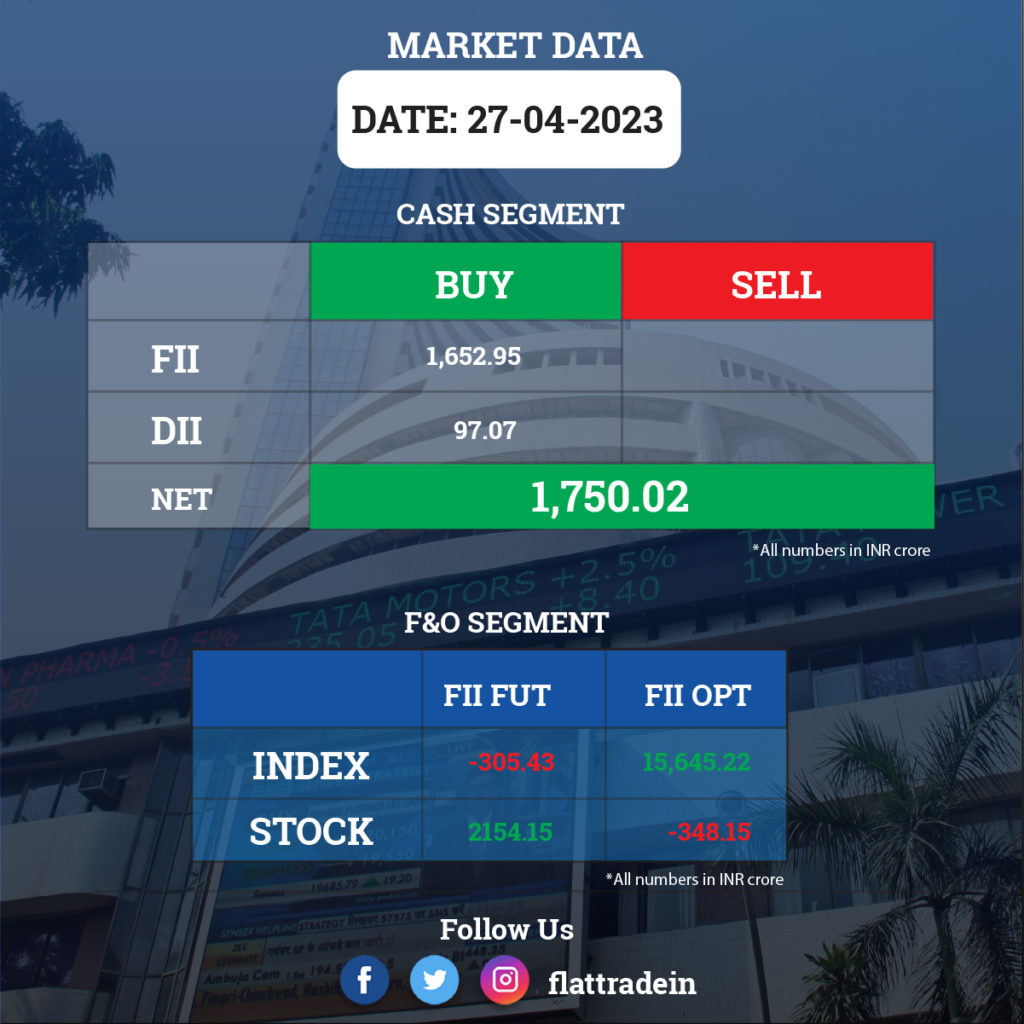

FII/DII Trading Data

Upcoming Results

Ultratech Cement, SBI Cards and Payment Services, Supreme Industries, L&T Finance Holdings, Atul, Orient Cement, Vedant Fashions, IndiaMART IndiaMESH, CarTrade Tech, Mahindra & Mahindra Financial Services, CSB Bank, Star Health and Allied Insurance Company, Datamatics Global Services, DB (International) Stock Brokers, eMudhra, Geojit Financial Services, Kesoram Industries, Kalyani Steels, Ramkrishna Forgings, Axita Cotton, Himadri Speciality Chemical, IOL Chemicals & Pharmaceuticals, Mangalore Refinery & Petrochemicals, RPG Life Sciences, Sangam (India), Satia Industries, Tata Metaliks

Stocks in News Today

Axis Bank: The private sector lender swung to a loss of Rs 5,728.4 crore for March FY23 quarter, against a profit of Rs 4,117.8 crore in same period last year. The loss was attributed to the buying cost of Citi Bank’s India consumer business during the quarter. Profit excluding the impact of exceptional items was been Rs 6,625.29 crore for the quarter, a 61% growth YoY. Net interest income grew 33.14% YoY to Rs 11,742.2 crore in Q4FY23. Net NPA stood at 0.39% in the quarter under review as against 0.47% in the preceding quarter.

Wipro: The IT major recorded a 0.7% sequential growth in consolidated profit at Rs 3,074.5 crore for quarter ended March FY23, while consolidated revenue declined 0.2% QoQ to Rs 23,190.3 crore for the quarter. EBIT fell 0.89% YoY to Rs 4,219.3 crore in the reported quarter. IT services business revenue increased 0.7% sequentially to $2,823 million, with constant currency revenue growth declining 0.6%. The company announced a share buyback, where it will buy 29.97 crore shares from existing shareholders at Rs 445 apiece, spending Rs 12,000 crore in total.

