Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.37% at 19,097.50, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were trading lower as investor were cautious ahead of Fed’s monetary policy meeting this week. The Nikkei 225 index fell 1.23% and the Topix was down 1.04%. The Hang Seng dropped 0.51% and the CSI 300 index was flat.

The Indian rupee closed at 83.24 against the US dollar on Friday.

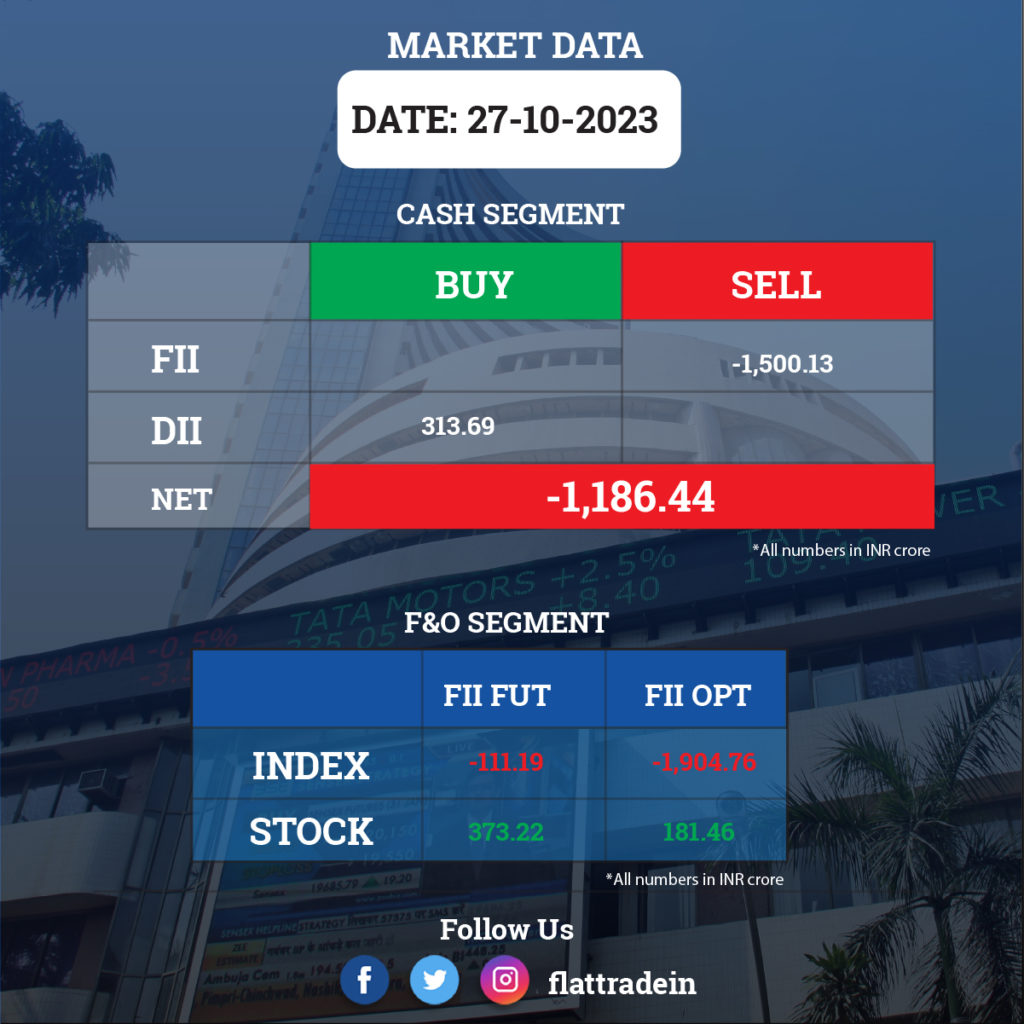

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The conglomerate reported a consolidated net profit of Rs 19,878 crore in Q2FY24, an increase of 29.7% YoY. Gross revenue from operations stood at Rs 2.55 lakh crore in Q2FY24, compared to Rs 2.52 lakh crore int eh year-ago period. Net profit attributable to the owners of the company (profit after tax and minority interests) came in at Rs 17,394 crore in the quarter under review, compared to Rs 13,656 crore in the same period last year. RIL’s Ebitda increased by 30.2% to Rs 44,867 crore in Q2FY24. RIL’s net debt fell to Rs 1.17 lakh crore in September, from Rs 1.25 lakh crore in March this year.

