Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.53% higher at 17,933, signalling that Dalal Street was headed for a positive start on Thursday.

Japanese shares opened lower on Thursday after the US-based Nasdaq index dropped following tepid results from Microsoft and Google’s parent company Alphabet. Nikkei 225 index was down 0.19% and Topix fell by 0.52%. Meanwhile, Chinese shares were trading higher. Hang Seng index jumped 2.74% abd CSI 300 in was up 0.28%.

Indian rupee stood at 82.73 against the US dollar.

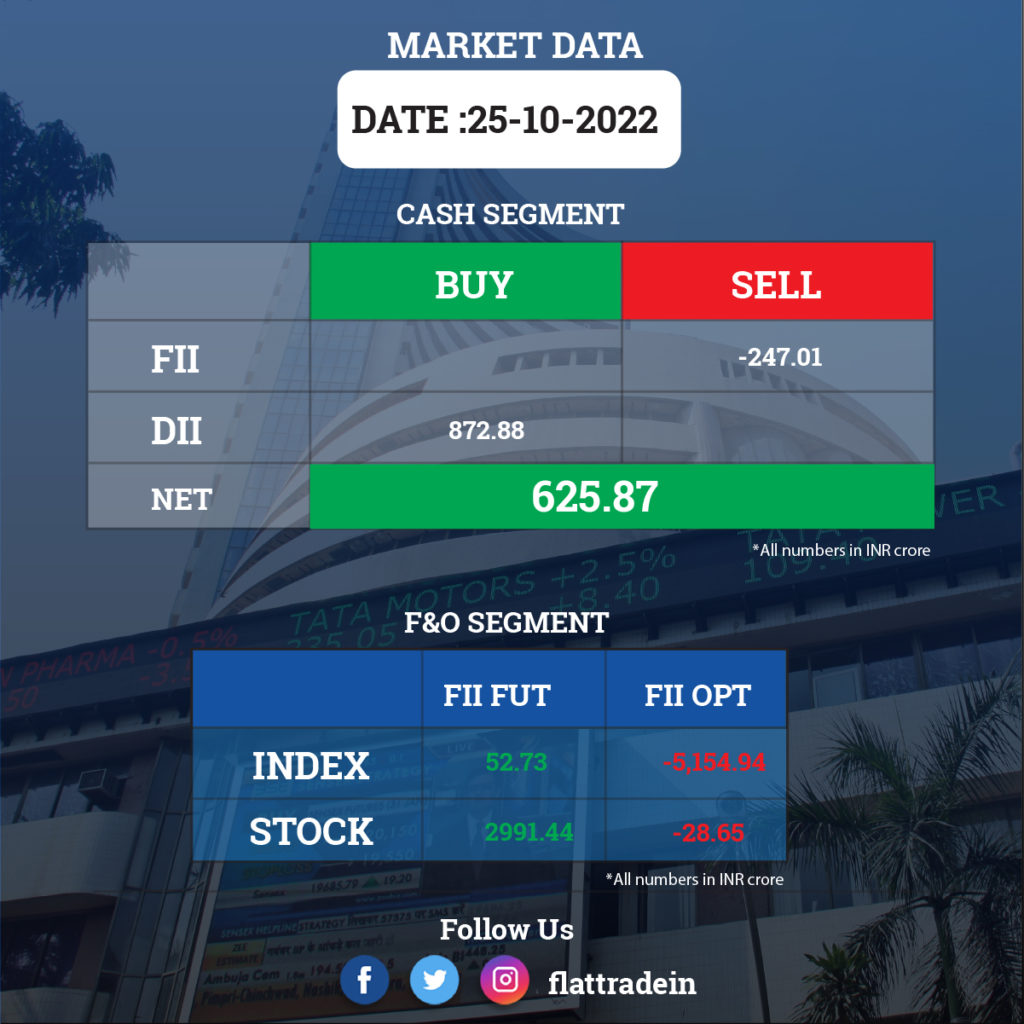

FII/DII Trading Data

Upcoming Results

Aditya Birla Sun Life AMC, SBI Cards and Payment Services, Indus Towers, PNB Housing Finance, Tata Chemicals, Anupam Rasayan India, Balaji Amines, REC, Latent View Analytics, Lloyds Steels Industries, CE Info Systems, PC Jeweller, Supreme Petrochem, Tamilnad Mercantile Bank, Vaibhav Global and V-Guard Industries will report their quarterly earnings on October 27.

