Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.36% higher at 18,794, signalling that Dalal Street was headed for a positive start on Friday.

Most Asian shares were trading higher as investor optimism rose after China eased Covid-19 restrictions. The Nikkei 225 index rose 1.35% and the Topix index gained 1.17%. The Hang Seng index advanced 0.42%, while the CSI 300 index fell 0.26%.

Indian rupee slipped 5 paise to 82.42 against the US dollar on Thursday.

Brent Crude oil prices stood at $76.74 per barrel and WTI Crude oil prices were hovering around $72.13 a barrel.

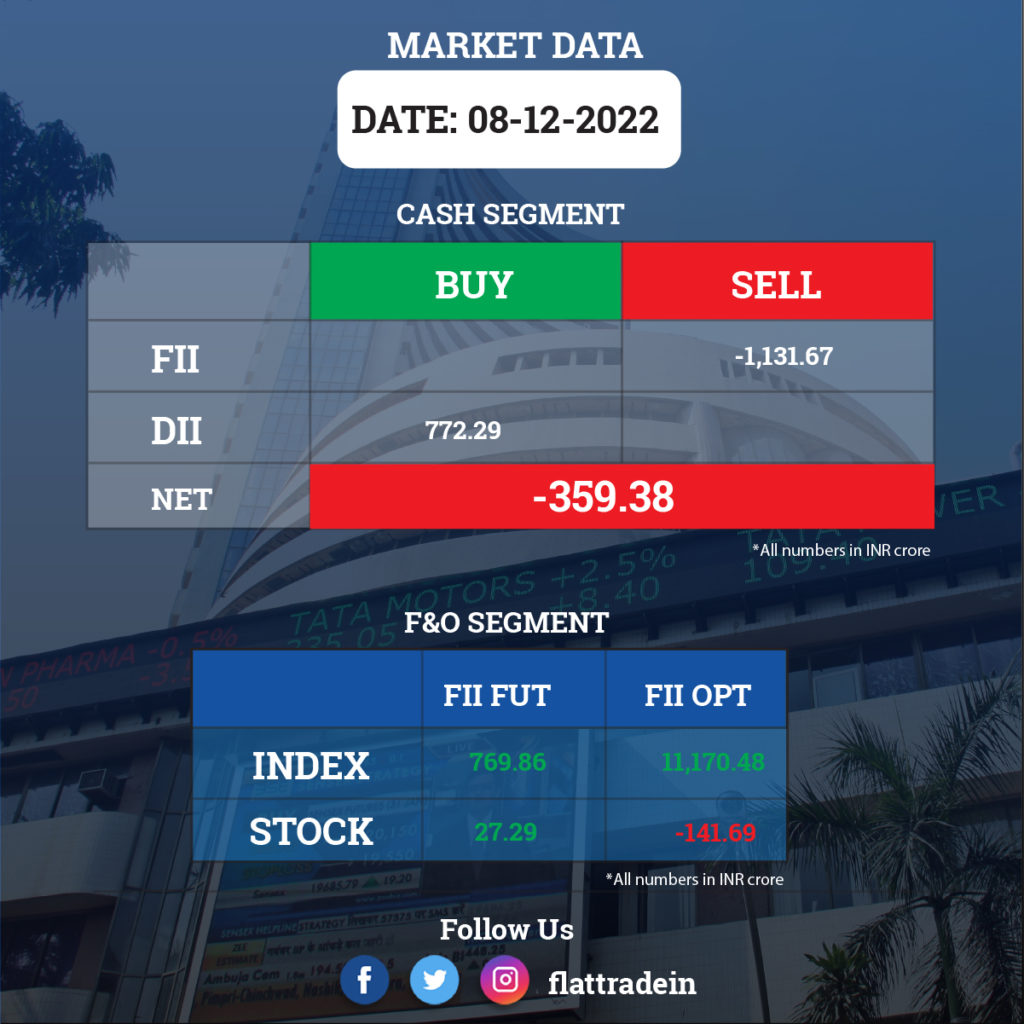

FII/DII Trading Data

Stocks in News Today

Adani Enterprises: The company has acquired 100% stake in Alluvial Mineral Resources, from Adani Infra (India). Alluvial Mineral Resources is engaged in mining of minerals & ores activities and other allied activities.

Hindustan Unilever Ltd (HUL): The FMCG company will acquire a 51% stake in Zywie Ventures’ OZiva for a cash consideration of Rs 264.28 crore. The remaining 49% will be acquired at the end of 36 months on pre-agreed valuation criteria, the company said. Separately, HUL will acquire a 19.8% stake for a cash consideration of Rs 70 crore. With this acquisitions, the company plans to foray into the health and wellbeing segment.

Jindal Steel & Power (JSPL): The company has acquired Monnet Power Company for a consideration of Rs 410 crore under the insolvency resolution process. JSPL last month won the bid for Monnet Power, which has a 1050 MW under-construction power plant in Odisha’s Angul. The company is likely to spend another Rs 1,500 – 2,000 crore as capital expenditure for the newly acquired assets of Monnet Power, which is expected to be fully operational in the coming 1-1.5 years.

One 97 Communications Limited (Paytm): The company will hold a board meeting on December 13 to consider a proposal for a share buyback, the fintech major disclosed said in an exchange filing. “The management believes that given the Company’s prevailing liquidity/ financial position, a buyback may be beneficial for our shareholders,” the company said.

InterGlobe Aviation (IndiGo): The carrier said it will operate 168 weekly flights to eight domestic destinations from the New Goa International Airport. The airport will commence commercial operations from January 5 next year. This will be the second international airport in the state that will be inaugurated by Prime Minister Narendra Modi on December 11.

Max Financial Services: The financial services firm has completed acquisition of balance 5.17% stake in Max Life Insurance Company from Mitsui Sumitomo Insurance Company, Japan. After this transaction, its shareholding in Max Life will rise to 87%.

Cummins India, GAIL: Cummins said that it would provide technology to build one of India’s largest proton exchange membrane (PEM) electrolyser for GAIL at Vijaipur, Madhya Pradesh, in collaboration with EPC player Tecnimont, the Indian subsidiary of Maire Tecnimont Group. The project is expected to produce 4.3 tonne of green hydrogen per day.

Kalpataru Power: The utilty company said its board has approved a proposal to raise Rs 99 crore through issuance of non-convertible debentures (NCDs). A total of 990 NCDs of face value of Rs 10 lakh each will be issued under the fundraising plan.

Lupin: The pharma major has appointed Spiro Gavaris as President of US generics business. Previously, he served as President of specialty generics business at Mallinckrodt Pharmaceuticals and the President of US injectables at Hikma.

Jyoti: The company has secured order for Khalwa micro irrigation project from Navayuga Engineering Company. The order worth Rs 21.25 crore includes designing, engineering, manufacturing, testing & supply of large capacity vertical pumps and HT motors for Water Resource Department (WRD).

Dharmaj Crop Guard: The agrochemical company had a strong stock market debut on Thursday, as it got listed at a premium of over 12% against its issue price on the stock exchanges. The scrip was listed at Rs 266.05 apiece on the NSE, registering a gain of 12.26% from its offer price of Rs 237 per equity share. The shares hit a high of Rs 279 and a low of Rs 264.30. Finally, the company shares closed at Rs 266.30.