Bharat Petroleum Corporation (BPCL): The state-owned oil marketing company posted a standalone profit of Rs 8,501.2 crore for the quarter ended September FY24, as against a net loss of Rs 304.2 crore in the same period last year. Revenue from operations fell by 10.3% YoY to Rs 1,02,986 crore during Q2FY24.

UltraTech Cement: The cement manufacturer said that its board has approved an investment of Rs 13,000 crore towards increasing the capacity by another 21.9 mtpa with a mix of brown field and greenfield projects. The commercial production from the new capacities is expected to go on stream in a phased manner from FY26 onwards and will increase the company’s cement capacity to 187 mtpa globally.

Union Bank Of India: The public sector lender reported a 90% YoY growth in net profit at Rs 3,511 crore in Q2FY24, led by a significant fall in provisions. Net interest income rose 10% to Rs 9,126 crore, and net interest margin expanded by 3 bps to 3.18% during the reported quarter.

Bharti Airtel: The telecom company has partnered with Microsoft to offer Indian organisations calling services over Microsoft Teams through an integration with Airtel IQ. Separately, the Department of Telecommunications has imposed a penalty of Rs 1,63,000 for an alleged violation of subscriber verification norms.

M&M Financial Services (MMFS): The company posted a net profit of Rs 235 crore in Q2FY24, down by 47.5% YoY due to an increase in impairment on financial instruments. Revenue from operations grew by 24.1% YoY to Rs 3,212 crore during Q2FY24. Net interest income rose 9% YoY to Rs 1,674 crore in Q2FY24. Net interest margin for the quarter stood at 6.5% due to higher borrowing rates. Disbursements during Q2FY24 rose 13% YoY to Rs 13,315 crore.

IDFC First Bank: The private sector lender has registered 35% YoY growth in net profit at Rs 751 crore in Q2FY24 on the back of strong growth in core operating income. Net interest income for the quarter under review stood at Rs 3,950 crore, up by 32% YoY and net interest margin expanding 49 bps YoY to 6.32% in Q2 FY24. Gross NPA fell 6 bps QoQ to 2.11% and the net NPA declined 2 bps to 0.68% in the reported quarter.

SBI Cards and Payment Services Ltd (SBI Card): The company reported a 15% rise in net profit at Rs 603 crore for the quarter ended September 2023. It had reported a net profit of Rs 526 crore in Q2FY23. The total income in rose 22% to Rs 4,221 crore in Q2FY24, from Rs 3,453 crore in Q2FY23. Its interest income grew 28% YoY to Rs 1,902 crore in Q2Y24. Net NPAs (bad loans) rose to 0.89% from 0.78% in the corresponding quarter of last year.

Tata Power: The company’s renewable energy arm has signed a power delivery agreement with Mukand Ltd., a Bajaj Group company for a 43.75 MW AC Group Captive Solar project. The installation will generate 99.82 MUs annually.

Bombay Dyeing: The company’s Global Depository Receipt program has been terminated and the GDRs have been delisted from the Luxembourg Stock Exchange. With this development, Naira Holdings has surrendered their 27.40 lakh GDRs for cancellation and has taken possession of the equivalent corresponding equity shares of the company.

Strides Pharma Science: The company’s Singapore unit Strides Pharma Global has entered into a binding agreement to sell its manufacturing facility to Rxilient Biohub for a consideration of $15 million.