Stocks in News Today

Dabur India: The FMCG company ended the second quarter of FY23 with consolidated profit of Rs 490.1 crore, down 3% compared to year-ago period. Its consolidated revenue stood at Rs 2,986.5 crore, up 6% YoY for the quarter ended September FY23. The company said it will buy 51% stake in Badshah Masala for Rs 587 crore and the remaining 49% stake will be acquired after five years. Badshah Masala is engaged in the business of manufacturing, marketing and export of ground spices, blended spices and seasonings.

Tata Steel: The company has inked an agreement with American carmaker Ford to supply “zeremis green steel” from its Netherlands-based IJmuiden plant after the unit shifts to hydrogen-based steel making. In Europe, Tata Steel is working to switch to low-carbon technologies to manufacture steel in the UK and the Netherlands.

Reliance Retail: The retail arm of Reliance Industries is expanding its business into the fast-growing toy sector through its brand Rowan to operate in the affordable segment with a smaller shop size. The company has now brought this homegrown brand to the front end by opening its first EBO (exclusive brand outlet) at Gurugram in NCR in the last quarter with a store size of 1,400 sq feet. Under this new format, Reliance Retail will have a range of affordable toys not only from the brand Rowan on its shelves but also from other brands.

Hero MotoCorp: The two-wheeler maker is set to commence its operations in the Philippines. Terrafirma Motors Corporation (TMC), a part of the Columbian Group of Companies, announced partnering with Hero and it will be the exclusive assembler and distributor of Hero MotoCorp motorcycles in Philippines.

Chennai Petroleum Corporation: The refiner recorded a 99% sequential decline in standalone profit at Rs 27.88 crore for the quarter ended September FY23, due to windfall tax on exports. Revenue declined nearly 17% QoQ to Rs 22,894 crore for the quarter. The government on July 1 levied duties on export of petroleum products at the rates notified on fortnightly basis, which have been reduced in the refinery transfer pricing. This has resulted in lower revenue and profitability for the quarter, the company said in a BSE filing.

Tata Power Solar Systems: The company announced the launch of cost-efficient solar off-grid solutions in West Bengal, Bihar and Jharkhand. Tata Power Solar Systems Ltd (TPSSL) is a subsidiary of Tata Power. The off-grid solutions provide a combination of high-efficient solar modules, inverters and batteries and are available in 11 variants ranging from 1 – 10 Kw with 5-year warranty, the company said.

DLF: The realty major plans to launch new projects worth Rs 3,500 crore during the second half of this fiscal, mainly in Gurugram and Panchkula to meet the rising demand. The company plans to launch around 3 million square feet area across residential projects.

Crompton Greaves Consumer Electricals: The appliance maker reported a drop of 18% in net profit to Rs 131 crore for the September quarter. The company had posted a net profit of Rs 159 crore for the July quarter. The consolidated revenue of the company grew by 23% to Rs 1,700 crore in the quarter under review from Rs 1,385 crore a year ago. The company’s EBITDA for the quarter stood at Rs 193 crore, a decline of 10%. The EBITDA in the year ago period was Rs 214 crore.

Zee Entertainment Enterprises (ZEEL): The company and Sony India have agreed to sell three Hindi channels — Big Magic, Zee Action and Zee Classic — to address anti-competition concerns due to their proposed merger. The CCI made public its detailed 58-page order, specifying the channels that would be dropped.