Tech Mahindra: The IT services provider posted a 13.8% sequential decline in consolidated net profit at Rs 1,117.7 crore on weak operating performance and lower topline growth. Revenue dropped 0.11% QoQ to Rs 13,718.2 crore during the quarter. EBIT fell 19.93% YoY to Rs 1,317.8 crore in Q4FY23. Revenue growth in constant currency terms came in at 0.3%, while deal wins were at $582 million in Q4FY23. The board has recommended a final dividend of Rs 32 per share for the fiscal 2023.

LTIMindtree: The IT company said its consolidated profit grew 11.3% QoQ to Rs 1,113.7 crore while revenue increased 0.8% to Rs 8,691 crore compared to the previous quarter. Operating numbers remained strong, boosting bottomline. EBIT rose 16.7% QoQ to Rs 1,560.10 crore in Q4FY23. Revenue in dollar terms increased by 1% QoQ to $1,057.5 million and the same in constant currency grew 0.7%. The board recommended final dividend of Rs 40 per share for FY23.

State Bank of India: The bank has raised $750 million through senior unsecured fixed rate notes, with a maturity of five years and coupon of 4.875%.

IRB Infrastructure Developers: The infrastructure company has emerged as the selected bidder for the project of tolling, operation, maintenance & transfer (TOT) of Nehru Outer Ring Road in Hyderabad, Telangana. The total length of the project road is 158 km. The company has received Letter of Award from Hyderabad Metropolitan Development Authority (HMDA). IRB will pay upfront concession fee of Rs 7,380 crore to HMDA for revenue-linked concession period of 30 years.

ACC: The cement company reported a 40.5% year-on-year decline in consolidated profit at Rs 235.63 crore for Q4FY23, impacted partly by weak operating performance and exceptional loss. Revenue grew 8.2% YoY to Rs 4,790.9 crore for the quarter. Ebitda fell 26.2% YoY to Rs 468.52 crore. The board recommended a dividend of Rs 9.25 per share for the fiscal 2023, subject to shareholders approval. The dividend is expected to be paid starting from July 25, 2023.

Mphasis: The company said consolidated revenue fell 4.14% QoQ to Rs 3,361.22 crore in Q4FY23. Consolidated net profit was down 1.69% QoQ at Rs 405.31 crore in Q4FY23. Ebit dropped 3.05% QoQ to Rs 574.99 crore in Q4FY23. The board declared a final dividend of Rs 50 per share for the fiscal 2023.

Motilal Oswal Financial Services: The company’s consolidated revenue was down 2.28% YoY at Rs 1,027.37 crore in Q4FY23. Net loss stood at Rs 50.68 crore in Q4FY23 as against a net profit of Rs 47.31 crore in the year-ago period. Ebitda fell 9.93% YoY to Rs 443.63 crore in Q4FY23. The board recommended an interim dividend of Rs 3 per share for the financial year 2022-23.

Aditya Birla Sun Life AMC: The company’s consolidated revenue fell 16.55% YoY to Rs 269.98 crore in Q4FY23. Net profit fell 14.48% YoY to Rs 135.57 crore in Q4FY23. Ebitda fell 33.12% YoY to Rs 131.02 crore in Q4FY23. The board recommended a final dividend of Rs 5.25 per share for the fiscal 2023.

Trent: The company’s consolidated revenue rose 64.26% YoY to Rs 2,182.75 crore in Q4FY23. The company reported a consolidated net profit of Rs 45.01 crore in Q4FY23 compared to a consolidated net loss of Rs 20.87 crore in the year-ago period. The board approved a final dividend of Rs 2.20 per share for the previous fiscal, setting the record date at May 25, 2023. The dividend will be paid starting from June 16, 2023.

Indian Hotels Company: The company said consolidated revenue was up 86.39% YoY at Rs 1,625.43 crore in Q4FY23. Net profit was up 343% YoY at Rs 328.27 crore in Q4FY23. Ebitda was up 236.83% YoY at Rs 535.49 crore in Q4FY23. The company announced a dividend of Rs 1, subject to investors’ approval at the upcoming AGM.

IRB Infrastructure: The company has received the letter of award from Hyderabad Metropolitan Development Authority for building an eight-lane outer ring road on tolling, operation, maintenance and transfer model. The company’s asset base will expand to over Rs 70,000 crore and O&M order book will grow by Rs 14,500 crore.

KNR Construction: The company signed a concession pact with for building a six-lane greenfield highway from Greenfield Highway from Marripudi to Somvarappadu of Bengaluru-Vijayawada economic corridor in Andhra Pradesh.

HFCL: The company has received purchase orders worth Rs 65.72 crore from Reliance Retail for supply of optical fiber cables “to one of the leading private telecom operators of the country.”

SpiceJet: The airline has appointed Arun Kashyap, the chief technical officer at Air India, at its chief operating officer, effective June 12.

PI Industries: The company’s wholly owned subsidiary PI Health Sciences will acquire Indian subsdiairiy of Therachem Research Medilab — TRM India — for $42 million (Rs 343.37 crore). It will also acquire Solis Pharmachem for $3 million and Archimia for €34.2 million. The company will purchase certain identified products of PI Health Sciences US for $5 million

Indian Railways Catering and Tourism Corporation: The company has signed an MoU with Border Security Force for comprehensive train booking and on-board catering services to paramilitary force’s personnel.

Punjab National Bank: The bank will participate in the rights issue of overseas subsidiary Druk PNB Bank to infuse Rs 72.82 crore.

RattanIndia Enterprises: The company launched its first direct-to-consumer fashionwear brand Fyltr via its wholly owned subsidiary Neobrands.