IRB Infrastructure Developers: The company has secured an order that entails tolling, operation, maintenance and transfer of a 316 km highway stretch in Uttar Pradesh and Madhya Pradesh. The IRB Infrastructure Trust shall pay an upfront concession fee of Rs 4,428 crore to NHAI for a revenue-linked concession period of 20 years.

SJVN: The company’s unit, SJVN Green Energy, has signed an MoU with Norway’s Ocean Sun for collaboration in the green and clean energy sector. The unit will develop and finance a pilot membrane based floating solar project of about 2 MW in India, with Ocean Sun providing patented technological support for the same.

Blue Dart Express: The logistics company has reported a 22% YoY decline in consolidated net profit at Rs 73.06 crore for the quarter ended September FY24. Revenue from operations during fell by 0.06% YoY to Rs 1,324.5 crore in Q2FY24. Meanwhile, the company’s CFO V.N. lyer will resign with effect from January 31, 2024.

Thermax: The company’s subsidiary, Thermax Onsite Energy Solutions, has invested Rs 24.94 crore in its step-down subsidiary, Thermax Energy & Environment Lanka. The additional capital has been invested to meet the funding requirements for execution of a project.

Grindwell Norton: The company has executed a share sale and purchase agreement with Shinagawa Refractories Co., and SG Shinagawa Refractories India Pvt. for selling 49% stake held by the company in SG Shinagawa Refractories India.

NACL Industries: The company’s consolidated revenue was up 2.71% at Rs 580.26 crore in Q2FY24 as against Rs 564.91 crore in Q2FY23. Consolidated Ebitda fell 43.62% to Rs 30.56 crore in Q2FY24 from Rs 54.19 crore in Q2FY23. Consolidated net profit was down 86.34% to Rs 4.08 crore in Q2FY24 from Rs 29.89 crore in Q2FY23.

City Union Bank: The private sector lender said that its net profit rose 1.8% YoY to Rs 281 crore in Q2FY24 on improved recovery and decline in bad loan slippages. Net interest income fell by 5.3% YoY to Rs 538 crore during the reported quarter. Gross NPA fell 25 basis points QoQ to 4.66% and net NPA fell 17 basis points QoQ to 2.34% in Q2 FY24.

Central Depository Services: The company has registered a 35.4% YoY growth in consolidated net profit at Rs 109 crore for the July–September period of FY24, backed by a healthy revenue. Its consolidated revenue from operations grew by 39.2% YoY to Rs 207.3 crore for the quarter under review.

Intellect Design Arena: The company’s consolidated revenue was up 17.3% at Rs 619 crore in Q2FY24 from Rs 527.5 crore in Q2FY23. Consolidated Ebitda was up 45.1% at Rs 121.9 crore in Q2Fy24 from Rs 83.9 crore in Q2FY23. Consolidated net profit rose 53.9% YoY at Rs 70.8 crore in Q2FY24 from Rs 46 crore in Q2FY23.

Route Mobile: The company’s consolidated revenue was up 4.88% at Rs 1,014.61 crore in Q2FY24 from Rs 967.34 crore in the preceding quarter of the current fiscal. Consolidated EBIT rose 0.54% to Rs 106.7 crore in Q2FY24 from Rs 106.12 crore Q1FY24. Consolidate profit after tax fell 3.64% to Rs 88.35 crore in Q2FY24 from Rs 91.69 crore in the preceding of FY24.

Hi-Tech Pipes: The company has posted over two-fold jump in consolidated net profit at Rs 10.53 crore in Q2FY24 compared to Rs 4.34 crore net profit in the year-ago period. The company’s total income rose to Rs 746.73 crore in the reported quarter, from Rs 599.40 crore in the same period last fiscal. The company said that total sales volumes increased to 1 lakh tonnes during the quarter from 0.85 lakh tonnes in Q2FY23 on higher demand for steel tubes.