Route Mobile: The company said its board has approved providing corporate guarantee in favour of Standard Chartered Bank for a term loan facility proposed to be taken by subsidiary Route Mobile (UK) of up to $15 million. The corporate guarantee will be treated as a contingent liability for the company.

Ramkrishna Forgings: The company has reported 27% growth in profit after tax (PAT) at Rs 64 crore for September quarter 2022 on account of higher revenues. It had clocked Rs 50.11 crore profit in July-September period a year ago. Revenue rose to Rs 762.55 crore in the reported quarter from Rs 578.93 crore in the year-ago period.

Power Finance Corporation: HDFC Mutual Fund through its several schemes sold a 2.07% stake in the company through open market transactions on October 21. With this, its shareholding in PFC reduced to 6.94%, down from 9.01%.

Trident: The company said it has completed a solar power project of 8.87 MWp at Budhni in Madhya Pradesh. With this, it has commissioned both phases—Phase 1 of 5.48 MWp and Phase II of 3.39 MWp solar power plants—for captive use. The company is moving towards a greener planet as the group aims to use renewable and clean energy for reducing carbon emissions, it said.

CSB Bank: Maybank Securities Pte Ltd acquired 26,39,673 equity shares (1.5% stake) in the private sector lender via open market transactions at an average price of Rs 232.3 per share. However, Nomura Singapore which held 1.84% shareholding in the bank as of September 2022 was the seller for shares in a transaction on October 25. Meanwhile, SBI Mutual Fund on October 21 had acquired additional 1.78% shareholding in the bank, raising is total stake to 7.21% from 5.42% earlier.

IIFL Finance: The company reported a 36% year-on-year growth in consolidated profit at Rs 397 crore for the quarter ended September FY23, driven by higher revenue as well as operating performance. Revenue from operations grew by 21% to Rs 2,023 crore compared to year-ago period.

Gland Pharma: The pharmaceutical company has reported a 20% year-on-year decline in profit at Rs 241.2 crore for quarter ended September FY23, dented by weak topline as well as operating performance. Revenue for the quarter fell 3% to Rs 1,044.4 crore compared to year-ago period, impacted by lower business from India and Rest of World, while core markets (US, Europe, Canada and Australia) recorded 3% YoY growth.

Ahluwalia Contracts (India): The company has secured orders for construction work of Amity Campus Hyderabad (Telangana) from Ritnand Balved Education Foundations worth of Rs 60 crore and construction of civil, structural and external development work from Muthoot Hospital worth of Rs 43 crore. The order inflow during the FY23 stood at Rs 3,114.72 crore, till date.

Zydus Lifesciences: The company has received approval from the United States Food and Drug Administration (USFDA) to market Micafungin for injection in the US. Micafungin is indicated to treat variety of fungal infections. It is also used to prevent fungal infections in patients who are having a stem cell transplant. The drug will be manufactured at the group’s injectable manufacturing facility at Jarod in Gujarat.

Century Textiles and Industries: The company recorded consolidated profit at Rs 70 crore for the quarter ended September FY23, up 118% over profit of Rs 32 crore reported in year-ago period, driven by strong operating performance. Revenue during the quarter grew by 20% YoY to Rs 1,242 crore aided by pulp and paper business.

PCBL: The company has reported a 4.6% year-on-year decline in consolidated profit at Rs 116.5 crore for the quarter ended September FY23, dented by higher input cost. Revenue for the quarter at Rs 1,628 crore increased by 52.5% compared to year-ago period.

Jammu and Kashmir Bank: The lender is planning to sell its non-performing assets worth Rs 960 crore, as part of its efforts to improve its balance sheet, PTI news reported citing sources in the bank. The bank is hoping that the process of sale of these non-performing assets to the National Asset Reconstruction Company Limited (NARCL) will be completed by the end of this month, the sources said.